Write-up on Honda Motor Co & Volkswagen AG

advertisement

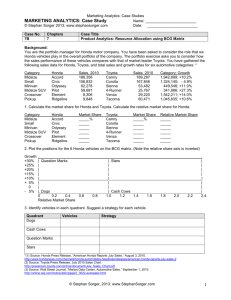

Global Business Overview Volkswagen AG and Honda Motor Co. Ltd Joel Tay 22 APRIL 2013 1 Contents 1. Executive Summary ......................................................................................................................... 2 2. Economic Outlook ........................................................................................................................... 3 3. Regional Market Developments ..................................................................................................... 4 4. Company Summary: Honda Motor Co. Ltd ..................................................................................... 5 4.1 Earning Drivers: Honda Motor Co. Ltd .......................................................................................... 6 4.2 SWOT Analysis: Honda Motor Co. Ltd........................................................................................... 8 4.2.1 Strengths: ............................................................................................................................... 8 4.2.2 Weaknesses: .......................................................................................................................... 8 4.2.3 Opportunities ......................................................................................................................... 9 4.2.4 Threats ................................................................................................................................. 10 5. Company Summary: Volkswagen AG ............................................................................................ 13 5.1 Earning drivers: Volkswagen AG ................................................................................................. 14 5.2 SWOT Analysis: Volkswagen AG.................................................................................................. 16 5.2.1 Strengths .............................................................................................................................. 16 5.2.2 Weaknesses.......................................................................................................................... 16 5.2.3 Opportunities ....................................................................................................................... 17 5.2.4 Threats ................................................................................................................................. 17 6. Comparative Analysis & Outlook .................................................................................................. 19 7. External Views ............................................................................................................................... 21 8. Appendix ....................................................................................................................................... 22 8.1 Sales Forecasts: Honda Motor Co. Ltd ........................................................................................ 22 8.2 Balance Sheet: Honda Motor Co. Ltd.......................................................................................... 24 8.3 Income Statement: Honda Motor Co. Ltd................................................................................... 25 8.4 Retained Earnings: Honda Motor Co. Ltd ................................................................................... 26 8.5 Valuation: Honda Motor Co. Ltd ................................................................................................. 27 8.6 Sales Forecasts: Volkswagen AG ................................................................................................. 28 8.7 Balance Sheet: Volkswagen AG................................................................................................... 30 8.8 Income Statement: Volkswagen AG ........................................................................................... 31 8.9 Retained Earnings: Volkswagen AG ............................................................................................ 32 8.10 Valuation: Volkswagen AG ........................................................................................................ 33 2 1. Executive Summary After a thorough analysis of the two companies, “Volkswagen AG” and “Honda Motor Co. Ltd”, “Volkswagen AG” is the better choice between the two to invest in. The results have been achieved through a variety of means; 3-year financial forecasts, SWOT analyses and an examination of macro-economic trends of the regions that both companies operate in. Both companies are among the top ten auto manufacturers across the globe. Volkswagen AG has a highly diversified brand portfolio that appeals to a wide segment of customers. Although its main market has traditionally been in Europe, we are seeing a shift in, mainly to Asia and South America. The rise of the emerging BRIC markets and the subsequent increased consumer demand for automobile products has helped the company increase its sales despite the economic slowdown in Europe. Honda Motor Co. Ltd is a more highly diversified business as it deals with both the automobile and motorcycle markets. While its traditional key markets have been Japan and North America, recent economic developments have led it to focus on other markets as well. Although both companies show growth potential in the coming years, the business strategy that is employed by Volkswagen AG places it in a better position to cater to the increasing demands and expectations of the consumer and weathering the harsh economic climate. As such, I would recommend Volkswagen AG over Honda Motor Co. Ltd as a company to invest in. 3 2. Economic Outlook Regional Economic Fundamentals by Standard and Poors FY20131 • According to analysts, the risk of the US falling into another recession in the next twelve months is now at about 15-20%, lower than previously forecast. GDP growth is forecasted to be at 2.3%. • Europe will continue to face tough economic conditions in 2013. There is likely to be zero GDP growth for the Eurozone region, with countries such as Spain, Portugal, Ireland and Greece facing negative growth. 1 • Japan’s GDP growth is likely to be less than 2% • There will be high single-digit GDP growth in China Top 10 Investor Questions For 2013: Global Autos and Trucks 4 3. Regional Market Developments Latest Market developments and highlights by just-auto2 Europe • West European markets continuing to slide • German car market seen to be slowing • Overcapacity problems being felt by OEMs North America • Market recovery on track • Recovery of Japanese OEMs in light vehicle market • Exit of Suzuki due to difficulties in entry-level market Asia 2 • Chinese economy slowing but market still forecasted to exceed 20 million units in 2013 • Chinese consumers being drawn more towards foreign brands than domestic brands • Continued huge inward investment by foreign partners in JVs • Japanese OEM still seeing negative fallout in Chinese sales due to diplomatic dispute • ASEAN markets looking buoyant in 2012 and 2013 (especially Indonesia) • Diesel hike in India • Japanese car outlook for 2013 weak due to end of eco-car subsidies Automotive markets intelligence service. Just-auto. 5th March 2013. 