Viewpoint

Petrobras corruption scandals

threaten to unseat Rousseff

n

Economy & Business

n

n

n

n

n

Energy & Environment

Good prospects for Brazil

Infrastructure issues

Banking and financial policy

Economy and business

Economists give voice

n

n

n

n

Oil & gas in brief

Petrobras news

Biofuels in brief

Electricity sector

Politics, Law, Society

n

n

n

n

n

n

n

Pressure in the Chamber

The campaign heats up

Senators and governors

Workers’ Party plans

Politics in brief

Legal issues

Social issues

International Affairs

n

n

Diplomatic briefs

International trade

Veirano Advogados’ Monthly review of economic, legal, and political developments

photograph: Roberto Stuckert Filho/PR

1

16

Petrobras corruption scandals

threaten to unseat Rousseff

Multiple charges of corruption within Petrobras have

launched five federal police investigations of the company,

in addition to others.

of the major incident chaired the company board. While

the full effects of the crisis remain ahead, it is possible to

establish a chronology of the facts.

The company has lost about 51 percent of its market

value within the last three years, shrinking from US$197

billion to US$90 billion. It dropped from 12th largest

company in terms of global market share five years ago

to 120th, according to the Financial Times. Over the same

period, production from Brazilian oil fields has stagnated

at approximately 2 million b/d.

Chaired by Rousseff, in 2006 the Petrobras board

approved the purchase of 50 percent of a refinery in Pasadena, Texas, for R$360 million (approximately US$165

million). The refinery had been acquired one year earlier

by Belgian company Astra Gl for US$42.5 million, and

Petrobras is reputed to have paid more than 10 times the

market value for its share of the operation at the time.

What appears to be a scandal on a monumental scale is

now tainting President Dilma Rousseff, who at the time

After a dispute with its partners in 2008, Petrobras was

obliged by a contractual clause to buy the other

…

april 2014 · Volume 03 · Number 04

04.14

Economy & Business

Energy & Environment

Politics, Law, Society

50 percent of the refinery, which it did in 2012, paying

US$1.18 billion.

VistaBrazil is published monthly

Produced by Prismax Consultaria

Editor: Georges D. Landau

Production: Blakeley Words+Pictures

© 2014 · Veirano Advogados and Prismax Consultoria

All text rights reserved

Vista Brazil is sponsored by Veirano Advogados

Founding Partner: Ronaldo C. Veirano

Managing Partner: Pedro Aguiar de Freitas

2

16

Rio de Janeiro

Av. Presidente Wilson, 231 / 23º andar

20030-021 – RJ

(55 21) 3824 4747 Phone

(55 21) 2262 4247 Fax

contact@veirano.com.br

www.veirano.com.br

São Paulo

Av. Brigadeiro Faria Lima,

3477 / 16º andar

04538-133 - SP

(55 11) 2313-5700 Phone

(55 11) 2313-5990 Fax

Porto Alegre

Rua Dona Laura,

320 / 13º andar

Rio Branco – 90430-090 – RS

(55 51) 2121 7500 Phone

(55 51) 2121 7600 Fax

Brasília

SCN Qd. 2

Ed. Corp. Financial Center – Bloco A

10º andar/Sala 1001 – 70712-900 – DF

(55 61) 2106 6600 Phone

(55 61) 2106 6699 Fax

Disclaimer

This newsletter is intended to provide general information regarding recent events,

developments, and trends in Brazil. It is not intended, nor should it be relied on, to

provide legal analysis or legal advice on any of the information covered in the newsletter.

Veirano Advogados and Prismax Consultoria cannot ensure against or be held

responsible for inaccuracies. To the full extent permissible by law Veirano Advogados

shall have no liability for any damage or loss (including, without limitation, financial loss,

loss of profits, loss of business, or any indirect or consequential loss), however it arises,

resulting from the use of any material appearing in this publication or from any action or

decision taken as a result of using information presented in the publication.

Rousseff says that she approved the transaction based

on a deficient report whose author, Nestor Cerveró, an

international director for Petrobras at the time, was then

fired on 20 March 2014 while vacationing in Europe.

