Currency Moves - Bloomberg Briefs

advertisement

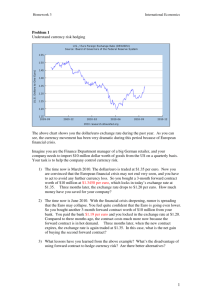

www.bloombergbriefs.com CURRENCY MOVES & Central Bank Policy The world’s central banks have split into two camps, the few that are likely to tighten and the majority with easing on their agenda. This division has reintroduced the currency markets to an old acquaintance: a dollar bull market. Our analysis plots the major central-bank moves and considers how the rest of 2015 will play out. March 18, 2015 Bloomberg Brief Currency Moves 2 QUICKTAKE Keep the (Cheaper) Champagne on Ice CONTENTS CENTRAL BANK MONITOR At least 14 countries have recently cut rates. What do they have in common? PAGE 3 BY THE NUMBERS Stronger dollar, weaker (almost) everything else. PAGE 4 BY SCOTT LANMAN The almighty dollar is mightier than ever since the global financial crisis. As the U.S. economy surges and most others slump, investors are flocking to it, enabling the U.S. to borrow lots of money at low interest rates. American consumers can feast on it, buying imported goodies for less. U.S. politicians tout it as evidence of the economy’s eternal dynamism. Other countries are driving their currencies down to make their goods more competitive on the world market. Not the U.S. It stands out as the one nation that prefers its money superpower-strong. That’s a mixed blessing. The high dollar hurts some American multinational companies’ earnings by reducing the value of sales abroad. It pushes down inflation that’s already considered too low. For the rest of the world, danger lurks in surging dollar-denominated debt sold in emerging markets like Brazil and India; the stronger dollar makes those bonds harder to repay. The U.S. Dollar Index, which tracks the greenback against six major currencies, surged 12.6 percent in 2014 and touched an 11-year high in March. Higher U.S. interest rates, expected this year, would make the dollar more attractive, pushing its value higher. Drug maker Pfizer said currency swings cut its revenue by 3 percent, or $449 million, in the fourth quarter. A stronger dollar means a weaker yen, hurting U.S. automakers by helping Japanese competitors like Toyota, which make more money on each car sold in dollars. A slumping euro means good things for companies in Europe that sell in the U.S. In Africa, the rising greenback threatens to curb borrowing this year after countries including Ghana, Ethiopia and Kenya took advantage of record low interest costs in dollars to finance road building and power projects. Then there’s a slowdown in the high-end home market in places like Miami, Las Vegas and Los Angeles, where foreign buyers need more of their own money to cover prices in stronger dollars. The Treasury Department is unwavering in its allegiance to the strong dollar. Elsewhere there are other opinions. Commerce Secretary Penny Pritzker said in January that the potential impact on American exporters makes the dollar’s rise “something to keep an eye on.” At its January meeting, Federal Reserve officials noted the greenback’s strength would be a “persistent source of restraint” on U.S. exports. Japanese policy makers are wary that declines in the yen could damage confidence. As Japanese and European central banks buy bonds to stimulate their flagging economies, investors are likely to pour more money into the U.S. The resulting rise of the dollar, warned Former Treasury Secretary Lawrence Summers, could slow the economy significantly. So Americans should hold off on the champagne, even if the strong dollar makes it a bargain. — For a full version of this overview, click the QuickTake U.S. ECONOMY The stronger dollar may weigh on the economy and slow Fed progress on rate normalization. PAGE 5 EUROPE The chances for euro-dollar parity; how the British pound is navigating a middle path; and why the Swiss franc might continue to strengthen. PAGES 6-10 ASIA China's yuan market is signaling further depreciation, while a revival in Japan may stem the decline in the yen. Policies may continue to diverge elsewhere in emerging Asia. PAGES 11-14 COMMODITY FX: CAD, BRL The oil slump has winded the Canadian economy; Brazil's outlook is much worse. PAGE 15 EMERGING MARKETS Dollar strength, expected Fed tightening take a toll. PAGE 16 TRADING STRATEGY After a decade-long lull, interest in FX momentum trading is reviving. PAGE 17 COMPANIES OVERHEARD Who's hurting from the strong dollar? Condensed comments from U.S. companies' first-quarter earnings calls and recent presentations. PAGE 18 March 18, 2015 Bloomberg Brief Currency Moves 3 CENTRAL BANK MONITOR Easy Does It Central banks in at least 14 countries have lowered their benchmark interest rates in the past month. What do they have in common? For most, the answer lies in the last column of the table below. Headline consumer-price inflation is negative or below 1 percent in eight of the countries that have cut in the four weeks to March 18 — and 12 of 24 if the time frame is widened to the past six months. Plummeting oil prices that have dragged inflation lower have also hurt producers' economies, giving their central banks another reason to ease. Of course, sorting by rate changes ignores two paragons of loose policy: the Bank of Japan and the European Central Bank. Stuck at the zero lower bound, they're now relying on asset purchases to boost the economy and stoke inflation. Source: Bloomberg. Japan excluded because its central bank no longer targets a benchmark interest rate. Bloomberg Brief March 18, 2015 Currency Moves 4 BY THE NUMBERS The U.S. Dollar Against the World The dollar is getting stronger, the euro is sinking, and developing market currencies are almost all weaker as monetary policy in the U.S. and the euro zone diverges. Click the chart to launch an Interactive Story Chart investigating the changes globally. Stronger Dollar, Weaker Everything Else Ruble Leads the Way Down Note: All data as of March 18. Record lows encompass the entire Bloomberg series for each currency. Euro data include a synthetic range covering the period before its introduction in 1999. On a historical basis, the currency is 28 percent above its record closing low of $0.8272 on Oct. 25, 2000. March 18, 2015 Bloomberg Brief Currency Moves 5 DOLLAR IMPACT CARL RICCADONNA, BLOOMBERG INTELLIGENCE ECONOMIST From Strength, Weakness: Currency Appreciation to Pinch U.S. Growth Those who think it can’t be war because there are no losers have never lived in the Rust Belt. History shows clear winners and losers when currencies move. The lessons from the Federal Reserve’s experience in the aftermath of the financial crisis are instructive. The Bernanke Fed did not directly intervene in currency markets, but it created conditions which resulted in significant dollar depreciation. It accomplished this first by cutting rates effectively to zero and promising to keep them there for an extended period, then through aggressive balance sheet expansion via quantitative easing. The mechanisms through which asset purchases aided the economy were not entirely understood at the time, particularly since fixed-income yields generally increased when various rounds of QE were implemented, but a clear channel did emerge via a weaker dollar. While the Fed bristled at claims it was specifically targeting the exchange rate, its actions drove the trade-weighted dollar to a three-decade low. At the time, QE critics were dismissive of the economic impact from a weaker dollar — not unlike some of the refrains echoing out of Europe presently. The results speak for themselves. A weak currency provides a double dose of economic stimulus. Exports of goods and services become cheaper in international markets, and imported goods become more expensive, both supporting domestic production. Exports are only about 12-14 percent of U.S. economic output, so an impressive pace of growth is required to significantly impact growth. This is just what occurred in the first two years following the recession. Real GDP grew by 2.2 percent, of which more than 50 percent — 1.2 percentage points — was directly attributable to exports. This was possible because exports grew by 11 percent. This growth engine was critical. Were it not for exports, overall GDP would have been closer to 1.0 percent — a pace which would not have been sufficient to reduce unemployment and begin sowing the seeds of sustainable recovery. Put simply: without exports, the U.S. Export Reversal: New Orders Hint at Trouble Ahead economy probably would not have been able to achieve critical “escape velocity.” What a weak dollar giveth, a strong dollar shall taketh away. The Fed appears increasingly cognizant of the potential negative impacts of the strong dollar, including “imported deflation” and dwindling factory orders. Appreciation cuts import prices, and in turn weighs on core consumer inflation, largely through falling goods prices. This has already pushed the core CPI to the lowest levels since its post-recession rebound in 2011, and the trend will probably further intensify in the near term as long as dollar strength persists. This matters for policy makers who, having signaled willingness to boost rates when inflation rebounds, may be stymied by the core hitting new lows. The impact extends far beyond the Fed's inflation target as well, because it creates a difficult pricing environment for U.S. industry — especially manufacturing — in both domestic and foreign markets. There were signs of this in fourth quarter GDP data, which did not fully incorporate the cumulative currency move. The trade-weighted dollar has appreciated by an additional 10 percent since the fourth quarter, so that data provided only a hint of developments that will intensify over the next several quarters. Imports surged 10.1 percent in the fourth quarter compared to an eight-quarter trailing growth rate of 2.4 percent. This is a sign that consumers and businesses have begun to shift toward cheaper, foreign-produced goods. The more than 11-point slide in the new orders component of the manufacturing ISM survey over the last six months provides further corroboration that domestic industry is being squeezed. Export growth was positive (3.2 percent), but the year-on-year trend is now approaching the lows of the cycle. The new export orders component of the manufacturing ISM — a useful leading indicator of exports — has fallen to levels which suggest outright contraction may be imminent. In other words, the small but mighty export “growth engine” is at risk of shifting into reverse. The headwinds from a stronger dollar could significantly damp factory output, and in turn weigh on the broader economy. This may lead the Federal Reserve to move less aggressively toward rate normalization, in order to avoid inflicting excessive pain on the factory sector. Bloomberg Brief March 18, 2015 Currency Moves 6 EURO FUNDAMENTALS JAMIE MURRAY, BLOOMBERG INTELLIGENCE ECONOMIST The Hardest Part Is Still to Come for the ECB’s QE A weaker euro is a key channel for the European Central Bank's quantitative easing program to affect the economy. A boost to demand for sovereign bonds is intended to push down yields and send investors hunting for better returns elsewhere. On this metric, the policy is already a resounding success. The hope is that the resulting improvement in competitiveness will help lift the euro area's economic fog. A lot depends on whether those nations needing the biggest boost to demand will be able to capitalize on the change to relative prices. The euro has indeed slipped markedly, but it remains to be answered how much that owes to QE. Relative rates of return between the euro area and the U.S. are critical to that assessment. Here, it's important to note that not all of the decline in euro-area bond yields can be attributed to the direct effects of QE. Much of the slippage reflects lower expectations of risk-free rates, a global phenomenon. The 10-year swap rate has declined significantly in both the U.S. and the euro area in 2014 and early 2015. The first chart shows that the euro-area swap rate has fallen by more — traders expect the ECB's main policy rate to remain lower for much longer. That puts substantial downward pressure on the euro relative to the dollar. Where QE has had a significant effect is in suppressing yields on the assets that aren't risk-free. Spain can now borrow for 10 years more cheaply than the U.S., and the decline in its borrowing costs since the beginning of 2014 has been substantially larger than Germany's, as the second chart shows. Overall, while differences in expectations for policy rates doubtless account for some of the depreciation of the euro, asset purchases look to have played a big role too. In part, some of the recent declines in bond yields and the euro reflect the process of price discovery. Much of the effect of QE on the bond market was priced in well before the purchases began, but it was never known with certainty how much the ECB would have to pay to pry enough bonds away from their owners to meet its targets. The latest moves in yields suggest it may have been a bit harder than thought — the lower rate Main ECB Policy Rate Seen Lower for Much Longer Decline in Spain's Borrowing Costs Outpaces Germany's of return that this has prompted may now be weighing on the euro even further. QE has probably played a big role in pushing the euro down against the dollar, but that's the easy part — anyone can buy bonds, especially with a printing press. Harder to judge is whether the euro area will respond with significant improvements in competitiveness. First, exporters could push their prices up (knowing foreigners can now afford to pay more) and pocket the margin, rather than aim for a bigger market share. Over time, one would reasonably expect competition to erode those margins but it may take a while for more supply to come on stream. Until then, that may moderate the boost to the volume of exports and real GDP. Second, new exporting companies don't appear out of thin air. The banking sector has a big role to play in reallocating capital away from domestic-facing activities toward catering to the external sector — and in some of the countries most in need of a boost from external demand, the banking sector looks to be least able to perform that role. There are nascent signs that the euro area is turning a corner and lower oil prices will create a bit of extra domestic demand on top of that generated by QE. Yet it is too soon to chalk up a success for unconventional monetary policy. March 18, 2015 Bloomberg Brief Currency Moves 7 DOLLAR TRENDS CARL RICCADONNA, BLOOMBERG INTELLIGENCE ECONOMIST Rate Differentials Indicate U.S. Currency on Course for Euro Parity A rudimentary model constructed using interest rate differentials between U.S. and German yields has done an impressive job at predicting euro-dollar moves. This model suggests scope for more dollar