No pain no gain

advertisement

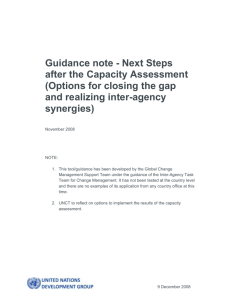

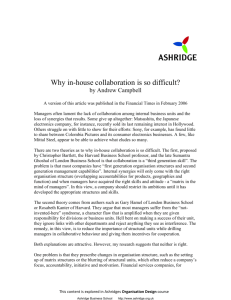

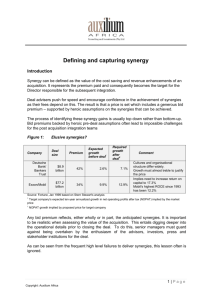

No pain, no gain Pitfalls and best practices for planning and realizing revenue synergies 1 Research findings on realizing revenue synergies Making mergers and acquisitions work is not easy. Conclusion of our research is that revenue synergies No pain, no gain Realizing revenue synergies is a key value driver in can contribute significantly to creating value through corporate M&A (Mergers & Acquisitions), but has M&A, but it requires leadership, careful preparation and proven to be one of the most difficult aspects. Turner disciplined execution: no pain, no gain. Introduction and Nyenrode University conducted research into planning and realizing revenue synergies. Extensive This research was conducted for and by Turner’s PMI literature research and interviews with corporate (post merger integration) practice in our ongoing management and staff of a wide variety of companies search for knowledge and understanding of creating gave valuable insights into the pitfalls and best value through mergers and acquisitions in order to practices for a complex issue. better help our clients dealing with M&A. Use it as a magazine, each segment can be read separately. It 2 Revenue synergies are the increase in sales revenue, starts with a summary of the six main conclusions by enhanced sales volumes and/or sales prices, of the of the research. Then we present our framework for combined firm over what the two firms are already creating value through M&A, which has been the expected or required to accomplish as individual basis for this research. The next six chapters each firms. We distinguish six different types of revenue handle one of the main conclusions in a more detailed synergies: cross-selling, shared sales skills, combined manner. Each of these chapters describes the issues at product power, hand and the solutions we came across to face those improved geographical coverage and forward vertical issues effectively. The last chapter is dedicated to our integration. research method. development, increased market 3 Index 14 18 22 Firms are frequently not fully aware of the variety of revenue synergy opportunities and miss out because of that. An increase in revenue is only possible with proper understanding of clients. Managers are afraid to set growth targets. This leads to a singleminded focus on realizing cost synergies. 26 30 34 Absorbing another company in one’s own business model is not as straightforward as most managers think. One cannot integrate new business without adjusting the ‘old’ company. Cost synergies are (mostly) properly defined and addressed in programs, whereas revenue synergies are often just handles as normal business. Be aware Scrutinize Know clients Change Be brave Invest 2 Introduction 6 Summary 8 Theoretical framework 38 Research Method About Turner Colophon Issued by Turner. Authors Copyright 2009 Turner management consultancy is is known as a high-grade independent advice, a customized approach and co- Post Merger Integration practice Martijn Babeliowsky Nothing in this issue may be duplicated Olav de Maat and/or published by means of print, copy or specialized in strategy implementation. management consultancy with a proven production with the client organization: Wouter Bruggers in any other way, without written consent of Our mission is to achieve solid and track record in both private and public sustainable change because people sustained performance improvement sector. We make strategy work, based matter and results count. and highly motivated people. Turner on sharp transparent analysis and the publisher. Design Henry Hennipman 4 5 have long been met. Employees are 1. Be aware straightforward as most managers searching for self-actualization and Firms are frequently not fully aware think. Scrutinize both business want to know what a company can of the variety of revenue synergy models. bring them in the long run. Short- opportunities and miss out because synergy purposes means changing term cost cutting does not fit that of that. Be aware of the types of revenue models. Changing revenue desire and might result in talent revenue synergy to pursue. Each models affects the whole of the leaving revenue Increase type requires a different approach. business model. Knowing how Using the wrong approach means it affects the company is crucial positive outlook that helps their losing possible revenues. for staging synergy and making it to company. for in revenues gives employees a readiness the Merging put their weight behind the integration. come true. 2. Know clients When merging, companies do 5. Change Still, realizing revenue synergies not focus enough on what clients One cannot integrate new business remains difficult, as indicated by want. However, clients are the without adjusting the ‘old’ company. Summary the statistic above: 70% of mergers number causing It is not just the acquired that lose do not realize planned revenue stakeholder. Clients have reasons their identity. Lose the old way of synergies. So, how to plan and for (not) buying the stuff your working. The two companies build No pain, no gain realize them? merged company has to offer them. one new company together. Even Understand what clients expect and with huge size differences, both want in the new business context companies will never be the same. Merging must be for revenue too Revenue synergies, who dares? one revenue due to a merger, and actively All parties involved must be aware What we found was that the involve them. Knowing your client of this. Going back to business typically offset a 25% failure on Secondly, revenue synergies more acquiring company must be willing means knowing where to focus as anticipated cost savings.) frequently are part of the take- to invest in order to gain those on when planning and realizing for synergy. over sought-after revenue synergies. Making mergers and acquisitions (M&A) work is not easy. Other Realizing revenue research shows that many deals do becomes more not create value. Different studies important. First of all, we are in an indicate that on average 40% of economic downturn. First item on mergers do not deliver planned the management agenda in these cost synergies and no less than 70% fail to achieve expected revenue synergies price, since competitive revenues. It must usual is the best remedy bidding between interested buyers lose its old and easy-going ways. has common. Obtaining extra revenues is not 3. Be brave Invest time, money and project Stakeholders -- and specifically something one summons forth. The Revenue synergies are very hard capacity. Pursue revenue synergies shareholders -- want to know acquirer must get out of its seat. to quantify up-front. But still, in the same way as you do cost how a company is planning on It is not only the target company merging companies must not be synergies. Revenue synergies will times is cutting costs. Sadly, a lot maintaining Merely that has to be taken apart and afraid to make estimates and set not just come to be by increasing of companies are at the bottom of reducing costs is no longer enough reassembled. The acquirer must targets. Management should stand top-line targets of line managers. synergies. Most companies, when their bottom line. Cutting more as a business case for making the also consciously investigate itself for those targets as if they are the They must be built and monitored merging, focus