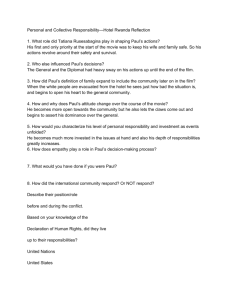

ACCOUNTING PRINCIPLES

advertisement