gains. The chart shows this, depicting the spread between the U.S. two-year Treasury yield and the equivalent German yield relative to the dollar-euro spot rate. The correlation over the last decade is an impressive 80 percent. While this technique exhibits some predictive power, foreign exchange rates are notoriously difficult to forecast, as they are driven by a complex array of shifting factors, including capital flows and expected rates of return. Still, the model suggests that the dollar is likely to hold its gains or appreciate further, given expectations for further widening of the two-year interest rate differential as expressed by the forwards curve. Presently, the spread is a little over 80 basis points. It is projected to be roughly 170 basis points one year forward and over 200 basis points in two years. This is consistent with forward guidance Bund-UST Yield Correlation Signals Path to Parity from the respective central banks. The Federal Reserve is on course to initiate policy tightening at some point later this year, while the European Central Bank is easing policy. Based on this relationship, expectations for the euro to trade below parity for an extended period seem reasonable — dependent, of course, on the willingness of Federal Reserve officials to push interest rates higher while much of the rest of the world eases monetary policy. Bloomberg Brief March 18, 2015 Currency Moves 8 EURO TRENDS DAVID POWELL, BLOOMBERG INTELLIGENCE ECONOMIST Why the Euro's Slide Might Overshoot Parity The European Central Bank’s path to sovereign bond buying has weighed heavily on the euro, especially versus the U.S. dollar. Diverging monetary policies are likely to push EUR/USD toward parity, with a chance of a slide beyond that psychologically important level. Quantitative easing has driven the trade-weighted euro about 14 percent lower during the last year by pushing down market expectations of interest rates in the euro area and by untethering the peg between the single currency and the Swiss franc. The spread between the two-year swap rate for the euro and a trade-weighted average of those of its major trading partners has dropped in the last 12 months to minus 0.47 percentage point from minus 0.20 percentage point. That measure of the euro dropped about 3 percent the day the Swiss National Bank abandoned its peg. The depreciation of the euro has been the greatest versus the U.S. dollar over the past year among the Group of 10 currencies. EUR/USD has fallen by about 24 percent. The ECB is likely to maintain loose monetary policy much longer than the Federal Reserve to combat deflationary pressures. The unemployment rate is still 1.5 percentage points above the OECD’s non-accelerating inflation rate of unemployment, which may even underestimate the spare capacity in the economy over the long term. The U.S. jobless rate is close to its long-run equilibrium rate. That is likely to continue pushing investors in search of higher returns into the U.S. from Europe. With EUR/USD having peaked in the summer of 2008, the currency pair’s downtrend has further room to run before it starts to look overly mature. Trends in the exchange rate between the euro (or a synthetic measure of the euro before its introduction in 1999) and the dollar have historically lasted five to eight years. After peaking in January 1980, EUR/USD fell over the next five years and then rallied for the seven years that followed. After hitting a cyclical top in September 1992, the currency pair fell over the next eight years before starting an eight-year rally in October 2000. Exchange Rate Reversals Triggered by Extreme Misvaluation EUR/USD Trends Have Lasted Five to Eight Years The exchange rate may fall to about parity. Major reversals of the currency pair have been associated with at least a 25 percent over- or undershoot of the 10-year moving average. That level can be viewed as an estimate of a currency pair’s purchasing-power-parity equilibrium value because studies have shown PPP cycles last about a decade. In other words, over a 10-year period, on average, a pair should be at the fair value implied by PPP. The 10-year moving average currently stands at about 1.34. The 25 percent threshold hasn’t acted as a cap in the past. It merely acts as a marker of extreme over- or undervaluation that could trigger a reversal. If the currency pair breaks through the key psychological level of parity and expectations begin to build in the months ahead for additional monetary easing from the ECB, EUR/USD would be likely to start to slide toward its all-time low of 0.82. March 18, 2015 Bloomberg Brief Currency Moves 9 BRITISH POUND JAMIE MURRAY, BLOOMBERG INTELLIGENCE ECONOMIST Sterling Caught in the Crossfire Waits for Signs on BOE Path The British pound has made a steady ascent lately, beating a middle path between a soaring U.S. dollar and a plummeting euro. Behind those currency moves is the divergence of monetary policy between the U.S. and euro area. The motivation for the differing trajectories might best be illustrated by the relative rate of unemployment. While the American recovery has continued broadly uninterrupted since the financial crisis came to an end, the same cannot be said of Europe — elevated joblessness persists and has shown only tentative signs of budging downward. Yet it wasn’t until 2014 that ECB sovereign bond purchases became a safe bet, and the path of expected policy rates has also declined substantially. Over a similar period, the U.S. Federal Reserve slowed and then stopped its asset purchase program and it’s now eyeing its first rate increase. Consequently, the euro has tanked against the dollar. Broadly speaking, U.K. monetary policy has been restless without an obvious move one way or the other during this period. At the beginning of 2014, the first U.K. interest rate increase wasn’t fully priced in until well into 2016. That changed as the year wore on, particularly after Bank of England Governor Mark Carney gave a speech in June that was widely interpreted as hawkish. Subsequently, expectations slipped again and are now roughly back where they started. Taking into account the U.K.’s trading partners, sterling has been caught in the crossfire. The trade-weighted exchange rate has cut a path between the strengthening dollar and weakening euro, registering a more modest overall appreciation. That may soon change. With uncertainty about the margin of slack remaining in the economy, the Bank of England has sensibly placed emphasis on the wages data in determining when the Rate Expectations Are Back Where They Started GBP Cuts Path Down the Middle on Restless U.K. Policy lift-off for interest rates should be. With many compensation negotiations in April, it shouldn’t be too long before the earnings numbers give a more definitive signal as to how much spare capacity remains in the labor market. A strong number may push the BOE closer to the Fed’s rate-tightening path, while a weaker one might prompt a delay. In either case, the result would be a lurch in the value of sterling. Bloomberg Brief March 18, 2015 Currency Moves 10 SWISS FRANC DAVID POWELL, BLOOMBERG INTELLIGENCE ECONOMIST Strong Franc in the Hands of Nervous Swiss As Switzerland struggles to recycle its large current account surplus, the franc is likely to continue strengthening and become increasingly overvalued. The trend would probably reverse on a restoration of risk appetite, though that appears