The refinery purchase is currently being investigated by

the federal police, the Federal Court of Accounts (TCU),

and the office of the Federal Prosecutor. The Brazilian

Congress on 9 April also approved the creation of a mixed

parliamentary commission of inquiry (CPMI) to deal with

the matter and other corruption scandals. It had been

called for by opposition candidate Senator Aécio Neves of

the Brazilian Democratic Movement Party (PMDB) and

violently opposed by the Workers’ Party (PT).

PT wants to avoid repercussions for the president and for

the party itself, but it is bound to have electoral consequences. An opinion poll released by Datafolha in the first

week of April showed Rousseff’s support dropping from

44 to 38 percent the previous month.

Some analysts suggest, however, that the timing of the

scandal smacks of political opportunism, considering that

the refinery sale was effected years ago.

International Affairs

As well, former director for supplies Paulo Roberto Costa

was apprehended by the federal police on 20 March –

the first arrest of a company director in 60 years. He is

alleged to have been involved money laundering.

As if that were not enough, the company is being investigated over allegations that its officials took bribes in

exchange for steering contracts to SBM Offshore NV, a

Netherlands-based supplier for offshore vessels. The

Office of the Federal Public Prosecutor will join forces

with the federal police to investigate the charges of corruption in Petrobras related to SBM Offshore. Petrobras is

also conducting its own investigation.

On 12 March the Chamber of Deputies approved, by

268 votes to 28, the creation of an external commission

of inquiry to investigate the charges related to SBM

Offshore. The vote represents a political defeat for the

government.

On 27 March the Senate Commission of the Environment

approved an invitation to both Minister of Mines and

Energy Edison Lobão and Petrobras CEO Maria Graça

Foster to testify in the Senate about the Pasadena refinery

and the energy crisis.

And on 7 April, the company denied a suggestion

that it had shelved plans to sell debt in local and

…

Veirano Advogados

Offices in Rio de Janeiro, São Paulo, Porto Alegre, and Brasília …

april 2014 · Volume 03 · Number 04

Viewpoint

international markets later this year, allegedly worried

that investor perception about the extent of the scandals

could dampen demand or raise borrowing costs.

Energy & Environment

Politics, Law, Society

Economy & Business

The Lula angle

Rousseff and former president Lula da Silva met for three

hours on 4 April in São Paulo. It was their first meeting

after the news emerged about the Pasadena refinery, and

Lula repeatedly advised Rousseff to do her utmost to

thwart the CPMI about Petrobras, which he regards as a

“weapon” against her.

3

16

Lula addressed bloggers in Rio de Janeiro on 8 April, setting the tone for the Rousseff campaign by urging her to

take the offensive on several issues – notably the CPMI.

He reminded his listeners that the mensalão CPI had

started with the investigation of a minor incident of corruption in the postal services and had escalated to dominate the national political scene.

As a result, the former president thinks that it is essential

to defend Petrobras against all investigations. Lula also

argues that the president should take a proactive role in

her re-election campaign, while emphasizing his own role

as her chief ally despite ever more insistent demands for

his return to power. Rousseff, for her part, said that she

will not yield a millimeter in her political campaign.

Other factors threatening her drive to re-election are

mixed economic news, power shortages caused by

drought, and the rising costs of hosting the FIFA World

Cup of soccer.

Veirano Advogados

International Trade / WTO …

International Affairs

Even so, the Central Bank has sustained its market

interventions in order to force the value of the real upward.

Foreign investment is attracted by a number of factors,

among them an interest rate of 11 percent per year. US

pension funds and mutual funds are strong players in the

financial market.

On the negative side of the coin, inflation rose 1.48 percent in March, the largest increase since July 2012, and

was the highest economic indicator for the month of

March. Inflation has increased 7.55 percent over the last

12 months, well above the target ceiling of 6.5 percent.

Infrastructure issues

The price of inefficiency

In March alone, Brazilian enterprises raised US$12 billion

Good prospects for Brazil

Foreign investment and successive interventions by the

Central Bank have led to strongest exchange rate for the

real against the US dollar in the last five months (R$2.217)

in the Brazilian market. While Brazil imports more than it

exports and thus loses foreign exchange, in the financial

market the reverse is true: copious foreign investment has

increased the value of the Brazilian currency.

The Brazilian stock exchange Bovespa has attracted US$2

billion since the beginning of the year and is performing

above expectations. In March alone, Brazilian enterprises raised US$12 billion, and the economy is buoyant

thanks to the strong inflow of funds invested in the stock

exchange and in debt papers issued by the government.

