4. Forward Exchange Rates - Personal Home Pages (at UEL)

advertisement

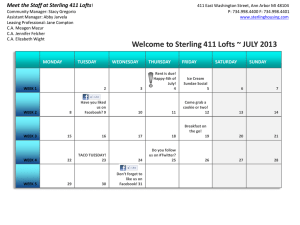

Forward exchange rates The forex market consists of two distinct markets - the spot foreign exchange market (in which currencies are bought and sold for delivery within two working days) and the forward foreign exchange market (in which contracts are entered into for the delivery at agreed prices of currency at some time in the future, the usual contract periods being one month and three months, although longer periods are possible especially for heavily traded currencies). The original purpose of forward exchange rates was to provide protection against foreign exchange risk (to allow companies to hedge against risk, or to cover themselves against risk, or to move from an open to a closed position in the market). However, the forward market is now widely used for speculation. 1. The expression of forward rates Forward foreign exchange rates are quoted as being at either a premium or discount to the spot exchange rate. If a currency is at a forward premium, it is more expensive to buy forward than to buy spot. If it is at a discount, it is less expensive forward than spot. If the spot and forward rates for a currency are equal, the currency is said to be flat. Box 1 shows how spot and forward rates are expressed in the pages of the Financial Times. Box 1: Spot and forward rates of exchange th At the close of business of the London forex market on the 4 June 1999, the spot exchange rate between sterling and the dollar stood at £1 = $1.6060-1.6066. The Financial Times does not provide the bid-offer spreads for forward rates of exchange and so to compare spot and forward rates, we need to use the closing mid-point of spot exchange rates. For the dollar against the pound sterling, this was £1 = $1.6063. The onemonth forward exchange rate at the same time was £1 = $1.6058. In other words, the dollar was trading one month forward at a premium against sterling (fewer dollars would be required to buy a given amount of sterling one month forward than spot). Alternatively, we could say that sterling was at a forward discount. The Financial Times calculated for us that the one-month forward premium on US dollars was 0.3 per cent per annum. We can see easily how this figure was arrived at. In money terms, the premium was $1.6063 - $1.6058 = $0.0005. Remember that this was the premium for one month. To convert this into an annual premium we need to multiply by 12, giving us $0.0060. We then need simply to divide this by the spot exchange rate of $1.6063 and multiply by 100 to obtain a percentage. This gives us 0.37 per cent. Both the spot and forward exchange rates used in this calculation have been rounded down or up and so it is not surprising that our answer is very slightly different from that provided in The Financial Times. The general rule stated below suggests that one month interest rates on US dollars must have been very slightly below those in the UK at the time. A look at the international th currency rates table in the newspaper confirms this. At the close of trading on 4 June 1999, the mid-point of one month interest rates on the US dollar was 4.91 per cent; on sterling it was 5.25 per cent - a difference of 0.34 per cent. Allowing for transactions costs, we can accept that covered interest parity applied, with the interest rate differential between the two currencies being very nearly equal to the forward premium on US dollars. 2. The explanation of forward premiums and discounts - interest rate parity Consider the position of two investors, X and Y. Each of them has one million Euros to invest in a secure form for three months (the forex market is a market for large players). X buys German government securities at existing Euro interest rates. However, Y notices that interest rates on sterling securities are higher than euro interest rates. She thus decides to sell the one million euros for sterling in the spot forex market and to use the sterling to buy British government securities. At the end of the three months, the British securities mature and Y then sells the sterling for euros in the spot market. Who finishes up with more euros at the end of three months? Clearly, there are only two factors involved: (a) the difference in interest rates on UK and German securities; and (b) the difference in the £/Euro exchange rate at the beginning and at the end of the three months. Since interest rates in the UK are higher than in Germany, then, if there were no change in exchange rates during the period, Y would finish up with more euros. However, X could finish up with more euros, if the value of sterling against the Euro fell sufficiently during the three months. For example, let the interest rates be 5 per cent on the UK security and 3 per cent on the German security. Assume an initial exchange rate of £1 = ∈1.50. X buys German securities, obtaining 3 per cent for 3 months and finishing up at the end of the period with ∈1,007,500. Y converts her Euros into sterling and obtains £666,667, on which she receives 5 per cent interest for three months. She therefore finishes up with £675,000 and converts this back into Euros. We can easily work out that for Y to finish up no worse off than X, she would need an exchange rate of £1 = ∈1.493. That is, at the beginning of the period Y must have thought that the value of sterling against the euro would weaken by no more than a half of one percent. If it weakened by more than that, Y would do worse than X. The position in which the strategies of X and Y are thought likely to produce the same result is known as uncovered interest parity. The word 'uncovered' simply indicates that Y would be taking a risk in following her strategy, because she does not know what is going to happen to the exchange rate over the ensuing three