Starbucks in India

advertisement

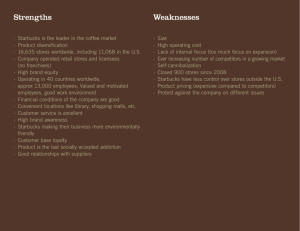

Starbucks in India Why partner with Tata? Starbucks’s International Strategy • Approximately 9,400 company-controlled retail locations. • Expanding in countries with growing middle class. • • • • China Vietnam India Colombia Tata’s Dominance • Conglomerate: 100 Companies. • Major Companies: Tata Steel, Tata Motors, Tata Consultancy Services, Tata Power, Tata Chemicals, Tata Television Services, Titan, Tata Communication, Indian Hotels, Tata Global Beverages. • 2011-2012 Revenue: 100.09 Billion Dollars. • Revenue in India: 42%. Indian Economy • Growing middle class. • “Next big spender is India’s middle class.” • Population growth. • Changing demographics. • 50% of population under 25. • 65% of population under 35. Indian Coffee Market • Demand shifting. • Away from tea. • Coffee consumption increased by 80% from 2000 – 2010. • Starbucks as a third place. • Store design. • Meeting place. • Free Wi-Fi. Coffee Demand in India Price Income Population Quantity 0 Why form 50:50 Joint Venture? • Advantages for Starbucks: • • • • • Incumbents – Very Strong Tata retail chain - Star Bazaar. Tata hotel chains - Taj Hotels Resorts and Palaces. Tata Coffee - Asia's largest coffee plantation company. Tata Group Companies - Easy reach upper middle class (Starbucks’s niche). Tata’s Planned entry into airline industry - Opportunity to offer coffee during flight. • Starbucks gets access to best coffee grown in India, real estate in premium locations, easy market penetration, and the Tata brand. Heterogeneous Oligopoly • Specialty coffee retail shop industry controlled by three firms: • Barista • Mocha • Café Coffee Day • Specialty coffee retail shops are about experience rather than coffee. • Firm Differentiation: • Barista preferred outlet for business meetings. • Mocha trendier outlet. • CCD hangout place for the youth. Joint Venture Payoffs Hypothetical payoffs in a normal game between Starbucks and Tata: Partner with Starbucks Don’t Partner with Starbucks Partner with Tata 1000, 900 100, 300 Don’t partner with Tata 150, 400 50, 50 Both firms’ dominant strategy is to partner with each other. Nash Equilibrium occurs where both firms partner with each other. Barriers to Entry • Relatively low barriers for private coffee restaurateur. • Medium to high barriers to achieve scale prior to market saturation. • Need for quick growth. • 2,000 current cafes in 40 Indian cities. • • • • • • High real estate costs. Consumer tastes. Brand recognition to develop scale. Local, large scale supply network. Local politics. High bargaining power of coffee bean suppliers. • Supply of quality beans controlled by few, large firms. Transaction Costs Transaction Costs of Joint Venture Transaction Costs of Going Alone Contract Legal Fees Relationship Specific Exchange Finding local suppliers Bargaining with suppliers Identifying real estate Transaction Costs of Joint Venture < Transaction Costs of Going Alone Costs of Not Partnering • Market Research. • Advertising. • Market loss to established competitors due to slow growth. • Asymmetric information: • Hidden actions of suppliers. Risks of Partnering • Hostile takeover by Tata. • Tata severing ties with Starbucks once experience is gained. • Minimized profits from revenue sharing. • Rapid penetration worth the loss of revenue? • Does partnership neutralize Demand shift? Looking Ahead • Achieve scale quickly through joint venture with Tata prior to market saturation. • Mitigates risk of quick expansion. • Protects against rivals’ expansion strategies. • • • • Capitalize on Tata brand to create product differentiation. Capitalize on non-Indian markets penetrated by Tata. Vertically integrate by acquiring coffee plantations. Product and market differentiation increasingly more important as lower quality entrants such as McDonald’s and Dunkin Donuts start to offer coffee. • Only consider this strategy in regions where competitive coffee is low. • Joint venture strategy useful in established markets experiencing rapid growth.