Brazil has dropped 20 positions in the global ranking of

logistics, according to a World Bank survey of 160 countries. The report released on 20 March takes into account

business perceptions of the efficiency of the country’s

transport infrastructure. Brazil is now ranked 65th, its

worst ranking since the survey was launched in 2007.

Entrepreneur Jorge Gerdau, head of a complex of steel

mills in Brazil and abroad and chair of the Management

Policies Committee of the government, remarked on 8

April that Brazilians ought to rebel against the poor quality

of public services, especially logistics.

Designing concessions

The government has decided to change the procedure for

federal highway and railway concessions, whose design

will cease to be the monopoly of public enterprise Estruturadora Brasileira de Projetos (EBP). This should make concession projects more attractive to the private sector.

…

april 2014 · Volume 03 · Number 04

Economy & Business

photograph: flickr/c melo

Viewpoint

Viewpoint

Economy & Business

Putting money in

The CCR Group and Arterics, two of the largest concession holders for highways, are together expected to invest

over R$6 billion this year in their highway projects, double

what they invested in 2013.

Politics, Law, Society

International Affairs

photograph: wikimedia/Diego Silvestre

The Secretariat for Civil Aviation (SAC) announced on

17 March that it will hold a public hearing on a proposed

national plan for concessions of regional airports.

Energy & Environment

Airport concession holders will invest R$3.2 billion this

year, according to a survey conducted by the National

Agency for Civil Aviation (ANAC) and the National

Agency for Land Transport (ANTT).

Odebrecht will invest R$30–40 billion over the next

three years, largely in infrastructure in Brazil and abroad.

The conglomerate is involved in sanitation projects as well

as oil and gas.

Vale will invest R$7 billion in port logistics through to

2017, of which 70 percent will go to Terminal de Ponta da

Madeira. The Maranhão terminal is to be used mainly for

iron ore exports.

Giant French firm Louis-Dreyfus Commodities (LDC) will

invest US$1 billion in logistics for grains exports over the

next five years.

Highway to the future

President Dilma Rousseff on 12 February signed concession contracts for three lots of highways tendered in late

Veirano Advogados

Infrastructure & Projects …

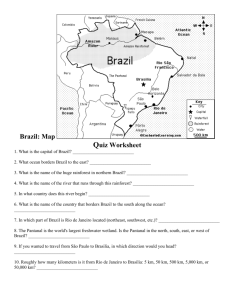

A planned underwater tunnel between Santos (shown here) and Guarujá is estimated to cost R$1.8 billion

2013: BR-163 in Mato Grosso and Mato Grosso do Sul, and

BR-040 between Juiz de Fora and Brasília. The contracts

involve total investment of R$18.2 billion over 30 years,

with road duplication to be concluded within five years.

To that end it has ordered 2,000 railway carriages from

AmstedMaxion and Randon for the transport of bulk

commodities in its various logistical corridors.

Tunneling under water

Railway concession holder Transnordestina Logística

(TLSA) on 26 March received R$400 million from Valec,

the federal railway builder, toward the 25 percent stake

the latter is taking in TLSA.

The government of São Paulo received proposals on 13

March from five consortia bringing together 18 enterprises interested in the contract for an underwater tunnel

between Santos and Guarujá, two coastal cities in the

state. The project, estimated to cost R$1.8 billion, will be

financed in part by the Inter-American Development Bank

(IDB), whose rules will apply to the tender. Some 11 Brazilian enterprises and 7 foreign ones will participate.

Taking a stake

Railway news

Running a ring round São Paulo

The railway ring around the city of São Paulo, Ferroanel, is

about to take off with support from the state of São Paulo

through a partnership between the government and the

private sector. The project is essential to improve access

to the port of Santos. It will cost R$2 billion.

Rolling stock

Vale subsidiary Valor de Logística Integrada (VLI) plans

to invest R$9 billion in ports and railways through to 2017.

The port of Itagui, Maranhão, is to receive up to R$3

billion through to 2020 in order to expand as the

Port prospects

…

april 2014 · Volume 03 · Number 04

4

16

Economy & Business

cargo hub for the center-west and “Matopiba” area: the

states of Maranhão, Tocantins, Piauí, and Bahia. The port

moved 15.3 million tons of goods in 2013, and volume is

expected to rise to 17 million tons.

