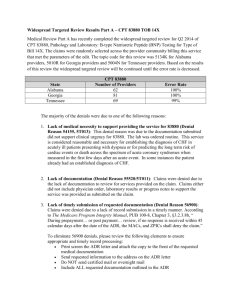

Summary of macroeconomic forecasts

Group Economic Research http://economic-research.bnpparibas.com

Summary of macroeconomic forecasts

GDP Growth Inflation Curr. Account / GDP Fiscal balances / GDP

2014 2015 e 2016 e 2014 2015 e 2016 e %

Advanced

United States

Japan

United Kingdom

Euro Area

Germany

France

Italy

2.8

0.9

1.6

0.2

2014 2015 e 2016 e

1.8

1.9

2.3

2.4

-0.1

2.4

0.8

2.9

0.9

2.3

1.6

1.8

1.2

2.0

1.9

2.3

1.8

-0.4 0.8

1.3

1.5

0.4

0.8

0.6

2014 2015 e 2016 e

1.4

0.5

1.9

1.6

2.7

0.4

0.9

2.5

1.5

0.3

0.2

0.5

0.4

1.7

1.5

1.8

1.5

0.2

0.2

1.1

-2.3

0.5

-5.5

2.1

7.8

-1.0

1.9

-2.5

2.8

-4.6

3.1

8.1

0.0

2.0

-2.8

2.7

-3.5

3.1

8.1

-0.0

2.3

-2.8

-5.5

-5.0

-2.4

0.7

-4.0

-3.0

-2.8

-4.3

-3.9

-2.0

0.8

-3.7

-2.6

-2.4

-3.9

-2.7

-1.5

1.0

-3.3

-2.2

Emerging 4.5

4.0

5.3

5.6

6.2

6.2

China

India

Brazil

Russia

7.4

7.1

0.1

0.6

7.1

7.1

-2.0

-2.5

7.3

7.5

0.5

1.5

2.0

6.7

6.3

7.8

1.2

5.4

8.6

13.0

1.7

7.2

6.6

6.2

World 3.3

3.1

3.9

3.7

3.6

4.3

Source : BNP Paribas Group Economic Research / GlobalMarkets (e: estimates & forecasts)

2.1

-1.7

-4.0

3.2

4.0

-1.3

-4.3

2.9

4.0

-1.4

-4.3

3.0

-2.1

-4.4

-6.2

-0.5

-2.4

-4.1

-6.4

-3.6

-2.8

-3.9

-5.9

-1.6

In the US , the economy is running at 2.5% annual path, while the unemployment rate is falling toward 5%, time for monetary policy to become less accommodative.

Although lower oil prices and stronger dollar weigh on headline inflation, the first rate hike is likely to occur by end-2015

With low inventories, low real interest rates, upswing in prices and optimistic surveys, the housing market will continue to do well, supporting private consumption Corporates are still largely self-financing their capital spending (high margins) and investment is likely to keep healthy. Main risk : fall in oil prices to dampen capex in the energy sector.

In the euro zone, the recovery has been on a good track until mid-2015 (growth close-to +1.5% annual path), but the perspective of a “Grexit” has dampened business surveys as well as market prices recently. In Germany, the expected IfO index is down for the third month in a row in June, suggesting that activity might become less dynamic for a while.

1 US GDP growth and composite ISM 2 EMU GDP growth and composite PMI

▌GDP, q/q, ann. [L]

▬ ISM composite [R]

6%

4%

2%

0%

-2%

-4%

-6%

40

35

-8%

2009 2010 2011 2012 2013 2014 2015 2016

30

Source : Thomson Datastream, BNP Paribas

65

60

55

50

45

▌GDP, q/q, ann. [L]

▬ PMI composite [R]

60

4%

2%

55

0%

-2%

50

45

-4%

-6%

40

-8%

2008 2009 2010 2011 2012 2013 2014 2015 2016

35

Source : Thomson Datastream, BNP Paribas

Some pay-back after the very strong GDP number printed by the The PMI indexes were good until June, in line with a 1.5% to 2% end of last year. Yet, the US activity keeps on a solid trend and may have rebounded in Q2. annual rate of growth in GDP.

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

Summary of financial forecasts

Interest rates

End of period, %

US Dol.

Fed Funds

2015

Q1

0.25

Q2 Q3e Q4e

2016

Q1e Q2e Q3e Q4e

0.25 0.25-0.50

0.5-0.75 0.75-1.00 1.00-1.25 1.25-1.50 1.75-2.00

######## ######## ########

2014

0.25

2015e 2016e

0.5-0.75 1.75-2.00

Libor 3m $ 0.27

0.28

0.75

1.00

1.30

1.55

1.85

2.30

0.26

1.00

2.30

T-Notes 10y

Euro. A.

