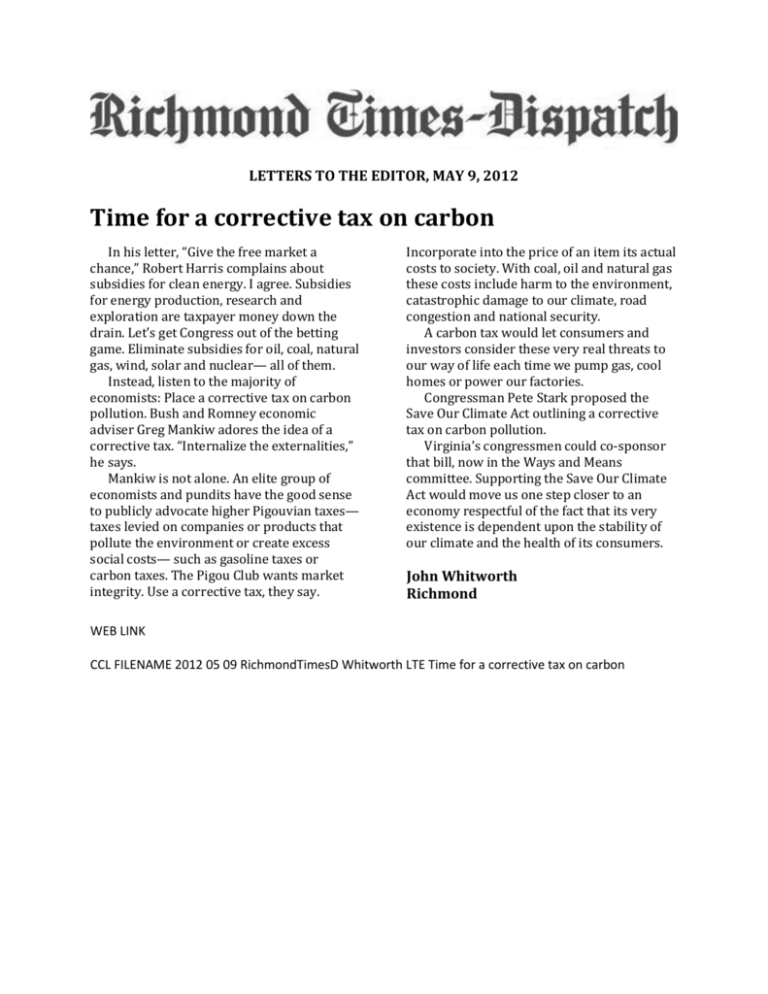

Time for a corrective tax on carbon

advertisement

LETTERS TO THE EDITOR, MAY 9, 2012 Time for a corrective tax on carbon In his letter, “Give the free market a chance,” Robert Harris complains about subsidies for clean energy. I agree. Subsidies for energy production, research and exploration are taxpayer money down the drain. Let’s get Congress out of the betting game. Eliminate subsidies for oil, coal, natural gas, wind, solar and nuclear— all of them. Instead, listen to the majority of economists: Place a corrective tax on carbon pollution. Bush and Romney economic adviser Greg Mankiw adores the idea of a corrective tax. “Internalize the externalities,” he says. Mankiw is not alone. An elite group of economists and pundits have the good sense to publicly advocate higher Pigouvian taxes— taxes levied on companies or products that pollute the environment or create excess social costs— such as gasoline taxes or carbon taxes. The Pigou Club wants market integrity. Use a corrective tax, they say. Incorporate into the price of an item its actual costs to society. With coal, oil and natural gas these costs include harm to the environment, catastrophic damage to our climate, road congestion and national security. A carbon tax would let consumers and investors consider these very real threats to our way of life each time we pump gas, cool homes or power our factories. Congressman Pete Stark proposed the Save Our Climate Act outlining a corrective tax on carbon pollution. Virginia’s congressmen could co-sponsor that bill, now in the Ways and Means committee. Supporting the Save Our Climate Act would move us one step closer to an economy respectful of the fact that its very existence is dependent upon the stability of our climate and the health of its consumers. John Whitworth Richmond WEB LINK CCL FILENAME 2012 05 09 RichmondTimesD Whitworth LTE Time for a corrective tax on carbon ERROR: undefined OFFENDING COMMAND: STACK: