September - Citibank Australia

advertisement

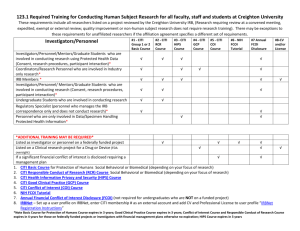

Market Outlook. September 2013. Feature Article 01 Equity Markets 03 Bond Markets 06 Currencies 07 Feature Article Fed Tapering and its Implications for Emerging Markets Ongoing uncertainty surrounding Fed QE tapering and fears of the potential reduction of global liquidity have shifted focus to markets especially vulnerable to possible capital outflows. Indeed, we are seeing accelerating capital outflows and currency depreciation in EM countries with large external deficits, especially in Indonesia and India. The United States Federal Reserve (the Fed) is expected to begin tapering following the 17-18 September meeting, scaling down bond purchases from US$85 billion per month probably to US$60 billion, while signalling its intention to end the programme around the middle of 2014. Moreover, the Fed is likely to accompany the start of tapering with other announcements, in particular, lower forecasts for the jobless rate, a signal that the jobless threshold for rate guidance may be reduced below 6.5% over time, and outline projections by the Federal Open Market Committee (FOMC) members for the path of the economy and Fed Funds in 2016. The Fed’s overall message may shift its emphasis from asset purchases, to keeping rates on hold until recovery is well advanced and gradual tightening thereafter. This prospect appears to be already reflected in the prices of US asset markets. US financial conditions remain highly supportive of growth prospects and would continue to be supportive, even if conditions tighten slightly). Impact to Emerging Markets However, it is unclear whether the inevitable declines in global liquidity amidst slowing Emerging Market (EM) growth is fully discounted in prices of non-US assets. Sluggish EM growth reflects various country-specific factors, but common themes are weak export growth due to modest advanced economy growth, the deterioration in private sector balance sheets, and the vulnerability of many EMs to Yen depreciation and China’s slowdown. Chart 1: CPI Inflation and Current Balance Forecast CPI Inflation Current Balance (% of GDP) 2012 2013F 2014F 2012 2013F 2014F Asia 3.9% 3.5% 3.7% 1.8% 1.6% 1.5% China 2.6 2.7 3.0 2.3 2.2 2.0 Hong Kong 4.1 4.3 3.6 1.1 2.2 3.7 India* 7.3 5.5 5.0 -4.8 -4.3 -3.2 Indonesia 4.3 7.1 5.5 -2.8 -3.2 -2.3 Korea 2.2 1.5 2.6 3.8 4.3 2.5 Malaysia 1.6 2.0 2.6 6.1 2.3 3.9 Philippines 3.2 2.8 3.2 2.8 2.5 2.1 Singapore 4.6 2.5 2.8 18.6 14.0 13.5 Taiwan 1.9 1.5 1.9 10.5 9.1 8.5 Thailand 3.0 2.4 2.3 0.0 -0.1 -0.4 *Note: In India, policymakers look at the wholesale price index Sources: National sources and Citi Research as of 21 August 2013. Feature Article 1 With US long-term interest rates on the rise, it is not surprising that EM countries with current account deficits have seen their currencies under pressure. Hence, the last two weeks have seen accelerating capital outflows and currency depreciation in EM countries with large external deficits, especially in Indonesia and India. These countries remain vulnerable to the scaling back of the Fed’s asset purchases, with limited policy options to revive growth given the worsening current account, thin reserves and high inflation rates. India and Indonesia Although Citi analysts expect both currencies to weaken further, they do not expect a full-scale crisis given that both countries retain far greater capacity to contain the outflows in the current environment than previously, suggesting that a repeat of earlier episodes is unlikely. While countries with stronger fundamentals may begin to stabilize as soon as the cyclical recovery gathers pace, those countries with the largest current account deficits and the weakest domestic fundamentals will need to prove their policy credentials. Chart 2: India and Indonesia with biggest external funding need Sources: Haver Analytics as of 22 August 2013. Feature Article 2 Equity Markets S&P500 Chart 1: ASX200 Index Chart 2: S&P 500 Index *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg Australia United States At a turning point? Job growth and private demand have held up well Topix •The RBA cut rates by 0.25% to 2.50% in August. Whilst the Board did not want to rule out further rate cuts, they did not communicate that rates were likely to be cut again in the near future. Inflation remains in the lower half of the 2%-3% target range, leaving the Bank relatively unconstrained in its efforts to promote growth. But with the AUDUSD exchange having fallen more than 10% in recent weeks and the oil price at high levels, the next quarterly inflation release in October is likely to have a bearing on whether the RBA cuts rates again in November. At this stage, Citi views further cuts as unlikely. •Recovery appears