ECB "Refi"

Euribor 3m

Bund 10 ans

OAT 10y

BTP 10y

R-Uni BoE Base rate

Gilts 10y

Japon BoJ Ov ernight

JGB 10y

0.42

1.29

0.50

1.58

1.93

0.05

0.02

0.18

0.02

0.40

2.33

0.05

-0.01

0.77

1.20

2.31

0.50

2.03

0.01

0.44

0.85

1.65

0.50

2.10

2.50

0.05

0.00

0.55

0.10

0.55

0.95

1.60

0.50

2.25

2.75

0.05

0.00

0.70

0.10

0.60

1.05

1.75

0.75

2.35

2.80

0.05

0.00

0.80

0.10

0.70

Exchange rates

End of period

USD EUR / USD

2015

Q1

1.07

Q2

1.11

Q3e

1.04

Q4e

1.02

2016

Q1e

1.00

Q2e

1.00

USD / JPY

EUR EUR / GBP

EUR / CHF

EUR / JPY

120

0.72

1.04

129

122

0.71

1.04

136

127

0.69

1.08

132

130

0.68

1.10

133

132

0.68

1.10

132

Source : BNP Paribas Group Economic Research / GlobalMarkets (e: Estimations, prév isions)

132

0.69

1.10

132

1.20

1.95

0.75

2.40

2.85

0.05

0.00

0.95

0.10

0.80

Q3e

1.02

134

0.69

1.10

137

1.35

2.15

1.00

2.50

2.95

0.05

0.00

1.10

0.10

1.00

Q4e

1.04

136

0.70

1.10

141

1.55

2.35

1.25

2.60

3.00

0.05

0.00

1.25

0.10

1.00

2014

1.21

120

0.78

1.20

145

0.84

1.88

0.50

1.76

2.18

0.05

0.08

0.54

0.07

0.33

2015e

1.02

130

0.68

1.10

133

0.95

1.60

0.50

2.25

2.75

0.05

0.00

0.70

0.10

0.60

1.55

2.35

1.25

2.60

3.00

0.05

0.00

1.25

0.10

1.00

2016e

1.04

136

0.70

1.10

141

3 US, interest rates vs nominal GDP growth 4 Euro area, interest rates vs nominal GDP growth

─ ─ US nominal GDP growth, y/y

▬ Fed funds rate ▬ 10y bond yield

8%

─ ─ Euro area nominal GDP growth, y/y

▬ ECB "refi" rate ▬ German 10y bond yield

8%

Forecast Forecast

6% 6%

4%

2%

0%

-2%

-4%

2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

Far below the “natural” rate implied by GDP growth

4%

2%

0%

-2%

-4%

2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

Stick to zero for the foreseeable period

5 Euro Area, spreads of Italy and Spain vs Germany

▬ Spain, 10y gov. rates spread with Germany

▬ Italy, 10y gov. rates spread with Germany

6.0%

Forecast

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

EBC”s purchases to put a cap on spreads,

6 Euro area, euro-dollar vs interest rates differential

▬ 3M EUR-USD rates spread

▬Euro vs dollar [RHS]

1.5%

Forecast

1.60

1.0%

1.50

0.5%

1.40

1.30

0.0%

1.20

-0.5%

1.10

-1.0%

2009 2010 2011 2012 2013 2014 2015 2016

1.00

Source : Thomson Datastream, BNP Paribas

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The US economy

7 US, housing market, strong recovery ahead

▬ Housing starts, x1000 [L]

▬ NAHB [R]

3 000

2 500

2 000

1 500

1 000

500

90

60

30

0

1990 1995 2000 2005

Source : Thomson Datastream, BNP Paribas

2010 2015

0

The NAHB index still suggests housing starts will continue to gain momentum.

8 US, investment cycle vs corporate profits

▬ Nonfinancial corporate, fixed investment (% value added) [L]

▬ Nonfinancial corporate, net profits (% value added) [R]

22% 14%

20%

18%

16%

12%

10%

8%

6%

4%

14%

1990 1995 2000 2005

Source : Thomson Datastream, BNP Paribas

2010 2015

2%

Corporate investment continues to recover, in the wake of high profit margins

9 US, retail sales not booming, but robust 10 US deleveraging, a concern for China?

▌Private consumption, 3m/3m, ann. [L]

▬ Retail sales, vol., 3m/3m, ann. [R]

6%

▬ US, households debt ratio (%gross income) -L-

▬ China, exports (% GDP) -R-

140%

3%

15%

10%

5%

0%

120%

40%

30%

0%

-3% car sales

(adjusted to scale)

-5%

-10%

-6%

2008 2009 2010 2011 2012 2013 2014 2015 2016

-15%

Source : Thomson Datastream, BNP Paribas

100%

80%

2000 2005 2010

Source : Thomson Datastream, BNP Paribas

2015

20%

10%

Private consumption (read the left scale) is very robust, thanks to US households are still reducing their debt to income ratio, a the pick-up in employment and the fall in energy bill. process that weighs on Chinese exports.

11 US, no concern for inflation… neither deflation

2%

1%

0%

-1%

-2%

▬ CPI Core y/y

▬ CPI Headline, y/y

4%

3%

Energy

-3%

2009 2010 2011 2012 2013 2014 2015 2016

-30%

Source : Thomson Datastream, BNP Paribas

40%

30%

20%

10%

0%

-10%

-20%

Energy is largely responsible for the decrease in inflation rate.

