h Glenn A. Gurtcheff h Glenn A. Gurtcheff

advertisement

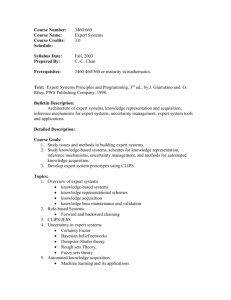

U.S. Bancorp Piper Jaffray Middle Market + Mergers & Acquisitions – Analyzing Weekly M&A Activity – March 17, 2003 hFEATURE Glenn A. Gurtcheff ARTICLE U.S. Bancorp Piper Jaffray will be publishing a technical research piece entitled "The Effect of an Acquisition on Earnings per Share – Accretion/Dilution Analysis.” An important consideration for many public companies in determining the acquisition consideration and purchase price is the effect of an acquisition on earnings per share. This M&A Insights article will review the reason that many public companies are concerned about the effect that an acquisition has on earnings per share. Specifically, many public companies are concerned that an acquisition not be dilutive to their earnings per share. The major reason for this is because of the potential effect it may have on the purchaser’s share price. A simple example will highlight this concern. Assume that a company’s stock trades at a price-to-earnings ratio of 25 times and the company has earnings per share of $1. The company’s stock price would be $25. Assume that the company desires to make an acquisition and expects that it will trade at a price-to-earnings multiple of 25 times subsequent to the acquisition. If the acquisition is dilutive to earnings per share (i.e., earnings per share fall below $1), the share price will fall below $25. On the other hand, if the acquisition is accretive, then the share price will rise above $25. It should be noted that this simple example does not highlight the many factors that result in the company’s stock trading at a different price-to-earnings multiple subsequent to the acquisition. In addition, it is important to note that there are many analysts and investors who place much more reliance on financial measurements other than earnings per share and the price-to-earnings multiples. The key considerations in determining whether a stock transaction is accretive or dilutive are the acquirer’s price-to-earnings ratio and the price-to-earnings ratio that is paid for the incremental earnings that are added as a result of the acquisition. Incremental earnings include the target’s after-tax earnings increased by any synergies (adjusted for taxes) that result from the acquisition. If the price-to-earnings multiple that is paid for the incremental earnings is lower (greater) than the purchaser’s price-toearnings multiple, the transaction will be accretive (dilutive). As an alternative to issuing stock, a purchaser may issue debt and use the cash proceeds to finance the acquisition. If the additional interest expense is less (more) than the pretax incremental earnings, the transaction will be accretive (dilutive). In conjunction with this article, U.S. Bancorp Piper Jaffray will be publishing a report entitled “Packaging Industry Public Acquirers – Earnings per Share Accretion/Dilution Considerations.” If interested in receiving the full report of either article, please contact Michelle Mudek at (312) 920-2158. hDEAL GlennOF A.THE Gurtcheff WEEK Jason Efthimiou 612.303.6375 Sylvan Learning Systems Enter Agreement with Apollo Management On March 11, 2003 Sylvan Learning Systems (NASD: SLVN) agreed to sell eSylvan, its signature tutoring centers business and its internet-based tutoring offshoot to Apollo Management, a New Yorkbased private equity firm, for a price estimated at $275 million to $300 million. Industry analysts have praised the potential deal as a positive for current shareholders and enables Sylvan to untangle its partnership with Apollo in Sylvan Ventures, whose losses were eroding confidence and value in the parent company. In addition to providing simplicity and transparency to Sylvan’s financials, the potential transaction enables Sylvan to focus entirely on running its six colleges in Europe and Latin America and its online universities, Walden and National Technological University. Sylvan’s higher-education operation is viewed to be more efficient and have greater long-term growth potential than its sales-intensive tutoring unit in the U.S. Sylvan will remain a publicly traded entity but with a new name and stock symbol in the coming year, while the tutoring business will no longer operate as a publicly traded company. U.S. Bancorp Piper Jaffray and Credit Suisse First Boston advised Sylvan Learning Systems while J.P. Morgan advised Apollo Management. Nondeposit investment products are not insured by the FDIC, are not deposits or other obligations of or guaranteed by U.S. Bank National Association or its affiliates, and involve investment risks, including possible loss of the principal amount invested. Securities products and services are offered through U.S. Bancorp Piper Jaffray Inc., member SIPC and NYSE, Inc., a subsidiary of U.S. Bancorp. ($ in Billions) Week of 03/10/03 Calendar Year 2002 Value (1) $ 3.2 $ 408.2 Volume 102 6,398 YTD 2002 vs. YTD 2003 1,500 $75 1,200 $60 900 $45 600 $30 300 $15 0 Value An acquirer may finance an acquisition by issuing stock or debt, or using existing cash on its balance sheet. In the case of stock, the purchaser may exchange its stock for the target’s stock or alternatively issue equity to third parties (e.g., the public markets) and use the proceeds as acquisition consideration. In recent years, cash has been used as the acquisition consideration in the majority of transactions (approximately 60 percent). In evaluating whether the acquisition consideration used will be stock or cash, the purchaser and the seller consider a variety of factors including: the effect on the purchaser’s financial measures, access to financial markets, the quality of an investment in the purchaser, whether the transaction will result in a tax deferral, and the desire of the seller to maintain a continuing influence in the business. DOMESTIC M&A TRANSACTIONS Volume Doug Lawson 312.920.2139 The Effect of an Acquisition on Earnings per Share – Accretion/Dilution Analysis $0 YTD 2002 Volum e YTD 2003 Value (1) Total value based on deals with reported values Source: Securities Data Corporation LTM median deal value is up to $21.0 million in 2003 from $18.0 million in 2002. LTM TRANSACTION MULTIPLES By Size ($ in millions): Less than $25 $25 to $100 $100 to $250 $250 to $1,000 Over $1,000 EBIT 7.8x 11.0x 12.5x 12.3x 13.1x EBITDA 6.8x 8.6x 9.0x 9.3x 8.6x * Based on multiples between 0x and 25x. Public Company Premiums: 1 Week prior to announcement 4 Weeks prior to announcement 32.0% 35.3% DEAL FINANCING Leveraged Bank Loan(1) High Yield Bond Rate Senior Debt / EBITDA Total Debt / EBITDA Current 4.43% 10.58% One Year Ago 5.19% 11.52% 2.9x 3.9x 2.7x 3.5x (1) Current data as of March 17, 2003 Source: Portfolio Management Data BUYOUT FUNDS - $ IN BILLIONS Funds Raised Deals Completed (1) 2003(1) $0.9 $6.2 2002 $29.0 $43.9 2001 $36.9 $23.1 Current data as of March 17, 2003 For more information, contact Heather D. Goodwin at hgoodwin@pjc.com