months. It is the expected future spot rate of exchange that is crucial to her decision. Let us consider next how we might arrive at uncovered interest parity. It is clear in our example above that if investors do not switch from euros into sterling and nothing else happens to move the exchange rate away from the £1 = ∈1.50 rate, they will have missed a profit opportunity. They could have moved their funds into sterling and back and finished up with more Euros than they did, simply by keeping their funds at home. Thus, in practice, investors who think that the rate of exchange is unlikely to move, will take advantage of the apparent profit opportunity and will follow the strategy proposed for Y above. Think what then happens. A large amount of Euros are sold for sterling at the beginning of the period, increasing the demand for sterling and pushing up the price of sterling. As this happens, the value of sterling rises above ∈1.50 and later investors receive less sterling in exchange for their euros. At the same time, the increased demand for British securities pushes their price up and pushes the rate of return on them below 5 per cent. The interest rate differential between British and German securities falls below 2 per cent. Clearly, Y's strategy of buying British securities is becoming less attractive for two reasons - British interest rates have fallen and the prospect of investors losing on the currency exchange are increasing. They are now paying more than ∈1.50 for each pound but have no reason for changing their view that the exchange rate in three months' time will be £1 = ∈1.50. As interest rates and exchange rates change, the advantage of Y's strategy over X's is steadily reduced. When the profit opportunity from following Y's strategy has disappeared altogether and there is no longer any incentive to exchange euros for sterling in order to buy British securities, we have uncovered interest parity. _____________________________________________________________________________ _ Uncovered interest parity when the gains from investing in a country with a higher interest rate are equal to the expected losses from switching into that country's currency and back into the original currency _______________________________________________________________________________ _ The process described above of moving from one currency to another in order to take advantage of a higher interest rate in another country is known as uncovered interest rate arbitrage. In this discussion, we have made two simplifying assumptions. Firstly, we have ignored transactions costs. As we have seen in our discussion of the expression of exchange rates, there is always a difference between the bid and offer rates of exchange. This difference is a cost to investors engaged in uncovered interest arbitrage and so, in practice, the profit opportunity disappears before we reach full parity. In other words, the expected losses from moving from one currency to another and back include the spread between bid and offer rates of exchange. Secondly, we have ignored differences in default risk. We have assumed above that the only difference between German and British securities is the differences in interest rates - that is, we have assumed the two types of securities to be perfect substitutes for each other. In practice, there may be a considerable difference in the default risk attached to the two securities. For example, German investors may demand a risk premium before they are willing to hold British securities, not just because of the foreign exchange risk but also because of a difference in default risk. In this case, we certainly do not reach uncovered interest parity. Even if the two securities are objectively very similar, German investors may well feel that they have more information about the risks associated with the German securities and demand a higher interest rate on British securities before they begin to think of buying them. The existence of forward exchange markets allows a third strategy, one that overcomes the risk associated with uncovered interest arbitrage. A third investor, Z, realizes that he can buy sterling secutities and, at the same time, sell sterling three months forward at an agreed rate of exchange. This means that he is able to calculate exactly how many euros he will receive when the securities mature in three months' time and so can make a precise comparison between the number of euros he would receive from buying UK securities and from leaving his money invested at home in German securities. This comparison will be influenced by: (a) the difference in interest rates on UK and German securities; and (b) the difference between the spot and 3-month forward exchange rates for sterling against the Euro. Assume that the £ and the Euro were trading with no forward premium or discount (spot and forward rates were exactly the same) but that Euro interest rates were higher than sterling interest rats. Clearly, then, Z's investment strategy would be better than X's since Z could take advantage of the higher interest rates in the UK without taking on any foreign exchange risk. In the jargon, he would have locked in to the existing spot exchange rate of £1 = ∈1.50. However, this position would not last for very long. A large number of investors would see the benefits of Z's strategy and would follow suit. In other words, they would sell German securities (forcing their price down and pushing the yield on them up); buy sterling spot (forcing up the spot exchange rate of sterling above ∈1.50; buy UK securities (forcing their price up and the yield on them down); and to cover their exchange rate risk sell sterling three months forward (forcing down the threemonth forward exchange rate of sterling below ∈1.50). Thus, the interest rate differential between UK and German securities would