Year End Report - The Milford Bank

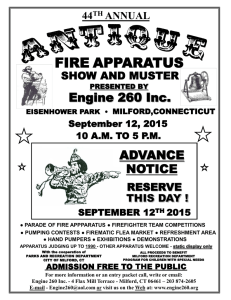

advertisement

Board of Trustees Officers of the Corporation James R. Beard Carol A. McInnis President and CEO Josephine R. Culmone David B. Rubin Leo P. Carroll, Chairman Robert V. Macklin Samuel S. Bergami Jr. Louis J. D’Amato Raymond A. Macaluso Joseph Pelaccia DeForest W. Smith Corporators; The Board of Trustees and… Joseph M. Agro Jr. Andrew Apicella Matthew J. Arciuolo Jr. Kenneth E. Brannin Gerardo W. Burdo George J. Canaveri Armand J. Cantafio Christopher B. Carveth Max S. Case Thomas J. Cody Jr. James J. D’Amato David J. Esposito L. Kenneth Fellenbaum Lloyd N. Friedman Harry J. Garafalo Bradford G. Gesler John A. Harkins Lisa A. Hazelton Carrie A. Jayne Gary M. Johnson Bernard F. Joy Jr. Ann L. Loesch Thomas B. Lynch Joseph J. Mager Jr. William B. Maley Jr. Richard C. Meisenheimer Paul E. Moss David C. Novicki Ray S. Oliver Gary L. Opin Perry M. Opin Susan L. Shields John F. DaRin Ann Marie C. Lenart Jorge A. Santiago Robert J. Cannon Jr. Senior Vice President and Senior Commercial Loan Officer Senior Vice President and Branch Administrator Nancy B. Fay Vice President and Manager, Loan Origination Clare B. Geoghegan Vice President and Manager, Woodmont Office Sharon R. MacKenzie Vice President and Manager, Loan Servicing Cathleen M. Russo Vice President and Controller Ronald S. Silverberg Vice President, Commercial Lending Chief Operating Officer, CFO and Treasurer Senior Vice President – Human Resources and Corporate Secretary Vice President and Credit Analyst Patricia M. Gallagher Vice President and Manager, Stratford Office Lawrence R. Leete III Vice President, Commercial Lending Paul M. Portnoy Vice President, Commercial Lending Robert J. Russo Vice President and Manager, Main Office Craig W. Smith Vice President and Compliance/ Enterprise Risk Officer Marta F. Stanton Lynn A. Viesti Berube David L. Reynolds David A. Wall Mark R. Attanasio Winthrop S. Smith Jr. Ric T. Biroscak John Kuehnle Celeste M. Lohrenz Nora D. Paige Paul L. Otzel Michael J. Paolini Cyrus Settineri James B. Stirling Beverly K. Streit-Kefalas Wendy S. Weir Advisory Board Member Barbara Lisman Robert V. Macklin Vice President and Manager, Devon Office Vice President, Information Systems and Security Officer Assistant Vice President and Manager, Security and Facilities Assistant Vice President and Manager, Post Road West Office Sindy K. Berkowitz Assistant Treasurer and Manager, ShopRite Office Vice President and Marketing/ Communications Specialist Assistant Vice President and Manager, Post Road East Office Assistant Vice President and Infinex Financial Advisor Assistant Vice President and Manager, Operations Department Nancy E. Senk Office Locations ATM Locations Main Office 33 Broad Street Milford, CT 06460 Milford Woodmont Office 259 Merwin Avenue Milford, CT 06460 119 High Street (Drive-Up) 33 Broad Street 300 Seaside Avenue (Milford Hospital Lobby) Devon Office 205 Bridgeport Avenue Milford, CT 06460 259 Merwin Avenue 205 Bridgeport Avenue Post Road East Office 1455 Boston Post Road Milford, CT 06460 1455 Boston Post Road (Drive-Up) Post Road West Office 295 Boston Post Road Milford, CT 06460 295 Boston Post Road (Drive-Up) Stratford Stratford Office 2366 Main Street Stratford, CT 06615 2366 Main Street (Drive-Up) ShopRite Office (Inside ShopRite) 250 Barnum Ave Cutoff Stratford, CT 06614 250 Barnum Ave Cutoff (Inside ShopRite) New Haven Office (Loan Production Office) 142 Temple Street, Suite 208 New Haven, CT 06510 (203) 785-9148 milfordbank.com (203) 783 - 5700 