to be weathering the worst of the fiscal headwinds, with growth estimated at a 1.5% annual rate in 1H and signs that activity was picking up heading into Q3. Housing, capex, car sales and payrolls all are on healthy upswings and new cyclical lows in jobless claims in mid-August suggest little spillover from cuts in federal spending. •Economic growth has been sluggish thus far in 2013 and business conditions remain challenging across a number of industries. But recent months have seen forecasts amended to reflect that the recovery is still taking place, though taking longer than previously estimated. Citi currently forecasts GDP growth of 2.5% in 2013 and 3.1% in 2014. •The semi-annual reporting season is drawing to a close with 82% of S&P/ASX200 constituents having reported so far. On the whole, results have not been as bad as many had feared. Bloomberg reports earnings per share (EPS) to be down 3.54% on consensus estimates, which is better than each of the previous four years which were followed by a series of analyst downgrades. The market is currently at approximately 14.5x 1yr forward EPS, very close to the long run average. •Whilst the headline numbers are neither good nor bad, the dispersion of results underlines how different sectors are performing in a multi-speed economy. Encouragingly, consumer-related stocks have tended to surprise to the upside and valuations have adjusted in most cases back towards the market average. Cyclical industrials on the other hand have tended to disappoint. Overall, the outlook has generally improved for companies that derive a significant proportion of their earnings from overseas since the fall in the exchange rate. Citi expects the market to finish the year at a target of 5400, rising to 5600 in mid-2014. Equity Markets •Fed officials continue to emphasise that scaling back QE still would leave policy on a highly accommodative path where no rate hikes are planned for a long time. Citi analysts expect that tapering in September could mark a shift to greater reliance on forward guidance to supplant QE and possibly enhance accommodation by altering thresholds for exit strategies. Citi analysts think unemployment may be belowMarkets 7% before QE ends and MSCI Emerging that rate hikes may be delayed until the jobless rate is closer to 6%. •From an equity perspective, with more than 92% of companies in the S&P 500 having reported 2Q results, EPS trends appear to have come in about $0.20-$0.25 below forecast at $27.33. Moreover, lower tax rates have been supporting profits and this may not be sustainable in the future. Accordingly, some downward adjustments to forward estimates are required as recent guidance has become more negative. •Citi’s 2013 and 2014 S&P 500 EPS estimates are being trimmed to $109.50 and $116.25 from $110.00 and $117.00, respectively, reflecting a review of margins and earnings results, recognizing that the 2H13 “hockey stick” consensus bottom-up trend seems quite unlikely. Indeed, investors may have been a tad too focused on a rising stock market in recent weeks rather than earnings, especially since many management teams highlighted back half optimism that some have just started to cut in the past few days, with more probably coming in the next month. Citi’s new roughly 6% EPS growth outlook for 2014 is meaningfully lower than the 10%-like bottomup view, though more in-line with buy-side surveys. 3 Equity Markets Topix Chart 3: DJ Stoxx 600 Dow Jones Stoxx 600 Index Chart 4: Topix Index *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg Euro-Area Japan No longer expect the ECB to cut rates in Q4 Consumption tax hike is key event to monitor •The better-than-expected 2Q GDP data, showing the first gain in seven quarters, together with the more constructive tone from recent surveys, lead Citi analysts to raise their 2013 GDP forecasts by 0.2ppt to -0.5% and the 2014 average by 0.4ppt to 0.6%. •Citi analysts expect solid growth to continue until the 1Q14 before the consumption tax hike in April 2014 puts a strong brake on activity. Meanwhile, under the assumption that the tax hike is implemented as planned, Citi analysts expect a sharp contraction in activity, driven by plunging household demand, in 2Q14. While GDP could likely return to positive growth in the 3Q14, a sharp fall in household demand is likely to hit smaller firms (especially nonmanufacturers) and to weaken growth in incomes and profits, as in 1997. MSCI AC Asia ex Japan •As a result of better growth dynamics, Citi analysts no longer expect the ECB to cut rates in Q4, with the main refi rate and the deposit rate staying unchanged (at 0.5% and 0% respectively) for a long period. A cut in one or both interest rates could come back on the agenda in the event of a sharp strengthening of the euro or ‘unwarranted’ increases in market rates, but even then the authorities would probably aim to talk down the currency and rate expectations first. •In terms of strategy, Citi analysts have backed Defensive Growth since mid-2009. These are companies which had low (or no) earnings drawdown during the 2008-09 earnings recession, but which also offer investors 2-year compound earnings growth at/above market growth rates. Defensive Growth includes many Health Care and Food & Beverage stocks. •Indeed, Defensive Growth has outperformed the market by 70% over the past 5 years. This low beta group has led a strong rise in European equity markets. Defensive Growth has out-gunned Financials and Offensives since the 2008-09 financial crisis, with an attractive combination of less risk and more growth. But the prospect of higher GDP growth and lower macro risks in the US and Europe over the next 1-2 years suggests that: 1) there may be less need for investors to seek downside protection, 2) there may be a broader growth menu to choose from, and 3) recovery plays become more important within the market. Equity Markets MSCI Emerging Markets •The most important factor to monitor over the nearterm is PM Abe’s final decision on whether or not to implement the consumption tax hike (likely in late September or early October). In Citi’s view, the probability that PM Abe will go ahead with the current plan is 60-70% while the possibility of postponement of the tax hike is 30- 40%. If the tax hike is implemented, the government is very likely to introduce another fiscal stimulus package, in order to mitigate its negative impact. •Citi analysts have revised up their TOPIX EPS estimate to 89.3, above the pre-Lehman peak of 80.4 (FY3/08) given corporate revenues and profits may rise in both FY3/14 and FY3/15 and forecast FY3/15 TOPIX to be 1,590. Even if nuclear plant restarts are slower than expected this would only cut around 1.8pts from the TOPIX EPS in Citi’s view. •PBRs of Japanese equities tend to move in line with RoE and the ¥/$ rate. Based on this relationship, Citi’s PBR estimate is 1.48x for FY3/14 and 1.64x for FY3/15. Citi’s FY3/15 estimate is still below the average of 1.67x since July 1993, after the dust had settled on the asset bubble of the 1980s. Citi analysts expect peak levels are auto-related companies to post FY3/15 RP well ahead of post-FY3/01. While share price performance at these companies has been firm, valuations and other factors suggest more upside potential. 4 Equity Markets Chart 5: MSCI AC Asia ex Japan MSCI Asia ex Japan Index Chart 6: MSCI Emerging Markets MSCI Emerging Markets Index *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg *Denotes cumulative performance Performance data as of 31 August 2013 Source: Bloomberg Asia Pacific Emerging Markets Accelerating capital outflows Neutral on Latam equities •EM Asia countries with large external deficits recently have seen accelerating capital outflows and currency falls, especially in India and Indonesia. Moreover, policymakers in these countries probably have limited options to revive growth, given worsening current account and fiscal balances, declines in reserves and high interest rates. •Although CEEMEA1 is often considered to be the most ‘risky’ part of EM, currency sell-offs in the past 3 months have treated EMs in the European time zone relatively lightly. While the ZAR and TRY have depreciated sharply given large current account deficits financed by volatile capital flows, other currencies in the region have fared better. Better Eurozone data is one reason for this, and another is the relative lack of direct exposure to China among CEEMEA economies. •Although Citi analysts do not expect a full-scale crisis, these countries remain vulnerable to the rising US rates on the rise, and their currencies remain under pressure. In Citi’s view, best they can do now is to smooth the macro adjustment (weaker FX, higher risk premiums, slower growth) through improved policy credibility and find offsets to portfolio flows. •In Indonesia, Citi analysts believe that BI needs to signal a more hawkish stance with rate hikes to stabilize local FX markets. Indonesia’s portfolio equity flows are far smaller than debt flows, and debt investors tend to put greater premium on stabilizing FX than supporting growth. On the other hand, India needs to keep liquidity tight and mobilize more external funding sources. RBI has recently stepped up FX intervention alongside import curbs and significant liquidity tightening, dampening growth expectations in the process. To avoid losing credibility on its intervention ammunition, mobilizing more external funding may help. •In China, better earnings, expectation of policy support and economic stabilization had triggered recent market rebound from June’s