5 4. Company Summary: Honda Motor Co. Ltd Honda Motor Co. Ltd is a diversified company. It manufactures and sells motorcycles, automobiles and power products. It also has a financial services segment that provides financial services to support the sales for its products. The company operates globally through its 378 subsidiaries and 88 affiliate companies. Among that, it also has manufacturing facilities located across Asia, North America, South America and Europe3. Its headquarters is located in Tokyo, Japan. For its automobile segment, the company produces passenger cars, speciality cars (such as hybrid vehicles) and related parts. Its passenger car consists of mini vehicles, small to medium sized passenger cars, light commercial vehicles and cross utility vehicles. As for its specialty vehicles, Honda’s hybrid vehicles run on dual systems that include gasoline and electric motors. Fuel cell vehicles are run on hydrogen powered fuel cell technology. This segment accounts for 73% of the company’s total net sales in FY2012.4 The motorcycle segment manufactures motorcycles, all-terrain vehicles and the related parts. There is a huge variety in the types of motorcycles that are manufactured in terms of size and performance; motorcycles sold range from the 50cc scooters to 250cc sports motorcycles. The segment has accounted for 17% of net sales in FY20125. The power products segment of the company manufactures engines and generators for households, OEM and construction machinery and other miscellaneous products such as grass cutters, snow throwers and water pumps. Other technologies include thin film solar cells. The segment has not been too profitable in recent years and only accounts for 3% of net sales in 20126. Finally, as stated above, the Financial Services business provides retail lending and leasing for its products. Wholesale financing services are available to its dealers worldwide through the company’s numerous subsidiaries. The segment has accounted for 6% of net sales in 2012. 3 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013., Honda Motor Co. Ltd Annual Report 2012 5 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013., Honda Motor Co. Ltd Annual Report 2012 6 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013.,Honda Motor Co. Ltd Annual Report 2012 4 6 4.1 Earning Drivers: Honda Motor Co. Ltd From my analysis of the company’s performance and current economic climate and trends, I have identified key areas that I believe will perform as earning drivers for the company. These are; • The ASEAN motorcycle market • Small to mid-sized automobiles in the North American market • Fuel efficient “Eco” cars and motorcycles • The Financial Services Division The company has been performing well in ASEAN markets, with it having significant presence in countries such as Vietnam, Thailand and Indonesia with market share of 61%, 69%, 52% respectively. The expected increase in motorcycle sales in this region is expected to benefit Honda Motor Co. Ltd as the company is the current market leader with a global market share of 29.3%. Its closest competitor is Yamaha, who has a global market share of 17.9%7. In fact, while motorcycles sales have fallen in recent years in markets such Europe, the Asia-Pacific market have seen a CAGR of 1.5% over 2007-20118. With plans to introduce at least 10 newer models into the market in 2013, I believe that the company will well positioned to be leverage on the growing urbanisation rates in these countries, thus being to further expand its foothold in these markets. Despite a dismal performance in the North American markets in FY2012, Honda is poised to make a comeback in FY2013. This is due to the introduction of its new redesigned Civic and Accord sedans. While the Civic has historically been a popular mainstay in the U.S market, the 2011 iteration was not well received. While Honda had lowered the cost of the car by not investing much in design and using cheaper materials for the interior trims, consumers were not pleased and instead turned to rival competitors such as Toyota or Hyundai. Instead of waiting for another 3 years for a model refresh, Honda executives brought forward the newer iteration by 1.5 years. The new Civic has been redesigned in both its exterior and interior, with it now being marketed as an upscale and premium small sedan9. 7 Global – Motorcycles. Datamonitor Industry Market Research. Global – Motorcycles. Datamonitor Industry Market Research. 9 http://www.nytimes.com/2013/03/03/automobiles/autoreviews/a-well-done-do-over-raises-the-finalgrade.html?pagewanted=all 8 7 The new Honda Accord has been gaining market share in North America, with it competing with Toyota’s Camry model for the top spot in the mid-sized sedan category. Several factors have led to its success; its new sportier design, variety of line-up in terms of engine capacities and interior trim. These two models are believed to be the ones that will increase Honda’s revenues in the North American market, which is also Honda’s biggest market for automobiles. In fact, sales for Q1 2013 have been encouraging, with Honda expecting that its sales in March being 8% more than 1 year ago10. Another key earnings driver for Honda will be the “eco” car market. With increasingly strict regulations put in place by governments across the world, Honda’s key competency and long experience in fuel efficient vehicles puts the company in a good position to gain further market share. According to analysts, demand for light hybrid vehicles is expected to reach 5.2 million units due to rising costs and stricter emissions controls, such as the Euro3. Honda currently has about 3 hybrid automobiles in its line-up, the Civic hybrid, the Insight and the CR-V with 3 high fuel economy motorcycles in the pipeline11. It is believed that the growing market demand for these fuel efficient vehicles will enhance the revenue of the company. Finally, the Financial Services Division is set to benefit from the estimated increase of sales of vehicles. Due to the current economic conditions and tight credit, it is believed that automobile financing will play an even bigger role in the years to come. As such, the commercial leasing and lending programs of the Financial Services Division will continue to play a big part as an earnings driver for the company. 10 11 http://online.wsj.com/article/SB10001424127887324789504578384912617473262.html Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. 