M&A and Accretion / Dilution November 10, 2012

advertisement

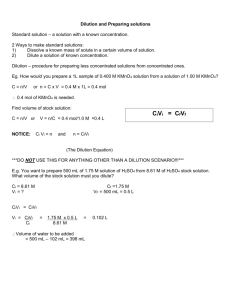

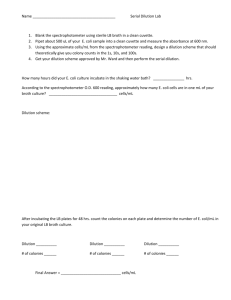

M&A and Accretion / Dilution November 10, 2012 In partnership with the Joshua Jia Jules Koifman Alexander Banh | Instructor / CEO | Instructor | CSO Table of Contents 1. Background • • • • Types of M&A Synergies Transaction types Role of investment banks 2. Process • • Buy side process Sell side process 3. Accretion / Dilution • • • Stock vs. cash acquisitions Effects of an acquisition Shortcuts 4. Merger Model • • • Steps Excel examples Goodwill Background 1 Types of M&A • Strategic vs. sponsor • Strategic acquisition Purchase of an operating business that is in the same industry or complements the buyers current business. • Sponsor acquisition Purchase of a business by a financial sponsor (private equity firm) Typically through a leveraged buyout (LBO) We’ll cover this in greater detail next class Background Process Accretion/Dilution Merger Model Background 2 Types of M&A • Horizontal acquisition Acquirer and the target are in the same industry • Vertical acquisition A cquirer and target are in the same value chain E.g. airline company acquiring a travel agency • Conglomerate acquisition: The acquirer and the target are not related to each other Also known as diversification Background Process Accretion/Dilution Merger Model Background 3 Why do mergers and acquisitions happen? • Gain market share Market / monopoly power • Fewer organic growth opportunities • Too much cash on balance sheet Common issue for large tech companies • Seller is undervalued • Up-selling and cross-selling opportunities Background Process Accretion/Dilution Merger Model Background 4 Why do mergers and acquisitions happen? • Patents, critical technology E.g. Google buying Motorola Mobility • Entering new market and / or new country • Diversification Very common in the 1980s Japanese trading houses, “sogo shosas”, like Itochu and Marubeni • Management is doing a poor job We can do better • …And of course: “synergies” Background Process Accretion/Dilution Merger Model Background 5 “Synergies” • Perhaps the most overused business term of all time • Synergies: 2+2=5 • Combining two firms will result in some strategic benefit above and beyond their combined intrinsic values • Two main categories: cost and revenue synergies • Other synergies include: tax synergies, financing synergies Background Process Accretion/Dilution Merger Model Background 6 Cost Synergies • Easiest to understand and predict • Only need one headquarters, can eliminate the other • Can consolidate buildings, lay off redundant support and admin. staff • Economies of scale Spread fixed overhead over a larger number of units More bargaining power against suppliers • Vertical integration Disintermediation removes mark ups, delivery fees, bullwhip effect • Target may have key competencies, technology or infrastructure that can help reduce the costs of the acquirer Background Process Accretion/Dilution Merger Model Background 7 Revenue Synergies • Cross-sell products to new customers • Up-sell new products to existing customers • Expand into new geographies • Network effect • Market / monopoly power • Since these are tough to predict, projected revenue synergies are not taken as seriously Background Process Accretion/Dilution Merger Model Background 8 Tax / Financing Synergies • Net operating losses Bidding firm with past losses could acquired a profitable target and then apply its NOLs • Unused debt capacity • A larger firm can sometimes get cheaper financing • Write up purchased assets to fair market value, providing a larger depreciation tax shield • Used to be able to amortize goodwill (tax benefits), but no longer allowed under IFRS Background Process Accretion/Dilution Merger Model Background 9 Why do most mergers and acquisitions destroy value? • About two thirds of mergers and acquisitions destroy value • From 1980 to 2001, acquisitions resulted in an average of a 1-3% decline in acquirer share price, or $218 billion of value transferred from acquirers to sellers (McKinsey & Co.) • Why? Background Process Accretion/Dilution Merger Model Background 10 Why do most mergers and acquisitions destroy value? • Management egos Bigger company = bigger bonus • Diversification results in loss of management focus • Clashing cultures • The transition phase is often underestimated • Easy to overestimate synergies Synergies often not enough to overcome control premiums and financing / transaction fees • Winner’s curse When an attractive target is put into play, competing bidders often enter Background Process Accretion/Dilution Merger Model Background 11 Strategic M&A Advisory • Investment banks can add a great deal of strategic value compared to more transaction oriented situations like equity or debt issuances • Host of key