Welcome to TTK

advertisement

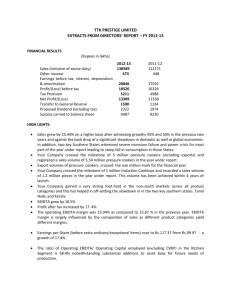

Welcome to TTK The TTK Group Indian roots, Global Reach Mission of the group To provide quality consumer products at affordable prices Core values of the group Trust, Transparency and Knowledge Diversified Group Structure TTK Prestige Limited Incorporated in 1955. India’s largest kitchenware company. • IPO in 1994. • 1500 strong human capital • Two brands in the portfolio. Prestige and Manttra • 8 Manufacturing units • Captive design and tool‐room facilities • Versatile distribution network A unique combination of strong manufacturing, design and marketing systems. • • Paid up capital Rs. 113 million , 10000 shareholders Board of Directors/ Management Promoter Directors • Mr. TT Jagannathan – Executive Chairman • Mr. TT Raghunathan – Vice Chairman • Dr.(Mrs)Latha Jagannathan Executive Directors • Mr. S. Ravichandran – Managing Director • Mr. K. Shankaran – Director (Corporate Affairs) Independent Directors • Mr. Ajay I Thakore • Mr. R. Srinivasan • Mr. Arun Thiagarajan • Dr.(Mrs) Vandana Walvekar • Mr. Dileep Kumar Krishnaswamy Well balanced Board Sub Board level – Mr. Chandru Kalro – Executive Vice President (Marketing) – Mr. V. Sundaresan – Vice President (Finance) & CFO – Mr. H.T. Rajan‐ Chief Manufacturing Officer Vision and Values CORE VISION • • • • • • A Prestige in every Indian Kitchen CORE VALUES Quality products at affordable prices Trust, Transparency, Knowledge and “Prestige” in whatever we do Fair dealings with every stakeholder Respect for Environment CORE STRATEGY Providing Total Kitchen Solutions rather than just a product THE JOURNEY SO FAR 1955 – INCORPORATION 1959 – FIRST MANUFATURING UNIT IN BANGALORE 1981 – SECOND MFG UNIT IN HOSUR ‐ TAMILNADU TILL 1990 – A SINGLE PRODUCT COMPANY – JUST ALUMINUM OUTER LID PRESSURE COOKERS – DOMINANT IN SOUTHERN INDIA • 1990‐94‐ LAUNCH OF SS PRESSURE COOKERS AND NON‐STICK COOKWARE • 1990s ‐ EXPORT THRUST –LAUNCH OF MANTTRA BRAND • 2000‐2003 ‐ PERIOD OF TURBULANCES ‐ YET BOLD INITIATIVES LAYING THE FOUNDATION FOR BRAND EXTENSION AND EXPLOSIVE GROWTH ‐ THE UNLEASHING OF THE BRAND AND PEOPLE POWER • • • • ……the journey so far • THIS PERIOD SAW THE LAUNCH OF STOVES AND APPLIANCES AND THE MAJOR MARKETING INITIATIVE OF EXCLUSIVE RETAIL NETWORK – PRESTIGE SMART KITCHENS • 2006 – LAUNCH OF WELL DIFFERENTIATED INNER LID PRESSURE COOKERS ‐ NEW CAPACITIES IN UTHARKAND AND COIMBATORE • 2006‐ 2010 – TRANSFORMATION INTO A TOTAL KITCHEN SOLUTION PROVIDER LEAD BY INNOVATIONS LIKE INDUCTION TOPS, APPLE COOKERS,MICROWAVE PRESSURE COOKERS AND A HOST OF APPLIANCES • 2010 – 11 ADOPTION OF A SIMPLE BUT POWERFUL VISION – “ A PRESTIGE IN EVERY INDIAN KITCHEN “ • 2011 ‐ LARGEST CAPACITY EXPANSION INTITIATIVE TO BACK THE ABOVE VISION THE PATH OF THE JOURNEY SINCE 2002 • FOCUS ON OCCUPYING THE MINDSHARE OF THE CONSUMER • FOCUS ON DOMINATING THE KITCHEN DOMAIN WITH DIFFERENTIATED PRODUCTS • FOCUS ON GROWTH , GAINING MARKET SHARE AND EXPANDING CUSTOMER BASE • KEY METRICS ‐ GROWTH ‐ CAPITAL EFFICIENCY ‐ RETURN ON CAPITAL EMPLOYED ‐ MARGIN IS A STRATEGY TO GROWTH RATHER THAN AN END IN ITSELF • MARGIN IMPROVEMENT THROUGH IMPROVING EFFICIENCIES ‐ PASS TO CONSUMER COST ESCALATION AND NOT COST OF INEFFICIENCIES FRUITS OF THE JOURNEY ¾ WE DERISKED THE COMPANY FROM BEING DEPENDANT ON SINGLE PRODUCT AND SINGLE MARKET ¾ TOPLINE GREW AT CAGR OF AROUND 28 % SINCE 2003 – FROM RS.113 CRORES TO RS.780 CRORES ¾ PRESSURE COOKERS VOLUMES GREW FROM 1 MILLION TO 3.6 MILLION ¾ COOKWARE VOLUMES GREW FROM 0.4 MILLION TO 3.5 MILLION ¾ APPLIANCES BECAME A SIGNIFICANT PART OF THE PORTFOLIO ¾ ESTABLISHED CLEAR LEADERSHIP IN KEY PRODUCT CATEGORIES ¾ FROM A NEGATIVE