GLOBAL LiNKS

advertisement

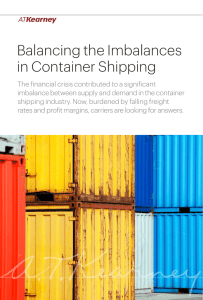

GLOBAL LiNKS B Y PAT R I C K B U R N S O N Financial Distress in Container Shipping Industry Rises for Third Straight Year Continued sluggish demand, a growing mountain of debt, and a radically changing global marketplace has the ocean container shipping industry reeling, say financial analysts. S 6 Supply Chain Management Review • May/June 2014 Global Fleet Capacity (Million TEU) Debt ($Bn) Patrick Burnson is the executive editor at Supply Chain Management Review. He welcomes comments on his columns at pburnson@peerlessmedia.com upply chain managers are justifiably vessels,” and fill key trade lanes with these concerned about the recent consoli- new ships. This represents a trend that over dation of ocean carrier services, but the past decade has steadily increased leveran even greater threat to their operations age across the industry and has left it with an may be lurking ahead. According to a new average EBITDA interest-coverage rate of just AlixPartners study, many of the major inter- 4.9. This is less than half the rate it was in national players face more financial dis- 2011 (10.8) and less than a third of what it tress—even possible bankruptcy. was in 2010 (15.0). Esben Christensen, director of the busiThe study notes, too, that while global fleet ness advisory firm, says that listed companies capacity in the industry has risen steadily in have been troubled for the past three years. the past decade, to 16.9 million TEU (twenty“Our analysis suggests that the number foot equivalent unit) for the 12-month period of parties controlling containerized transpor- ending September 2013, up from 16.3 million tation on critical trades is shrinking through TEU in 2012 and from 10.9 TEU in 2007, operational alliances and—potentially in the that capacity is a long way from being totally future—through carriers exiting the busi- utilized. This has led to more alliances in the ness,” he says. EXHIBIT 1 Contributing mightily to this situation, says Debt of Carriers Analyzed and Global Fleet Capacity the study, is a so-so global $120 16.9 18 16.3 15.4 economy that still hasn’t 16 14.3 100 $105 bounced back from the 13.1 14 $99 12.4 $91 downturn following the 80 12 10.9 $80 worldwide financial cri$77 10 60 sis of 2008-2009 the way $63 8 $54 other post-recession econ40 6 omies have in the past. 4 However, the study also 20 2 points to several structural 0 0 issues also buffeting the 2007 2008 2009 2010 2011 2012 2013* industry. These include *2013 Figures are trailing 12 month to end of September 2013, all other figures are full year. Source: Publicly available data and AlixPartners analysis a drive to build “mega www.scmr.com GLOBAL LiNKS (continued) industry and will likely create an environment of haves and have-nots where smaller carriers will face some hard choices in the future. Structural Changes On top of all that, the study asserts that other structural changes that will challenge companies this year include changing trade routes in some parts of the world, with cost increasingly trumping transit time, and a newfound pressure on the part of some of the stronger lines to squeeze, or even totally bypass, non-vessel-operating common carriers (NVOCCs), giving those lines more advantage over the have-nots of the industry. “The container shipping industry as a whole continues to face stiff challenges, and for many companies in the industry those challenges could be existential if not addressed,” says Lisa Donahue, managing director and global head of Turnaround and Restructuring Services at AlixPartners. “These challenges also have, and will continue to have, a big effect on shippers and investors as well.” There’s likely to be even more disruption in the ocean cargo carrier arena. For shippers, the study recommends closely monitoring the financial health of the carrier base, not “over- I Supply Chain Implications n an exclusive interview, Supply Chain Management Review (SCMR) asked AlixPartner’s Esben Christensen for a few more details on supply chain implications. SCMR: Do you anticipate any sudden shift in rates? Esben Christensen: AlixPartners’ analysis suggests that the number of parties controlling containerized transportation on critical trades is shrinking through operational alliances and—potentially in the future—through carriers exiting the business. This would have a profound impact on the supply chain managers who rely on these services, in that the consolidation often brings with it less choice and higher prices. In the longer term, however, the change that’s on the horizon could be largely positive for the carriers who survive with more efficient ships and greater pricing power. In the shorter term, though, shippers should probably expect rates to remain at low levels as the market sorts out all of these changes. SCMR: How should supply chain managers mitigate risk? Christensen: The report suggests that supply chain managers can mitigate the risks related to financial distress amongst the carriers by closely monitoring the health of their providers, contracting with groups of carriers representing www.scmr.com consolidating” the carrier base (so as to have alternatives should markets brighten), considering index-linked contract options, and benchmarking rates and service levels via objective third-party resources. For investors, the study recommends paying close attention to the widening chasm between the leaders and the laggards, and working with experts to determine which companies have viability and which may not—while also keeping an eye out for attractive asset sales, as many lines may move to divest themselves of assets, especially non-core ones, in the future. Meanwhile, for carriers themselves the study recommends divesting non-core assets, exiting unprofitable trades, adopting a laser-like focus on cost control, reassessing all value propositions, and partnering where partnering makes sense. “For all the challenges facing all of the players in the container shipping industry today, there are also a lot of opportunities, including the promise of the much greater profitability that a streamlined, resilient industry might bring, as has been the case in many other industries,” says Donahue. “But to make the most of those opportunities will take insightful analysis and then firm, decisive action. It’s been done in other industries, and it can be done in this one as well.” jjj diverse alliances (as opposed to over-consolidating their volume with just a few carriers or alliances), and keeping at least one non-vessel operating common carrier in their provider base. In the shorter term, these important steps should help allow supply chain managers to proactively direct their volume to healthy and stable partners, sustain a disruption without it reaching catastrophic scale, and tap extra capacity as need dictates to address contingencies. In the longer term, savvy supply chain managers should probably also consider the merits of index-linked contracts that could protect them against wild price movements. SCMR: Finally, will the financial distress in the container shipping industry lead to greater reliance on air cargo, even though it’s more expensive? Christensen: Probably not in a structural sense. There may be some freight that moves to air to compensate for disruptions, but our study does not anticipate a reversal of the long-term trend of air cargo moving to slower, cheaper modes. Rather, in the longer term it is likely that more container capacity in fewer hands will lead to more reliable sailing schedules, which, in turn, could bite further into the air cargo volume. Supply Chain Management Review • May/June 2014 7