issues which bankers must decide • How do we structure the transaction? Plan of Arrangement, Takeover Bid, Amalgamation • Consideration? Cash, shares, preferred shares, warrants, special warrants Background Process Accretion/Dilution Merger Model Background 12 Strategic M&A Advisory • Price? • Deal terms? Break fee, reverse break fee Go-shop clause Right to match Are options assumed by buyer, cashed out, or ignored? Locking up management, BoD, large shareholders • Tax consequences? Creation of goodwill Transaction structure and consideration will affect taxes E.g. can defer capital gains with amalgamation or stock purchase Background Process Accretion/Dilution Merger Model Background 13 Strategic M&A Advisory • Special situations Buying firm after bankruptcy or restructuring Insider bids (requires protection of minority shareholders) Reverse mergers Three-way mergers • Cross-border transactions are more complex Government intervention Different regulations Background Process Accretion/Dilution Merger Model Background 14 Strategic M&A Advisory • Execution M&A process can be lengthy Many legal procedures need to be followed Due diligence • Regulation Certain deals must be carefully structured to maintain compliance with anti-trust, national interests, and other legal issues Many large deals get blocked by the government Background Process Accretion/Dilution Merger Model Background 15 Buy side vs. sell side • Investment banks can advise on the buy side or sell side • Buy side: advising the buyer Helps buyer determine the right bid and deal terms Can be complex with multiple bidders or with hostile takeover Takes 16 – 36 weeks Takes another 3 – 4 months to close after announcement • Sell side: advising the sell side • Which advisory role do investment banks typically prefer? Background Process Accretion/Dilution Merger Model Background 16 Sell side…strong side? • Sell side advisory roles have much higher chance of closing then buy side advisory roles Transaction and financing fees are based on the transaction closing • Most companies can be sold for some price • However, if there are multiple bidders, then the buyer may not get the deal Background Process Accretion/Dilution Merger Model Background 17 Other roles • Acquisitions after restructuring require special expertise E.g. Deloitte buying Monitor • Spinoffs / divestitures • Fairness opinion Independent valuation to determine if offer price is fair Most Board of Directors require a fairness opinion before selling their company Fees tend to be lower than advisory role Background Process Accretion/Dilution Merger Model Background 18 Other roles • “Strategic review” Means a firm has hired an investment bank to assess strategic alternatives, including finding buyers for the company • Hostile defense Is our company undervalued? Are we vulnerable to a raider? Background Process Accretion/Dilution Merger Model Background 19 Why choose X bank as an advisor? • How does a firm choose an investment bank? • Relationship business • Strategic expertise can play a role Certain banks are strong in certain sectors • Rarely decided on fees Most banks have similar fee structures • On the buy side, financing offered by banks will vary Important decision criteria for companies • Sometimes there is a “stapled financing package,” meaning sell side advisor provides financing for buyers Buyers no longer need to scramble for last-minute financing Background Process Accretion/Dilution Merger Model Background 20 Types of Transactions • Plan of Arrangement An actual “plan” is prepared, showing the steps needed to close deal No direct offer to shareholders Requires shareholder approval of two-thirds Provides maximum flexibility for structuring (e.g. three way mergers) Useful when there are multiple classes of shares Useful for buying a subsidiary of a publically-traded target Costs more and takes longer Requires court approval Must be friendly Background Process Accretion/Dilution Merger Model Background 21 Types of Transactions • Take-Over Bid Offer to acquire outstanding voting or equity securities Bid must be made to all holders of the class with identical consideration If bidder increases price, everybody who tendered gets the benefit of the increased price If 90% tender, then compulsory acquisition of the remaining 10% If only two-thirds tender, then move into second stage process Background Process Accretion/Dilution Merger Model Background 22 Types of Transactions • One stage process If 90% tender, then compulsory acquisition of the remaining 10% This is the fastest • Two stage process • If more than two-thirds tender, but less than 90% Company must call a shareholder meeting Shareholders will vote to merge / amalgamate, which requires two-thirds approval Minority shareholders are squeezed-out Background Process Accretion/Dilution Merger Model Background 23 Types of