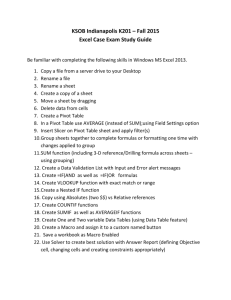

eBook - Getting an Edge

advertisement

Getting an Edge Learn What to Pay Attention to and How Things Work in the Forex Market If you've read Jack Schwager's 'The New Market Wizards,' he finds there are three things the best of the best traders have in common. One of them is they all have an edge in trading. What is meant by having an edge? It means having a unique approach, system or perspective on the market that is tested, clear and unique. They find these edge's and apply them to the markets. Your goal as a trader is to find an edge. The question is which one? In reality, there are many edge's which will work. There are tons of traders who can make a system work while others cannot with the same system. It is not too important which one you take as long as it has; a) an edge b) it matches your overall personality Finding an edge with a in place is not hard, finding one with b takes a little more effort because it requires you to understand yourself. It means finding a trading method you can trade and live with day in day out - not something that satisfies your ego or fantasies of what you'd like trading to be. We all want to make boatloads of money as fast as possible - this is the time of instant gratification. And rightfully so, who wouldn't prefer making money now as opposed to 3mos or 1year later? The bottom line is you have to find an edge that is adaptable but to find an edge you have to understand how things work and what to look for. Once you have those, you can go about finding an edge. What we are going to cover in this eBook is; 1) how things work in the forex market 2) how to find the 'where' to get in 3) how you can get an edge knowing these two things How Things Work in the Forex Market If I was to tell you a surfer was trying to ride waves out into the ocean instead of into the shore what would you say? You would think they were nuts. The waves to surf are the ones which head towards the shore. However there are many traders who trade against the waves or against the surf. They are called counter-trenders and this is one of the most counterintuitive ways to trade. Why? Because if a trend has formed, its being created by big money. The large players move the market - period. In 2009, it was measured the retail traders on average are responsible for about $110 billion in currency flows across options, swaps, futures and spot forex. This may seem like a lot of money, but contrast it to the $3.2+trillion moved daily and you realize it is only about 3% of the daily volume. Keep in mind this is spread across all pairs so if you bundled all the retail traders into one pair and traded at the same time, it would not put a dent in the market. Hence, the 1st dictum of trading is the large players move the market & we have to watch what waves they make. Trading counter-trend is exactly the opposite of this and trading against the large money, momentum, force and the direction the market is already moving. Seem counter-intuitive? Hopefully so. What are the Key Moves/Waves Made by Institutional Players? This is a much simpler endeavor than you would imagine. The way to find the key moves made by institutional players is to find the Impulsive moves or also known as imoves. What are Impulsive moves? The original term for these moves was penned in the Elliot Wave Theory whereby the market would make moves where there was either commitment or a lack thereof. The committed moves were 'impulsive' moves and the less than committed moves were corrective. It helps to identify both but the most important one to identify is the impulsive moves. Thus, imoves are defined as price moves that are rapid or powerful in one direction. These are caused by strong imbalances in the order flow whereby one side of the market has more control than the other. When this event happens, value and price moves powerfully in one direction. In summary, impulsive moves have a force and strength behind them and are clearly identifiable via the chart if you can find 3 simple characteristics; 1) Impulsive Moves tend to have the largest candles in a series or amongst the most recent price action 2) Impulsive Moves tend to produce more candles of the same color Chris Capre, Founder – 2ndSkiesForex http://2ndskiesforex.com 3) Impulsive Moves often produce candles with smaller wicks (tails) and closes near the highs if the direction is up and lows if the direction is down If there is any type of movement or base chart formation you will want to spot more than anything else, it is impulsive moves. Once you find them, all you have to do is get in the same direction they are moving and find the right place to get in. Getting in the same direction is not complicated but learning how to find the right place takes a little more skill. We will address the 'how' for this in the next section. Before we do, we will show you some examples of impulsive moves. Example #1 EURUSD 1hr chart Now ask; Does the down move have the largest candles in the set? Check Does the sell-off tend to have most of the candles one color (red)? Check