low. However, the market may remain choppy and its upside may likely be capped by ongoing earnings downgrades, Fed tapering, and 4Q growth uncertainty. •Citi analysts maintain their call to overweight IT, health care, renewable energy, consumer, and property sectors which have resilient organic growth and could benefit from structural reform, while further rebound in cyclical sectors could be largely driven by earnings visibility, rather than valuation expansion. Equity Markets •Although valuations are attractive, sentiment on CEEMEA remains poor and growth prospects remain uninspiring. Preferred market is Russia due to cheap valuations. Both South Africa and Turkey sit as neutral, given their shaky social and political backdrops, as well as valuations which shows neither market looks particularly cheap. •Collectively, Latam currencies face fairly adverse headwinds, including: weak macro (BRL, CLP, COP); twin deficits on the current and fiscal accounts (all four); commodity reliance (all four); deep China exposure (BRL, CLP) and, except for COP, relatively overvalued currencies. •Within Latin America, Citi analysts have downgraded their 2013 and 2014 real GDP growth estimates for Brazil to 2.1% and to 2.0% (from 2.2% and 2.5% respectively). In Mexico, they have cut their 2013 growth forecast to 2% from 2.7%. •As for Latam equities, Citi analysts are neutral. Despite expected double-digit EPS growth for 2013, Latam’s relative earnings momentum has been weak. Preferred market is Mexico. The market has been held up by close links to the improving US economy, lower commodity exposure, low debt levels and prospects for structural reforms. 1. CEEMEA is the collective term for Central and Eastern Europe, Middle East and Africa. 5 Bond Markets Overweight High Yield US Treasuries Diminished liquidity and elevated volatility is likely to persist as carry trades and long positions continue to unwind, fostering choppy market conditions in the months ahead. Citi analysts prefer to maintain only shortdated positions in Treasuries and to use any rallies to shed duration. US Corporates While Citi analysts are relatively constructive in 2H13, they remain defensive. The biggest risk is a further significant rise in interest rates. Therefore, Citi analysts prefer to be selective and favour maturities in the 3-year to 7- year range. US High-Yield The sell-off in high yield has not been fundamentally driven. Concerns about higher US interest rates and the potential impact on the broader macro environment have weighed heavily on valuations. Indeed, valuations have become attractive given that Citi analysts expect default rates to remain low for the next several years. Emerging Market Debt External (hard currency) and local currency emerging market sovereign debt remains volatile as investors re-evaluate risk exposures. Citi analysts prefer to keep duration short and hedge currency exposures. Euro Bonds While central bank actions (such as forward guidance introduced by the ECB and BoE, or tapering of asset purchases by the Fed) are critical to rate expectations, any sustainable divergence in longer-term yields is more likely to be fuelled by economic factors, not central bank policy. As such, Citi analysts continue to expect “lower for longer” yields in the Eurozone to bolster Bunds and Gilts relative to Treasuries. Japan Bonds The Bank of Japan’s (BoJ) easing measures far exceeded market expectations. It introduced monetary base in order to aggressively expand Japan’s aggregate money base. Also it expanded the JGB purchase amount and the maturity of JGBs eligible for purchase to 40 years to keep JGB long-term yields low. With these measures in place, long-term interest rates are setting record lows for the time being. Asia Bonds Citi analysts are neutral PHP bonds as the pending SDA liquidity injection could help, and they also turned neutral VND bonds given periodic USD liquidity risk amid SBV’s reluctant intervention that could undermine sentiment, amid some foreign unwinds. Despite FX risks, they also favour INR and LKR government bonds. Bond Markets 6 Currencies USD: Moderate upside over 6-12 months Short term consolidation in USD exchange rates over 0-3m may likely give way to further moderate USD upside over 6-12m. Indeed, Citi’s forecasts still envisage generalised USD strength medium term, driven by: (i) a relatively strong cyclical performance in the US; (ii) an expected shift towards relatively less expansive US monetary policy as QE3 is first tapered and then ended altogether by mid 2014; (iii) relatively looser monetary policies elsewhere focused on rates guidance and, in Japan, ongoing QE; and (iv) deteriorating fundamentals and rising risk premia in EM economies. EUR: Flows support EUR EUR/USD has recently moved back to the upper end of the 