8 4.2 SWOT Analysis: Honda Motor Co. Ltd 4.2.1 Strengths: Global presence Honda Motor Co. Ltd has a wide reach in terms of geography, allowing it to attain economies of scale and recognition of its brand. It operates across the globe in the Americas, Europe, Middle East, Africa, Asia and Oceania. Honda is very experienced in setting up operations overseas and further expansions should be able to be done with relative ease. Another advantage that the company has due to its huge worldwide presence is the ability to mitigate business risks that is associated with an overdependence on any single market12. Strong engineering capabilities Following the words: “Do not imitate” by its founder Soichiro Honda, the company has placed a huge emphasis on its innovation and engineering capabilities13. The company has its roots in racing, with it being one of the earliest Japanese automobile manufacturers to participate in the F1 races. As such, the company has always put the development of engines as its top priority. This has allowed the company to be a leading player in naturally-aspirated engines, fuel-efficient engines and hydrogen powered fuel cell technologies. In 2011, the company announced that it would start the development of next-generation technologies titled “Earth Dreams Technology”, which consists of next generation gasoline, diesel and hybrid engines14. 4.2.2 Weaknesses: Product Design The design strategy of Honda has not been consistent, which has proven to be one of its biggest challenges in recent years. The Honda Civic is an excellent example of this inconsistency; while the eighth generation of the Civic was well received in the North American market due to its sleek design curves and interiors, Honda did not leverage on its success. Instead, the company introduced the ninth generation which was not popular due to its blander, boxier design and perceived inferior interior trim quality. 12 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. http://corporate.honda.com/innovation/ 14 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. 13 9 One of the reasons why Honda has not been able to perform well in the European market is due to design issues as well. According to research, Europeans have not viewed favourably upon the design of Japanese cars and prefer European automobile manufacturers such as Peugeot, BMW and Alfa Romeo due to their preference for style rather than practicality. Supply-Chain Issues The company faced logistical disruptions in 2011 due to the flooding in Thailand and the earthquake and subsequent tsunami disaster in Japan. These disasters reduced global production of the company to 47% in April 2011 as compared to previous years. As such, shortage of equipment and inventory prevented the availability of new vehicles, such as the 2012 Civic15. Product Recalls The company has conducted numerous recalls of its products in recent years, with the latest being the recall of 1.135 million vehicles worldwide due to problems with the airbags in its automobiles16. The company recalled a total of 649,800 vehicles in the US in 2012 due to various mechanical problems such related to the driveshaft, wiring and struts17. These recalls have affected the brand image and safety of the company’s cars and might lead to a reduction in sales. 4.2.3 Opportunities Emerging Markets Although North America and Japan has been its traditional markets for its automobile segment, emerging markets will be just as important for continued growth of the company. While Honda has maintained its lead in markets such as Thailand, Vietnam and Indonesia, the market penetration rate is still hovering at a low 25.4%, 29.6% and 20.8% respectively. Furthermore, it is expected that there will be an increased demand of at least 20 million motorcycles in India in by 202018. As such, these markets still plenty of potential for further growth of which Honda should capitalize on. 15 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. http://www.japantoday.com/category/business/view/toyota-honda-nissan-mazda-recall-3-39-mil-vehiclesover-air-bags 17 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. 18 Honda Motor Co. Ltd Financial and Strategic Analysts Review. GlobalData. 7th March 2013. 16 10 Fuel Efficient Vehicles With rising fuel costs and stricter regulations, consumers are paying greater attention to the fuel-economy of their vehicles. Fuel efficiency technologies, such as electrical or hybrid system engines will play a bigger role in the automotive industry. As a leading market player in the field of green technology and engines, Honda is well positioned to deal with these upcoming changes. Joint Ventures While Honda already has joint ventures in emerging countries, such as China and India, Honda should consider other joint ventures with European partners. Honda’s presence in Europe has been insignificant, with its market share overshadowed by bigger European rivals such as Volkswagen, Daimler and Fiat. This is due to the lack of design issues (as mentioned above) and the lack of diesel engines in its product line up. One possible option for Honda to reverse its ailing fortunes in Europe is to partner with a European automobile company. This way, Honda would be able to leverage on the design skills and possibly diesel engine technologies from its partner whilst providing its technological expertise in terms of hybrid engines, reliability and safety mechanisms. 4.2.4 Threats Intense Competition The company faces an extremely competitive environment, with many different players in the market. While Honda has traditionally competed against home grown rivals such as Nissan and Toyota, there has been increased competition from foreign rivals such as Korean automakers like Hyundai and Kia. Competition from these Korean rivals have been intense, as the Korean companies have been investing heavily in R&D for the past few years. The Korean cars are known to be cheaper than its Japanese counterparts and are technologically advanced as well. In fact, the Hyundai brand was announced as the most fuel-economical brand in the United States, a designation which had been traditionally held by Honda19. Hyundai has been doing very well in North America, with its 19 http://www.bloomberg.com/news/2012-11-16/hyundai-fuel-economy-flap-seen-as-turned-tables-forhonda.html 11 current market share at 8.7% in the United States, which is a mere 0.1% lower than Honda’s market share of 8.8%20. In the emerging markets of India and China, Honda faces increasing pressure from low cost players such Tata and Geely. These companies are competing with Honda in the small to mediumsized automobile segment. Although the build quality and performance of the cars from the low cost players may be considered inferior to Honda’s products, consumers in these developing markets may overlook purchasing factors such as quality and performance and instead choose to focus on price only. Loss of intellectual property As with all other automobile manufacturers who operate joint ventures in emerging countries, there is a constant fear of a loss of intellectual property. As the rules and regulations