Does the sell-off have smaller wicks meaning more price acceptance? Check Before we go into the next example, lets take a look and see if the logic of counter-trend trading holds up. If you go long against the move, you will have to be quick to take profits. Why? Because if you notice, there are a) not many of them and b) they are all followed up with another red candle. Considering this is a hourly chart, each candle is 1hr's worth of price action. Thus, logically to make money counter-trend trading this pair, you'd have to a) get in at the right candle and b) be happy with not making much since each blue candle barely gains any ground. Simply put, the logic of counter-trend trading doesn't hold up with the natural movements of the market. Chris Capre, Founder – 2ndSkiesForex http://2ndskiesforex.com Example #2 GBPUSD 15m chart Regardless of the oscillation, the majority of the move was to the downside so this is where the real gains were to be made. Lets go through the checklist to see if all three of the characteristics of imoves were present; Largest candles red = check Majority of candle red = check Majority of red candles with staller wicks = check, Then its an impulsive move. Note*not all impulsive moves require all three characteristics (2 out of 3 is preferred to be safe). Thus, you have the formula for finding the moves the institutional players are involved in (imoves). Learn how to spot these moves inside and out and you will find the right moves / direction to get into. Now its time to discuss the location/place/where to get into these moves. The Where for Day-Traders - Pivot Points If I was to tell you on average the G8 pairs on any given day (exc. sundays) had about an 80% chance of touching a pivot point for every 1hr candle including mid pivots. Hence it should be pretty easy to assume the institutional players are getting in or responding to pivots on a day trading basis. If they were not, price would not respond to them so much because they are moving the market. They decide where it turns, reverses, breaks and trends. With the market reacting/responding so much to pivots, we need to learn how to pay attention to them. Lets take a look at a few examples to show how defintively price responds to pivots. Chris Capre, Founder – 2ndSkiesForex http://2ndskiesforex.com EURUSD - 1hr chart Look at the price action from the grey veritcal line which represents the London open. Notice how it found a quick ceiling within 2pips of the daily pivot, sold off aggressively and stopped exactly where? The S1 pivot. It then decded to bounce off this pivot two more times before it settled into a small range in between...two pivots. If you were looking to take advantage of the small range trading opportunity after the sell-off, being aware of those pivots would have changed the game for you and given you a precise entry and exit point. If you were looking to sell in the market open, you would have had a clear line in the sand to sell and if you were looking to buy into a dip, you would also have had an entry point so pivots really solve one of the most challenging piece of the puzzle for daytrader (entries and exits). Thus learning how to use these on a day trading basis will greatly improve your trading. Taking a look at another example below, AUDUSD 1hr chart This one is even more interesting because it moved slightly more directionally for the day. After the london open, the pair sold off a little bit and rejected off a particular price level - the M3 pivot for 3hrs. It then broke this pivot and rejected off Chris Capre, Founder – 2ndSkiesForex http://2ndskiesforex.com of...the M2 pivot for another 3hrs. After starting another sell-off, it then had two larger rejections off of...the M1 pivot. In fact every candle save the 3rd and 4th candles in this chart touches a pivot point showing how price gravitates, reacts and rejects off of them more than anything else. Thus if you are wanting to day trade, learning how to use pivot points is crucial to taking your trading to the next level. How to get an Edge? Up to this point we have covered what are the key moves you want to get into (impulsive moves) and what are the key intraday levels price is more likely to respond/react to more than anything else. These two things alone should enhance your ability to find greater trading opportunities in the market. This alone can give you an edge but it helps to find systems based upon these methods such as price action and pivot point systems. If you'd like to learn proprietary systems based upon more complex price action formations or pivot point systems based upon 10 years of proprietary quantitative data, then check out our Advanced Price Action Course. If you are serious about learning advanced price action and pivot point setups and want to join a growing community of traders, then sign up for the course where you get permanent access to the course forum and a private follow up lesson with me. Saludos Cordiales, Chris Capre Founder – 2ndSkiesForex chris@2ndskiesforex.com Chris Capre, Founder – 2ndSkiesForex http://2ndskiesforex.com