Transactions • Stock purchase By far the most common Purchase of the entire entity by buying up all equity ownership (stock) • Asset purchase Seller retains ownership of equity Buyer simply buys up the assets from seller (and sometimes associated liabilities) Buyer creates a new entity or uses another existing entity Background Process Accretion/Dilution Merger Model Process 24 Buy Side Process • Four stages: 1. Assessment 2. Contacting targets and valuation 3. Pursuing the deal and due diligence 4. Definitive agreement and closing Background Process Accretion/Dilution Merger Model Process 25 Preliminary Assessment (4 – 8 weeks) • Analyze competitive landscape • Identify potential targets • Find key issues to address Pensions Contingent liabilities Off balance sheet items Inside ownership Unusual equity structures (special warrants) • Build out acquisition timetable Tendency to be optimistic Background Process Accretion/Dilution Merger Model Process 26 Contacting Targets and Valuation (4 – 8 weeks) • Contact candidates • Negotiate Confidentiality Agreement (CA) • Perform preliminary valuation on target Trading comparables Precedent transactions DCF Accretion / Dilution LBO Background Process Accretion/Dilution Merger Model Process 27 Pursuing the Deal, Due Diligence (4 – 10 weeks) • Send letter of intent (LOI) with details of initial offer • Conduct due diligence Create data room Analyze products and services Analyze the company and industry Assess the company’s financials Identify contingent liabilities Conferences with management, auditors, lawyers Site visits • Finish valuation Background Process Accretion/Dilution Merger Model Process 28 Definitive Agreement and Announcement (4 – 10 weeks) • Finish due diligence • Arrange, negotiate and execute definite agreement Board must approve for it to be a friendly acquisition • Provide financing, unless stapled financing package in place • Conduct any required filings and announce deal • Seek shareholder approval • Seek regulator approval • Deal may take another 3 to 4 months before it is officially closed Background Process Accretion/Dilution Merger Model Process 29 Sell Side Process • When a firm wishes to sell itself, it will usually either: Contact investment bank which it has a strong relationship with Contact investment bank which has strategic expertise in its sector Invite multiple investment banks to a “beauty contest” • During a beauty contest, multiple investment banks will present their qualifications, expertise, proposed strategy, key issues, and universe of buyers to the firm Firm picks the “best” bank Background Process Accretion/Dilution Merger Model Process 30 Preliminary Assessment (2 – 4 weeks) • Identify seller’s objectives and determine appropriate sale process Broad or narrow auction? • Broad auction Contact many potential buyers More bidders = higher price (usually) Risks leaking competitive information Higher chance that process will be leaked, which will interfere with the deal process and morale of employees Often best option if the public is expecting sale When companies announce they are performing a “strategic review,” this often means a broad auction Background Process Accretion/Dilution Merger Model Process 31 Preliminary Assessment (2 – 4 weeks) • Narrow auction Contact a few strategic buyers Prevents leaking competitive information Often best option if the public is expecting sale When companies announce they are performing a “strategic review,” this often means a broad auction Background Process Accretion/Dilution Merger Model Process 32 First Round • Contact potential buyers • Negotiate and execute CAs • Send out Confidential Information Memorandum and initial bid procedures letter • Prepare management presentation • Build data room • Negotiate stapled financing package if there is one • Receive initial bids, and filter buyers to second round Background Process Accretion/Dilution Merger Model Process 33 Second Round • Facilitate management presentations Management brings bankers to presentations to add legitimacy • Facilitate due diligence Site visits Open up data room to buyers • Send out final bid procedures letter and create a draft of the definitive agreement • Buyers make their final bids Background Process Accretion/Dilution Merger Model Process 34 Negotiations • Evaluate final bids • Negotiate with top bidders • Select winning bidder Not always the highest bidder Other factors like deal terms, type of consideration, future plans, if buyer is willing to cooperate with existing management’s vision • Arrange for fairness opinion (if needed) • Receive board approval and execute definitive agreement • Transaction is announced Background Process Accretion/Dilution Merger Model Process 35 Closing • Shareholder approval • Regulatory approval • Financing and closing • May take 3 to 4 months for acquisition to officially close