Core inflation (excluding food and energy) is rather stable and below 2%, which is the official target.

12 US, no concern for inflation… neither deflation

▬ CPI Core, y/y [LHS]

▬ Unit labor costs, y/y [RHS]

4%

3%

2%

1%

0%

-1%

-2%

-3%

2000 2003 2006 2009

Source : Thomson Datastream, BNP Paribas

2012 2015

No particular concern on wage front. However, at 5.5% in Feb. the unemployment rate is moving closer to the NAIRU as computed by the Fed.

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The US economy

13 US, non-farm payrolls vs unemployment rate 14 US, labour force participation rate

▬ Monthly change in nonfarm payrolls (x1000) [L]

▬ Unemployment rate [R]

400

200

0

10%

9%

8%

Participation rate

% of total population

68%

66%

-200

-400

7%

6% 64%

-600 5%

63%

-800

2009 2010 2011 2012 2013 2014 2015 2016

4%

Source : Thomson Datastream, BNP Paribas

62%

1985 1990 1995 2000 2005 2010 2015

Source : Thomson Datastream, BNP Paribas

Nonfarm payrolls have come stronger recently The trend is now close largely above +200K jobs (net) per month, allowing the unemployment rate to fall further

Part of the fall in the unemployment rate is explained by the historical low rate of labour force participation (workers getting older or simply discouraged don’t apply for a job…)

15 US, corporate credit, back to pre-crisis level 16 US, mortgage loans, far from pre-crisis level

▌Credit to corporate*, net flows, an $bn [L]

▬ Banks tightening credit, % [R]

1 000

800

600

400

200

0

-200

-400

-600

2005 2007 2009 2011

Source : Thomson Datastream, BNP Paribas

2013 2015

90

60

30

0

-30

▌Mortgage credit ., net flows $bn an. [L]

▬ Banks tightening credit, % [R]

1 800

1 200

600

0

-600

2005 2007 2009 2011

Source : Thomson Datastream, BNP Paribas

2013 2015

90

60

30

0

-30

Credit conditions are loose and flows to corporate (loans & bond issues) are back to their pre-crisis level…

… which is not the case for mortgage loans. They have recently stopped to contract, after a five year period of slump. But lending activity for house purchases is still very weak

18 US, narrowing current account deficit

Current account balance

% GDP

2%

17 US, narrowing budget deficit

Budget balance

% GDP

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

2000 2003 2006 2009 2012 2015

On the fiscal front, brakes are coming off owing to improved receipts. The federal budget deficit is shrinking rapidly.

0%

-2%

-4%

-6%

2000 2003 2006 2009 2012 2015

Current account deficit is closing at a time when the US economy is recovering, a rather unusual story.

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The US economy

19 US, Fed funds rate and inflation

▬ Fed funds

▬ Core CPI, yy

8%

6%

4%

2%

0%

-2%

-4%

2000 2003 2006 2009

Source : Thomson Datastream, BNP Paribas

Negative real Fed funds rates

2012 2015

Fed funds rates have been negative in real terms for now six years.

20 US, real Fed funds rate and unemployment rate

▌Real Fed Funds rate [L]

▬ Unemployment rate [R]

8%

6%

4%

2%

0%

-2%

-4%

2000 2003 2006

Negative real Fed funds rates

2009

Source : Thomson Datastream, BNP Paribas

2012 2015

10%

9%

8%

7%

6%

5%

4%

3%

A 5% to 5.5% level in unemployment rate is the limit where real

Fed fund rates start to be positive.

21 US, real estate investment trusts balance sheet 22 US, Federal reserve balance sheet

REITS Balance sheet

▬ MSB, $bn [R] ─ Repo as % of total liabilities [L]

40%

30%

20%

10%

350

300

250

200

150

100

50

0 0%

2000 2003 2006 2009 2012

Source : Thomson Datastream, IMF, BNP Paribas

2015

Real estate investment trusts (REITS) use repo markets as a source of funding for longer-term, less-liquid assets like RMBS.

Some are vulnerable to contagion risks / asset fire sales [IMF].

Federal Reserve, total assets

USD bn

5 000

4 500

4 000

3 500

3 000

2 500

2 000

1 500

1 000

500

0

2007 2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

2-juil.

Federal Reserve’s total assets increased more six time since

2007 and now account for 25% of GDP. The QE is now over and the Fed is expected to hike rates by mid-2015.

24 US, investment hit by falling oil prices, stronger dollar

Dollar, real effective exchange rate

Deviation from long-term average

30%

▌Invest. Mach.& Eqpt., q/q, ann. [L]

▬ Cap. Good orders , 3m/3m, ann. [R]

20% 40%

20%

10%

10% 20%

0% 0%

0%

-10%

-10% -20%

-20%

-30%

1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

Source : Thomson Datastream, IMF, BNP Paribas

Looking at the real effective exchange rate (trade weighted & adjusted for inflation) the dollar has moved back toward its long term equilibrium level.