on cost reductions costs would be equal to cutting investment of merging. in order to ascertain where and whole truth. Ignoring to do so will with a much higher attention level through how integration of the acquired lead to wavering faith, which leads than ‘normal’ business. company can be done successfully. to volatile revenues. of more become more growth. scale. into the very core of the company, However, it is mainly revenue which makes it less likely to come And thirdly, giving employees a instead of cost that determines out fighting when the economic positive perspective becomes more the succes of a merger (e.g. one tide turns. Fixing and solidifying important. We are at the top of the We found that six specific topics are 4. Scrutinize study suggests that beating a the top line is a safer and more Maslow pyramid. Our primary -- the key to successful planning and Integrating another company in target revenue growth by 1% can durable remedy for hard times. physiological and safety -- needs realization of revenue synergies. one’s own business model is not as 6 economies and 6. Invest 7 Framework of value creation through M&A. Our research on CONSIDERATION planning and realizing revenue synergies is built on Are you paying too much? Value creation by integration Value today Potential value VALUE CREATION POTENTIAL 3 Turner’s framework for creating value through M&A, 2 developed in over fifteen years of experience in M&A 1 and integration projects. The main elements of this 5 4 2. Value creation requires integrating 3 Value through M&A Synergies New strategies 2 1 Target risk business models 3. Value creation requires careful planning and structured realization 4. Key stakeholders are not only shareholders, but A merger or acquisition is not a goal in itself, but one Standalone value Totale price Deal costs Premium Standalone value through M&A What is the base value of the means for companies to create value. Whether Destroy value Intergration risk also clients and employees 5. ‘Soft’ factors are of the utmost importance 1. Synergies are key drivers of value creation Create value 6 framework are: 1. Synergies are key drivers of value creation New strategy risk one must first understand the broader concept Synergy risk for value creation through M&A To understand the specifs of revenue synergies, What is the potential to create value? What is the risk that value will not be realised? value is actually created depends on the result of three parameters (see figure 1): Figure 1: Value creation through M&A 1. The price paid for the acquired business in relation to the actual stand-alone value 2. The mitigation of M&A related risks that could lead to value leakage (also referred to as dissynergies) 3. The synergies achieved by combining the leakage due to the transition. In the introduction of Revenue synergies particularly refer to an increase in this report we already indicated that the impact of sales revenue by enhanced sales volumes and/or sales revenue synergies on value creation has proven to be prices of the combined firm (on top of what the two significantly higher than cost synergies. firms are already expected or required to accomplish as individual firms). Based on our own post-merger two businesses 8 We define synergies as the increase in performance of integration practice, and validated during our research, Value is only created if the synergies achieved the combined firm over what the two firms are already we distinguish six types of revenue synergies, as compensate for the paid premium and actual value expected or required to accomplish as individual firms. depicted in figure 2 on the next page. 9 Type of Revenue Synergy 1. Cross-Selling 2. Combined Product Development Definitions The combined entities’ ability to sell their products and/or services to each other’s customer bases. The combined entities’ ability to combine products or services to create unique solutions. 3. Shared Sales Skills The combined entities’ ability to draw upon the stronger sales skills of one company to improve the sales force performance of the other. 4. Increased Market Power The combined entities’ ability to gain more revenues by benefiting from a stronger market position. 5. Improved Geographical Coverage 6. Forward Vertical Integration Figure 2: Different types of revenue synergies The combined entities’ ability to serve additional customers through enhanced geographical coverage. The combined entities’ ability to ensure a continuous demand for a company’s product by means of additional or exclusive distribution channels. Note: one could argue that there is a seventh type of revenue synergy: Cost Leadership, defined as the combined entities’ ability to increase competitive advantage by enabling product price reductions through cost synergies. This type of revenue synergy clearly is of a different nature and therefore not the main focus of this report. 2. Value creation requires integrating business models to be made on how the business models of both Planning value creation structured realization In parallel with the deal making process, the acquiring firm should develop a sound and feasible business The challenge of value creation is twofold: preventing case: what are the specific drivers for value creation, value leakage due to loss of clients and talent, and and what needs to be done to actually make it optimizing synergies. Creating value starts before the work? In addition, a first draft of the integration plan deal is closed, and requires a structured approach. The should be developed that will guide the post-deal integration process. Deal signed Predeal Closing Day 1 Deal completion “We agree where the value drivers are” “We are ready for Day 1” Deal making Day 1 preparation Planning value creation First 100 days “We know what we will change and can see how it will work” 100 Day integration planning Long term integration “We can start to see benefits flowing through” Implementation “We can see further flow through of benefits ” Optimization Integrated company decision making processes within a corporation. Figure 3: Main steps for M&A 3. ICT & Means: focuses on the question with what the primary process is or should be supported, e.g. When two companies merge, clear decisions have 3. Value creation requires careful planning and main steps to be followed are summarized in figure 3. technology, machines, buildings, but also forms and formats. Day 1 preparation From the first day onward, the two companies must Deal making start operating as one. The first day should be an companies will be combined. All aspects of the 4. People & Culture: all things having to do with the Mergers and acquisitions start with a deal between issue-free day where solutions are 70% perfect but business models should be assessed as to whether human part of organizing (such as behavior, job the firms involved. After an initial agreement due 100% achievable, therefore not destroying any value they are complementary or mutually exclusive. Also, positions, competencies and rewards). diligence is conducted to assess the value of the firm to of the merged firms. To prevent dissynergies and value be acquired. Final terms are set, based on negotiations leakage, careful preparation of the transition on day 1 on price, strategy and conditions, resulting in a sale is key. these aspects must be balanced into one new coherent business model. 