Background Process Accretion/Dilution Merger Model Accretion / Dilution 36 Benefits of acquiring with cash • Cash is generally cheaper than equity Opportunity cost of balance sheet cash is forgone interest in cash Typically 1%, while cost of equity is usually double digits Debt is also generally cheaper than stock • Good for confident buyers With cash, buyer retains 100% of the benefit since acquiring shareholders own all of the entity’s shares Target shareholders will receive the acquirer’s shares in exchange for their own Stock transactions distribute benefit / loss between acquiring shareholders and target shareholders Background Process Accretion/Dilution Merger Model Accretion / Dilution 37 Benefits of acquiring with cash • Less uncertainty Stock offers are usually made with an exchange ratio, no fixed value Stock price could fluctuate before tendering of shares Cash is a fixed value (assuming no currency risk) • Better if stock of acquirer is weak Cash is more common in economic downturns • Will result in better profitability ratios However, liquidity ratios will decline Background Process Accretion/Dilution Merger Model Accretion / Dilution 38 Benefits of acquiring with stock • Good if acquirer’s stock is doing well Many stock acquisitions by tech companies before tech bubble burst • Better for tax With cash acquisition, capital gain is immediately taxable With stock, these capital gains can be deferred • Acquirer may not have access to cash Background Process Accretion/Dilution Merger Model Accretion / Dilution 39 Accretion / Dilution • What is accretion? If pro forma (combined) EPS > Acquirer’s EPS • What is dilution? When pro forma (combined) EPS < Acquirer’s EPS Background Process Accretion/Dilution Merger Model Accretion / Dilution 40 What are the effects of an acquisition? • Foregone interest on cash Opportunity cost of balance sheet cash is lost interest income • Interest on debt If buyer uses debt • Additional shares outstanding If buyer pays with stock, it issues additional shares • Combined financial statements • Creation of goodwill and other intangibles Write up target’s assets from historical cost to fair value Goodwill represents the premium over this amount (approximately) Background Process Accretion/Dilution Merger Model Accretion / Dilution 41 Acquirer, P / E of 10. Target, P / E of 5. Accretive? • What’s the consideration? Assume all stock Background Process Accretion/Dilution Merger Model Accretion / Dilution 42 Acquirer, P / E of 10. Target, P / E of 5. Accretive? • This is accretive • In an all-stock deal, accretive if P / E of Target < P / E of Acquirer • Think of it as a more expensive company acquiring a cheaper company, in terms of stock price to earnings • You are paying for a company that is generating more earnings than you are per dollar of stock price Your EPS will go up if you buy their relatively underpriced stock with your own relatively overpriced stock • Note: we have not accounted for financing fees, transaction fees, or synergies Background Process Accretion/Dilution Merger Model Accretion / Dilution 43 All-Cash Acquisition • If a deal is finance only through cash and debt, there is a shortcut for calculating accretion / dilution • If: interest expense for debt + foregone interest on cash < target’s pre-tax income, then acquisition is accretive • Think of it as: pre-tax cost of the capital being used < pre-tax income being consolidated with your own • Assumes no synergies, transaction fees, financing fees • Complete equation: If transaction fees + financing fees + interest expense for debt + foregone interest on cash < target’s pre-tax income + synergies, then acquisition is accretive Background Process Accretion/Dilution Merger Model Accretion / Dilution 44 Accretion / Dilution Analysis • No shortcuts for finding accretion / dilution for acquisitions that use a mix of cash or stock Must build merger model • Advantages of using a merger model: Intrinsic valuation allows you to understand break-even synergies, key variables, as well as bull, base and bear case scenarios • Disadvantages: Using precedents transactions may provide a more objective view, since there is less room for manipulation Difficult to model out synergies, transition costs, effect on corporate culture and employee morale Background Process Accretion/Dilution Merger Model Merger Model 45 Accretion / Dilution Analysis Steps 1. Input purchase price assumptions (% cash / stock / debt) 2. Build standalone income statement and balance sheet for acquirer / target 3. Allocate purchase price to the writing-up of assets to fair value, the creation of new goodwill, and transaction fees 4. Build a sources & uses table to calculate amount of cash / stock / debt 5. Make adjustments to the target’s balance sheet based on step 3 6. Create pro-forma post-merger balance sheet and income statement, making