unlikely to materialize in the foreseeable future. Switzerland has been unable to channel its current account surplus into international capital markets since the onset of the euro crisis. Swiss residents increased their net holdings of foreign portfolio investment by 448 billion francs from the start of 2000 through the end of the first quarter of 2010, according to calculations of Bloomberg Intelligence using data from the Swiss National Bank. The sum remained at about 426 billion francs by the end of the third quarter of last year, the latest reporting period. As a percent of GDP, the country’s current account surplus remains large at 6.4 percent at the end of the third quarter, down from 11.7 percent of GDP at the end of the first quarter of 2010. The nominal effective exchange rate has appreciated by about 16 percent during that period. The upward pressure on the currency appears likely to remain unless either Swiss savings are once again pushed abroad or the current account surplus is eliminated. Risk aversion may be hampering purchases of foreign assets. The elimination of a current account surplus that has been persistently high for decades also appears unlikely in the near future, though an extended period of currency overvaluation may eventually trim global appetite for Swiss exports and temper the imbalance. The Swiss monetary authorities seem to have lost their appetite for large-scale intervention to prevent significant appreciation of the franc, though they are unlikely to completely refrain from meddling in the foreign-exchange market. The SNB had accumulated about 197 billion euros as part of its foreign currency reserves before abandoning the peg between the euro and the franc in January. The SNB appeared unable to Swiss Pause in Net Buying of Foreign Financial Assets Swiss Current Account Surplus Still Large stomach the potential for large losses from euro depreciation as a result of the European Central Bank’s quantitative easing program. The country will continue to suffer from an overvalued exchange rate in the meantime. The nominal effective exchange rate is about 25 percent above its 10-year moving average, a measure of fair value. Swiss investors taking a plunge into foreign investments would likely trigger a reversal for the franc. One of the first signs of that process would be a stabilization of the currency in the absence of reserve accumulation. That still seems like a distant prospect as the euro crisis persists and a recovery in global growth since the slowdown of 2011 remains elusive. Bloomberg Brief March 18, 2015 Currency Moves 11 JAPANESE YEN TOM ORLIK, BLOOMBERG INTELLIGENCE ECONOMIST Japan's Revival May Mean End of Yen Declines The yen’s weakness has been a reflection of Japan’s. As the economy shows signs of revival, the currency may avoid further declines. The 28 percent fall in the yen against the dollar since the end of 2012 happened in two stages. The first came at the beginning of 2013 in anticipation of and in reaction to Japan's first round of quantitative easing. The second started in August 2014 in advance of the second round of QE. The consensus forecast calls for the yen to end 2015 at 125 to the dollar, down from around 121 as of mid-March. It’s true that the coming first move on U.S. interest rates will widen the rate differential. Still, as that is the most widely anticipated central bank move in the world, it may take more than that for the yen to gap down. That suggests the forecast is pricing in a further round of easing by the Bank of Japan. At first sight, the case for further easing looks clear cut. BOJ Governor Haruhiko Kuroda has staked his reputation on hitting a 2 percent inflation target. A 0.2 percent year-on-year increase in prices in January, excluding the impact of the sales tax increase, is far off track. That explains why about three-quarters of the economists surveyed by Bloomberg expect more easing by the end of the year. On closer examination, underlying inflation dynamics are looking more positive. Labor markets are tight, with the unemployment rate at 3.6 percent in January. That raises hopes for a substantial boost in salaries during the spring wage negotiations — providing solid demand to underpin rising prices. The Tankan survey shows firms are operating at close to full capacity. Inflation expectations, which the BOJ says are a crucial component of its strategy, are so far stable. The BOJ’s household survey shows expectations on a five-year time horizon have actually edged up slightly. In a speech in March, Deputy Governor Hiroshi Nakaso said that if inflation expectations remain unaffected by the oil price drop and underlying trends in inflation are positive, Yen Weakness Runs Ahead of Rate Differential Tight Labor Markets May Keep BOJ on Hold there is no need for monetary policy to respond. There are other reasons to expect the BOJ to stay on hold. Massive purchases are already distorting the operation of government debt markets. ETF, REIT and other markets where the BOJ may expand its operations are much smaller in size, and thus are much more prone to distortion. Small businesses are complaining that a weaker yen is hurting their profits. Put it together and there could be enough to keep the BOJ on hold, even if oil drags the CPI further down in the months ahead. By the time October — the most common pick for further easing — rolls around, the impact of the oil plunge will be fading and the story on inflation may look a lot more positive. In that case, bets on further easing, and a weaker yen, will prove wide of the mark. Bloomberg Brief March 18, 2015 Currency Moves 12 CHINESE YUAN TOM ORLIK AND FIELDING CHEN, BLOOMBERG INTELLIGENCE ECONOMISTS Dollar's Strength Is China's Weakness A crawling peg with the U.S. currency is a boon for China during periods of dollar weakness. In times of dollar strength, it threatens a bust. A 25 percent climb in the dollar index in the past year presents China with a difficult choice. Following the dollar up risks adding to the woes of exporters, already suffering from higher labor costs. Allowing the yuan to fall risks capital flight and financial stress. Signals from the market show expectations of depreciation. The yuan’s spot price is hugging the weak end of its trading band. The offshore price is weaker than the onshore. At 6.26 per dollar as of mid-March, the yuan has declined about 1.8 percent against the greenback in the past year. The only thing preventing a more pronounced drop in the currency is the central bank. Since the end of November, the People’s Bank of China has been using its daily fixing to claw back the market losses of the previous day. On occasion, that has meant pulling the currency back a full 2 percent from the last day’s close. The currencies of China’s Asian neighbors have been falling sharply. The yuan’s moderate fall against the dollar has still left it up 6 percent year on year on a real effective basis. With a currency war raging around it, and exports a crucial source of demand in a flagging economy, it may seem odd that China’s central bank is playing the role of peace keeper. At the top of the list of reasons is concern about capital flight. China saw record capital outflows in the fourth quarter of 2014. Early signs suggest that has continued into the start of 2015. A pronounced fall in the yuan would add to the incentive to exit. That would increase volatility in banks’ deposit bases, adding to risks to financial stability. China’s overseas borrowing has been growing fast. Data from the Bank for International Settlements show foreign claims on China rising to $1.7 trillion in the third quarter of 2014, almost double Bear Hug: Yuan Sticks to Weak End of Trading Band Weaker Currency Adds to Incentives for Capital Flight the $906 billion total at the end of 2012. A weaker yuan would add to repayment costs and raise financial stress for debtor firms. The consensus forecast is for the yuan to end the year at 6.21 to the dollar, up slightly from the current 6.26 spot price. That seems too optimistic. Given market pressure, the plight of the export sector and risks from capital flight, something between stability and mild depreciation is the most likely outcome. Bloomberg Brief March 18, 2015 Currency Moves 13 KOREAN WON FIELDING CHEN, BLOOMBERG INTELLIGENCE ECONOMIST South Korean Won Won't Hit Rock Bottom in Race Down South Korean officials will likely feel continued pressure to weaken the won to support the country’s external sector as near-term domestic growth prospects deteriorate. The degree of further depreciation may be limited by South Korea’s huge current account surplus and the potential for an economic turn-around on pro-growth government policies. The won has been trending lower against the dollar since mid-2014, with an unexpected rate cut by the Bank of Korea on March 12 setting the stage for additional depreciation in the months ahead. Korean policy makers have grown visibly more concerned in recent months at actions taken by foreign central banks — including Japan's and Europe's — that have led to depreciation of their currencies. Korean exports account for more than 50 percent of GDP. Korean products from auto parts to electronics compete head to head with Japan's in the global market, and Europe is a major export market. So any substantial depreciation in the euro or yen that isn't mirrored by the won stands to hurt Korean exporter competitiveness. While the won has fallen 5.3 percent against the dollar in the past year, sharper falls in the yen and the euro have left it stronger on a real effective basis. This likely added motivation for the March rate cut. China is also a major concern for Korea. The region’s largest economy is Korea’s biggest export market, accounting for about one quarter of total overseas sales in 2014. China’s imports fell about 20 percent year on year in the first two months in 2015. Expectations that China’s GDP growth may decelerate to 7 percent or lower this year from 7.4 percent last year damp Korea’s export outlook and may provide government officials with further impetus to weaken the won. Domestically, there is more room for the BOK to cut. Even after three 25-basis-point rate cuts since August, Korea’s inflation rate remains well below the central bank's target. More interest rate cuts, combined with an expected liftoff by the Fed this year, would mean a South Korea's Exports Have Decelerated Won's Weakness Against Dollar Is Relative narrowing won-dollar interest rate differential. That promises to add to fund outflows, deepening the persistent capital account deficit and weakening the currency. Yet there may be limits to how low the won can go. Korea maintains a large current account surplus that totaled $89.2 billion, or about 6 percent of GDP, in 2014. The Bloomberg consensus forecast is for the current account surplus to be a similar proportion of GDP in 2015, indicating strong demand for the won. Additionally, looking further ahead, economists forecast a gradual pickup in South Korea’s economy, to 3.4 percent GDP growth in 2015 and 3.6 percent in 2016. That may eventually reignite investors' appetites for Korean assets. Bloomberg Brief March 18, 2015 Currency Moves 14 EMERGING ASIA TAMARA HENDERSON, BLOOMBERG INTELLIGENCE ECONOMIST 2015: The Year of Relative Value in Asian Currencies The Philippine peso and Indian rupee are out-performing peers in emerging Asia this year, and are among the few currencies that have gained ground against the U.S. dollar. In contrast, all of the currencies in the G-10 have weakened against the greenback. External dynamics — including Federal Reserve policy, oil prices, China rebalancing and currency wars — suggest this divergence may persist into year-end. Fed Uncertainty: Risk appetite tends to increase as uncertainty diminishes, suggesting that once the timing and trajectory of Fed rate hikes are known, the U.S. dollar may weaken. A "buy-the-rumor-sell-the-fact" phenomenon is also supported by extreme positioning in the greenback by non-commercial accounts shown in U.S. Commodity Futures Trading Commission data. The emerging Asia currencies that have benefited the most in the past from improved risk appetite are typically those with higher real yields and current account deficits. India has both. Thailand and Malaysia have the highest real yields currently, while Indonesia also has a current account deficit. Deflation Mirage: The plunge in oil prices since June was supply-driven. This indicates a limited role for central banks aside from ensuring no second-round effects. With lower oil prices supportive of discretionary spending, deflation risk in most economies is low. Absent a further plunge in oil, the impact on inflation and economic growth will be temporary — fading in the second half of the year as the favorable basis of comparison erodes. The currencies in emerging Asia that benefit most from low oil prices are those with higher consumption and oil import concentrations, such as India. Growth in the Philippines and Indonesia is also consumption-driven, while South Korea has a significant oil import share, or about 27 percent of total imports. As the oil price effect on inflation fades into year-end, the currencies of Asia's oil producers — Malaysia and Indonesia — have potential to outperform. Asia's Divergent Currency Performance May Persist Rupee, Peso Display Higher Risk-Adjusted Returns China Reform: China's rebalancing from investment- to consumption-driven growth benefits more trade-reliant economies where discretionary consumer goods and services comprise a large share of total exports. In emerging Asia, South Korea, Taiwan and Thailand are more prominent members of the automobile supply chain. Thailand and Malaysia have the highest number of tourists. Currency Wars: The recent trend has been to use the oil-related drop in inflation as a reason to loosen monetary policy and maintain export competitiveness. Central banks in Malaysia, the Philippines, Taiwan and Vietnam have yet to engage in the currency war. Market forces have already significantly weakened the ringgit, which dropped in tandem with oil prices. Competitive devaluations, at best, provide a temporary boost to growth. As inflation normalizes into year-end, monetary policy may appear too accommodative in Indonesia and Thailand, as suggested by Taylor Rule metrics. March 18, 2015 Bloomberg Brief Currency Moves 15 CANADIAN DOLLAR RICHARD YAMARONE, BLOOMBERG INTELLIGENCE ECONOMIST Loonie May Continue to Weaken as Central Bank Cuts The Canadian dollar hit a six-year low against the U.S. dollar after the February employment report showed the impact of the oil slump. The Bank of Canada will probably try and get ahead of deteriorating economic conditions by cutting its benchmark interest rate an additional 25 basis points. This could cause the loonie to retest the 1.39 level per U.S. dollar