governing intellectual property in these countries may not be fully developed yet, companies may not have legal recourse should intellectual theft occur. Domestic companies may have the incentive to form joint ventures with the foreign investing company for a few years before incorporating any technologies gained into their own products, thus becoming the investor’s competitor. Economic Slowdown While the global economy is seen to have relatively stabilised from the Lehman shock crisis since 2008, the ongoing European crisis has a potential to destabilize and reverse any economic recovery gains. Should the European debt contagion spread to key economies such as the United States, it is highly likely that sales will be negatively affected to a great degree. Sino-Japanese Crisis While there has been a recovery since the recent Sino-Japanese Crisis over the Senkaku Islands dispute, any further disputes will cause a huge disruption in the Chinese operations of Japanese companies. During the crisis, many production facilities faced a drop in production due to labour strikes and damage to equipment. Products that were Japanese in origin, such as automobiles 20 China Autos Report. Business Monitor International. 12 were boycotted by Chinese customers21. As such, Honda may see a huge drop in revenues from the Chinese mainland should any political crisis reoccur. 21 http://www.fairobserver.com/article/economic-costs-china%E2%80%99s-anti-japanese-sentiment 13 5. Company Summary: Volkswagen AG Volkswagen AG is one of the world’s biggest automobile manufacturers and the largest car maker in Europe. The company manufactures and sells engines and vehicles such as passenger cars and commercial vehicles. The company has 62 production facilities worldwide and operates in more than 153 countries22. The company operates four business segments; the Automotive division, Trucks and Buses division, the Power Engineering division and lastly, the Financial Services division. The Automotive division develops engines and vehicles and the production of passenger cars, commercial vehicles and related parts. The company has a diverse portfolio of brands, such as Volkswagen, Skoda, Audi and Lamborghini23. These brands operate as an independent entity in the market24. Out of all these brands, the majority of sales has been from the Volkswagen-branded group of cars25. The segment accounted for 57.9% of net sales in FY2012. The Trucks and Buses division develops, manufactures and sells heavy commercial vehicles, buses and related parts. While the segment was originally named as “Scania”, the division was renamed due to the consolidation of the MAN Group and its commercial vehicle businesses26. The segment accounted for 14.8% of net sales in FY2012. The Power Engineering Division is involved in the development of production of large bore diesel engines, turbo compressors, industrial turbines and chemical reactor systems27. The segment is relatively new one, which was formed in FY2011. The segment currently account for only 3.9% of net sales in FY 2012. The Financial Services division of the company provides financial support to its dealers and customers. It also is involved in commercial lending and leasing, banking and insurance and fleet management. These businesses operate through a number of subsidiaries located in North America and Europe28. This segment accounted for 23.4% of net sales in FY2012. 22 Global – Automotive Manufacturing. Marketline. June 2012. Volkswagen AG Annual Report 2013. 24 Global – Automotive Manufacturing. Marketline. June 2012. 25 Volkswagen AG Annual Report 2013. 26 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 27 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 28 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 23 14 5.1 Earning drivers: Volkswagen AG Through my analysis of the company’s business models and current economic trends, I have identified key areas that I believe has and will constitute Volkswagen AG’s earning drivers; • Volkswagen-branded cars (Golf) • Asian markets • Luxury Market • Financial Services Division Volkswagen-branded cars have traditionally formed the majority of sales for the company. Despite the tough economy, Volkswagen-branded car sales were up by 9% in FY2012 as compared to the previous fiscal year29. Driving this growth is the Volkswagen Passat, Jetta and Golf. One of the reasons why Volkswagen has managed to increase its sales during this period is due to the build quality of its vehicles as well as its competitive pricing despite it being a premium brand30. The Volkswagen Golf hatchback has been a particularly popular model, due to its small compact size, drivability, design and good fuel economy31. Reviews of the latest iteration, the Golf 2013 has positive, with the car been lauded for its performance and handling by famed British WhatCar? magazine32. As such, it is expected that the new model will continue to drive sales growth for the company. In terms of pricing, the car is competitive priced against its rivals, with its base model in the U.S going for $18,095 as compared to its American rival, the Ford Focus at $19,200. The Asian market, particularly China and India is expected to constitute a key are of growth for the company in the coming years. The Asian market now accounts for 17.6% for total global sales, up 6.2% from FY2010’s levels of 11.4%. While the global economy has been set back by the recent financial crises, the economies of China and India has been proven to be resilient. Rising urbanisation rates and growing affluence of the middle class in these countries have led to an increase in demand for automobiles. Volkswagen has been doing very well with its joint-ventures in China. Currently, its two JVs in China, Shanghai-VW and FAW-VW, is ranked number 2 in terms of 29 Volkswagen AG Annual Report 2013. http://online.wsj.com/article/SB10000872396390444230504577617662726166818.html 31 http://www.telegraph.co.uk/motoring/car-manufacturers/volkswagen/9815598/VWs-Golf-one-of-the-bestthings-of-our-age.html 32 http://www.whatcar.com/car-reviews/volkswagen/golf-hatchback/full-review/26158-5 30 15 sales volume, with General Motors and its JV taking the number 1 spot33. The importance of “face” and status have led to an increase in demand for branded foreign vehicles, which have led domestic customers, especially in China, to be drawn towards brands such as Volkswagen and Audi34. Despite the economic downturn, Volkswagen AG has unveiled new super luxury models for its brands Bentley and Lamborghini at the Geneva Motor Show held this year35. With the introduction of this new models, it seems that there is still appetite for luxury cars from wealthy consumers whom are relatively unscathed from tough economic conditions. Volkswagen’s luxury brand, Audi, has been doing well in the Chinese market, with sales overtaking other German rivals such as Mercedes Benz and BMW36. Lastly, earnings from the Financial Services division is set to increase due to expected growth in sales for the company. The biggest increase in revenues is set to come from India, as it is estimated that at least 70% of all car purchases in India are financed37. In the Chinese market, the company expects financing to increase by at least 2 billion CNY in the coming years38. As such, it can be said the Asian market will the highest priority for Volkswagen AG. 33 China Auto Report. Business Monitor International. Automotive markets intelligence service. Just-auto. 5th March 2013. 