MFM FUND_Global Convert Bonds_KIID Classe EUR A_10 09

advertisement

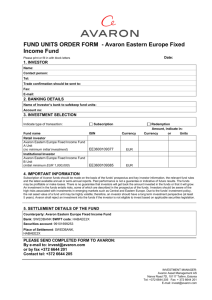

Key investor information This document provides key investor information about this subfund. It is not a promotional document. The information it contains is provided under a legal obligation to help you understand what an investment in this subfund involves and the risks associated with it. You are advised to read it in order to take an informed decision on whether or not to invest. MFM Global Convertible Bonds (the subfund) is a subfund of MFM FUND (the Fund) Class of shares (CHF) I (class) (ISIN: CH0036975255) Fund Management: GERIFONDS SA, a company of the group Banque Cantonale Vaudoise (BCV) Objectives and investment policy • • • The subfund is intended to achieve capital gains in the medium to long term by investing primarily in convertible bonds and other similar securities with rights of conversion or option rights issued in Swiss francs or other currency, by public or private issuers worldwide. The subfund is actively managed. The investment policy is characterised by a careful selection of issuers, in terms of both their solvency and their development potential. Investments are diversified at the geographical and sectoral level. hedge its portfolio. They can also be used for purposes of good portfolio management. • Investors may redeem their units every banking day, unless the price of positions held by the fund is not available (market closed). • • The class distributes its net income annually. The class meets its own transaction costs, which are offset against the yield. • The class is open to qualified investors. The reference currency is the Swiss franc. • The subfund does not offer any guarantee or surety for the capital. The subfund uses derivative financial instruments to Risk profile and performance Lower risk Higher risk Potentially lower yield 1 2 Potentially higher yield 3 4 5 6 7 The class is also exposed to the following risks that are not captured by the summary indicator: • Credit risk: since the subfund is investing in bonds, issuers may not be able to redeem the bond in full. • The risk category represents the annual historical volatility over a period of 5 years. • • Historical data, such as those used to calculate the summary indicator, may not be a reliable indicator of the future risk profile of the class. Liquidity risk means the possible inability of a market to absorb given trading volumes thus affecting the purchases and sales of positions held by the subfund. • Counterparty risk occurs when a third party (borrower or a data structure) is not able to meet its obligations vis-àvis the subfund, which may adversely affect the value. • Operational risk arises when inadequate or defective internal processes negatively impact the value of the fund. • The risk category shown is not a target or a guarantee and could change over time. • The lowest risk category is not equivalent to a risk-free investment. • The fund invests in convertible and similar bonds of private or public issuers worldwide, which explains the allocation of this risk category. 1 Fees Fees charged to the investor Issue commission Max. 2.50% Redemption commission No The percentage shown is the maximum that can be deducted from the capital invested by the investor Fees which can be charged to the assets of the class over a year Recurrent fees 1.01% Fees which can be charged to the assets of the class under specific conditions Performance Fee No The fees are used for the operation of the class, including its marketing and distribution. These fees are offset against the potential growth of the investment. Issue and redemption commissions are maximums and, in some cases the investor might pay less. Please consult your financial advisor or distributor for the actual amount of the issue and redemption commissions. Recurrent fees are based on the previous year which ended on 15 May 2014 and can fluctuate from year to year. They do not include transaction costs, except for costs related to the issue or redemption of units in target funds. For more information on fees, please see the section "Fees and Costs" in the Fund's prospectus. Past performance The class was launched on 15 February 2008 (the subfund was launched on 6 October 2003). Past performance is no guarantee of future performance. Past performance does not take into account commissions and costs incurred for the issue and redemption of units. 15.0% 10.0% Past performance has been calculated in CHF. 5.0% 0.0% -5.0% -10.0% MFM Global Convertible Bonds (CHF) I 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 12.1% 4.0% -5.0% 9.7% 9.6% Practical information • Deposit bank: Banque Cantonale Vaudoise, Lausanne. • Manager: MFM Lausanne. • Mirante Fund Management SA, The fund contract and prospectus as well as the most recent annual and semi-annual reports are available free of charge in French from the head office of GERIFONDS SA, Rue du Maupas 2, 1002 Lausanne, or on its website www.gerifonds.ch. that are misleading, inaccurate or inconsistent with the relevant parts of the fund contract and prospectus. • This document describes a class of a subfund of the fund. • The assets and liabilities of the various subfunds are maintained separately. This means that investors are only entitled to the assets and income of the subfund in which they hold units. • Additional information and the most recent unit prices as well as other practical information can be obtained from GERIFONDS SA or on its website www.gerifonds.ch. • Other classes exist in this subfund. For more information, please refer to the chapter "Information on the umbrella fund and subfunds" of the fund prospectus. • GERIFONDS SA can only be held liable on the basis of the statements contained in the present document • Tax legislation may have an impact on the personal tax position of the investor. This subfund is approved and supervised by the Swiss Financial Market Supervisory Authority (FINMA). The key investor information provided in this document is accurate as at 10 September 2014. The present document is a translation. For the interpretation of the key investor information, only the French version is 2 authoritative.