Operating Earnings Yield (OEY)

advertisement

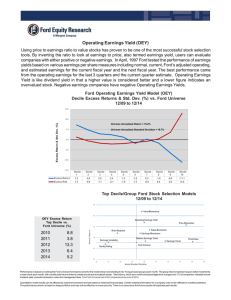

Operating Earnings Yield (OEY) Using price to earnings ratio to value stocks has proven to be one of the most successful stock selection tools. By inverting the ratio to look at earnings to price, also termed earnings yield, users can evaluate companies with either positive or negative earnings. In April, 1997 Ford tested the performance of earnings yields based on various earnings per share measures including normal, current, Ford’s adjusted operating, and estimated earnings for the current fiscal year and the next fiscal year. The best performance came from the operating earnings for the last 3 quarters and the current quarter estimate. Operating Earnings Yield is like dividend yield in that a higher value is considered better and a lower figure indicates an overvalued stock. Negative earnings companies have negative Operating Earnings Yields. Ford Operating Earnings Yield Model (OEY) Decile Excess Returns & Risk-Std. (%) vs. Ford Universe 12/07 to 12/12 20.0 15.0 Universe Annualized Return = 5.9% Universe Standard Deviation = 25.9% Excess Returns & Risk (%) 10.0 5.0 0.0 -5.0 -10.0 Decile Decile Decile Decile Decile Decile Decile Decile Decile Decile 1 2 3 4 5 6 7 8 9 10 Excess Return 9.4 4.3 0.9 0.2 -1.9 -3.6 -1.4 -4.5 -6.8 -1.4 Excess Risk 8.4 -0.7 -2.9 -4.9 -5.4 -4.5 -2.5 1.4 5.8 18.2 Top Decile/Group Ford Stock Selection Models 12/07 to 12/12 20 Price/Value 18 OEY Excess Return Top Decile vs. Ford Universe (%) Operating Earnings Yield 16 14 -2.8 50.3 8.8 3.8 13.3 Annual Return 12 2008 2009 2010 2011 2012 Price Momentum Value Momentum Earnings Momentum 10 Rel. Earnings Trend Earnings Trend Sales Momentum Share Buyback (-5%) 8 Earnings Variability Ford Universe 6 Quality Rating 4 2 S&P 500 0 15 20 25 30 35 40 45 Annual Standard Deviation Performance is based on ranking the Ford Universe from best to worst for the model shown and dividing it into 10 equal-sized groups each month. The group returns represent equal–dollar investments in each stock each month, with monthly total returns linked to create annual and annualized results. Total returns, which sum month-end percentage price changes and 1/12 of companies’ indicated annual dividend yield, exclude transaction costs and management fees. The Ford Universe had 4021 companies at the end of 2012. Quantitative model results can be affected by market environment and are based on historical financial data. Certain material information for a company may not be reflected in models presented. The performance shown is based on large portfolios and may not be effective on every security. There is no assurance that future results will duplicate past results. OEY Decile Performance on Capitalization Sectors Average Annual Returns (%) 12/07-12/12 Large Cap Standard Deviation 1 2.6 29.5 2 2.7 26.2 3 3.6 23.2 4 5.4 20.7 5 5.0 19.2 6 3.3 19.1 7 2.5 19.9 8 1.1 20.6 9 1.9 22.1 10 Cap Univ. 0.6 3.0 29.4 22.5 Mid Cap Standard Deviation 8.8 37.0 12.4 28.1 8.6 26.5 5.5 23.7 4.4 23.3 4.1 22.2 2.1 23.0 6.1 24.5 3.4 27.1 2.0 36.1 6.0 26.4 Small Cap Standard Deviation 14.5 40.6 11.9 31.3 5.9 27.2 7.1 25.4 5.0 22.4 5.9 26.0 5.2 28.1 -1.6 28.5 -2.1 32.1 -4.2 41.7 5.1 29.3 Large, Mid and Small Cap constituents include the top 1000, second 1000, and third 1000 companies in the Ford universe of stocks when ranked by market capitalization. OEY Top Decile Annual Excess Return by Industry Group 12/07 - 12/12 15 10 5 0 -5 -10 -15 -20 Correlation Coefficients 12/07 - 12/12 Ford Proprietary Models PVA OEY EMO PRM VMO SHB QTY SMO SED SDR EDV Price/Value (PVA) 1.000 0.679 0.154 0.541 -0.181 -0.550 -0.676 -0.279 0.708 0.614 -0.756 Operating Earnings Yield (OEY) 0.679 1.000 -0.041 0.391 0.020 -0.199 -0.390 -0.351 0.215 0.132 -0.489 Earnings Momentum (EMO) 0.154 -0.041 1.000 0.112 0.246 -0.401 -0.390 0.329 0.616 0.583 -0.432 Price Momentum (PRM) 0.541 0.391 0.112 1.000 0.462 -0.439 -0.598 0.109 0.391 0.245 -0.559 Value/ Momentum (VMO) -0.181 0.020 0.246 0.462 1.000 -0.113 -0.056 0.427 -0.076 -0.094 -0.012 Share Buyback (SHB) -0.550 -0.199 -0.401 -0.439 -0.113 1.000 0.746 -0.310 -0.723 -0.577 0.786 Quality Rating (QTY) -0.676 -0.390 -0.390 -0.598 -0.056 0.746 1.000 -0.134 -0.713 -0.527 0.888 Sales Momentun (SMO) -0.279 -0.351 0.329 0.109 0.427 -0.310 -0.134 1.000 0.074 0.053 -0.128 Earnings Trend (SED) 0.708 0.215 0.616 0.391 -0.076 -0.723 -0.713 0.074 1.000 0.908 -0.780 Relative Earnings Trend (SDR) 0.614 0.132 0.583 0.245 -0.094 -0.577 -0.527 0.053 0.908 1.000 -0.613 -0.756 -0.489 -0.432 -0.559 -0.012 0.786 0.888 -0.128 -0.780 -0.613 1.000 Earnings Variability (EDV)