35 http://www.bbc.co.uk/news/business-21381911 36 China Auto Report. Business Monitor International. 37 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 38 China Auto Report. Business Monitor International. 34 16 5.2 SWOT Analysis: Volkswagen AG 5.2.1 Strengths Market Presence Volkswagen AG is the third largest auto manufacturer in the world. Its global market share for FY2011 has been estimated to be at a high 11%. Key markets for the company are Germany, Europe and Asia Pacific which made up 80% of total company sales in 2011. The company’s market share in Europe, the Middle East and Africa currently stands at 19.27%. North American market share is at 8.01%39. The company and its products is highly recognisable across the world, giving it a strong brand equity. With numerous production facilities located globally, the company is able to attain economies of scale, thus allowing it to decrease its costs. Brand Portfolio The multi-brand strategy of the company has given it a competitive advantage against its competitors. The vast variety of vehicles and brands that the company owns allow it to cater to almost all segments ranging from compact cars to super luxury cars. It is believed that the company’s brand portfolio and product line-up have contributed much to the increase of Volkswagen’s market share across the globe40. Another advantage of having a vast brand portfolio is that it allows the company to retain loyalty from its customers. Current satisfied customers looking to upgrade or downgrade their automobiles (eg: Volkswagen to Audi and vice-versa) have plenty of choice to choose from within the portfolio, which allows the company to retain its customer base regardless of the brand. 5.2.2 Weaknesses Majority of sales from Europe Europe has historically been the biggest market for the company, with combined sales in Germany and Europe accounting for 59.9% of net sales in FY2012. The automobile market in Europe can be considered a mature one and such, is highly unlikely to see any amount of growth. With declining sales and an ongoing debt crisis in the European region, it is expected that consumer demand will fall. 39 40 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 17 Late entry to fuel-efficient vehicle market While Volkswagen has a strong brand portfolio, the company has not had hybrid vehicles in their line-up until this year41. This has put them at a disadvantage in terms of market share as other competitors such as Honda and Toyota have been in the market for a much longer time. As such, the company may face difficulties into breaking into the market and capturing market share. 5.2.3 Opportunities Emerging Markets Developing markets, such and India and China are expected to growth and this is expected to boost sales of the company. In fact, analysts have predicted that the Asian market will account for at least 40% of growth in the auto industry over the next five to seven years42. As domestic car makers in these growing economies are still in the midst of developing their own technologies to international standards, Volkswagen AG has plenty of opportunity to further enhance their presence in these markets. Possible options include other joint ventures, strategic partnerships or M&A. Financing The company has been able to secure cheap financing through its bonds. Volkswagen bonds have a much lower couple rate than its competitors. For example; Volkswagen AG has managed sell its 2015 at a 2.125% coupon as compared to Peugeots’ 2014 issue at 6%43. This difference in funding has allowed Volkswagen to pass on its savings to consumers through lower car prices. Given that about 36% of all Volkswagen car sales’ are financed, it is believed this percentage will increase, this benefiting the Financial Services Division. 5.2.4 Threats European Debt Crisis 41 http://web.vw.com/hybrid/ http://finance.yahoo.com/news/auto-industry-outlook-review-feb-211459510.html 43 http://online.wsj.com/article/SB10000872396390444230504577617662726166818.html 42 18 The company faces increased risk than other companies due to its huge exposure to the European market. With the current ongoing European debt crisis and austerity cuts, consumers are spending less on automobiles than before. With no clear recovery in sight, the fragile Eurozone is in danger of falling into a deeper recession should any further European Union member default from its obligations. Emissions Regulations The company’s operations could be negatively impacted if stricter emission regulations are put into place. While Euro5 standards have been put into place since 2009, the stricter regulation, Euro 6, which governs emissions from diesel engines will be put into effect in 2013. These new emission regulations bring about requirements which will lead to increased cost for the company. Other emissions standards are currently in the pipeline, with the United States Environmental Protection Agency (EPA) suggesting a new standard to be placed in 200744. Loss of intellectual property As with the case of Honda, Volkswagen constantly has to fear a loss of intellectual property. While the company has numerous joint ventures in developing economies such as China and India, the rules and regulations governing intellectual property in these countries may not be fully developed yet. As such, the company may not have legal recourse should intellectual theft occur. 44 Volkswagen AG – Financial and Strategic Analysts Review. 21st March 2013. 