adjustments for any synergies or new debt / interest expense 7. Calculate post-merger fully diluted shares outstanding 8. Did EPS increase? Sensitize analysis to purchase price, % stock / cash / debt, revenue synergies and expense synergies Background Process Accretion/Dilution Merger Model Merger Model 46 Allocation of Purchase Price Allocation of Purchase Price Book value (A-L) Less: Old Goodwill Tangible Book Value Plus: Option proceeds (increases bv) Tangible Book Value (trans. Adj.) Plus: Write up of Inventory Plus: Write up of PP&E Plus: Write up of Amortizable Intagible Assets Less: Deferred taxes Target FMV Non-financing transaction expenses Goodwill Purchase price (offer value + transaction fees) Sources & Uses of Funds Sources of Funds Acquisition Debt Stock Issued Total Sources Uses of Funds Cash to Target Stock to Target Transaction Fees Financing Fees Total Uses Background Process 0.2% 0.3% 0.2% 2,457.0 1,024.0 1,433.0 0.0 1,433.0 75.0 150.0 100.0 99.8 1,658.2 458.7 44,668.6 $46,326.8 break circularity? (y/n) n 24,116.2 22,934.1 $47,050.3 $22,934.1 22,934.1 458.7 723.5 $47,050.3 Accretion/Dilution Merger Model Merger Model 47 Adjusting Target’s Balance Sheet Pro Forma Balance Sheet Adjustments Prior to Merger Acquirer Target PG Gillette $5,892.0 $644.0 4,062.0 1,216.0 4,400.0 1,407.0 958.0 302.0 1,803.0 190.0 14,108.0 3,524.0 19,610.0 1,024.0 4,290.0 570.0 1,925.0 1,082.0 Cash and equivalents Accounts Receivable Inventories Deferred Tax Assets Other Current Assets PP&E Goodwill Intagibles Other Assets Deferred Financing Fees Total Assets 0.0 75.0 (1,024.0) 150.0 44,668.6 100.0 723.5 Accounts Payable Other Current Liabilities Deferred Tax Liabilities Total Debt (ex. Convertible) Convertible Debt Other Liabilities Minority Interest Convertible Preferred Stock Common Equity Total Liabilities + SE Balance Check Background Adjustments $57,048.0 $9,959.0 3,617.0 10,243.0 2,261.0 20,841.0 598.0 2,139.0 652.0 3,112.0 99.8 24,116.2 0.0 2,808.0 1,526.0 15,752.0 57,048.0 0.0 Process 932.0 69.0 2,457.0 9,959.0 0.0 Accretion/Dilution 0.0 (2,457.0) 22,934.1 Merger Model Pro Forma 6,536.0 5,278.0 5,882.0 1,260.0 1,993.0 17,782.0 64,278.6 4,960.0 3,007.0 723.5 111,700.1 4,215.0 12,382.0 3,012.8 48,069.2 0.0 3,740.0 69.0 1,526.0 38,686.1 111,700.1 0.0 Merger Model 48 Pro Forma Income Statement Pro Forma Income Statement Adjustments Transaction Year Date 6/30/05 % of transaction year post-deal date 79.2% Acquirer FY EPS $2.56 Diluted Shares Outstanding 2,597.5 Net Income 6,649.7 Target FY EPS $1.72 Diluted Shares Outstanding 1,017.3 Net Income Converted in consensus EPS? (y/n) 1,385.3 Plus: Pref. dividends saved on conversion of converts y 0.0 Plus: Interest exp. saved on conversion of converts y 0.0 Net Income (adj. for convertible securities) 1,385.3 Pro Forma Net Income (pre adjustments) 8,035.0 Plus: Planned Synergies Plus: Interest income from option proceeds Less: Addtl. Interest Expense Less: Amort. Financing Costs Less: Addtl. Depreciation Less: Amort. of ID'd Intangibles Total Pretax Adjustments (Taxable) Tax Impact of adjustments at acquirer's 30.7% tax rate Total Adjustments Pro Forma Net Income (post adjustments) Diluted Shares Outstanding Pro Forma EPS Accretion/Dilution -- per share Accretion/Dilution -- % Additional Synergies Requiried to Breakeven ($MM) Background Process Accretion/Dilution 100.0 0.0 (763.7) (71.6) (7.9) (6.3) (749.5) 230.1 (519.4) Yr 1 6/30/06 Yr 2 6/30/07 $2.82 2,597.5 7,325.1 $3.14 2,597.5 8,156.3 $1.93 1,017.3 1,963.4 0.0 0.0 1,963.4 $2.13 1,017.3 2,168.7 0.0 0.0 2,168.7 9,288.5 10,325.0 200.0 0.0 (964.6) (90.4) (10.0) (8.0) (873.1) 268.0 (605.0) 300.0 0.0 (964.6) (90.4) (10.0) (8.0) (773.1) 237.3 (535.7) 7,515.5 2,923.7 $2.57 8,683.5 3,009.5 $2.89 9,789.3 3,009.5 $3.25 $0.01 0.4% - $0.07 2.3% - $0.11 3.6% - Merger Model Merger Model 49 Deferred tax liabilities • Writing up target’s assets to fair values creates deferred tax liabilities (DTLs) • On your books, it seems like you don’t have to pay as much tax, since you are writing up your assets up and increasing your depreciation base • In reality, you still have to pay the same amount of tax Naturally, government does not let you reduce taxes by writing up the target’s assets after an acquisition • There will be a discrepancy between your books and the taxes you actually pay • This discrepancy creates a DTL DTL = asset write-up x tax rate Background Process Accretion/Dilution Merger Model Merger Model 50 Goodwill • We write up the target’s assets from historical cost to fair market value • We then have to account for any DTLs created • Goodwill = equity purchase price – seller book value + seller’s existing goodwill – asset write-ups – seller’s existing deferred tax liability + writedown of seller’s existing deferred tax asset + newly created deferred tax liability Background Process Accretion/Dilution Merger Model