5. Knowledge: concerned with the knowledge that is crucial to the company’s success. and purchase agreement. Synergies have become a We discern five aspects in a business model: These five aspects are all vital for optimal operations more and more important factor: synergies can enable 100 day integration planning 1. The primary process: creates the output and is within a company. They must be mutually balanced, firms to offer a better purchase price which can make The first 100 days are a crucial period. All stakeholders the “added value” for a company. The other four reinforcing one another. Making a change in one of the difference between winning and losing the battle expect changes, and this is the window of opportunity aspects support the execution of the primary the aspects (e.g. process optimization) will not have for a target company. In 2006 on average nearly for clarifying those changes. The aim of the 100 process. the desired effect if it is not supported by the other 43% of all potential synergies were included in the day integration planning step is to define how the aspects (e.g. the right capacities for performing the take-over price. business models of both firms are to be combined. 2. Organization & Structure: includes such things as planning and control, corporate governance, and 10 new process). 11 Furthermore, realization of quick wins in this stage is Of all stakeholders, the shareholder usually gets most very important for boosting the morale of employees if not all attention during mergers and acquisitions. and other stakeholders. Output of this period is a We consider this to be an ineffective way of working. detailed implementation plan. An organization should always find an optimum between the values of all stakeholders as they all Implementation have a direct effect upon the long term profitability This step is about implementing the integrated business of a company. Shareholder value is determined by a model, thereby creating the conditions for actually short term outlook. Integrating two companies and achieving synergies. This includes adjusting and realizing revenue synergies is not a matter of months. tuning processes and systems, combining departments It takes years. Making sure the needs and wants of all and stakeholders are met means that all stakeholders will rightsizing or downsizing headcount, and aligning cultures. contribute to the total value of the organization over a longer period of time. Optimization The full value creation potential is very rarely achieved 5. Importance of soft factors in one go. After a while new market circumstances and additional insights into the businesses involved require Benefits adjustment of plans (second wave). Based on lessons accomplished if the people within the organizations learned and results achieved thus far, optimization involved truly change their ways of doing business. opportunities should be identified and planned, so that Effective organizational change requires a balanced the full benefits of working together can be achieved. focus on hard and soft factors. Hard factors concern of mergers and acquisitions are only issues that can be designed, calculated and measured. 4. Key stakeholders are not only shareholders, but Soft factors are about all things that can be done to also clients and employees optimize the change process, stimulate commitment and address emotions. Each organization has its own set of stakeholders with their own set of stakes. In general there are three types When merging, both aspects of change are of equal of stakeholders: importance. Most of the time, management focuses on the hard issues when deciding on taking over 1. Shareholders: the owners and/or decision makers of the company. or merging. Questions about markets to be served, products to be delivered or parts of the overhead to 2. Customers: people or companies that (might) become redundant outweigh questions about cultural purchase and/or use products and services differences, management styles or insecurity among of a company. employees. We believe that, even when making a 3. Employees: the company. the people that work for business case for merging, one needs to incorporate the soft issues too. Failing to do so, will affect the outcome of M&A in a negative way. 12 13 Issue: more than meets the eye In our research we found that only few companies or less detailed (revenue) synergies plan. However, had clearly articulated what they exactly meant with none of the companies used a structured method for revenue synergies. There are many ways to increase a exploring and identifying the revenue synergy areas to company’s revenues, and the same holds for realizing be included in this plan. revenue synergies. Firms are frequently not (fully) aware of the variety of revenue synergy opportunities, The fact that firms are not fully aware of the variety and in many cases do not clearly define what types of revenue synergy opportunities and frequently fail of revenue synergies they anticipate to realize in a to clearly define the type(s) of revenue synergies they particular merger or acquisition. Some companies want to pursue, brings about two key issues: expect to achieve revenue synergies by just adding the other company’s turnover, instead of really generating 1. Firms are not fully exploiting the value creation additional sources of revenues, on top of the revenues potential of a particular merger or acquisition of the combined firms. Firms tend to go for the obvious synergy areas only, and do not structurally check the full range Also, there is no clear terminology available for revenue of synergy opportunities. In this way they could synergies. For instance, there appears to be ambiguity miss out substantial value creation potential. about a term like cross-selling. Sometimes cross- 2. Firms are not able to define an appropriate and selling is considered to focus purely on increasing the effective integration strategy share-of-wallet of individual clients by selling them Different types of revenue synergies require additional products or services, in other cases cross- different integration approaches. Using the wrong selling is defined more broadly, including the use of approach means missing certain revenue synergies, each other’s distribution channels. or even worse, creating revenue dissynergies. A number of companies involved in our research Be aware Firms are frequently not fully aware of the variety of revenue synergy opportunities and miss out because of that. Be aware of the types of revenue synergies to pursue. Each type requires a different integration approach. Using the wrong approach means losing possible revenues. 14 prepared the merger or acquisition by making a more Case: value potential ignored During the preparation of an acquisition, year after the acquisition, it has become business appear to stimulate cost savings the deal making team of an industrial clear that there are in fact substantial and clearly hinder any cross-selling company focused on a proper valuation cross-selling However, initiatives. Management now confesses of the stand-alone target company and on no progress is made in this area yet: that, had they known this from the start, potential cost saving synergies. Revenue management is still very busy with difficult they would have made different choices synergies were no topic for discussion, cost saving measures. What is more, for the integration strategy. since these were clearly not solid enough the chosen management structure and to include in the business case. One incentive system for the newly acquired opportunities. 