19 6. Comparative Analysis & Outlook The two companies are fundamentally different, with Honda Motor. Co Ltd focusing on its motorcycle and automobile segment. Its key competencies lie in its strong engineering capabilities and technological prowess in fuel efficient technologies. Honda is currently focuses on the low-mid end segment of the automobile market, and its top competitors are Toyota, Nissan, Ford with other Korean rivals such as Hyundai and Kia. On the other hand, Volkswagen AG is mostly focused on the automobile sector and has pursued a multi-brand strategy to gain market share. Due to its large brand portfolio, the company faces immense competition from all segments of the market, from the lower-mid to super-high end segments. Competitors of Volkswagen include but are not limited to; Daimler, BMW, GM, Honda, Toyota. While the main markets of Honda have been Japan and North America, Volkswagen has not gained significant market share in the U.S market and has played a rather niche role. This could be attributed to the cheaper prices of Japanese cars45, the lack of a hybrid model and weak SUV lineup46. With regards to the European market, the presence of Honda in Europe is insignificant, while Volkswagen is the market leader. Again, this weakness of Honda can be attributed to the preference of highly stylized cars as compared to its European counterparts. However, the main emphasis of this report is about the key importance of emerging markets such as India and China. As stated before, these two markets will be the growth drivers of the auto industry in the near future. Therefore, I believe that the performance of any major auto company in these two markets can be an indicator of a company’s future performance. According to my analysis of key company trends and the macroeconomic environment, Volkswagen is in a better position to leverage on the growth of these markets. Honda has not been doing too well in the Indian market, as reports show that its latest sales for the month of March 2013 has plunged 9% as compared to the previous fiscal year47. Meanwhile, Volkswagen sales for the months of January and March has increased by 21% as compared to the last fiscal year48. I believe that Honda’s low-cost car strategy in India will not work well as expected, 45 http://www.businessweek.com/magazine/content/11_22/b4230011766104.htm http://www.thetruthaboutcars.com/2011/01/vw-might-launch-big-suv-in-the-u-s/ 47 http://www.moneycontrol.com/news/business/honda-cars-domestic-sales-fall-9march_845159.html 48 http://articles.economictimes.indiatimes.com/keyword/volkswagen-india 46 20 as high inflation and planned fuel price hikes in the country are more likely to affect the low-end customers that Honda is targeting, rather than the mid-higher end customers that Volkswagen caters to49. As for the Chinese market, Honda has not fully recovered from the effects of the recent protest. Sales of the company has decreased by 5.2% for the first quarter of FY2013 as compared to last year50. For Volkswagen, their sales in China has increased by 23.7% for the first quarter of this year as compared to the last51. It is also worthy to note that while Honda has joint ventures in China as well, they are not performing as well as Volkswagen, which sales are number two in China, behind General Motors. The future performance of Honda in China in unclear, due to the ongoing tension between Japan and China over the Senkaku Islands. Should any dispute reoccur, sales of Honda will be expected to drop, with other non-Japanese rivals such as Volkswagen taking away Honda’s market share. Honda may succeed in the North America market, due to the recent depreciation of the Japanese yen. While Korean competitors have been able to price their cars lower than the Japanese, the depreciation of the yen will enable Honda to price its cars more competitively. However, the current dismal performance of the company in its home market Japan and emerging markets may offset the gains. Also, the overdependence on the North American market increases the amount of risk the company is exposed to as the American economy is still in its recovery stages. Although Europe is still in a crisis, Volkswagen still remains the market leader with a significant market share. The company’s exposure to the European market and its associated risks can be mitigated by its relatively good performance in the emerging markets. The main risk that the company faces now is stricter emissions control in these markets. This is especially the case in China, where government authorities have been worried about the high levels of pollution. However, the new Jetta and Touareg hybrid models and 3 other EV models that Volkswagen is developing with its Chinese partners will allow it to overcome these new obstacles52. Overall, these factors and developments in the market have led me to believe that Volkswagen AG is the better company to invest in. 49 http://online.wsj.com/article/SB10001424127887323296504578398482826617730.html http://online.wsj.com/article/BT-CO-20130402-700626.html 51 http://www.chinaknowledge.com/Newswires/NewsDetail.aspx?type=1&cat=CMO&NewsID=51177 52 China Auto Report. Business Monitor International. 50 21 7. External Views According to a survey conducted by auditor and consulting company KPMG, German companies Volkswagen AG and BMW were the favourites to gain market share in the global auto industry over the next five years. Among those who were surveyed were 200 senior global auto industry executives who were mostly based outside of North America53. (Above) Chart from KPMG’s Global Automotive Executive Survey 201354 Echoing my analysis, the majority of those polled were more in favour of Volkswagen gaining market share rather than Honda. 53 54 http://www.reuters.com/article/2013/01/09/us-autos-survey-kpmg-idUSBRE90805R20130109 KPMG’s Global Automotive Executive Survey 2013. KPMG International. 22 8. Appendix 8.1 Sales Forecasts: Honda Motor Co. Ltd Total Revenue 2010 2011 2012 2013E 2014E 2015E Motorcycle 1,140,292 1,288,194 1,348,828 1,433,804 1,542,423 1,672,388 Automobile 6,554,848 6,802,316 5,822,742 6,224,886 6,930,266 7,774,565 FS 618,811 573,458 526,576 547,412 603,721 671,794 Other 304,618 318,279 289,734 305,428 311,721 319,171 Total 8,618,569 8,982,247 7,987,880 8,511,530 9,388,131 10,437,918 Less: Eliminations (39,395) (45,380) (39,785) (47,412) (48,253) (45,742) Consolidated Total 8,579,174 8,936,867 7,948,095 8,464,118 9,339,878 10,392,176 Operating Income 2010 2011 2012 2013E 2014E 2015E Motorcycle 58,837 138,594 142,602 120,330 134,512 143,825 Automobile 126,758 264,550 (77,206) 74,960 98,777 100,927 FS 194,901 186,279 170,006 151,633 172,060 194,148 Other (16,721) (5,525) (4,038) (9,786) (9,214) (7,412) Adjustment - (14,123) - - - - Total 363,775 569,775 231,364 337,137 396,135 431,488 Operating Margin % Motorcycle Automobile FS Other Total 2010 5.2% 1.9% 31.5% -5.5% 4.2% 2011 10.8% 3.9% 32.5% -1.7% 6.4% 2012 10.6% -1.3% 32.3% -1.4% 2.9% 2013E 8.4% 1.2% 27.7% -3.2% 4.0% 2014E 8.7% 1.4% 28.5% -3.0% 4.2% 2015E 8.6% 1.3% 28.9% -2.3% 4.2% 23 Total Revenue 2010 2011 2012 2013E 2014E 2015E Japan 3,305,777 3,611,207 3,362,952 3,503,467 3,794,745 4,165,387 North America 3,908,216 4,147,897 3,714,756 4,010,843 4,499,764 5,078,818 Europe 825,472 699,298 580,792 505,285 454,601 422,491 Asia 1,518,580 1,841,167 1,490,478 1,682,517 1,921,195 2,188,947 Others 896,491 982,083 893,132 981,663 1,111,194 1,246,733 Total 10,454,536 11,281,652 10,042,110 10,683,774 11,781,500 13,102,376 Less: Eliminations (1,875,362) (2,344,785) (2,094,015) (2,219,656) (2,441,621) (2,710,200) Consolidated Total 8,579,174 8,936,867 7,948,095 8,464,118 9,339,878 10,392,176 2011 2012 2013E 2014E 2015E Operating Income 2010 Japan (29,135) 66,118 (109,834) (128,203) (155,977) (218,740) North America 236,379 300,922 223,293 296,400 366,877 453,944 Europe (10,872) (10,203) (12,109) (94,820) (182,980) (261,737) Asia 113,006 150,637 76,870 171,908 236,162 300,985 Others 45,808 69,549 56,956 91,852 132,053 