-20% -40%

-30%

2009 2010 2011 2012 2013 2014 2015 2016

-60%

Source : Thomson Datastream, BNP Paribas

Stronger dollar and falling energy prices may have dampen corporate investment during the first quarter of 2015, especially in the shale oil sector.

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

25 Euro area, better prospects 26 Euro area, consumption strengthening

▌GDP, q/q, ann. [L]

▬ PMI composite [R]

60

4%

2%

0%

55

50

-2%

-4%

45

-6%

40

-8%

2008 2009 2010 2011 2012 2013 2014 2015 2016

35

Source : Thomson Datastream, BNP Paribas

The composite PMI close to the 55 level suggests GDP would expand at a 1.5% to 2% annual pace over the first half of 2015.

▌Private consumption, yy

▬ Retail sales, vol., yy

4%

2%

0%

-2%

-4%

2011 2012 2013 2014

Source : Thomson Datastream, BNP Paribas

2015 2016

Consumption to be the main driver behind the Eurozone recovery at the early stage of 2015. Data are particularly impressive in

Germany.

27 Germany, GDP growth vs business surveys

▌GDP, q/q, ann. [L]

- - - PMI Manuf.[R] ▬ PMI composite [R]

6%

4%

2%

0%

-2%

-4%

-6%

40

35

-8%

2009 2010 2011 2012 2013 2014 2015 2016

30

Source : Thomson Datastream, BNP Paribas

65

60

55

50

45

Better business surveys + buoyant retail sales point toward stronger activity at the start of 2015.

29 France, construction activity still very low

Housing permits and starts

12 m cumulated, x1000

600

28 France, GDP Growth vs business surveys

▌GDP, q/q, ann. [L]

- - - Composite indicator (BdF&Insee) ▬ PMI [R]

6%

4%

2%

0%

-2%

-4%

-6%

40

35

-8%

2008 2009 2010 2011 2012 2013 2014 2015 2016

30

Source : Thomson Datastream, BNP Paribas

65

60

55

50

45

The rebound is not as impressive as in Germany. However, surveys are less depressed, companies own prospects look better in the manufacturing industry

30 France, budgetary effort

Change in Gen. Govt. primary structural deficit, % GDP

█ EMU █ France

1.5%

500

1.0%

400

300

0.5%

200

1991 1995 1999 2003 2007

Source : Thomson Datastream, BNP Paribas

2011 2015

0.0%

2012 2013 2014 2015

Source : Thomson Datastream, European Commission BNP Paribas

Part of the French poor performance in Europe is due to the housing market, trending at all-time low. According to the INSEE, the fall in the property market drags 0.4pp to growth in 2014.

The fiscal effort (the reduction in structural deficit) has come higher in France than in the rest of the Euro area since 2013. But the way is will be prolonged through 2015 is an open question

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

31 Italy, GDP growth vs business surveys 32 Spain, GDP growth vs business surveys

▌GDP, q/q, ann. [L]

- - - PMI Manuf.[R] ▬ PMI composite [R]

6%

4%

2%

0%

-2%

-4%

-6%

40

35

-8%

2008 2009 2010 2011 2012 2013 2014 2015 2016

30

Source : Thomson Datastream, BNP Paribas

65

60

55

50

45

By early 2015, the first genuine sign of expanding activity since four year…

▌GDP, q/q, ann. [L]

- - - PMI Manuf.[R] ▬ PMI composite [R]

6%

4%

2%

0%

-2%

-4%

-6%

40

35

-8%

2008 2009 2010 2011 2012 2013 2014 2015 2016

30

Source : Thomson Datastream, BNP Paribas

65

60

55

50

45

Spain is on a good track. The PMI above the 55 level suggests that the economy keeps expanding at a 2% 2.5% annual rate…

33 Euro area, fixed investment vs cap. utilization rate

▬ Investment (Mach. & Equipt) % of GDP (LHS)

▬ Capacity utilisation rate (RHS)

11.5% 90%

11.0%

10.5%

85%

80%

10.0%

9.5%

2000 2003 2006 2009

Source : Thomson Datastream, BNP Paribas

Higher capacity utilisation rates…

2012

34 Euro area, corporate fixed investment vs profits

▬ Investment (Mach. & Equipt) % of GDP (LHS)

▬ Unit profit margin index, whole economy. (2002 = 100, RHS)

11.5% 106

11.0%

10.5%

104

102

75% 10.0% 100

2015

70% 9.5%

2000 2003 2006 2009

Source : Thomson Datastream, BNP Paribas

2012 2015

98

… and stabilisation in profit margins might prompt companies investment to pick up, albeit from very low levels.

35 Euro area, trend in corporate profits

Corporates profit margin index, 2002 = 100

▬ Spain ─ Ireland

130

36 Euro area, trend in unit labour costs

Unit labor costs (2001 = 100)

▬ EMU - - -France ─ Spain

140

120 130

110 120

100 110

90

2002 2005 2008 2011

Source : Thomson Datastream, BNP Paribas

2014

100

2000 2002 2004 2006 2008 2010 2012 2014

Source : Thomson Datastream, BNP Paribas

Corporate profits at historical high in Spain, Portugal and Ireland Spain is becoming more and more competitive within the Euro area, challenging Italy &

France…

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

37

Exports, 2008 = 100 (vol.)