The bulk of expected investment will come from the private sector. The Maranhão grain terminal, for example,

is under construction by a consortium that includes

Glencore Services and Trade, CGG Trading and Growth

Consortium, Amaggi Exportação, and NovaAgri. It is

expected to cost around R$600 million.

Banking and financial policy

5

16

S&P cuts, Moody doesn’t

Standard & Poor’s (S&P) has lowered Brazil’s debt rating

from BBB to BBB–, the agency’s lowest investment-grade

rating. At the same time, it cut the credit ratings of Petrobras, Eletrobras, and mining company Samarco. S&P

finds Brazilian fiscal targets “challenging,” and discards

as unlikely the possibility of any reform before the next

election.

The rating agency nevertheless clarified that Brazil is not at

risk of losing its investment grade. Another lowering of the

rating is “not on the horizon,” and the country’s prospects

are stable in light of the solid composition of its debt.

Only three days after the announcement, Brazil borrowed €1 billion with an overseas issue of bonds. Minerva,

a meat-packing company, issued US$300 million in

Veirano Advogados

Banking & Finance …

Energy & Environment

Politics, Law, Society

perpetual notes. It seems that the rating cut was mostly

ignored by investors.

Moody’s has decided to maintain Brazil’s credit rating at

Baa2 rather than follow the leadership of S&P. The agency

does not expect any surprises in either the domestic or the

international economic scenario in 2014, and intends to

wait for Brazilian election results and evaluate the proposals of a new government before adjusting its credit rating.

Central Bank policy

An unexpected hike in food prices has alerted the Brazilian

Central Bank to the risk of further inflation. While testifying on 18 March before the Senate Commission on Economic Affairs, Central Bank president Alexandre Tombini

signaled the possibility of new increases in the Selic basic

interest rate, due to the pressure of agricultural products.

He added, however, that monetary policy should be able

to soften the impact of this price shock.

International Affairs

papers denominated in reais yielded 3 percent interest this

year, and the proportion of Brazilian debt papers in foreign

hands rose to 16.5 percent in January. According to JP

Morgan, this is the highest yield in four years.

Bonds, bank bonds

In order to take advantage of a good phase in the market and obtain greater liquidity for some of its bonds,

the Banco do Brasil on 18 March issued bonds worth

€300 million, yielding 3.75 percent and due in July 2018.

Demand exceeded €800 million.

Stiff competition

The president of the US Ex-Im Bank, Fred Hochberg, visited Brazil in early April to attend a meeting of national

export credit agencies and to promote the bank’s activities in Brazil. Hochberg sees opportunities in various

parts of the Brazilian economy, such as oil and gas, mining, biofuels, the medical sector, air transport, and energy.

In its quarterly report on inflation, the Central Bank

expected the price index to remain above 6 percent per

year until the second half of 2015. The bank also advised

that it will extend the rising interest rate cycle and cut the

forecast for GDP growth from 2.3 to 2 percent in 2014.

Ex-Im Bank has lost 23 percent of its country portfolio

over the last five years, largely due to competition from

the National Bank for Economical Fund and Development

(BNDES). In 2012, Ex-Im disbursed US$28 billion globally.

The bank’s Committee on Monetary Policy (Copom)

announced on 2 April the ninth consecutive rise in the

basic interest rate, from 10.75 to 11 percent per annum,

the highest since November 2011.

The Ministry of Finance has renegotiated loans of R$238.2

billion to BNDES, equivalent to half the R$415.1 billion debt

owed by the bank to the National Treasury.

BNDES raises funds

Foreign investors stay the course

BNDES raised US$1.5 billion in early April by means of a

bond issue, in two tranches. This was the bank’s second

bond issue this year. The last one, of €650 million, was

directed at the European markets whereas this new one

was 80 percent subscribed by US investors.

Inspired by high interest rates and relatively low risk, US

asset managers have been buying Brazilian debt. Sovereign

On 27 March the bank closed financing contracts

This compares with 3.5 percent in Mexico and 12 percent

in Nigeria.