15 Solution: check it all Explore all types of revenue synergies We also found that there are a few logical combinations of types of synergies. Cross-selling and shared sales Benefiting from the full revenue synergy potential skills is one of those combinations. They both have to starts with clearly defining what the potential synergy do with reinforcing the sales force. Also, when cross- areas are, and ensuring that everyone involved in the selling is in play, one starts selling one’s products execution is aware of the range of synergy areas to be to customers of the other. Without knowing how dealt with. to approach those customers, one can never be successful. In those cases companies have to share The most simple way to professionalize the synergy their sales knowledge. exploration process is by structurally checking all possible types of revenue synergies. See figure 2 Another logical combination is product development (p. 10) for an overview of revenue synergies. and market power. In general a large company takes over a smaller one in order to use the (product) Choose the most appropriate integration knowledge of the smaller. In turn, the smaller company strategy up-front uses the brand image and network of the larger company in order to get new products into the market. When a firm has defined the types of revenue synergies To accomplish this, a well designed integration process to be pursued, the next step is to translate the revenue is essential. “In the workshops we not only explored revenue growth areas, but also discussed our level of confidence for each area.” synergy ambitions into the best suitable integration strategy. Each type of synergy requires a specific Don’t forget potential dissynergies approach in combining the two business models. Key variables are: The risk of losing business during the transition period 1. The speed of integration (quick and dirty or slowly of a merger is huge. Sales cannibalization due to overlap and gradually) in customer and product portfolio, internal focus, loss 2. The level of integration (extent of consolidating of key talent, operational disturbances, and increased product portfolios, front office processes, back attacks from competitors are common phenomena. office processes, systems, etc) Firms should anticipate well on these downside risks 3. The key driver of change (process driven or people/compentence driven) 4. The level of involvement of staff (top-down or bottom-up approach) 16 Showcase: joint exploration and prepare mitigating actions. If not, more value will A telecom company, in preparing the to explore and quantify potential revenue investments. This way, a challenging but be destroyed than can ever be won back. acquisition of one of its competitors, synergy areas. In addition, synergy feasible business case was developed, carefully explored the synergy potential figures of earlier acquisitions were used resulting in a winning bid for the target in order to enable a competitive bid, to benchmark initial estimates. Scenarios company and a clear plan for realizing the since potential and potential issues were explored, and required synergies. bidders. Workshops were organized with integration strategies were examined to management and commercial personnel assess feasible timelines and required there were several 17 Know clients 18 for customers. Understand what clients expect and want in the new business context due to a merger, and actively involve them. Clients are the number one revenue causing stakeholder. Clients have reasons One would say that an increase in revenue is only possible with proper for (not) buying the products your merged company has to offer them. understanding of clients. Surprisingly, we found that planning and Knowing your client means knowing where to focus on when planning realizing synergies has an internal focus, with very little attention and realizing revenue synergies. It almost sounds like marketing… 19 Issue: “Clients? We’re merging here!” Our research shows that in practice there is far too little focus on customers during M&A. Companies usually have limited dedicated resources for mergers and acquisitions. The M&A related work needs to be executed on top of the normal workload of the going concern. Due to tight schedules and maximum focus on achieving deadlines, time is limited. Excuses for not carefully examining the impact of the merger on existing and new clients are numerous. Solution: marketing for new business “Unfortunately we were not aware of the subtle differences in our clients’ sourcing requirements.” Neither the literature we studied nor the interviews To be honest, in many cases there is at the end of the we held reveal valid reasons for ignoring customers integration, some form of customer consultation, just during M&A. Nevertheless it is a fact that customers before the final marketing campaign. Mostly this is at are involved too little. You think you know your a certain point where assumptions already have been clients? What was the last time you talked to them? made and there is no way back. During a recent assignment we asked employees of our client company what their customers would say about their services. After that we asked their customers the same questions. The answers employees gave Our top three is: in order to better understand the quality of the were in several cases the complete opposite of what 1. “We have no time for this.” target’s customer base. But this will still not provide a customers said. 2. “We already know our clients and markets good understanding of how clients will respond to the well enough.” 3. “We are not allowed to make contact with measures anticipated in the integration of both firms. “Time is scarce during M&A,” is the number one Effects can be disastrous. excuse. However, everyone knows time is a matter of priorities. Also, companies hide behind the excuse our (new) clients.” The need for customer consultation is not that hard that they are not allowed to talk to clients. Research by Invalid excuses for a very important issue. Without to understand. Then why do most merging companies an independent third party is the cure for that. Involve actual customer consultation it is not possible to ignore this logic? Especially with realization of revenue the marketing department in the M&A process as well. understand what clients expect and want in the new synergy, questions of this nature are very relevant. One cannot deny that obtaining revenue synergies business context due to the merger. Most merging How will clients react to the new sales strategy? Do by M&A is like a huge marketing program for new companies depend on what they already (think they) they actually want our new products? Is there a need business. Would you launch a new product or service know about their (existing) customers. Sometimes for the way we are planning on servicing them? What without a solid marketing study? This better be a they also invest in a commercial due diligence process, do they think is actually in it for them? rhetorical question… Case: unpleasant surprises “Integration is a complex process, but in essence it’s simple: it all starts with our customers.” Showcase: food for thought A big manufacturer (Big) acquired a clients preferred to use different channels requirements for the products of Big and When a food producer completed the meetings with clients of buyer and target. and services were validated with several smaller production company (Small) with for the type of products Big was offering Small. One-stop shopping of both types of acquisition of a smaller competitor, Main subject: client needs in the context clients in order to develop a solid business a strong network in a market segment than for the type of products Small was products was not an interesting solution complementarities and of the extended business. Based on these case for the anticipated changes and where Big had almost no position. Big offering. If Big would have asked its (new) for clients. No cross-selling synergies markets were clear. However the question meetings, market segmentation was investments. Result: a focused integration thought cross-selling opportunities would clients beforehand, it would have known were realized. still remained: how to fully benefit from this? restructured, and product portfolios for process with clear benefits for clients be great. However, it appeared that most about subtle differences in their sourcing Directly after acquisition, management each segment were optimized. Potential and substantial revenue synergies for the organized client benefits of combined products food producer. 