▬ Germany ─ Spain

120

110

100

90

Euro area, trend in exports for some countries

80

2008 2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

Spain and Portugal : an export- led recovery, that now spreads on domestic demand, mainly companies investment

38

Euro area, the periphery is getting more and more competitive

Current account, % GDP

▬ Italy ─ ─ Portugal ─ Spain --- Ireland

9%

6%

3%

0%

-3%

-6%

-9%

-12%

-15%

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

“Internal devaluations” led to a significant reduction in unit labour costs and surge in external surpluses at the periphery of the

EMU

39 EMU, distribution of foreign direct investments

Foreing direct investments

% GDP, 2 year cumulated flows, upt to 2014Q1

4%

3%

2%

1%

0%

-1%

-2%

IR PT GR ES BG FN FR IT NL BD OE

Source : Thomson Datastream, BNP Paribas

… It also allowed foreign direct investments to come back.

40 EMU, closing imbalances

Intra EMU trade balances, % GDP

▬ Germany - - - Italy ─ Spain

3%

2%

1%

0%

-1%

-2%

-3%

-4%

-5%

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

Intra-EMU imbalances have been reduced or closed, as a result of the global deleveraging process. For the first times since the launch of the euro, Germany gets no trade surpluses inside EMU

41 Germany, current account balance with China

German current account with China

% GDP

0.5%

42 EMU, current account balance

Current account balance

% GDP

3%

0.0%

2%

1%

0%

-0.5%

-1%

-1.0%

2001 2003 2005 2007 2009 2011 2013 2015

Source : Thomson Datastream, BNP Paribas

Part the German surpluses have shifted from EMU to emerging countries. Trade in goods and services with China is now generating positive revenues

-2%

2008 2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

The largest current account surplus ever seen…

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

43 Euro area, the fall in the euro beccomes very supportive 44

Trend in th euro (2011 = 100)

▬ Against the dollar ─ Trade weighted

115

110

105

100

95

90

85

80

2011 2012 2013 2014

Source : Thomson Datastream, BNP Paribas

2015

Down 20% against the dollar, 10% in nominal effective terms.

Empirical models suggest the positive response to the shock could be +0.5/ +0.7 pp of GDP after one year.

Euro area, decoupling yields

▬ 10y Govt. Bond yield, Germany

▬ 10y Govt. Bond yield, US

5%

1%

0%

-1%

-2%

4%

3%

2%

-3%

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

2.4%

0.85%

2-juil.

10 year yield spread between the Bunds and Treasuries is close to 200 bps, a record.

45 Euro Area, credit to corporates vs bank lending survey 46 Spain, credit to corporates (<1y, EUR 1mn)

▌Credit to corporate*, net flows EUR bn [L]

▬ Expected tightening, % [R] - - - Expected demand, % [R]

1 200

1 000

800

600

400

200

0

-200

-400

2005 2007 2009 2011

Source : Thomson Datastream, BNP Paribas

2013 2015

90

75

60

45

30

15

0

-15

-30

Spain, credit to corporates (<1y & 1M EUR)

▬ Annualized net flows (EURbn, s.a., monthly) ▬ Trend

100

0

-100

-200

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

ECB’s bank lending surveys are improving with credit standards … credit to corporates (under 1 year and EUR 1mn) tends to pick back to their normal levels. Demand for credit addressed by the private sector is weak, but expected to improve… up in Spain, albeit from very depressed levels.

47 Fall in interest rates… not everywhere 48 Cross border lending activity as not yet recovered

Interest rates on banks lending to corporates (<1y, 1MEUR)

▬ Spain --- France ─ ECB (refi)

7%

6%

5%

4%

3%

2%

1%

0%

2003 2006 2009

Source : Thomson Datastream, BNP Paribas

2012 2015

Cross border holdings, "Core" vs "Periphery"

% GDP

30%

25%

20%

15%

10%

1999 2002 2005 2008

Source : Thomson Datastream, BNP Paribas

2011 2014

First positive reaction of ECB asset purchase program? Interest rates charged by Spanish banks have come down recently …

Cross border lending activity is still very low in the Eurozone and partly explained by the new regulatory environment

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

49 Euro Area, M3 vs core inflation rate 50 Monetary aggregates, Euro area vs US

▬ CPI Core y/y [L]

▬ M3, y/y [R]

3.0%

2.5%

2.0%

1.5%

15%

12%

9%

6%

Monetary aggregates (2008 = 100)

— EMU (M3) ▬ US (M2)

160

150

140

130

120

1.0% 3%

110

0.5% 0%

100

0.0%

1997 2000 2003 2006 2009 2012 2015

Source : Thomson Datastream, BNP Paribas

-3%

2008 2009 2010 2011 2012 2013 2014 2015 2016

Source : Thomson Datastream, BNP Paribas

The main monetary aggregate M3 is bottoming out. But this is Money growth still subdued when compared to other developed largely as a result of investors shift toward liquid assets from longer-term financial liabilities. countries like the US or UK.