1.28-1.34 range holding over the past 6 months. A generalised USD correction reflecting rally fatigue and excessively long positioning contributed to this. But there were also EUR positives in play. One factor is the recovery in European financials, which tend to be correlated with EUR performance. Another factor arguably helping EUR is the stance of ECB monetary policy. Aside from these short term factors, Citi analysts continue to think that medium term flows underpin the EUR. These include flows from the rising current account and long term capital accounts on the balance of payments – the so called broad balance of payments. All in all, Citi’s forecasts show EUR holding its own or even appreciating a little against a relatively strong USD over the medium term. Citi analysts expect 1.35 over 0-3 months and think 1.30-1.35 may be a central trading range over 6-12 months. GBP: Carney & forward guidance Following the introduction of the widely expected forward rates guidance in the UK by BoE Governor Carney, the response to the new policy details has been a modestly stronger sterling. Having previously broken upwards from the 0.84 – 0.86 range, EUR/GBP currently trades back within this band having failed at close to February and March highs. Citi analysts expect EUR/GBP to continue to trend higher over time, partly because they remain constructive on the EUR. Citi analysts forecast 0.87-0.88 for EUR/GBP over their forecast horizons. However, uncertainties around “guidance”, the markets’ initial response to it, and follow up policy actions in reaction mean that the GBP outlook is unusually cloudy. JPY: Relative policy supports higher USD/JPY USD/JPY fell slightly since the last forecast and is currently close to last month’s 0-3m projection of 98 which Citi analysts leave unchanged this time. In recent months, the exchange rate has entered a relatively large sideways consolidation pattern with still rising lows in corrections but highs receding in rallies since May. The expected fundamental drivers for USD/JPY remain the same. Over time, Citi analysts expect the Fed to begin to withdraw maximum monetary accommodation, first tapering in Q4 and then stopping QE3 altogether in around mid 2014. This is consistent with further moderate upwards pressure on US 10y yields and similarly on yield spreads to Japan. AUD: Further weakness anticipated Medium term, Citi analysts still look for some further downside in AUD/USD based on a continued deterioration in the terms of trade. Commodity prices should generally be weak over this time horizon according to Citi commodity market strategists. In addition, US centric factors may help the USD against other major currencies and Citi analysts remain concerned about Chinese economic developments which could yet impair AUD. Over 6-12 months, Citi analysts see AUD/ USD around 85-90c. EM Asia: A weaker China and CNY Citi analysts anticipate some stability now in most cases, with Asia overall forecast to be less weak in the next three months than the last three. But there are fat tails around the distribution, from risks of a credit crunch in several Asian economies including, crucially, China, and in twin deficit countries like India and Indonesia. USD/CNY spot, fixings and market forwards have all been trading sideways/lower in a choppy range. Citi point forecasts remain unchanged from last month, but with greater two way risks. On the one hand, weak growth may require exchange rate depreciation to stimulate, especially given little or no fiscal wiggle room. Indeed, although very recent data have been better, Citi economists have not turned more bullish, citing temporary stabilization and strong base effects. If, on the other hand, China suffers a real credit crunch as some fear, CNY could strengthen as foreign assets are repatriated to recapitalize banks. Citi analysts forecast USD/CNY trading between 6.15 and 6.18 over the next twelve months, with risks skewed toward a weaker CNY near term. Currencies 7 General Disclosure: “Citi analysts” refers to investment professionals within Citi Research (“CR”), Citi Global Markets Inc. (“CGMI”) and voting members of the Citi Global Investment Committee. Citibank N.A. and its affiliates / subsidiaries provide no independent research or analysis in the substance or preparation of this document. The information in this document has been obtained from reports issued by CGMI. Such information is based on sources CGMI believes to be reliable. CGMI, however, does not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute CGMI’s judgment as of the date of the report and are subject to change without notice. This document is for general information purposes only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or currency. No part of this document may be reproduced in