20 an of products intensive process of 21 Be brave During the integration process, management attention appears to be “We find it too risky to quantify revenue synergies.” Issue: unclear top line ambitions mainly focused on realizing cost synergies. Main reason: during deal making clear cost targets have been set, whereas revenue synergy ambitions have been formulated rather vaguely. Revenue synergies are very hard to quantify up-front, but this should not prevent merging companies from being clear about their top line ambitions. Ignoring to do so will lead to wavering faith and volatile revenues. We found that lack of clear revenue synergy targets to predict. Or, as one of our interviewees tautologically is one of the main reasons why companies have stated: “Predicting is always difficult, especially if it difficulties in realizing revenue synergies. In many concerns the future.” cases management has clear and detailed targets for cost synergies, whereas targets for revenue synergies Since quantifying revenue synergies is hard, firms tend are lacking or vague. In addition, achieving cost to focus on cost synergies during deal making. Only synergies is usually much more straightforward than if really necessary, revenue synergies are included in realizing revenue synergies. It is therefore not that the business case. In those cases where firms chose (or strange that management attention during integration were forced) to quantify revenue synergies up-front, is focused on cost synergies, whereas revenue synergies they had substantial difficulties in getting to solid are neglected. and reliable figures. Intuition, experience and belief (‘Fingerspitzengefühl’) are the main – if not only – Why are revenue synergy targets often lacking sources for revenue synergy target setting. or vague? Considering the fact that takeovers concern millions if It appears that companies find it much harder to quantify not billions of Euro’s, this is a remarkable fact. Research revenue synergies than to quantify cost synergies. has shown that conscious thought is no guarantee at all One reason is that companies have more control over for making the best decisions on big issues. However, their own costs (just a matter of reducing workforce this research is about decisions with limited choices. or other resources) than over their customer’s buying Estimating the amount of revenue synergies to expect behavior. Another reason is that revenues are strongly has many options and even more variables. Using your influenced by market developments, which are hard carpenter’s eye should not be enough. Case: self-fulfilling prophecy 22 When insurance company A acquired B, were considered not solid enough to these received insufficient attention since both cost and revenue synergies were incorporate in the business case. After they were not monitored in the same way. foreseen. For cost savings clear targets the acquisition, managers became very Hence, progress on revenue synergies were set, as these were included in active with achieving their cost saving was limited, and management – probably the business case for the acquisition. targets, which were thoroughly monitored unjustly – concluded it had been a wise Revenue synergy areas were identified by the PMI office. They were also asked decision not to include revenue synergies as well, but not quantified since they to work on the revenue synergies, but in the business case. 23 Solution: put all cards on the table Being successful with revenue synergies requires 3. Talk with your own and the target’s customers in acquisitions. The amount of synergies and as soon as possible dissynergies previous Notwithstanding our belief that using just your synergies. Objectives and targets should be defined up- This topic is already addressed in the chapter acquisitions (in similar market segments) can intuition is not enough when you set the bar for front for both types of synergies, whether these targets Know clients. It is obvious that clients provide a provide valuable benchmark data for a new revenue synergies, some ‘soft’ factors come in play. are to be included in the purchase price or not. Our valuable source of information for assessing the transaction. interviewee Especially leadership is a key success factor once research revealed seven best practices for setting clear potential impact of certain integration strategies. mentioned that earlier acquisitions had shown a revenue synergy ambition has been set. Most of an increase in their customer turnover rate from our interviewees said that the hard thing about example, in one 17% to 25% in the first year after acquisition. This these ambitions is that they are not as solid as Start with rough numbers, refine along the way for execution provided a solid basis for estimating the revenue cost synergy targets are. We say: so what?! Once By using a phased approach in getting to solid Involve managers, who will be responsible dissynergies for their new acquisition. you set the bar, you have to go for it. You cannot targets it is not only possible to increase the level for achieving the revenue synergy targets, in of confidence for the synergy targets as soon as developing the business case. They know the possible, it also facilitates the translation of the ins and outs of market dynamics. They will also In the flow of the deal process it is very difficult for targets into clear executable and controllable automatically perform an important sanity check: deal owners to keep both feet on the ground and plans that can guide the efforts of the organization will we really be able to realize these ambitions? present an unbiased business case. It has proven during integration. But even more important, these managers will to be very healthy to structurally organize checks be much more committed to actually achieving and balances in this respect. We have come across 4. Involve and commit management responsible 1. For achieved Show leadership in setting targets balanced management attention for cost and revenue and feasible revenue synergy objectives and targets. actually 7. 