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Swiss roll into Brazil

Nearly three years after having bought 30 percent of the

capital of GPS Investimentos Financeiros e Participacoes,

which is the largest independent asset manager in Brazil,

Swiss banking group Julius Baer bought another 50

percent share, giving it a majority stake.

The deal, which cost the Zurich-based Baer 100 million

Swiss francs (US$113 million), is part of a drive to expand

abroad as a crackdown on tax evasion hits private

banking in Switzerland.

6

16

Moelis opens in São Paulo

New York-based investment bank Moelis & Company

has opened an office in São Paulo, its first in Latin America. Moelis focuses on financial advisory services and in

particular on mergers and acquisitions. It expects M&As

to surge in Brazil.

M&A activity has lagged behind the boom in equity markets. If merger activity catches up, boutique banks such as

Moelis will be in a good position to take advantage of the

rebound. The private equity firm is about to make an IPO.

Taxing overseas profit

At a meeting with large entrepreneurs held on 12 March,

Minister of Finance Guido Mantega accepted the idea of

changing Provisional Measure no. 627, which deals with

taxation of company profits earned overseas.

Specific changes to the measure will be proposed within a

fortnight by a working group consisting of representatives

of the business sector, the Ministry of Finance, and the

Federal Revenue (which objects to any changes).

Politics, Law, Society

Government debt

The savings that the government holds for payment of

interest on the public debt decreased nearly 50 percent in

January–February in relation to the same period in 2013.

The Central Bank has increased its forecast of the external

account deficit in 2014 from US$78 billion to US$80 billion. The increase is due principally to a reduction of the

trade surplus, which dropped from US$10 billion to US$8

billion this year.

International Affairs

photograph: wikimedia/United States Treasury Department

with the Japan Bank for International Cooperation (JBIC)

and Mizuho Bank, in the amount of US$800 million.

Energy & Environment

Minister for Social Security Garibaldi Alves regards the

government’s estimate of a R$40.1 billion deficit in the

social security system for 2014 as unrealistic. He puts the

figure at R$49.9 billion.

Rewarding innovation

Financiadora de Estudos e Projetos (FINEP), an agency of

the Ministry of Science and Technology, plans to increase

its innovation credit by 60 percent, raising the limit to

R$10 billion in 2014 from R$6.3 billion last year.

Economy and business

GDP growth estimates

The year 2014 began with activity above expectations

in terms of income, employment, industrial production,

retail sales, and cargo movements, and that means avoiding a drop in GDP growth in the first quarter of the year.

The International Monetary Fund (IMF) World Economic

Outlook, released on 8 April, forecasts growth of 1.8 percent in 2014, 2.7 percent in 2015, and 3.5 percent in 2019.

The head of PriceWaterhouse Coopers in Brazil, Fernando

Alves, estimated that GDP growth in 2014 of between 2

and 2.2 percent, and slightly less in 2015.

US Secretary of the Treasury Jacob Lew

Talking to the US

Minister of Finance Guido Mantega met US Secretary of

the Treasury Jacob Lew in São Paulo on 17 March to discuss the impact of a recovering US economy on emerging countries like Brazil. Mantega considers the recovery

insufficient.

The two also discussed the governance of the International Monetary Fund and new US sanctions against Russia prompted by the crisis in Ukraine.

What business wants

The American Chamber of Commerce in São Paulo

(AmCham), canvassed 170 São Paulo business people

representing large enterprises and found that 41.6 percent of them intend to invest more in Brazil in 2014. Two

factors are noted as deterrents: deficient infrastructure

and the lack of rainfall.

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Politics, Law, Society

Introduced by Lloyd’s

Brazil’s industrial production rose 2.9 percent in January

but is still far from recovery. Industry still operates at 4

percent below the record level of May 2011. The majority

of retail chains and manufacturers of consumer goods

plan to invest at the same level as 2013 (R$12.26 billion)

or higher in 2014.

Lloyd’s announced on 8 April the entry into the Brazilian

market of one of its underwriters. Bermuda-incorporated

insurer Hiscox, which specializes in niche areas such as

coverage of hacking, kidnapping, and satellite damage,

also offers property and contents insurance for highervalue properties. Hiscox is the latest company to enter

the Brazilian insurance and reinsurance market.