be reduced and, at the same time, a discount would develop on three-month forward sterling. Both developments would be reducing the profitability of Z's strategy. This process would continue until the rates of return on the strategies chosen by X and Z came into equality (with some small allowance, as above, for transactions costs and any perceived difference in default risk). We would then have established covered interest parity. _____________________________________________________________________________ _ Covered interest parity when the gains from investing in a country with a higher interest rate are equal to the forward discount on that country's currency _______________________________________________________________________________ _ What would the final outcome be? Euro interest rates started below £ interest rates but Euro interest rates rose while £ interest rates fell. Thus, the interest rate differential between the two countries would have been reduced. The spot exchange rate of £ rose but the 3-month forward rate fell, establishing a discount on three month forward sterling. This establishes a general rule: The currency of the country in which interest rates are higher, will be trading at a forward discount; the currency of the country with the lower interest rates will be at a forward premium. Exercise 8.3 requires you to think about the relationship between spot and forward rates of exchange. Exercise 8.3 th At close of trading on the 4 June 1999, the exchange rates for Japanese yen against the US dollar were: Spot $1 = ¥121.81; one-month forward $1 = ¥121.315; three months forward $1 = ¥120.265. (a) Was the yen at a forward premium or discount against the dollar? (b) What were the annual percentage premiums or discounts for yen one-month and three-months forward? (c) Given that US dollar one-month interest rates were 4.91 percent, approximately what must have yen one-month interest rates have been? In a simple example, an exporting company needs only to estimate when it will receive the dollars it is expecting and then sell dollars that period of time forward. An importing company, expecting to meet a bill in US dollars at some known time in the future, needs to buy dollars forward to the required amount. In practice, the selling bank in a forward contract may require the buyer to hold 'compensating balances' in the bank until the actual exchange of currency takes place, allowing the bank to use the funds until that time. Nonetheless, the forward contract gives the buyer certainty regarding the rate at which he will be able to acquire foreign exchange. There are, however, obvious limitations of the forward exchange rate market. To begin with, forward exchange rate deals are for specified periods (as we mentioned earlier, normally for one month or three months). In practice, however, the period involved may not be a round number of months. Again, it may be for a period rather longer than is usually arranged on the forward market. Worse, the date on which the payment will be made or is required may be uncertain and may change. Flexibility can be increased in a variety of ways, often through the use of derivatives contracts. For example, uncertain payment dates may be covered by taking out a forward option in which the maturity date is left open, although it must fall within a stated option period. Alternatively, swap deals may be entered into. Such deals may be either forward/forward swaps or spot/forward swaps. A forward/forward swap combines two forward contracts entered into at the same time but for different maturities. One contract is for a forward purchase, the other for a forward sale of a currency. For example, a UK exporter may have a contract for the sale of goods to a German importer with an invoice value of DM 2m and a contract date of 26/2/00, but the settlement date may be uncertain. On the contract date, the UK company takes out a forward contract for some arbitrary period (say, three months) i.e. it sells DM2m three months forward (maturing 26/5/00). Suppose, however, that on the 6/5/00, the companies agree that payment will take place not on 26th May but on 26th June. The UK firm must now: (a) counter the original forward contract and replace it with a contract for settlement on 26th June. So it now buys DM2m 20 days forward (maturing on 26th May), countering the first contract and simultaneously sells DM2m forward 51 days, extending the delivery date to 26/6/00. A spot/forward swap is similar except that it combines a spot contract with a forward contract. This time the firm waits until the original maturity date (26th May) and: (a) buys DM2m spot; and (b) sells DM 2m forward 31 days. Yet another possibility is for the bank with which a client has taken out a normal fixed term forward contract to agree, for a consideration, to roll the existing contract forward. Foreign exchange swaps are used to a considerable extent in interbank business. Thus, if a UK bank needs Italian lire now, it may arrange with another bank to buy lire with sterling today and enter into a forward deal to sell the same quantity of lire back for sterling in, say, three months time. Assume the bank was willing to sell at £1 = 2151.25 lire, agreeing to buy back in three months at £1 = 2160.25 (lire are at a discount of 9 lire). The difference represents the swap rate and can be quoted as an annual rate either as a percentage (1.499% p.a.) or as basis points (149 basis points - 1 basis point is equal to .01%). Central banks have in the past frequently engaged in foreign exchange swaps (or have set up swaplines), especially between 1945 and 1973, in order to defend fixed exchange rates. Several other instruments have been developed to help to meet the needs of companies unwilling to face potential exchange rate losses, notably futures, currency options and currency swaps.