2. Apply a multidisciplinary approach during say: “I think our revenue synergies will amount to 6. Organize a second opinion 20%, but don’t take my word for it. Anything can the targets post-deal. As one interviewee stated: companies where the central M&A department is due diligence “Without clear business owners we would never always asked to conduct an independent check By combining commercial, operational, financial make an acquisition, because the integration will on the business case presented by a business unit. and HR due diligence all relevant aspects of the definitely fail.” In other cases an independent person outside the business model can be examined, which is key in order to assess opportunities, risks and required measures for preserving and growing revenues. happen…” company with good knowledge of the respective 5. Use prior acquisitions as a benchmark Many companies already have a track record market sector was asked to test the synergy plans by raising ‘tough questions’. Showcase: let’s go for it! “Even when in doubt, you still have to set the bar.” 24 When integrating three divisions, the CEO statement that sector A would be the way their doubt and start to make choices that stated that a certain sector of the food to go. During the interview the CEO told us would be unfavorable for the chosen path. business (‘sector A’) would be the nucleus he himself had doubts about this strategy Because he showed leadership in creating for growth of the joint organization. At first too. He knew the choice made sense, focus and setting targets, sector A did his subordinates were skeptical about but still. He also knew that he could not become the fastest growing business. this strategy. Nonetheless, the CEO kept share his concerns. Had he done that, his his course and made statement after subordinates would feel acknowledged in 25 “Next time, I would not fit in something that is not our own thing.” Issue: inadequate diligence It has become common practice to start as early as processes, organization structures, systems, people, possible with defining how two merging companies culture, etc). should be integrated into a joint new company. Usually this implies that a new top structure is In our interviews, more than once interviewees Scrutinize defined, the number of offices and production sites are confessed that they had not done an in-depth review rationalized, and headcount reductions are determined of business models. Too much focus was on financials for overlapping functions. In this way significant cost and high level decisions on the joint business synergies may be achieved (at least for the short term), model. Insufficient time was spent on translating but for revenue synergies this will usually not be statements like ‘we will combine best of both worlds’ Integrating another company in one’s own business model is not as enough. Simply providing sales people with brochures into a consistent way of working in which processes, of the other company’s products will not lead to systems, skills, and cultures are optimally aligned. the intended cross-selling if bonus schemes are not In doing so, not only did they miss out on possible adjusted, CRM and order management systems are not revenue synergies (also see chapter Be aware), they aligned, and different sales people approach the same also clients with inconsistent messages. Being commercially models. These mismatches made the realization phase successful together requires a sophisticated merging a lot tougher and in some cases anticipated revenue of all elements of both business models (business synergies turned out to be unfeasible. straightforward as most managers seem to think. Merging for revenue synergy purposes means changing revenue models for both companies. Changing revenue models affects the whole of the business model. overlooked mismatches between business Knowing how it affects both companies is crucial for staging synergy and making it come true. Therefore, both business models must be scrutinized. 26 Case: incompatibility A publishing company (PC) took over a This difference in revenue models was to plan and control its business appeared small Internet company (SIC). PC has a no subject during due diligence which to be inappropriate for SIC’s business. A long history in ‘traditional’ publishing and focused on the stand-alone performance director at PC told us that this gave a lot of still makes most of its money by selling of SIC. Issues only became apparent difficulty during integration, thwarting the subscriptions and ads. SIC however makes when both companies were already realization of revenue synergies. money based on usage and projects. merged. The traditional way PC was used 27 Solution: paying diligence due If you want to make good decisions, you have to For a lot of companies these are not new questions. But do your homework. A professional due diligence the depth in which they are answered up-front usually phase consists of a detailed legal, financial, strategic, is not sufficient to guarantee adequate integration. commercial, cultural and operational review. Due to Also, confronting revenue models of both companies time pressure, focus usually lies on determining the is not common practice yet. If one wants to make more standalone value of the target and main cost saving revenue together, one must understand the ways in opportunities assets which both companies earn money. If one company and people. Our interviews showed that this is not makes money by advertising and the other does it by enough. Both companies must be compared on the selling products, you can be sure that both sales forces different aspects of the business model, and a new are focused on different aspects of the market. These business model has to be designed. Can we integrate companies must decide in advance if and how they the commercial strategies of both businesses? How want to align these revenue and business models. through rationalization of do we merge the management styles of both companies? How and when do cultural differences come into play? Which IT system do we choose? Showcase: racing a Formula 1 car With the take-over of a smaller by a larger not just because of public belief. Also, best driver will emerge automatically.” insurance company (respectively Small employees of Small were proud of their According and Large), one of the biggest challenges label. This made repairing the false image employees of Small quickly discovered during the realization phase was to ‘repair’ not only necessary, but also a tough thing they could learn a lot from employees of the image that Small was the best pension to do. Therefore, during the realization Large. This made it a lot easier for them insurer. This image was fed by the fact phase a lot of attention was paid to to agree to an integration of Small into the that Small had 85% brand recognition. presenting the facts and letting these pension company of Large. Therefore, public belief was that Large facts speak for themselves. The facts would place its pension activities under showed that Large had a much better Because management of Large had done the brand of Small.. Public belief would performance in pension insurance than their homework and had not single- have been correct, were it not for one Small, in contrast to popular belief. mindedly focused on the brand of Small, thing: Large had organized its business a to this board member, they knew that performing a reverse lot better than Small had. Doing a reverse As a former board member of Large integration would be a foolish thing to integration would not be a sensible move. stated: “Give them a Formula 1 car and do. By letting the facts speak, gut feelings The false image had to be repaired, and let them both race a couple of laps. The were overcome. 28 “Give them a Formula 1 car and let them both race a couple of laps. The best driver will emerge automatically.” 