EYK 18-1 Summary of Financial Statement Analysis Ratios

advertisement

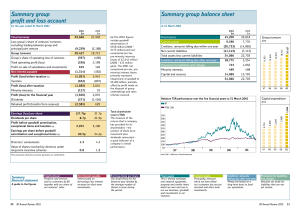

EYK 18-1 Summary of Financial Statement Analysis Ratios Ratio Formula Measure of: Liquidity and Efficiency Current ratio ⫽ Current assets Current liabilities Short-term debt-paying ability Acid-test ratio ⫽ Cash ⫹ Temporary investments ⫹ Net current receivables Current liabilities Immediate short-term debt-paying ability Accounts receivable turnover* ⫽ Net sales Average net accounts receivable Liquidity and efficiency of collection Days’ sales uncollected ⫽ Accounts receivable ⫻ 365 Net sales Liquidity of receivables Merchandise turnover* ⫽ Cost of goods sold Average merchandising inventory Liquidity and efficiency of inventory Days’ sales in inventory ⫽ Ending inventory ⫻ 365 Cost of goods sold Liquidity of inventory Total asset turnover ⫽ Net sales (or revenues) Average total assets Efficiency of assets in producing sales Accounts payable turnover* ⫽ Cost of goods sold Average accounts payable Debt ratio ⫽ Total liabilities ⫻ 100% Total assets Creditor financing and leverage Equity ratio ⫽ Total equity ⫻ 100% Total assets Owner financing Book value of pledged assets Book value of secured liabilities Protection to secured creditors ⫽ Income before interest and taxes Interest expense Protection in meeting interest payments Profit margin ⫽ Net income ⫻ 100% Net sales (or revenues) Net income in each sales dollar Gross profit ratio ⫽ Gross profit from sales ⫻ 100% Net sales Gross profit in each sales dollar Return on total assets ⫽ Net income ⫻ 100% Average total assets Overall profitability of assets Return on common shareholders’ equity ⫽ Net income ⫺ Preferred dividends ⫻ 100% Average common shareholders’ equity Profitability of owner’s investment Book value per common share ⫽ Equity applicable to common shares Number of common shares outstanding Liquidation at reported amounts Book value per preferred share ⫽ Equity applicable to preferred shares Number of preferred shares outstanding Liquidation at reported amounts Basic earnings per share ⫽ Net income ⫺ Preferred dividends Weighted-average common shares outstanding Net income on each common share Price–earnings ratio ⫽ Market price per share Earnings per share Market value based on earnings Dividend yield ⫽ Annual dividends per share ⫻ 100% Market price per share Cash return to each share Efficiency in paying trade creditors Solvency Pledged assets to secured liabilities ⫽ Times interest earned Profitability Market *These ratios can also be expressed in terms of days by dividing them into 365. For example, 365 ⫼ Accounts receivable turnover ⫽ How many days on average it takes to collect receivables. 1