51 Euro area, core inflation rate by country

Core inflation

May. 2015

2.0%

1.5%

1.0%

0.5%

0.0%

-0.5%

-1.0%

OE IR BG BD NL EMU FR IT FN PT ES GR

Source : Thomson Datastream, BNP Paribas

Now positive everywhere except in Greece

52

Euro Area, ECB “refi” rate vs determinants

▬ Core inflation rate [L]

▬ Unemploment rate [R, inv.] - - - "Refi" rate [L]

4.5%

4.0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2000 2003 2006 2009 2012

Source : Thomson Datastream, BNP Paribas

2015

7%

8%

9%

10%

11%

12%

13%

The ECB has opted for an ultimate cut in interest rates on sept.

4. The refi is now 0.05%, while the deposit facility is charged at

0.20%. We do not expected any change in key rate before 2018.

53 Italian 10 year rates 54 Spanish 10 year rates

Italy, Govt. bond yields

▬ 10y ─ 2y

8%

7%

6%

5%

2-juil.

4%

3%

2%

1%

0%

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

2.33%

0.41%

Spain, Govt. bond yields

▬ 10y ─ 2y

8%

7%

6%

5%

A sharp rebound in 10 year yield as a result of global bond price Same story reassessment. No particular tension on spreads, despite of

Greece…

2-juil.

4%

3%

2%

1%

0%

2008 2009 2010 2011 2012 2013 2014 2015

Source : Thomson Datastream, BNP Paribas

2.31%

0.40%

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

The Euro area economy

55 Central bank balance sheet 56 Central bank balance sheet (at June 2015)

Central banks total assets, % of GDP

▬ ECB ─ Fed - - - BoE - - - BoJ

80%

70%

60%

50%

40%

30%

20%

10%

0%

2007 2009 2011

Source : Thomson Datastream, BNP Paribas

2013 2015

Gen. Govt. Debt hold by central banks

% of 2014 GDP

3.1%

20.9%

24.4%

ECB BoE Fed

Source : Thomson Datastream, BNP Paribas

59.7%

Boj

On sept 4 2014, the ECB announced it will start buying ABS and reintroduce a security market program focused on covered

ECB’s public debt holding has nothing to compare with those of others central banks. However, a large QE (

10pct of GDP) bonds. It’s balance sheet will start to expand again… based on government bonds purchases is launched

57 Banks current account to the ECB

- - - Rate on deposit facility [RHS]

▬ Excess reserves, €bn [LHS] ▬ Deposit facility, €bn [LHS]

1 000 0.20%

500

0

-500

-1 000

0.10%

0.00%

-0.10%

-0.20%

Source : Thomson Datastream, BNP Paribas

The ECB has opted for a negative interest rate on deposit facilities and excess reserves. Banks current accounts to the

ECB have come down, but will start to rise again with the QE.

58 EUR vs GBP

0.95

0.90

0.85

0.80

0.75

0.70

0.65

0.60

0.55

2000

EUR vs GBP [L]

3M Rates differential (%)

2003 2006

Reactive to real rates spreads…

2009 2012 2015

4.0

3.0

2.0

1.0

0.0

-1.0

-2.0

-3.0

-4.0

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

FOCUS ON PUBLIC FINANCES

GDP

In 2014

Germany

France

Italy

Spain

Netherlands

Belgium

Austria

Greece

Portugal

Finland

Ireland

€bn

2 904

2 142

1 616

1 058

655

402

329

179

173

204

185

EMU 10 070 -259.1

United Kingdom 2 222 -126.3

EU 13 929 -401.9

United States 13 113 -643.5

Gen. Gov. fiscal balance

Total

€bn

19.4

%GDP

0.7

Primary

%GDP

2.4

Struct.

%GDP

1.2

Interest paym ent

€bn

50.6

%GDP

1.7

Av. rate

Public debt

Total

€bn

2.3

2 170

%GDP

74.7

Rating S&P

AAA

-84.8

-49.1

-61.4

-15.0

-4.0

-3.0

-5.8

-2.3

-1.8

1.6

-2.5

-0.8

-2.6

-0.9

-2.0

-0.2

47.1

75.2

34.5

9.5

2.2

4.7

3.3

1.4

2.4

3.6

3.6

2.2

2 038

2 135

1 034

451

95.1

132.1

97.7

68.8

AA

BBB-

BBB

AA+

-13.1

-7.9

-6.4

-3.2

-2.4

-3.5

-0.2

-0.0

0.4

-2.8

-0.4

0.4

12.4

7.8

7.0

3.1

2.4

3.9

3.0

3.0

2.2

428 106.5

278 84.5

317 177.1

AA

AA+

CCC-

-7.7

-6.4

-7.6

-4.5

-3.2

-4.1

0.5

-1.9

-0.1

-0.8

-1.6

-4.1

8.6

2.6

7.5

5.0

1.3

4.0

3.9

2.3

3.5

225 130.2

121 59.4

203 109.6

BB

AA+

A+

-2.6

-5.7

-2.9

-4.9

0.1

-2.9

-0.3

-1.3

-1.0

-5.3

271.1

60.9

-1.7 353.7

-4.0 478.8

2.7

2.7

2.5

3.7

2.9

3.4

3.0

3.8

9 515

2 055

12 341

15 032

94.5

92.5

88.6

114.6

AAA

AA+

-5.7 -7.8 2.0

0.9

8 301 238.7

AAJapan 3 478 -269.8

Sources : European Commission, BNPP

-7.8 70.5

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

ECONOMIC RESEARCH DEPARTMENT

● William DE VIJLDER

Chief Economist

OECD COUNTRIES

● Jean-Luc PROUTAT

Head

● Alexandra ESTIOT

Deputy Head - Globalization, United States, Canada

● Hélène BAUDCHON

France, Belgium, Luxembourg

● Frédérique CERISIER

Public finances - European institutions

● Clemente DE LUCIA

Euro area, Italy - Monetary issues - Economic modelling

● Thibault MERCIER

Spain, Portugal, Greece, Ireland

● Caroline NEWHOUSE

Germany, Austria - Supervision of publications

● Catherine STEPHAN

United Kingdom, Switzerland, Nordic countries - Labour market

● Raymond VAN DER PUTTEN

Japan, Australia, Netherlands – Environment - Pensions

●

Tarik RHARRAB

Statistics

BANKING ECONOMICS

● Laurent QUIGNON

Head

● Delphine CAVALIER

● Céline CHOULET

● Laurent NAHMIAS

EMERGING ECONOMIES AND COUNTRY RISKS

● François FAURE

Head

● Christine PELTIER

Deputy Head - Methodology - China, Vietnam

● Stéphane ALBY

Africa, French-speaking countries

● Sylvain BELLEFONTAINE

Latin America - Methodology, Turkey

● Pascal DEVAUX

Middle East - Scoring

● Anna DORBEC

CIE, Hungary, Poland, Czech Republic, Slovakia

● Hélène DROUOT

Asia

● Johanna MELKA

Asia - Capital flows

● Alexandra WENTZINGER

Africa, Brazil

● Michel BERNARDINI

Public Relation Officer

+33.(0)1.55.77.47.31

+33.(0)1.42.98.56.54

+33.(0)1.43.16.95.41

+33.(0)1.43.16.95.54

+33.(0)1.42.98.44.24

+33.(0)1.42.98.79.82

+33.(0)1.42.98.56.27

+33.(0)1.42.98.02.04

+33.(0)1.42.98.26.77

+33.(0)1.43.16.95.51

+33.(0)1.42.98.48.45

+33.(0)1.42.98.33.00

+33.(0)1.58.16.05.84

+33.(0)1.55.77.80.60

+33.(0)1.42.98.05.71

+33.(0)1.58.16.73.32

+33.(0)1.58.16.81.69

+33.(0)1.58.16.03.63

+33.(0)1.43.16.95.52

+33.(0)1.42.98.27.62

+33.(0)1.57.43.02.91

+33.(0)1.43.16.95.50

+33.(0)1.55.77.71.89

+33.(0)1.42.98.53.99

+33.(0)1.43.16.95.56 william.devijlder@bnpparibas.com jean-luc.proutat@bnpparibas.com alexandra.estiot@bnpparibas.com helene.baudchon@bnpparibas.com frederique.cerisier@bnpparibas.com clemente.delucia@bnpparibas.com thibault.mercier@bnpparibas.com caroline.newhouse@bnpparibas.com catherine.stephan@bnpparibas.com raymond.vanderputten@bnpparibas.com tarik.rharrab@bnpparibas.com laurent.quignon@bnpparibas.com delphine.cavalier@bnpparibas.com celine.choulet@bnpparibas.com laurent.nahmias@bnpparibas.com francois.faure@bnpparibas.com christine.peltier@bnpparibas.com stephane.alby@bnpparibas.com sylvain.bellefontaine@bnpparibas.com pascal.devaux@bnpparibas.com anna.dorbec@bnpparibas.com helene.drouot@bnpparibas.com johanna.melka@bnpparibas.com alexandra.wentzinger@bnpparibas.com michel.bernardini@bnpparibas.com

Group Economic Research /// OECD Countries ///

Eco’Charts /// 09 July 2015

OUR PUBLICATIONS

CONJONCTURE

Structural or in the news flow, two issues analysed in depth

EMERGING

Analyses and forecasts for a selection of emerging economies

PERSPECTIVES

Analyses and forecasts for the main countries, emerging or developed

ECOWEEK

Weekly economic news and much more…

ECOFLASH

Data releases, major economic events.

