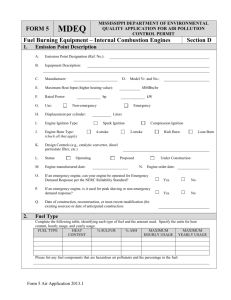

Tariffs list Old bpm tariffs

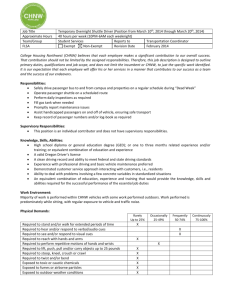

advertisement