last seen in 2004. The Bank of Canada’s next meeting is April 15; 11 of 19 economists surveyed by Bloomberg expect another cut during the second quarter. The Bank of Canada will probably view a weaker loonie as a positive booster for exports, while lower rates will positively support non-oil business sentiment and investment. These tailwinds should help keep at bay the full negative impact of lower oil prices on Canada’s economy. Canada Looks to Weaker Loonie to Support Exports BRAZILIAN REAL MICHAEL MCDONOUGH, BLOOMBERG INTELLIGENCE ECONOMIST Brazil's Real Has More Room to Fall on Domestic Hurdles, Fed Action The Brazilian real is the worst performing emerging market currency year-to-date. A deterioration in domestic outlook that has fueled the decrease is likely to persist. Expectations of Federal Reserve tightening are also in play, and will likely continue to be a factor. Brazil faces substantial hurdles in achieving its 2015 primary surplus target of 1.2 percent of GDP. Any perception that the reform agenda is lagging would further impair investor confidence. Last year, Brazil realized a primary fiscal deficit for the first since 1997, at around 0.6 percent of GDP. It has experienced a primary deficit in every month but two since May 2014. A worsening drought in the country will also begin to weigh on economic growth and sentiment. To thwart rapid depreciation and stem inflation, the central bank has conducted 175 basis points of rate increases since October. A collapse in commodities helped push the current account into deficit and FDI failed to compensate. This heightens the importance of highly Brazil Real in Fundamental Rut volatile portfolio flows to offset falling demand for reais. It comes at a time while Brazil’s worsening political and economic outlook deters foreign investor appetite, even at higher domestic rates. Eventual tightening by the Fed would likely further reduce demand for emerging market assets, including the real. Brazil’s central bank may also reduce foreign exchange market intervention. Bloomberg Brief March 18, 2015 Currency Moves 16 EMERGING MARKETS MICHAEL ROSENBERG, BLOOMBERG ECONOMIST & BOB LAWRIE, PRODUCT MANAGER Caught Between Capital Outflows and Weak Domestic Demand A combination of dollar strength and the anticipation of tighter Federal Reserve policy is exerting a toll on emerging-market asset prices. For the most part, these declines significantly exceed those that occurred during the last selloff in the second quarter of 2013 — the "taper tantrum." Emerging-market equity prices, as reflected in the MSCI-EM equity index, are down roughly 14 percent since mid-2014. JPMorgan's EM bond spread index (EMBI+), which captures the spread on EM bonds relative to U.S. bonds, has surged to 410 basis points from 275 basis points in mid-2014. And the returns on EM FX carry-related strategies have crumbled in the past nine months, as a long position in a basket of eight EM currencies funded with U.S. dollars has dropped 19 percent since mid-2014. On top of all this, commodity prices have tumbled some 38 percent over the last nine months, which has a negative impact on EM economies whose exports are linked to commodity-price developments. All of these adverse price trends are exerting significant downward pressure on capital flows to EM economies. The Institute of International Finance reports that net capital flows to EM economies have once again moved below average. Our own modeling work suggests that a bigger slide in EM capital flows lies in the offing. Bloomberg has constructed a high frequency composite index to gauge capital flows to EM economies on a real-time basis. The Bloomberg EM Capital Flow Proxy index tracks the trend in EM equity prices, bond spreads, carry trades and commodity prices to assess whether the demand for EM assets as a whole is rising or falling. This composite index is highly correlated (0.85) with EM portfolio flows as compiled by the Institute of International Finance. The chart shows that the Bloomberg EM Capital Flow Proxy index is currently sliding at a much faster pace than the Bloomberg's Proxy-Flows Index Slides IIF’s monthly EM Capital Flows Tracker index. If the strong correlation between the two series continues to hold, we would expect to see a further slide in actual emerging-market capital flows. The principal advantage of the Bloomberg Proxy index over conventional measures of EM capital flows is that the Bloomberg index is available on a real-time basis and thus should coincide with changes in actual capital flows. Indeed, the recent slide in our EM Capital Flow Proxy Index appears to be following a time-honored script that has played out in past Fed tightening cycles. Most studies find that changes in Federal Reserve policy have had a big impact on capital flows to EM economies, although the relationship is by no means perfect. In several instances, Fed tightening moves have had a significant negative influence on EM capital flows — notably the early 1980s tightening, which may have helped trigger the EM debt crisis in 1982; the 1994 tightening, which may have triggered the Mexican peso crisis later that year; and the 2013 "taper tantrum" that helped precipitate a major slide in EM asset prices. If past trends offer a hint to possible future moves, then EM capital flows may remain vulnerable going forward, particularly as we get closer to the day when the Fed Funds rate finally lifts off. Investors may wonder what measures EM policy makers will consider to stem a further slide in EM capital flows. Raising interest rates to attract capital inflows is one possible step, but such a move would run against the need for lower interest rates for domestic economic considerations. The need for lower rates is evidenced by the IIF's EM GDP monthly coincident economic indicator, which has been sliding in recent months. EM policy makers may also be reluctant to hike rates at a time when the euro is sliding sharply versus the U.S. dollar. A policy rate boost would run the risk of undermining the competitiveness of EM economies versus their euro-area counterparts. In the end, it may be in the best interests of EM policymakers to simply ride out the storm, as attempts to counter capital outflows might do more harm than good. Bloomberg Brief March 18, 2015 Currency Moves 17 TRADING STRATEGY MICHAEL ROSENBERG, BLOOMBERG ECONOMIST, & BOB LAWRIE, PRODUCT MANAGER FX Momentum Trading Makes a Comeback After a decade-long lull, interest in FX momentum trading is beginning to turn. Profits are returning too. The U.S. dollar has rallied against most G-10 and emerging-market currencies, generating significant returns for trend-following investors. For investors who make tactical shifts among FX trading styles (such as carry, momentum and valuation), the dollar gains are probably signaling a shift in favor of FX momentum and away from FX carry. It would be the first such signal in favor of momentum since 2009. Currency momentum and trend following trading strategies have long been popular trading tools for FX market participants who rely on technical trading rules for both portfolio and risk management purposes. Numerous academic studies document that a variety of trend-following trading models would have generated significant risk-adjusted profits in the past, at least in the 1970s, 1980s and early 1990s. More recent studies have found that whatever excess returns were available during that earlier