29 Change One cannot integrate new business without adjusting the ‘old’ company. Issue: arrogance is taking over The acquiring company usually decides on the integration strategy. It is the one that paid all the When taking over, be prepared to lose the old way of working. It is money in the first place, so why not be the one that calls the shots? Sounds fair and in general it is fair. not just the acquired that lose their identity. The two companies build However, being the one taking over and being the one that calls the shots, should not mean you are the one one new company together. Even with huge differences in size, both sitting back and watching it all happen. And it should definitely not mean you are the one sitting back and companies will never be the same. All parties involved must be aware looking the other way. This is often the case when a big company takes over a small one. The acquired of this and do something. Going back to business as usual is the best company gets registered somewhere at the bottom of a profit and loss statement (P&L). The business owner remedy for synergy. responsible for the P&L hardly notices the effect the new acquisition has on his overall performance “The acquisition just did not move the needle.” and therefore loses sight of the integration of the newcomers and the extra business they could bring. Case: no needle movement 30 A large telecom company (Phone) network. Unfortunately, people of Phone M&A officer at Phone told us that this acquired a small Internet service provider were very busy with their own business probably was caused by the ‘it does not (ISP). The size difference was huge. issues, and ISP people were forced to find move the needle’-effect: the business ISP had a couple dozen employees, out how things worked on an operational owner responsible for integrating ISP whereas Phone has tens of thousands. level at Phone by themselves. This caused did not experience enough trouble or The rationale behind the expected integration of ISP to go slow which pleasure from the synergy performance of revenue synergies was the combination made realization of revenue synergies ISP. Had he given more of his attention of Phone’s brand strength and network take longer than anticipated. Lack of to the integration process, the needle size and ISP’s new business. The services management attention for performance might have moved more clearly in the ISP had to offer would be distributed by and progress in the integration process right direction. Phone’s sales people through Phone’s made this lagging effect even bigger. An 31 Solution: get in it together When integrating, both original companies must merge insignificant parts of their big enterprise. In other way of working (and how they should change it) and into one new company. To say it with more drama: words, companies that take over others must be willing do whatever they can to improve business results by both companies have to lose part of their identity and to step aside for their new additions and make way for cooperating with their new colleagues. It also means way of working, and build one new way of working them to flourish together. This means changing the management of the acquiring company must put the together. Even when the acquired company is not old way of working and building a new one. Constant performance of the acquired company at the top of even a speck on the radar, the acquiring company management attention for the acquired company and the agenda of any management meeting. How far has needs to change too, in order to reap the benefits of positive communication about the new business and the integration progressed? What are the main risks the combined business. benefits of working together are key success factors. or reasons for suboptimal integration? Which revenue Nowadays large companies in mature markets search In practice this means looking at the business models of and qualitative terms) and how can we harvest some for new business by taking over small companies both companies, assessing which part of the acquiring more? Make it a point to move that needle as far successful in that new area. If those large companies company must be opened up to make way for the as possible! want to stay insignificant in that new area they acquired (also see chapter “Scrutinize”) and actually should ignore their new add-ons and treat them like enforce that managers and employees change their synergies have already been harvested (in financial Showcase: raise the flag A large firm wanted to integrate its Belgian strengths of both. Just rolling out the flag waved in front of the new Dutch and Dutch divisions, the Belgian part Dutch way of working into Belgium would HQ and all Dutch postings and business being the smallest, holding the humblest not lead to success. Several months before cards were replaced by Benelux ones. employees. Headquarters for the new day 1, the CEO had ordered a Belgian flag The first management team meeting was combination was to be in the Netherlands. to be waving at the Dutch HQ on day 1 held in Belgium, and business objectives The Belgians (and the Dutch) felt this of the merger. The CEO’s staff thought by country were integrated into Benelux was not a merger of equals, but a take- he was joking and ignored the order. targets. Thus making it clear for all to see over. The CEO of the new division was Shortly before day 1, the CEO asked if the that the smaller part of the Belgian-Dutch convinced, however, that further growth flag had been ordered. On hearing it was division was just as important, and the could only be achieved through a prudent not, he got up and ordered it himself. On merger would require changes on both and balanced integration, combining the the first day of the new division a Belgian sides. It is not all in the big gestures. 32 The caretaker of the building came up to my office and said: “I don’t want to be cheeky, but do I really have to raise the Belgian flag in front of our Dutch office building?” 33 Invest “All management left the company once it was taken over. Even with retention bonuses they did not want to stay.” Issue: you get what you are aiming for For most acquirers it has become obvious that the realization of cost synergies requires a structured integration program. Common practice During due diligence potential cost synergies are alone to actually plan and control the realization of determined and quantified. Everyone understands revenue synergies. the importance of realizing potential cost reductions. for realizing revenue synergies however is to just budget them by scaling of top-line targets of responsible managers. This difference in approach may very well be an explanation for the amount of synergies realized. The lack of focus on revenue synergies limits the realization That is why the total potential is usually allocated to Our research shows that revenue synergies are usually various projects (breakdown), with clear targets, roles budgeted by scaling targets of P&L managers. Mostly and governance, and reports on a structural basis there is no clear understanding of what should from the lowest possible levels up to the boardroom. be done to realize this increase. The path to extra In addition, realization of cost synergies is mostly revenue growth is harder to define. Unlike the rather relatively straightforward. We know what to do: straightforward approach to realizing cost synergies, it “We have two offices with the same activities, so we is a combination of many things, like fine-tuning the close