any manner without the written consent of Citibank N.A. Information in this document has been prepared without taking account of the objectives, financial situation, or needs of any particular investor. Any person considering an investment should consider the appropriateness of the investment having regard to their objectives, financial situation, or needs, and should seek independent advice on the suitability or otherwise of a particular investment. Investments are not deposits, are not obligations of, or guaranteed or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not indicative of future performance, prices can go up or down. Some investment products (including managed funds) are not available to US persons and may not be available in all jurisdictions. Investors should be aware that it is his/her responsibility to seek legal and/or tax advice regarding the legal and tax consequences of his/her investment transactions. If an investor changes residence, citizenship, nationality, or place of work, it is his/her responsibility to understand how his/her investment transactions are affected by such change and comply with all applicable laws and regulations as and when such becomes applicable. Citibank does not provide legal and/or tax advice and is not responsible for advising an investor on the laws pertaining to his/her transaction. Country Specific Disclosures: Australia:This document is distributed in Australia by Citigroup Pty Limited ABN 88 004 325 080, AFSL 238098. For a full explanation of the risks of investing in any investment, please ensure that you fully read and understand the relevant Product Disclosure Statement prior to investing. Hong Kong:This document is distributed in Hong Kong by Citibank (Hong Kong) Limited (“CHKL”). Prices and availability of financial instruments can be subject to change without notice. Certain high-volatility investments can be subject to sudden and large falls in value that could equal the amount invested. India: This document is distributed in India by Citibank N.A. Investment are subject to market risk including that of loss of principal amounts invested. Products so distributed are not obligations of, or guaranteed by, Citibank and are not bank deposits. Past performance does not guarantee future performance. Investment products cannot be offered to US and Canada Persons. Investors are advised to read and understand the Offer Documents carefully before investing. Indonesia: This report is made available in Indonesia through Citibank, N.A. Indonesia Branch, Citibank Tower Lt 7, Jend. Sudirman Kav 54-55, Jakarta. Citibank, N.A. Indonesia Branch is regulated by the Bank of Indonesia. Korea: This document is distributed in South Korea by Citibank Korea Inc. Investors should be aware that investment products are not guaranteed by the Korea Deposit Insurance Corporation and are subject to investment risk including the possible loss of the principal amount invested. Investment products are not available to US persons. Malaysia: This document is distributed in Malaysia by Citibank Berhad. People’s Republic This document is distributed by Citibank (China) Co., Ltd in the People’s Republic of China (excluding the Special Administrative Regions of Hong Kong and Macau, and Taiwan). Philippines: This document is made available in Philippines by Citicorp Financial Services and Insurance Brokerage Phils. Inc, Citibank N.A. Philippines, and/or Citibank Savings Inc. Investors should be aware that Investment products are not insured by the Philippine Deposit Insurance Corporation or Federal Deposit Insurance Corporation or any other government entity. Singapore: This report is distributed in Singapore by Citibank Singapore Limited (“CSL”). Investment products are not insured under the provisions of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of Singapore and are not eligible for deposit insurance coverage under the Deposit Insurance Scheme Thailand: This document contains general information and insights distributed in Thailand by Citigroup and is made available in English language only. Citi does not dictate or solicit investment in any specific securities and similar products. Investment contains certain risk, please study prospectus before investing. Not an obligation of, or guaranteed by, Citibank. Not bank deposits. Subject to investment risks, including possible loss of the principal amount invested. Subject to price fluctuation. Past performance does not guarantee future performance. Not offered to US persons. United Kingdom: T his document is distributed in U.K. by Citibank International plc., it is registered in England with number 1088249. Registered office: Citigroup Centre, Canada Square, London E14 5LB. Authorised and regulated by the Financial Services Authority. Equity Markets 8