period largely disappeared during the Great Moderation and subsequent years. Momentum strategies' returns depend on extended periods of directional currency movements. Looking at the frequency of losing and winning trades in a typical trend-following trading strategy, there are often more losing trades than winning trades. Profits can still be earned over time if losing trades are closed quickly while winning trades are allowed to run. If the macro environment generates more muted swings in exchange rates, however, one runs the risk that the correctly predicted up-moves do not carry far enough to offset the large number of small losses. At the same time that the macro environment was becoming more benign during the pre-financial crisis period, the FX market in general was becoming more efficient. As more players — notably CTAs, hedge funds and mutual funds/ETFs — entered the market Returns Swing Back to Momentum The Deutsche Bank currency momentum and carry-trade strategy indexes calculate the cumulative return on a hypothetical benchmark portfolio that is long the three G-10 currencies with the highest 12-month spot (or carry) return and simultaneously short the three G-10 currencies with the lowest 12-month spot (or carry) return, all versus the U.S. dollar. seeking to exploit the excess returns available to momentum traders, their collective actions began to arbitrage those profits away. With FX volumes surging, transaction costs declining and the electronic dissemination of information, the growing list of active market participants were able to essentially eliminate whatever excess returns were still available in the new, benign macro environment. Most studies find that over the course of the 1990s, the profits derived from momentum trading gradually declined and virtually disappeared for G-10 currencies by the early 2000s. Momentum profits were found to be still available in the case of EM currencies where trading was generally less crowded and thus less efficient. Also, the macro backdrop in the EM sphere was more conducive for trend-following strategies as significant differences in EM GDP growth rates, inflation rates and real interest rates worked in tandem to generate relatively long and pronounced swings. The macro environment became less benign in the 2000s, with the initial shocks of the bursting of the tech bubble, the 9/11 attacks and after-effects in the early 2000s, and then the global financial crisis in 2008 and the weak economic recovery that followed. Studies find that in the aftermath of a major financial market downturn, risk appetites tend to be low and perceived tail-risk probabilities tend to be considerably higher than normal. These studies generally find that the returns to momentum trading turn down during such periods. Not only did the returns on currency momentum investing weaken significantly in the first decade of the new millennium and slightly beyond, but the returns on equity momentum investing performed poorly as well. Indeed, the 2000-09 period marked the first decade that equity momentum investing posted a negative return since the 1930s. Bloomberg Brief March 18, 2015 Currency Moves 18 COMPANIES OVERHEARD Dollar Strength Punches Hole in Some Exporters' Earnings Statements Many U.S. companies operating overseas are hurting from the stronger dollar. But a little preparation — or hedging — goes a long way. Below, we've condensed comments from first quarter earnings calls and recent presentations. The comments have been edited. GAP CFO Sabrina Simmons (Feb. 26 earnings call): "Both the Japanese yen and the Canadian dollar have depreciated by about 30 percent over the past two years. With the continuing depreciation of these and other currencies against the dollar, our reported results have been and are expected to be negatively impacted.” Weyerhaeuser CEO Doyle Simons (Jan. 30 earnings call): “A stronger dollar generally is not a positive for Weyerhaeuser. In terms of Japanese logs, what we've seen is the demand has not been affected by the strong dollar. But if it continues, it could potentially affect our price. In terms of Chinese logs, the weak ruble is making Russian logs less expensive than U.S. logs. That, of course, reduces the price that the Chinese are willing to pay. With that said, there is a practical limit on just how much Russia can provide and the other thing is if prices are not at desirable levels, we are able to redirect some of our logs to domestic markets, which are holding up very well.” 3M VP of investor relations Matthew Ginter (March 17 presentation): "In the late 1990s when the Asian currencies devalued, our hedging approach was a little bit more short term. We were hedging in our company maybe over a two-to-three-month horizon. So on the heels of that, we decided to leg in to the strategy that we've been working since 2000, which is actually hedging 12 months forward on the developed market currencies. And we do that on a rolling 12-month basis. In mid-2014, we made a decision on a couple of the majors including the euro to just extend the horizon out to 24 months, still maintaining an overall roughly 50 percent hedge ratio." Wal-Mart CFO Charles Holley (Feb. 19 earnings call): “The strong U.S. dollar caused a negative impact of over $5 billion on revenue.” Pilgrim's Pride CEO William Lovette (Feb. 12 earnings call): "“I think the most important evidence [in Mexico] is through the recent devaluation of the peso to the dollar, we've not seen chicken demand go lower. It actually continues to be very strong in Mexico. That's one of the export markets where demand for leg quarters, for example, has remained very strong." Apple CFO Luca Maestri (Jan. 27 earnings call): "The biggest impact came from the Japanese yen, the Russian ruble but also from euro, Australian dollar, Canadian dollar. As we look forward and we look into particularly the March quarter, the foreign exchange headwinds will be stronger in Q2 than they were in Q1." VF Corp. CFO Robert Shearer (Feb. 13 earnings call): “Most of the impact on the transactional side results from the recent decision of the Swiss government to move away from pegging their currency to the euro. Because our European businesses are headquartered in Switzerland, in U.S. dollars our reported headquarter expenses increased. The reason these transactional impacts are not more significant is that we have a strong and efficient hedging program that offsets nearly all of these influences.” Inter Parfums CFO Russell Greenberg (March 12 earnings call): "Our earnings are positively affected by a strong dollar because approximately 40 percent of net sales of our European operations are denominated in U.S. dollars, while almost all costs of our European operations are incurred in euro." Delta Air Lines President Ed Bastian (March 3 presentation); "The strong dollar is clearly having an impact on fuel prices. We haven't done the math, but net-net, we believe we're a beneficiary to a strong dollar." Caterpillar CEO Douglas Oberhelman (Jan. 27 earnings call): "The rising dollar, I would expect in 2015 we would see more of that. It will not be good for U.S. manufacturing nor the U.S. economy. How that is offset against the lower oil, diesel, gasoline price, I don't know how it works out, but certainly anybody producing in Japan, the U.K. or Europe, particularly Germany, is going to have quite an advantage over their American competitors. We've worked hard to diversify