American giant private equity fund KKR (formerly Kohlberg Kravis Roberts and Co.) in early April closed the

purchase of a controlling share in Brazilian information

technology firm Aceco Ti, which specializes in the construction and maintenance of data centers. While the

cost of the acquisition was not disclosed, the company is

worth an estimated R$1.5 billion.

Card payment processing

Banco Santander Brasil announced on 7 April that it had

purchased the operations of GetNet Technologia for

R$1.104 billion. GetNet is one of the largest card payment

processors in Brazil, controlling about 6 percent of the

US$300 billion industry. It will be owned by Santander

Brasil’s own local card-processing unit.

IT complementarity

Chilean information technology company Sonda

announced on 13 March that it had bought Brazilian IT

company CTIS Tecnologia for about US$170 million. The

final acquisition price could increase by US$36 million,

depending on 2014–18 earnings. Sonda sees the acquisition as a way to increase its coverage in Brazil.

Veirano Advogados

Commercial Contracts …

International Affairs

photograph: Argo Tractors

Industrial production

Data center acquisition

7

16

Energy & Environment

A new plane from Embraer

Embraer on 12 February presented a new jet model in the

E175 category. A new wing design will permit up to 6.4

percent fuel economy. Embraer regards the 88-seat jet as

a transition to the newer generation of commercial jets.

Argo Tractors will open its first plant outside Europe in Belo Horizonte

Weg on the world stage

Vehicles and vehicle products

Tractor pull

Argo Tractors, an Italian manufacturer, is establishing

its first plant outside Europe in Brazil. To that end, it has

signed a memorandum of understanding with the government of Minas Gerais state for the installation of a plant in

the metropolitan area of Belo Horizonte. The investment

in fixed assets will be R$30 million.

Suspended animation

Eight months after buying a share of suspension manufacturer Suspensys from US company Meritor for US$200

million, the Brazilian group Randon, which specializes in the

production of heavy-duty vehicles, has started expanding

into the European, Asian, and African markets.

Truck tanks

Austrian automotive manufacturer Salzburg Aluminium

Group (SAG) opened its first factory in Brazil in early

April. Located at Jaguariúna, São Paulo, it will produce

aluminum tanks for trucks with an initial investment of

R$17 million.

Volkswagen invests

Volkswagen has defined a new investment cycle of R$10

billion in Brazil from 2014 to 2018. These resources will

be earmarked for the development of new products and

technologies in order to make the company the largest

global automotive manufacturer, ahead of Toyota.

Tires for all

Italian tire manufacturer Pirelli will invest R$500 million to

modernize and expand its factory at Campinas, São Paulo,

the largest plant for the company worldwide. Pirelli also

has plants in Santo André and Sumaré in São Paulo, Gravataí in Rio Grande do Sul, and Feira de Santana in Bahia.

Weg, a manufacturer of electric engines and domestic

electrical appliances with headquarters in the southern

state of Santa Catarina, has made another step toward

internationalization by acquiring a Chinese factory of

small electric engines.

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Unsold vehicles

At the end of March, 387,000 vehicles were left unsold

in automotive plants and retail stores. The number is

equivalent to 48 days of sales and is 60 percent higher

than average sales for the month.

Commodity companies invest

US commodities company Bunge is investing R$500

million in a new wheat mill in the state of Rio de Janeiro.

US commodities firm ADM announced on 12 February

that it plans to build a new complex for the production of

soy protein in Campo Grande, Mato Grosso do Sul, representing an investment of US$250 million.

8

16

New and bigger plants

Sweet news

Italian chocolate manufacturer Ferrero Rocher has operated a factory in Poços de Caldas, Minas Gerais, since

1983. On 18 February it announced a R$200 million

expansion.

Energy & Environment

Politics, Law, Society

Economists give voice

Reform and growth

other, in force since 2009, consisting of economic micromanagement. The latter has been a failure, as has the

policy of fiscal exemptions.

Antônio Delfim Neto, a former minister of finance, of planning, and of agriculture, wrote in his column in O Estado de

São Paulo of 8 April that Brazil needs coordinated reforms

of the budget, security system, labor code, and fiscal and

industrial policy.

The social contract requires that the state’s social expenditures rise at a higher rate than GDP, he noted, but Treasury credits for public banks must be reduced and tax

reform is crucial.

The only way to return to growth is by increasing productivity, says Neto, “and it won’t be easy. It is like changing

the tires on a truck that is moving.”

