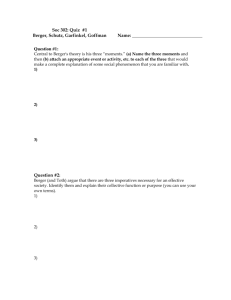

Final Annual Report Berger

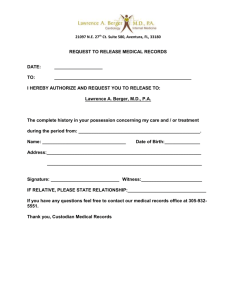

advertisement