our manufacturing footprint. We're large exporters and have a large cost base in Japan, Europe, U.K., as well, so we're taking advantage of that, but overall, I don't think it's a very good positive for U.S. manufacturing." Marriott SVP of investor relations Laura Paugh (March 5 presentation): "The U.S. is not particularly dependent on international arrivals, but when you go to Europe, 30 percent of demand in our European hotels comes from outside Europe. So a weak euro makes that market more attractive, and we are hopeful to see more Americans travelling to Paris this year. If you haven't booked your flight, you probably should because I think this is a real bargain and may not last long. In the U.S. we're rather insulated, but outside the U.S. there's lots of opportunity." Visit NI ORANGEBOOK<GO> on the terminal for more C-level economic commentary. Bloomberg Brief March 18, 2015 Currency Moves 19 FX MARKETS FOCUS BLOOMBERG NEWS & VIEW EURO CARRY TRADE Venezuela Keeps Hold on Mexichem as FX Eats Profit Euro Seen Draghi’s Savior as QE Targets Economy Yen Carry Trades at 2008 High Boost Inflation Hope He may be reluctant to admit it, but the biggest benefits from Mario Draghi’s bond purchases are likely to come from the plunge in the euro. The European Central Bank’s quantitative-easing program will boost euro-region inflation by 0.3 percentage point this year, with a weaker exchange rate doing most of the work, according to economists surveyed by Bloomberg. The euro tumbled to a 12-year low as the central bank unveiled details of its first week of purchases. “That’s the transmission mechanism that might be the most powerful,” said Hans Joerg-Naumer, head of capital-markets analysis at Allianz Global Investors, which oversees $412 billion. “They want to keep the euro exchange-rate low.” Click here for more. Borrowing yen to buy higher-yielding assets hasn’t been this popular since the global financial crisis. That’s a rare piece of good news for the Bank of Japan’s bid to achieve 2 percent inflation. Financial institutions borrowed 10.2 trillion yen ($84 billion) to send to headquarters overseas in November last year, the most since the same month in 2008, BOJ data show. The indicator of yen carry trade activity has been above 9 trillion yen every month since July, after the central bank doubled the size of a program providing cheap funds to lenders last year. Click here for more. — David Goodman and Andre Tartar Hey Auto Bulls, BMW Has Been Hedging for Years This year’s 12 percent plunge in the euro has ignited the biggest rally on record in automakers and helped push the DAX Index above 12,000. Demand for ways to protect gains is also soaring. Options on BMW and Volkswagen are the most expensive in more than two years relative to those on the Euro Stoxx 50 Index and contracts on Daimler climbed to their highest price since October 2013, data compiled by Bloomberg show. All three have rallied more than 36 percent this year. But investors such as Dirk Thiels at KBC Asset Management say the advance may have gone too far, in part because currency hedges from companies will limit the benefit to earnings. Click here for more. — Sofia Horta e Costa — Kevin Buckland and Shigeki Nozawa EMERGING MARKETS Fragile Five Down to Three as Fed Looms The Fragile Five is down to three. In August 2013 as the Federal Reserve considered when to slow its quantitative easing, Morgan Stanley identified the five major emerging markets with the most vulnerable currencies: Brazil, India, Indonesia, Turkey and South Africa. Now, as Fed officials debate how soon to raise interest rates for the first time since 2006, India and Indonesia may have dodged the bullet. Morgan Stanley economists say they’ve enacted enough economic reforms to have passed “the point of inflexion away from their old models of growth.” More pain before any gain is the scenario Morgan Stanley economists see: Higher Fed rates and a rising dollar could help impose a “catharsis” and force them to act.“The next 12-18 months may make things sufficiently worse so they can then get better,” they said. Click here for more. — Simon Kennedy Mexican companies operating in Venezuela are enduring a failing foreign-exchange system that’s draining profit. The outlook for local units of companies such as Mexichem and Coca-Cola Femsa is dimming as plunging crude prices and the world’s fastest inflation erode the value of the local currency. Click here for more. — Adam Williams,Katia Porzecanski,Patricia Laya VIEW How Asia Should Defend Against the Rising Dollar Can Asia beat the rising-dollar curse? The question is far from academic considering the central role that a strengthening U.S. currency played in sparking the region's 1997 crisis, as well as Latin America's own financial woes a decade earlier. When the dollar slides, liquidity flows into emerging markets, pumping up growth and assets. As the dollar rallies, it can act like a gargantuan money magnet drawing much-needed investment away from the developing world. Click here for more. — William Pesek China Has a Strategy for Winning the Currency Wars There's more than one way to win a battle. You can inflict increasing damage on your opponent, which is what most of the world is doing to the U.S. Or you can gain territory — which is what China is doing as its currency steals more and more of the global market. Click here for more. — Mark Gilbert Click here for more Bloomberg FX news and commentary. For analysis, see the Bloomberg Intelligence Currency Dashboard. March 18, 2015 Bloomberg Brief Currency Moves 20 Bloomberg Brief March 18, 2015 Currency Moves 21 CONTACTS Bloomberg Briefs Bloomberg Brief Managing Editor Jennifer Rossa jrossa@bloomberg.net +1-212-617-8074 Economics Editors - Asia Justin Jimenez jjimenez68@bloomberg.net +852-2977-2217 Newsletter Business Manager Nick Ferris nferris2@bloomberg.net +1-212-617-6975 Economics Editors - Europe Paul Smith psmith152@bloomberg.net +44-20-3525-8653 Jennifer Bernstein jbernstein60@bloomberg.net +852-2977-6733 Advertising Adrienne Bills abills1@bloomberg.net +1-212-617-6073 Scott Johnson sjohnson166@bloomberg.net +44-20-3525-8027 Stew Hawkins shawkins40@bloomberg.net +852-2977-6019 Alex Brittain abrittain4@bloomberg.net +44-20-3525-3183 Cover Design Pekka Aalto pekka2@bloomberg.net +852-2977-6013 Bloomberg Intelligence Chief Economist Michael McDonough mmcdonough10@bloomberg.net +1-212-617-6815 U.S. Economist Richard Yamarone ryamarone@bloomberg.net +1-212-617-8737 Europe Economist Maxime Sbaihi msbaihi@bloomberg.net +44-20-3525-4538 Asia Economist Tamara Henderson thenderson14@bloomberg.net +65-6212-1140 Chief U.S. Economist Carl Riccadonna criccadonna3@bloomberg.net +1-212-617-6935 Chief EMEA Economist Jamie Murray jmurray126@bloomberg.net +44-20-3525-0867 Europe Economist Niraj Shah nshah185@bloomberg.net +44-20-7330-7383 Asia Economist Fielding Chen schen609@bloomberg.net +852-2977-4830 U.S. Economist Josh Wright jwright136@bloomberg.net +1-212-617-3794 Chief Euro-Area Economist David Powell dpowell24@bloomberg.net +44-20-7073-3769 Chief Asia Economist Tom Orlik torlik4@bloomberg.net +86-10-6649-7211 Economics Editors - U.S. Anne Riley ariley17@bloomberg.net +1-212-617-0061 William C. Johnsen wjohnsen3@bloomberg.net +1-212-617-0509 Ben Baris bbaris1@bloomberg.net +1-212-617-2459 James Crombie jcrombie8@bloomberg.net +1-212-617-3590 Reprints & Permissions Lori Husted lori.husted@theygsgroup.com +1-717-505-970