EBIDTA OF 6.12 CRORES TO A POSITIVE OPERATING EBIDTA OF Rs. 125.95 CRORES ¾ PROFIT BEFORE TAX GREW FROM A LOSS SITUATION OF 17.42 CRORES TO PROFIT LEVEL OF 120.35 CRORES ¾ PAT GREW FROM A LOSS OF11.47 CRORES TO A PROFIT OF 83.75 CRORES ¾ NET CURRENT ASSET TURNOVER RATIO IMPROVED FROM 1.7 TIMES TO 9.3TIMES ¾ OPERATING ROCE FROM NEGATIVE TO 60.04% ¾ FROM DEBT BURDEN OF Rs.81 CRORES TO FREE CASH ¾ WON SEVERAL AWARDS India’s most awarded company and brand And last and most important… SNAP SHOT OF FY 2010‐11 (Rs. Crores) 2010‐11 ¾ SALES ¾ OTHER INCOME ¾ PROFIT BEFORE TAX 2009‐10 775.58 4.30 120.35 516.80 1.14 75.40 ¾ PROFIT AFTER TAX 83.75 52.44 ¾ DIVIDEND 16.45 13.20 HIGHLIGHTS OF FY 2010‐11 ¾ ¾ ¾ ¾ ¾ SALES GREW BY OVER 50% ALL TIME ABSOLUTE VALUE GROWTH‐AROUND Rs.259 CR. PROFIT BEFORE EXTRAORDINARY ITEMS INCREASED BY 69.31% PROFIT AFTER TAX INCREASED BY 59.71% THE OPERATING EBIDTA MARGIN WAS 16.24% AS AGAINST 14.74% IN 2009‐10 ¾ THE COMPANY CONTINUES TO BE DEBT FREE AND CARRIES A FREE CASH OF Rs. 76 CR. ¾ EPS (BEFORE EXTRAORDINARY/EXCEPTIONAL ITEMS) ROSE TO Rs.74.46 from Rs.42.98 – A GROWTH OF 73.24% ¾ THE RATIO OF OPERATING EBIDTA/CAPITAL EMPLOYED (INCLUDING FREE CASH BALANCE)IN THE KITCHEN SEGMENT ROSE TO 67.3% Strengths of the company Brand The Prestige Brand Core values of the brand are TRUST, SAFETY, DURABILITY Leaders in Pressure cookers, cookware, Induction Tops Prestige is a Superbrand One product sold every 5 secs in India The Prestige product portfolio Mixer grinders Food Processors Choppers Blenders Juicers Wet Grinders Knives Pressure cookers Non stick cookware LPG gas Stoves Induction Cook tops LPG Hobs OTG’s Microwave ovens Rice Cookers Barbecues Kettles Pop up Toasters Sandwich toasters Coffee Makers Tea Makers Complete kitchen Solutions. Service business Distribution Structure Sub Dealers Distribution Infrastructure and Reach Channel contributions Retail initiative Key highlights Results of the Retail initiative GOING FORWARD WE ARE NOW A Leading brand in Pressure Cookers A Leading brand in Induction Cook Tops A Leading brand in Cookware India’s first company to offer the complete Induction Cooking solutions A Leading brand in Value added Gas Stoves India’s largest Kitchen appliance Company WE NOW INTEND TO TAKE THIS LEADERSHIP POSITION EVEN FURTHER! We are making sizeable investments in Manufacturing ‐ Over Rs.200 crores OPPORTUNITIES ¾STRONG FUNDAMENTALS OF INDIAN ECONOMY ¾CONTINUING GDP GROWTH OF OVER 8% ¾SHIFT IN INCOME GROUPS ¾INCREASE IN RURAL CONSUMPTION ¾PREFERENCE TO BRANDED QUALITY PRODUCTS ¾VAST UNTAPPED MARKET CHALLENGES ¾ CONTINUING INFLATIONARY TREND IN ITEMS OF DAY TO DAY CONSUMPTION ¾ HIGHER INTEREST RATES ¾ VOLATALITY OF RAW MATERIAL PRICES ¾ SLOW REFORM PROCESS ¾ PROLIFERATION OF REGIONAL BRANDS ¾ LOCAL BRANDS YIELDING TO MNCs. ¾ INCREASING COST OF ADVERTISING AND COMPLEX CHOICE OF MEDIA ¾ WE BELIEVE THAT WE WILL STRIKE A BALANCE BETWEEN OPPORTUNITIES AND CHALLENGES ¾ WE WILL FURTHER BROAD BASE OUR PRODUCT RANGE ¾ WE HAVE CLOCKED 50% GROWTH IN FY 2010‐11 AND A CAGR OF 32% FOR THE LAST 3 YEARS. THUS OUR BASE HAS ALREADY INCREASED. ¾ WE EXPECT THAT GIVEN THE OPPORTUNITIES, MAINTAINING A GROWTH RATE OF 25% PER ANNUM IS FEASIBLE OVER THE MEDIUM TERM . SAFE HARBOUR THIS PRESENTATION MAY CONTAIN STATEMENTS WHICH ARE FUTURISTIC IN NATURE. SUCH STATEMENTS REPRESENT THE INTENTIONS OF THE MANAGEMENT AND THE EFFORTS BEING PUT IN BY THEM TO REALISE CERTAIN GOALS. THE SUCCESS IN REALISING THESE GOALS DEPENDS ON VARIOUS FACTORS BOTH INTERNAL AND EXTERNAL. THEREFORE THE INVESTORS ARE REQUESTED TO MAKE THEIR INDEPENDENT JUDGEMENTS BY TAKING INTO ACCOUNT ALL RELEVANT FACTORS BEFORE TAKING ANY INVESTMENT DECISIONS. Thank you