Optimal Retention Levels - Vermont Captive Insurance Association

advertisement

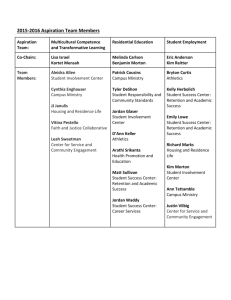

Optimal Retention Levels – How to get in the “Zone” Panelists: James Evans, Albert Risk Management Consultants Stephen DiCenso, Milliman, Inc. Matthew Byrne, Cathedral Indemnity Company Moderator: Michael Meehan, Milliman, Inc. August 13, 2014 © 2014 VCIA; Speaker materials used by VCIA under license. 0 Agenda • • • Industry Landscape Management Considerations Risk Appetite Board Perspective Actuarial Framework Total Cost of Risk (“Traditional Approach”) Cost of Capital Approach Captive Case Study – Cathedral Indemnity Company 1 Some Management Considerations in Risk Retention Strategies James Evans, Albert Risk Management Consultants 2 A Tale of Two Captives Cathedral Indemnity Co. Single Parent Formed 2012 Deductible reimbursement cover Property, WC Looking at increasing specific or aggregate limit Cup Re Single Parent Formed 2010 Reinsurance Company Liability Looking at increasing percentage participation in various layers 3 Common Elements of these Scenarios Pricing exercises Cost-benefit analysis Decision making in the face of uncertainty Volatility in results Multiple variables 4 Multiple variables External pricing Time value of money Impact of underwriting cycles on future pricing Capital considerations Loss expectancies 5 Two Common (possibly opposing) Perspectives Income Statement-(Re)Insurance as an expense Balance Sheet-(Re)Insurance as contingent capital 6 Income Statement Perspective (Re)insurance is an expense Cost/Benefit analysis often relies on a single assumption Decision based on current year arbitrage Focus on Cost of Risk Short horizon (one year) Funding shaped by spot pricing 7 Balance Sheet Perspective (Re)insurance is contingent capital Cost/benefit analysis includes range of assumptions/outcomes Decision based on most effective long-term cost and use of capital Includes Cost of Capital Longer horizon (multi-year) Funding shaped by probability simulation 8 Some Common Challenges Behavioral rules of thumb Familiarity with (re)insurance pricing and operations Availability of tools and techniques to improve decision making Relationship of scale and volatility/variability 9 Considerations for Decision Makers How can I move beyond rule of thumb approach? What tools/techniques are appropriate and available to understand/quantify the variability of losses and costs in the retained exposure? How do I price and fund the exposure? What are the long-term financial implications of retention strategy? How do the options under consideration affect capital management strategy? 10 Actuarial Framework Stephen DiCenso, Milliman, Inc. 11 Retention Analysis – 2 Views to Discuss “Traditional” Approach Cost of Capital Approach 12 “Traditional” Approach Evaluate expected cost of risk at retained limit • • Estimate loss cost per exposure unit based on historical losses or industry experience Account for operating expenses Evaluate cost of excess insurance (i.e., above retained limit) • Quotes from commercial insurance market Sum of retained losses and excess insurance is total cost of risk (TCOR) Run various proposed retentions and select scenario with lowest TCOR 13 “Traditional” Approach – Compare Options Figure 1 Current Retention Cost Component Expected Losses (in $M) Excess Insurance (incl. expenses) Total Cost of Risk (TCOR) Change in TCOR vs. $3M $3M Proposed Retentions $4M $5M $6M $7M $8M $9M $10M 10.02 10.42 10.70 10.93 11.11 11.25 11.38 11.49 1.80 1.30 0.90 0.65 0.43 0.24 0.18 0.13 11.82 11.72 11.60 11.58 11.53 11.49 11.56 11.62 (0.10) (0.21) (0.24) (0.29) (0.32) (0.26) (0.20) - 14 “Traditional” Approach – Single Year View 15 “Traditional” Approach – Ten Year View 16 Cost of Capital Approach Evaluate TCOR (similar to Traditional Approach) to calculate “savings” in moving to proposed retention(s) Evaluate Cost of Capital at proposed retention(s) • Estimate capital required (“at risk”) at retained limit to fund adverse loss scenario Capital at risk = 90th percentile loss amount minus expected loss • Estimate Cost of Capital required to fund adverse loss scenario We assume the internal cost of capital (“hurdle rate”) is 15% cont. 17 Cost of Capital Approach cont. Sum of TCOR and Cost of Capital is total cost of risk and capital (TCORAC) Run various proposed retentions and select scenario with lowest TCORAC 18 Cost of Capital Approach – Example Current Proposed $3M Retention $8M Retention Change (A) Expected retained losses $10.02 $11.25 $1.24 (B) Adverse retained losses (90th percentile) $14.51 $17.91 $3.40 (C) Capital needed to fund potential for adverse losses = (B) - (A) $4.50 $6.66 $2.16 (D) Cost of capital 15% 15% (E) Cost of holding capital to fund potential adverse losses = (C) x (D) $0.67 $1.00 $0.32 (F) Excess insurance $1.80 $0.24 ($1.56) (G) Total cost of risk = (A) + (E) + (F) $12.49 $12.49 $0.00 The $8M retention does not look favorable (i.e., looks equivalent) when considering the cost of capital 19 Cost of Capital Approach – Example cont. Here’s what it boils down to from a financial standpoint: Current Proposed $3M Retention $8M Retention Change (H) Excess insurance Expected excess losses Cost of renting insurer's capital in excess layer $1.80 $1.24 $0.56 $0.24 $0.00 $0.24 ($1.56) ($1.24) ($0.32) (I) Cost of using internal capital in excess layer $0.00 $0.32 $0.32 (J) Cost of capital = (H) + (I) $0.00 20 Cost of Capital Approach – Compare all Options Conclusion: $5M retention has lowest cost at 90th percentile 21 Cost of Capital Approach cont. For a given internal cost of capital (“Hurdle Rate”), this decision can also be looked at as: • The Decision Ratio: change in cost of renting insurer’s capital vs. capital at risk If Decision Ratio > Hurdle Rate, then choose higher retention – it’s worth the risk, as cost of insurance is too high If Decision Ratio < Hurdle Rate, then stay at current retention – insurance cost is less than cost of capital 22 Other Considerations Alternative adverse loss scenarios can be modeled • based on company risk tolerance Alternative Cost of Capital rates can be modeled as well Remember to incorporate the effect of the insurance market cycle • Run the model frequently to adjust to commercial market excess costs This work falls under broader Theory of Risk Reduction, an evolving area of research • these are two common methods, but others exist as well 23 Captive Case Study Matthew Byrne, Cathedral Indemnity Company 24 Two views from a Board and CFO evaluation of the feasibility approach in forming a captive: Risk retention pool and Self funded risk thought processes 25 Responsibility and Accountability Board members have the responsibility to look after the shareholders (members) interest in a for-profit or (nonprofit) firm with the view of making a profit or in the case of a nonprofit governing the multiplicity of specific missions with finite capital. Duties in both forms of organization include care, loyalty and obedience. The CFO role is to help formulate the business strategy allocating capital and the defining the risk, providing risk mitigation programs to fit the risk profile of the organization. Both Core and Non-core risks are evaluated and form the means to allocate capital. 26 CFO or Board Thought Process & Outcome 1. The only certainty is that there is no certainty 2. Despite uncertainty we must act 3. Judge decisions not only on results but also on how they are made 4. Decisions are a matter of weighting probabilities • • • Probabilities alone are insufficient when payoffs are skewed People are averse to loss when they make choices between risky outcomes Focus on probability is sound when outcomes are symmetrical but completely inappropriate when payoffs are skewed 27 CFO or Board Thought Process & Outcome “Risk has an unknown outcome, but we know what the underlying outcome distribution looks like. Uncertainty also implies an unknown outcome, but we don’t know what the underlying distribution looks like. Objective probability is the basis for risk, while subjective probability underlies uncertainty.” Frank Knight – Risk, Uncertainty and Profit 28 Road from Uncertainty to Probability in Decision-Making Degrees of belief are subjective probabilities. Propensities-based probabilities reflect the properties of the object or system Frequencies relates here the probability is based upon a large number of observations within a specific reference class. Without an appropriate reference class, there can be no frequencies-based probability assessment 29 Risk Retention Pool Choice in Forming a Captive Already managing and sharing risk on pooled basis Legal issues of the retention pool’s multiplicity of state insurance laws and compliance with State insurance commissions Desire to domicile the pool in a rigorous regulated environment such as Vermont with a knowledgeable captive industry and regulator Desire for the captive to assume all the underwriting, operating financial and accounting functions while members retain all authority and participation agreement remain in force Opportunity to establish additional lines of risk retention for our members and reduce costs while allocating capital prudently. Providing insurance capacity to our members in hard markets and transferring risk in soft markets Access to reinsurers as a captive company 30 Self-insured (funded) Risk Choice in Forming a Captive for Workers Compensation Already assuming a retained risk on a pay as you go basis Our WC balance sheet reserve account was not actuarially determined Coordination among Claims TPA, our entities that we provide workers comp coverage and us was scattered and payments (cash flow) no one specific party responsible. “Seat of the pants” not a good execution strategy Provide low, stable long term cost for an insurance-like program with improved risk management Contain the long term cost of risk, assuring availability of funds to pay losses and build capacity to broaden risk financing in leveraging capital and reinsurance markets 31 Rationale for a Captive Financial Leverage Formality of Risk Funding Program Flexibility to Change Underwriting Focus, Loss Reserves, Coverages and Risk Transfer Strategies Regulatory Oversight Objective: • Long term opportunity to translate the loss prevention, risk management and claims management discipline for the Archdiocese into reducing risk financing costs 32 Types of Firm Risk Core risks • These are risks the firm is literally in business (mission) not to get rid of • Each of these entities bears and manages those risks so that it can earn returns (provide service for mission) in excess of the risk-free rate • In the case of a non-profit earning return is substituted for providing capital prudently so as to preserve the intergeneration equity of its net assets to enhance the mission Non-core risks • These are risks to which the firm primary business (mission) exposes it but that the firm does not necessarily need to retain to engage in its primary business function • That results in risk management alternative decisions 33 Strategies of Retention Decision: Core vs. Noncore RETAIN NEUTRALIZE TRANSFER 34 Risk Team BOARD/CEO CFO CASH FLOW CAPITAL ALLOCATION CRM CAPITAL BUDGETING RISK CONSULTANT ACTUARY 35 Risks and Rewards Summarize the risks of the ultimate loss as actuarially calculated Match the risk profile to your confidence level of the High and Low probabilities of loss and expected values Select the confidence level most appropriate to the risk assumed Always value a project, service or firm on its net present value of cash flows as capital decisions affect both short term and long term cash flows CASH IS KING Retain Capital and Surplus through Captive formation Pay yourself 36 Questions? 37