The failure of developmentalism

O Estado de São Paulo on 6 April published a full-page

interview with Samuel Pessoa, director of the Center for

Economic Growth at the Brazilian Institute of Economics

(IBRE). Pessoa is a prestigious economist and currently

advises putative presidential candidate Aécio Neves.

Vaccine factory

Merial, the veterinary arm of French laboratory Sanofi,

will invest €400 million in a new vaccine factory in Brazil,

thus reinforcing Sanofi’s presence in the sector of vaccines against foot-and-mouth disease.

He is a severe critic of the current economic model, which

he calls a “national development essay” and a tragedy for

the country. Pessoa insists on the need for reforms to make

the state more efficient without reducing its size, in order to

give it management tools to improve the delivery of health,

education, and security services. He suggested that Brazilian families today want equity rather than growth.

Crop protection products

TIDE Group is a Chinese company producing crop protection products. It is establishing a new plant in Brazil,

regarded as the world’s most promising market in this area.

He describes the formulation of Brazilian economic policy

as following two different agendas: one, reflected in the

1988 Constitution, aimed at developing a comprehensive

welfare state along the model of continental Europe; the

Bathroom appliances

Bathroom appliances manufacturer Roca Sanitários Brasil

has invested R$44 million in the first phase of a new

plant in Brazil.

International Affairs

Growth at what cost?

In an interview in O Estado de São Paulo on 23 March,

Workers’ Party stalwart Marcio Pochmann, who presides

over party think-thank Institute Perseu Abramo and was

formerly the director of the Institute for Applied Economic

Research (IPEA), voiced his opinion that the only question

about the Brazilian economy is how much it will grow.

In his opinion, a hybrid model is needed to involve the

private sector in managing the great block of investments

created from 2011 to 2012.

While the developed world lost 62 million jobs over that

period, Brazil created 11.5 million new ones, he asserted,

and about 72 percent of jobs in the country are related to

the services sector.

Although he indicated that Brazil has succeeded in

reconciling the three important objectives of democracy,

growth, and income distribution, he pointed to the need

for reform in such areas as taxation in order to consolidate

this process. Landowners pay little by way of taxes, and

Pochmann sees it as a “brutally” unequal policy.

Veirano Advogados

Labor & Employment …

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Oil & gas in brief

Cowan sell off blocks

9

16

Politics, Law, Society

account of Petrobras, was paralyzed for 40 days by a

strike. Some 29,000 workers went on strike and some

violent demonstrations ensued.

International Affairs

photograph: rolls-royce

Energy & Environment

Energy & Environment

Chevron okayed to resume drilling

Cowan Petroleo e Gas, the oil and gas arm of contractor

Cowan, intends to diversify its exploration areas. This

strategy has led the company to divest itself of a 65 percent interest in two oil exploration blocks in Namibia. US

oil company Murphy Luderitz has taken a 40 percent

share and will be the operator, and Austrian OMV will get

a 25 percent share.

US oil major Chevron has received permission from the

National Petroleum, Natural Gas, and Biofuels Agency

(ANP) to resume drilling in the existing wells in the Frade

field in the Campos basin. The field was temporarily shut

after leaks were discovered in November 2011 and March

2012, and permission to resume activity had been held up

by the company’s apparent failure to deliver a full report

on the causes.

In Brazil itself, Cowan participates in 18 blocks, and this

year expects to drill at least one block in the Recôncavo

basin, in the state of Bahia.

No damage was done to workers, wildlife, or the shoreline,

and ANP officials said there was no sign of negligence

by Chevron.

Rolls-Royce will construct a new plant at Duque de Caxias

Comperj hit by strike

Tender, but of what?

Comperj, the largest petrochemical complex in the state

of Rio de Janeiro and still under construction for the

The government expects the next tender for exploratory

blocks for oil and gas to take place before 30 June 2015,

but hasn’t yet decided whether it will be for pre-salt areas,

mature areas, or new frontiers.

Rio de Janeiro. The plant will assemble and test engines

and other maritime equipment used in offshore drilling

platforms and other vessels in oil and gas E&P.

Rogue reservoir

Shell Brasil is optimistic about its negotiations with Pré-sal

Petroleo (PPSA) over an exploration agreement regarding

block Gato do Mato (BM-S-54), located in the pre-salt

layer of the Santos basin.