Our detailed views…

ECOTV

In this monthly webTV, our economists make sense of economic news

ECOTV WEEK

What is the main event this week? The answer is in your two minutes of economy

The information and opinions contained in this report have been obtained from, or are based on, public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate, complete or up to date and it should not be relied upon as such. This report does not constitute an offer or solicitation to buy or sell any securities or other investment. Information and opinions contained in the report are published for the assistance of recipients, but are not to be relied upon as authoritative or taken in substitution for the exercise of judgement by any recipient, are subject to change without notice and not intended to provide the sole basis of any evaluation of the instruments discussed herein. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permitted by law, no BNP Paribas group company accepts any liability whatsoever (including in negligence) for any direct or consequential loss arising from any use of or reliance on material contained in this report. All estimates and opinions included in this report are made as of the date of this report. Unless otherwise indicated in this report there is no intention to update this report. BNP

Paribas SA and its affiliates (collectively “BNP Paribas”) may make a market in, or may, as principal or agent, buy or sell securities of any issuer or person mentioned in this report or derivatives thereon. BNP

Paribas may have a financial interest in any issuer or person mentioned in this report, including a long or short position in their securities and/or options, futures or other derivative instruments based thereon.

Prices, yields and other similar information included in this report are included for information purposes.

Numerous factors will affect market pricing and there is no certainty that transactions could be executed at these prices. BNP Paribas, including its officers and employees may serve or have served as an officer, director or in an advisory capacity for any person mentioned in this report. BNP Paribas may, from time to time, solicit, perform or have performed investment banking, underwriting or other services (including acting as adviser, manager, underwriter or lender) within the last 12 months for any person referred to in this report. BNP Paribas may be a party to an agreement with any person relating to the production of this report. BNP Paribas, may to the extent permitted by law, have acted upon or used the information contained herein, or the research or analysis on which it was based, before its publication. BNP Paribas may receive or intend to seek compensation for investment banking services in the next three months from or in relation to any person mentioned in this report. Any person mentioned in this report may have been provided with sections of this report prior to its publication in order to verify its factual accuracy.

BNP Paribas is incorporated in France with limited liability. Registered Office 16 Boulevard des Italiens,

75009 Paris. This report was produced by a BNP Paribas group company. This report is for the use of intended recipients and may not be reproduced (in whole or in part) or delivered or transmitted to any other person without the prior written consent of BNP Paribas. By accepting this document you agree to be bound by the foregoing limitations.

Certain countries within the European Economic Area:

This report is solely prepared for professional clients. It is not intended for retail clients and should not be passed on to any such persons. This report has been approved for publication in the United Kingdom by

BNP Paribas London Branch. BNP Paribas London Branch is authorised and supervised by the Autorité de

Contrôle Prudentiel and authorised and subject to limited regulation by the Financial Services Authority.

Details of the extent of our authorisation and regulation by the Financial Services Authority are available from us on request.

This report has been approved for publication in France by BNP Paribas SA, incorporated in France with

Limited Liability and is authorised by the Autorité de Contrôle Prudentiel (ACP) and regulated by the

Autorité des Marchés Financiers (AMF) whose head office is 16, boulevard des Italiens 75009 Paris,

France.

This report is being distributed in Germany either by BNP Paribas London Branch or by BNP Paribas

Niederlassung Frankfurt am Main, a branch of BNP Paribas S.A. whose head office is in Paris, France.

BNP Paribas S.A. – Niederlassung Frankfurt am Main, Europa Allee 12, 60327 Frankfurt is authorised and supervised by the Autorité de Contrôle Prudentiel and it is authorised and subject to limited regulation by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin).

United States : This report is being distributed to US persons by BNP Paribas Securities Corp., or by a subsidiary or affiliate of BNP Paribas that is not registered as a US broker-dealer to US major institutional investors only.BNP Paribas Securities Corp., a subsidiary of BNP Paribas, is a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of the Financial Industry Regulatory

Authority and other principal exchanges. BNP Paribas Securities Corp. accepts responsibility for the content of a report prepared by another non-U.S. affiliate only when distributed to U.S. persons by BNP

Paribas Securities Corp.

Japan : This report is being distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited or by a subsidiary or affiliate of BNP Paribas not registered as a financial instruments firm in Japan, to certain financial institutions defined by article 17-3, item 1 of the Financial Instruments and Exchange Law

Enforcement Order. BNP Paribas Securities (Japan) Limited is a financial instruments firm registered according to the Financial Instruments and Exchange Law of Japan and a member of the Japan Securities

Dealers Association and the Financial Futures Association of Japan. BNP Paribas Securities (Japan)

Limited accepts responsibility for the content of a report prepared by another non-Japan affiliate only when distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited. Some of the foreign securities stated on this report are not disclosed according to the Financial Instruments and Exchange Law of Japan.

Hong Kong : This report is being distributed in Hong Kong by BNP Paribas Hong Kong Branch, a branch of

BNP Paribas whose head office is in Paris, France. BNP Paribas Hong Kong Branch is registered as a

Licensed Bank under the Banking Ordinance and regulated by the Hong Kong Monetary Authority. BNP

Paribas Hong Kong Branch is also a Registered Institution regulated by the Securities and Futures

Commission for the conduct of Regulated Activity Types 1, 4 and 6 under the Securities and Futures

Ordinance.