157,036 Total 355,186 577,023 235,176 337,137 396,135 431,488 Eliminations 8,589 6,875 (3,812) - - - Consolidated Total 363,775 583,898 231,364 337,137 396,135 431,488 Operating Margin Japan North America Europe Asia Others Total Eliminations Consolidated Total 2010 -0.9% 6.0% -1.3% 7.4% 5.1% 3.4% -0.5% 4.2% 2011 1.8% 7.3% -1.5% 8.2% 7.1% 5.1% -0.3% 6.5% 2012 -3.3% 6.0% -2.1% 5.2% 6.4% 2.3% 0.2% 2.9% 2013E -3.7% 7.4% -18.8% 10.2% 9.4% 3.2% 0.0% 4.0% 2014E -4.1% 8.2% -40.3% 12.3% 11.9% 3.4% 0.0% 4.2% 2015E -5.3% 8.9% -62.0% 13.8% 12.6% 3.3% 0.0% 4.2% 24 8.2 Balance Sheet: Honda Motor Co. Ltd Consolidated balance sheets 2010 2011 2012 Assets Current assets Cash and deposits 1,119,902 1,279,024 1,247,113 A/R 892,031 795,595 819,448 (8,555) (7,904) (7,293) Less: Provision for doubtful accounts Notes Rvcd 1,100,158 1,131,068 1,081,721 Inventories 935,629 899,813 1,035,779 Deferred income taxes 176,604 202,291 188,755 Other 397,955 390,160 373,563 Total current assets 4,613,724 4,690,047 4,739,086 Noncurrent assets Fixed Assets PP&E 7,052,579 6,970,777 7,246,297 (3,673,789) (3,800,082) Less: Accumulated depreciation on (3,657,769) buildings, equipment and fixtures LT Notes Rvcd 2,361,335 2,348,913 2,364,393 Other LT Assets 801,412 794,900 796,321 Total Fixed Assets 6,557,557 6,440,801 6,606,929 LT Investments and other assets LT Investment - Affiliates 457,834 440,026 434,744 Total noncurrent assets 7,015,391 6,880,827 7,041,673 Total assets 11,629,115 11,570,874 11,780,759 Liabilities Current liabilities A/P 802,464 691,520 942,444 Accrued Expenses 566,468 557,500 513,209 Notes Payable/ ST Debt 1,091,048 1,119,956 991,347 Current Portion of LT Debt 722,296 962,455 911,395 Other current liabilities 236,854 236,761 221,364 Total current liabilities 3,419,130 3,568,192 3,579,759 Noncurrent liabilities Long Term Debt 2,313,035 2,043,240 2,235,001 Other LT liabilities 1,440,520 1,376,530 1,437,709 Minority interests 127,790 132,937 125,676 Total noncurrent liabilities 3,881,345 3,552,707 3,798,386 Total liabilities 7,300,475 7,120,899 7,378,145 Shareholders' equity Preferred stock Common stock 86,067 86,067 86,067 Additional Paid-In Capital 172,529 172,529 172,529 Retained earnings 5,349,936 5,712,869 5,816,213 (1,208,162) (1,495,380) (1,646,078) Accumulated other comprehensive income Treasury stock (71,730) (26,110) (26,117) Total shareholders' equity 4,328,640 4,449,975 4,402,614 Total Equity 4,328,640 4,449,975 4,402,614 Total net assets 4,328,640 4,449,975 4,402,614 Total liabilities and net assets 11,629,115 11,570,874 11,780,759 2013E 2014E 2015E 1,156,579 872,590 (8,726) 1,102,864 1,098,279 189,217 387,226 4,798,028 1,302,606 915,674 (9,157) 1,216,974 1,043,661 193,421 383,650 5,046,829 1,301,321 944,743 (9,447) 1,354,087 1,043,144 190,464 381,480 5,205,792 8,115,853 (4,247,532) 2,357,408 797,544 7,023,274 9,089,755 (4,757,235) 2,601,323 802,130 7,735,973 10,180,526 (5,328,104) 2,894,407 810,151 8,556,980 444,201 7,467,475 12,265,503 439,657 8,175,630 13,222,459 444,054 9,001,034 14,206,825 1,000,343 547,455 1,067,450 865,382 231,660 3,712,291 1,092,968 602,475 1,184,870 960,574 257,142 4,098,028 1,195,283 670,979 1,291,508 1,047,026 280,285 4,485,080 2,197,092 1,418,253 128,801 3,744,146 7,456,437 2,438,772 1,574,261 142,969 4,156,002 8,254,030 2,658,262 1,715,944 155,836 4,530,042 9,015,122 86,067 172,529 6,026,461 (1,449,873) (26,117) 4,809,066 4,809,066 4,809,066 12,265,503 86,067 172,529 6,266,393 (1,530,444) (26,117) 4,968,428 4,968,428 4,968,428 13,222,459 86,067 172,529 6,501,356 (1,542,132) (26,117) 5,191,703 5,191,703 5,191,703 14,206,825 25 8.3 Income Statement: Honda Motor Co. Ltd Consolidated statements of income 2010 2011 Net sales 8,579,174 8,936,867 Cost of sales (6,414,721) (6,496,841) Gross profit 2,164,453 2,440,026 Selling, general and administrative expenses(1,337,324) (1,382,660) R&D (463,354) (487,591) Operating income (loss) 363,775 569,775 Non-operating income Interest income 18,232 23,577 Other 45,670 Total non-operating income 18,232 69,247 Non-operating expenses Interest expenses (12,552) (8,474) Other (33,257) Total non-operating expenses (45,809) (8,474) Ordinary income (loss) Total extraordinary income Total extraordinary losses 336,198 Income (loss) before income taxes and minority interests 630,548 Current income tax (90,263) (76,647) Deferred income tax (56,606) (130,180) 189,329 423,721 Income (loss) before equity in income of affiliates Equity in income of affiliates 93,282 139,756 Net income before minority interest 282,611 563,477 Less: Minority interests (14,211) (29,389) Net income 268,400 534,088 2012 7,948,095 (5,919,633) 2,028,462 (1,277,280) (519,818) 231,364 2013E 8,464,118 (6,282,157) 2,181,961 (1,357,206) (487,619) 337,137 2014E 9,339,878 (6,940,344) 2,399,534 (1,498,077) (505,321) 396,135 2015E 10,392,176 (7,769,336) 2,622,840 (1,670,407) (520,944) 431,488 33,461 2,956 36,417 25,090 25,090 27,376 27,376 28,642 28,642 (10,378) (10,378) 257,403 (86,074) (49,661) 121,668 100,406 222,074 (10,592) 211,482 (10,468) (10,468) 351,759 (84,942) (66,571) 200,246 111,148 311,394 (18,064) 329,458 (9,773) (9,773) 413,738 (99,908) (78,301) 235,529 117,103 352,632 (19,348) 371,980 (10,206) (10,206) 449,924 (108,646) (85,149) 256,129 109,552 365,681 (16,001) 381,682 26 8.4 Retained Earnings: Honda Motor Co. Ltd RETAINED EARNINGS STATEMENT 2013 2014 2015 Beginning Retained Earnings 5,816,213 6,026,461 6,266,393 Add: Net Income 329,458 371,980 381,682 Less: Cash Dividends 119,210 132,048 146,720 Ending Retained Earnings 6,026,461 6,266,393 6,501,356 2013 2014 2015 65 72 80 1,834 1,834 1,834 119,210 132,048 146,720 Dividend Payouts Div % Change Shares Dividends payout 27 8.5 Valuation: Honda Motor Co. Ltd Book Value Present Value of IV per Share of Equity Residual Earnings Intrinsic Value 4,470,260 ¥ 2,437.44 ¥ 4,402,614 ¥ 67,646 ¥ Year 2012 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 2025E 2026E Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Beginning of Year Book Value ¥ 4,402,614 4,535,848 4,743,406 4,977,754 5,218,214 5,487,529 5,789,162 6,126,991 6,505,359 6,929,132 7,403,757 7,911,606 8,455,004 9,036,441 9,658,578 Earnings 211,482 329,458 371,980 381,682 427,484 478,782 536,236 600,585 672,655 753,373 806,110 862,537 922,915 987,519 1,056,645 Expected Residual Redemptions Return on Equity Earnings & Dividends ¥ 396,235 ¥ -184,753 ¥ 78,248 408,226 (78,769) 121,899 426,907 (54,926) 137,633 447,998 (66,315) 141,222 469,639 (42,155) 158,169 493,878 (15,095) 177,150 521,025 15,212 198,407 551,429 49,156 222,216 585,482 87,173 248,882 623,622 129,752 278,748 666,338 139,771 298,261 712,045 150,493 319,139 760,950 161,964 341,478 813,280 174,239 365,382 869,272 187,373 390,959 28 8.6 Sales Forecasts: Volkswagen AG Total Revenue Segment 2010 2011 2012 2013E 2014E 2015E Commerical Vehicles 111,218 138,691 158,074 169,625 188,453 213,601 Trucks and Buses 8,179 11,723 20,567 22,154 23,749 25,459 Power Engineering - 662 4,234 4,361 4,505 4,654 Financial Services 14,069 17,245 19,854 21,599 25,341 30,463 Scania 8,179 - - - - - Less: Scania (8,179) - - - - - Total 133,466 168,321 202,729 217,740 242,049 274,177 Consolidation (6,591) (8,985) (10,052) (13,315) (14,887) (16,988) Consolidated Total 126,875 159,336 192,677 204,425 227,162 257,188 2010 2011 2012 2013E 2014E 2015E Operating Income/Loss Segment Commerical Vehicles 5,337 9,886 10,778 11,365 12,626 13,884 Trucks and Buses 1,050 937 358 354 380 382 Power Engineering - (6) 161 166 167 168 Financial Services 952 1,298 1,586 1,663 1,926 2,346 Scania 253 - Total 7,592 12,115 12,883 13,548 15,099 16,779 Consolidation (197) (844) (1,373) Consolidated Total 7,395 11,271 11,510 13,548 15,099 16,779 29 Operating Margin Segment Commerical Vehicles Trucks and Buses Power Engineering Financial Services Scania Total Geographic Revenues Segment 2010 4.8% 12.8% #DIV/0! 