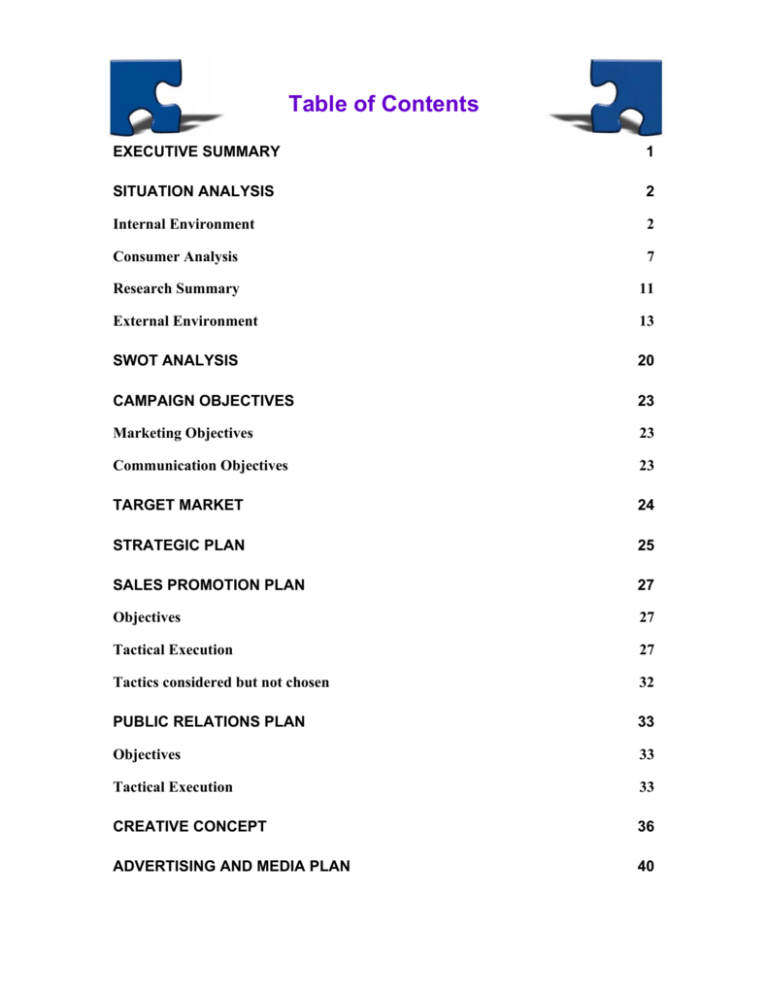

Flash 5 Energy Bars Marketing Campaign

advertisement