one.” proposition, training account-managers, integrating (also see “Be brave” and “Change”). Therefore, invest time, money and project capacity. Revenue synergies will not just come to be by simply sales channels and so on. Where to start? Moreover, Definition of revenue synergies however is often responsible managers are given increased targets, but done too late or in rather vague terms (see chapter mostly no (temporary) increase in funds. “Be aware”). And when they are defined in an early making someone responsible. They must be built and monitored with a much higher attention level than ‘normal’ business. stage, a clear ambition level or target lacks 90% of the This complexity hanging around the topic of revenue time (see chapter “Be Brave”). Most companies will not synergies results in wavering focus. It will be no even start to think about breaking potential revenue surprise that lack of focus on revenue synergies results synergy areas down into a number of deliverables; let in little success. Case: a plan is as good as its execution 34 A telecom company (Tring) acquired a Tring. Integration of this division into Tring Hello’s way of working or building a team smaller company (Hello). The acquisition was a top priority. However, the most consisting of Tring’s and Hello’s employees. was well prepared and the business important thing that was done, was that Result: most of Hello’s wholesalers left the models were properly scrutinized. Tring the wholesale division was put into the company, together with their knowledge, was very clear about one thing: Hello’s corporate structure of Tring. No extra experience and performance. wholesale division was an example for money was invested in really copying 35 Solution: just do it The impact on the results of common practice is targets (the second office is closed, HR is concentrated obvious. We know it cannot be overstated that in one location, staff has been reduced etcetera) and planning revenue synergies is more complex and you can focus on your ongoing business. This does not takes a longer breath to accomplish than to do cost work for revenue synergies. Whenever one reaches synergies. Nevertheless, all the necessary preparations the revenue synergy target, the eye must still be on can be made. You can be aware of the type of synergy the ball. One will have to continue to motivate and you want to pursue. You can know your clients. You stimulate the entire workforce in order to maintain can scrutinize the revenue and business models. You and grow the business. can bravely set targets. You can be willing to change. So why not take the final step? We can say a whole Invest in realization of revenue synergies. Revenue lot more about this subject, but this is where it comes synergies deserve at least the same approach as cost down to: just do it! synergies -- at least. At least start a proper program with synergy breakdown and plan it together with the And, keep doing it. After realization of cost synergies responsible managers. At least monitor progress to you can end the projects. You reached the defined make sure there is champagne on the road ahead. Showcase: planning, learning and monitoring The main rationale the account teams were established with were formed between sales, marketing merger of two consumer electronics the assignment to develop and execute and category management. The whole businesses was to increase top-line key account plans. A central PMI team process was sponsored by a senior and margins by leveraging mutual was set up to coordinate and assist executive steering committee. Through commercial networks. The business the account teams. Trainings were this structured and intensive approach, case was clear, but it would not be provided to the account teams, and based on a combination of support easy to achieve. Success would require several best practice workshops were and control, an effective learning a clear joint approach towards shared organized to stimulate knowledge and professionalization process was accounts, exchange between the teams. A established. Result: overperformance between the marketing, sales and dashboard on the original business case. category functions. progress and impact of the account In order to get the right focus, joint plans. So-called ‘commercial triangles’ 36 and between strong management alignment was used to monitor “Tight project monitoring was important, but without providing continuous support and new impulses it would not have worked.” 37 Research Method The research was built around two Also, the Turner Knowledge Bank knowledge methods: -- built with years of experience literature research and interviews gathering in the field of consulting -- was with experienced executives and stripped in search of useful models managers. Academic literature was and used to identify state-of-the-art best practices. insights on current and practices on planning and realizing revenue synergies and to structure Interviews further research. The interviews made it possible to test certain Representatives assumptions and companies were interviewed. The during literature research. Also the companies were selected on the interviews gave insight into how basis of their recent participation in ‘actual people in the field’ handle a merger where revenue synergies their ambitions of gaining more were to be expected. Interviewees revenue through merging. The were main goal for both methods was executive board or had a position to define best and worst practices close to the board during the when trying to plan and realize merger. For confidentiality reasons revenue synergies after a merger. we cannot divulge the names of made before either of member of the To give insight into the nature of the companies and discussed 75 articles and books on the subject synergies, we give a few specifics, of M&A in general and revenue without being too obvious. synergies in specific were studied. 38 Company B Interviewee Synergy type electronics 45,000 employees electronics 15,000 employees Corporate VP cross-selling shared sales skills market power financial 125,000 employees bank 6,000 employees Corporate M&A officer with A shared sales skills financial 110,000 employees financial # of employees not disclosed COO with A cross-selling shared sales skills market power FMCG 3,500 employees FMCG 700 CEO of A shared sales skills food 35,000 employees multiple food companies Corporate M&A officer with A cross-selling forward vertical integration insurance 700 employees insurance 800 employees Vice president with A product development market power (image) telecom 30,000 employees internet service provider # of employees not disclosed Corporate M&A officer with A product development market power (image) insurance 8,000 employees insurance 800 employees Board member with A cross-selling shared sales skills product development market power (general) publishing 700 employees internet 25 employees Director with A product development market power (image) telecom 1,000 employees telecom 30,000 Manager Finance & Control with A product development market power (image) publishing 3,000 employees not applicable HR Manager not relevant telecom 2,000 employees telecom 2,500 employees Corporate PMI officer with A cross-selling shared sales skills market power twelve the companies or interviewees. Literature research Company A 39 Bezoekadres: Huize “De Boom” Arnhemseweg 107 3832 GK Leusden Postadres: Postbus 228 3830 AE Leusden T +31 (0)33 - 285 93 00 F +31 (0)33 - 285 93 01 E turner@turner.nl www.turner.nl 40