CHOICE OF ENTITY OUTLINE

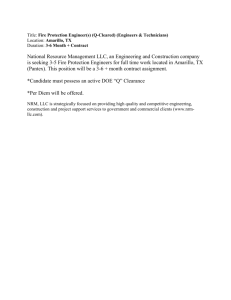

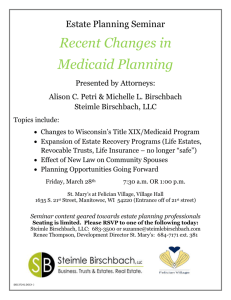

advertisement