6.8% 3.1% 5.8% 2010 2011 7.1% 8.0% -0.9% 7.5% #DIV/0! 7.1% 2011 2012 6.8% 1.7% 3.8% 8.0% #DIV/0! 6.0% 2012 2013E 6.7% 1.6% 3.8% 7.7% #DIV/0! 6.6% 2014E 6.7% 1.6% 3.7% 7.6% #DIV/0! 6.6% 2015E 6.5% 1.5% 3.6% 7.7% #DIV/0! 6.5% 2013E 2014E 2015E Germany 28,702 34,600 37,734 39,863 43,956 49,457 Rest of Europe 55,102 69,291 77,650 76,659 80,302 83,329 North America 15,193 17,553 25,046 26,984 30,213 34,335 South America 13,468 14,190 18,311 19,768 22,035 24,999 Asia 14,409 22,983 33,936 41,151 50,657 65,069 Total 126,874 158,617 192,677 204,425 227,162 257,188 30 8.7 Balance Sheet: Volkswagen AG Consolidated balance sheets 2010 2011 Assets Current assets 18,670 18,291 Cash and deposits + Cash equivalents Short-term investments 5,501 6,146 A/R 8,415 12,465 Notes Rvcd 30,164 33,754 Other Rvcd 2,375 5,166 Inventories 17,631 27,550 Other Current Assets 3,180 2,268 Total current assets 85,936 105,640 Noncurrent assets Fixed Assets PP&E 106,840 121,527 Less: Depreciation (68,929) (72,685) LT Notes Rvcd 37,170 44,659 Other LT Assets 5,434 Total Fixed Assets 80,515 93,501 Intangible assets Goodwill 3,410 4,334 Total intangible assets, net 9,694 17,841 Investments and other assets LT Investment (Affiliates) 14,168 13,298 Other (Investment Property) 1,422 12,822 15,590 26,120 Total investments and other assets Total noncurrent assets 113,457 148,129 Deferred assets Deferred Income Tax - LT 4,248 6,333 Total assets 199,393 253,769 Liabilities Current liabilities A/P 12,841 16,325 39,694 liabilities49,090 Current portion of bonds/ Current financial Notes Payable 158 Accrued expenses 3,402 4,956 Other current liabilities 20,804 30,865 Total current liabilities 76,899 101,236 Noncurrent liabilities 37,159 44,442 Long-term loans payable/ Noncurrent financial liabilities Deferred Income Tax - LT 1,669 4,055 Minority Interests 2,734 5,815 Other LT liabilities 34,954 40,684 Total noncurrent liabilities 76,516 94,996 Total liabilities 153,415 196,232 Shareholders' equity Common stock 1,191 1,191 Capital reserves 9,326 9,329 Retained earnings 35,565 48,788 Other Equity (104) (1,769) Total shareholders' equity 45,978 57,539 Total net assets 45,978 57,537 Total liabilities and net assets 199,393 253,769 2012 2013E 2014E 2015E 18,488 7,433 12,876 36,911 5,584 28,674 3,095 113,061 23,938 6,360 13,440 39,087 5,924 34,177 2,848 125,774 41,881 6,646 14,906 43,269 6,310 37,752 2,737 153,500 62,139 6,813 16,788 48,526 6,768 42,259 2,893 186,185 136,525 (76,634) 52,008 111,899 144,717 (81,041) 55,101 118,776 153,399 (88,972) 60,415 124,843 162,603 (97,562) 67,504 132,545 23,935 35,224 19,232 35,576 21,605 35,932 20,352 36,291 11,179 6,431 17,610 196,583 12,882 6,892 19,773 199,512 12,453 8,715 21,168 210,878 12,171 7,346 19,517 216,942 7,915 309,644 6,154 325,287 7,330 364,378 8,237 403,127 17,268 54,060 4,840 29,344 105,512 19,300 56,763 5,072 27,004 108,139 21,495 59,601 5,719 29,071 115,887 24,348 62,581 6,441 28,473 121,843 63,603 9,050 4,310 49,653 126,616 232,128 69,963 7,861 4,286 41,764 123,874 232,013 76,960 10,482 4,804 44,034 136,279 252,166 84,656 13,362 4,467 45,150 147,634 269,477 1,191 11,509 64,994 (179) 77,515 77,516 309,644 1,191 11,509 80,573 93,273 93,273 325,287 1,191 11,509 99,513 112,213 112,213 364,378 1,191 11,509 120,949 133,649 133,650 403,127 31 8.8 Income Statement: Volkswagen AG Consolidated statements of income 2010 2011 2012 Net sales 126,875 159,337 192,676 Cost of sales (105,431) (131,371) (157,518) Gross profit 21,444 27,966 35,158 Selling, general and administrative expenses (15,500) (18,966) (25,073) Other operating expenses (6,450) (7,456) (9,070) Other operating income 7,648 9,727 10,496 Operating income (loss) 7,142 11,271 11,511 Non-operating income Equity in earnings of affiliates 1,944 2,174 13,568 Other 2,053 7,528 2,967 Total non-operating income 3,997 9,702 16,535 Non-operating expenses Interest expenses (2,144) (2,047) (2,552) Total non-operating expenses (2,144) (2,047) (2,552) Ordinary income Total extraordinary income Total extraordinary losses 8,995 18,926 Income (loss) before income taxes and minority interests Total income taxes (1,767) (3,126) Income (loss) before minority interests 7,228 15,800 Minority interests in income 392 391 Net income (loss) 6,836 15,409 25,494 (3,608) 21,886 168 21,718 2013E 2014E 2015E 204,425 227,162 257,188 (176,013) (195,177) (220,590) 28,412 31,985 36,599 (28,178) (31,773) (36,808) (7,659) (8,062) (8,263) 12,266 15,901 18,003 4,840 8,052 9,531 14,395 3,148 17,543 15,996 3,498 19,494 18,111 3,960 22,071 (1,135) (1,135) (1,888) (1,888) (2,235) (2,235) - - - 21,248 (3,564) 17,685 391 17,294 25,658 (4,303) 21,355 391 20,964 29,367 (4,925) 24,442 391 24,051 32 8.9 Retained Earnings: Volkswagen AG RETAINED EARNINGS STATEMENT 2013 2014 2015 Beginning Retained Earnings 64,994 80,573 99,513 Add: Net Income 17,294 20,964 24,051 Less: Cash Dividends (1,714) (2,025) (2,614) Ending Retained Earnings 80,573 99,513 120,949 2012 2013 2014 DIVIDENDS STATEMENT 2015 Preferred 170.0 170.0 170.0 170.0 Common 295.0 295.0 295.0 295.0 DIV per preferred 3.6 3.7 4.5 5.8 DIV per common 3.5 3.7 4.3 5.5 DIV PAYOUT for Preferrred 635.5 762.6 991.3 DIV PAYOUT for COMMON 1,079.0 1,262.4 1,622.5 Cash Dividends Payout (MM EUR) 1,714 2,025 2,614 33 8.10 Valuation: Volkswagen AG Book Value Present Value of IV per Share of Equity Residual Earnings Intrinsic Value € 114,435 € 246.10 € 77,515 € 36,920 Year Year 2012 1 2013E 2 2014E 3 2015E 4 2016E 5 2017E 6 2018E 7 2019E 8 2020E 9 2021E 10 2022E 11 2023E 12 2024E 13 2025E 14 2026E 15 Beginning of Year Book Value € 77,515 € 97,061 112,626 131,493 146,996 168,642 192,770 220,275 251,631 287,378 328,128 372,445 421,193 474,815 533,801 Earnings 21,718 17,294 20,964 17,226 24,051 27,418 31,256 35,632 40,621 46,308 50,938 56,032 61,635 67,799 74,579 Expected Return on Equity € 10,852 € 13,589 15,768 18,409 20,579 23,610 26,988 30,839 35,228 40,233 45,938 52,142 58,967 66,474 74,732 Residual Redemptions Earnings & Dividends 10,866 € 2,172 3,705 1,729 5,196 2,096 (1,184) 1,723 3,471 2,405 3,808 3,290 4,269 3,751 4,794 4,276 5,392 4,874 6,075 5,557 5,000 6,622 3,890 7,284 2,668 8,013 1,325 8,814 (153) 9,695