Assistant Corporate Secretary and Executive Secretary to the President Equal Housing Lender Member 2013 Year End Report A Message from the President As expected, 2013 was a challenging year for The Milford Bank. We had to cope with the slow recovery from the recent recession, historically low interest rates, and the long expected slowing of the mortgage refinancing business. Despite these factors, the Bank ended the year in solid condition. Total assets crossed the $400 million threshold and ended the year at $406,233,275. Deposits totaled $356,771,743 and gross loans $333,361,581 at 12/31/13. Capital stood at $42,263,600 or 10.81% of average assets. The Milford Bank was again the number one mortgage lender in Milford in 2013. We wrote $68,343,201 in residential mortgage loans, compared to $94,443,988 in 2012, a 28% decrease year to year. In part as a result of that drop in business written, the Bank reported a net profit of $891,138 for 2013. Along with the continued recovery of the U.S. economy, we expect that the interest rate environment will eventually return to a more normal range which should help the Bank’s profitability picture going ahead. In order to attract and retain customers in today’s environment, the Bank is working constantly to make it easier for people to do their banking through The Milford Bank. Beyond attractive, friendly offices, the Bank now offers many electronic options ranging from Internet banking and online bill payments, to mobile banking through smart phones. Early in 2014, we expect to offer mobile deposit capability — taking a picture of a check and having it credited to your account with the push of a button. Also in 2014, all of our ATMs will be upgraded to accept debit cards with electronic chips — a safer alternative that will be available in the next year or two by the big card processors. As always, the main focus of The Milford Bank is the communities that we serve. The Bank contributed $189,790 to various organizations in Milford and Stratford in 2013. The Bank also contributed $25,000 to The Milford Bank Foundation. A total of $12,800 was distributed by the foundation to 18 community groups. Always realize that as you do your banking with The Milford Bank, you are also contributing to your community. Bob Macklin President & CEO Statement of Condition (dollars in thousands) Assets as of 12/31/13 as of 12/31/12 Cash and Due from Banks 32,934 Federal Funds Sold 0 Investment Securities 16,962 Loans – Held for Sale 0 Loans Receivable 333,362 Less: Allowance for Credit Losses 3,137 Net Loans 330,225 Bank Premises and Equipment 6,564 Cash Value of Bank-Owned Life Insurance 10,399 Accrued Income and Other Assets 9,149 Total Assets 406,233 Liabilities & Retained Income Deposits 349,555 Mortgagors’ Escrow Accounts 7,217 Advances and Borrowings623 Reserve for Unfunded Credit Commitments231 Accrued Expenses and Other Liabilities 6,344 Total Liabilities 363,970 Retained Income 42,263 Total Liabilities and Retained Income 406,233 47,476 87 16,958 1,669 306,878 3,325 303,553 6,985 10,110 10,021 396,859 Statement of Income (dollars in thousands) Income as of 12/31/13 Interest and Dividend Income 13,959 Interest Expense 1,240 Net Interest and Dividend Income 12,719 Provision for Credit Losses (35) Net Interest Income After Provision for Credit Losses 12,754 Non-Interest Income 2,401 Non-Interest Expense 13,951 Income Before Income Taxes 1,204 Income Tax Provision 313 Net Income 891 341,485 6,925 567 234 6,977 356,188 40,671 396,859 as of 12/31/12 14,688 1,693 12,995 132 12,863 3,529 14,061 2,331 690 1,641