Shell discovered the deposit and is its operator, but the

reservoir exceeds the concession area, intruding into an

adjoining area that belongs to the federal Union.

Veirano Advogados

Oil, Gas & Biofuels …

Maritime equipment plant

Rolls-Royce announced on 7 April that it would begin in

May the construction of a new plant at Duque de Caxias,

The plant will consume investment of R$80 million, and

its first commission is part of a US$100 million order from

Sete Brasil for equipment to be installed on six drilling

platforms.

Petrobras problems trickle down

Domestic producers of machinery, equipment, and technical solutions for the oil and gas sector are encountering

great difficulty in borrowing funds at the subsidized rates

of interest available to national enterprises providing

these goods and services.

The Inovapetro I program has R$3 billion available to

finance the development of submarine installations,

surface processing, reservoirs, and wells at belowmarket rates.

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

The enterprises involved are suppliers to Petrobras but

are having to shelve innovation projects given that company’s cash flow difficulties. The government now plans

to disburse just R$500 million, 16 percent of the total

earmarked funds. It does, however, expect to analyze

proposals and disburse resources by 2015, when pre-salt

exploration will be at full tilt.

Biofuels in brief

Sugarcane news

10

16

Confirming its interest in ethanol production, BNDESpar

has decided to acquire a share of up to R$300 million

in the Center for Sugarcane Technology (CTC). CTC is

owned by sugarcane giants Copersucar and Raízen, the

latter a joint venture of Cosan and Shell.

Drought has affected the objectives of Raízen for 2014–15.

The company will nevertheless process 65 million tons of

sugarcane in this harvest, maintaining previous levels and

permitting an 8–9 percent return on invested capital.

Consultancy Datagro forecast on 24 March, however,

that 574.6 million tons of sugarcane will be processed in

south-central Brazil from the 2014–15 harvest, 3.6 percent less than in 2013–14.

Suzano surges ahead

Suzano Papel e Cellulose is one of the largest companies

in the Brazilian paper sector. On 19 March it opened a

new cellulose factory in the municipality of Imperatriz,

Maranhão. The US$3 billion factory will increase Suzano’s

production of cellulose to 4.4 million tons per year, making it the world’s second-largest producer of blanched

cellulose from eucalyptus.

Energy & Environment

Politics, Law, Society

Petrobras news

New find, deep waters

International Affairs

form of senior bonds denominated in US dollars. With

this issue, the company will have raised US$20.5 billion

so far this year.

Petrobras has announced that it has found oil in deep

waters in the Potiguar basin, off the coast of Brazil’s

northeastern-most state, Rio Grande do Norte. The

well, informally christened Pitu, yielded oil 55 km off

the coast at a depth of 1,731 m. The well reached a total

depth of 5,353 m, and the hydrocarbon column measures 188 m. The oil has a density of 24º API.

In a rare move, however, the company’s Fiscal Advisory

Board (Conselho Fiscal) recommended on 14 March

that management reduce its financial leveraging to

avoid the possibility that risk classification agencies will

lower their ratings.

Record refining

The Supreme Federal Court (STF) on 18 March

suspended the distribution of R$4 billion in royalties by

Petrobras for one year.

Petrobras reached a record volume of processing at

its refineries during the month of March, The average

volume processed was 2.151 million b/d, exceeding

by 12,000 b/d the former record of 2.139 million b/d,

reached in July 2013.

Borrowing for Abreu e Lima

Petrobras has borrowed R$4 billion (US$1.8 billion)

in a 17-year loan from Banco Bradesco SA to help pay

for work on the Abreu e Lima refinery in northeastern

Brazil and at the Comperj petrochemical complex in Rio

de Janeiro, a source with direct knowledge of the deal

said on 8 April.

The maritime support fleet

Petrobras CEO Maria Graça Foster gave a press

conference on 17 March that presented an evaluation of

the six-year Program for the Renewal of the Maritime

Support Fleet for E&P (Prorefarm). Her main message

was that the fulfillment of local content requirements

is not as important as is the timely fulfillment of

production targets.

Raising funds

The program involves the construction of 146 support

vessels, with high local content requirements. So far

only 87 contracts have been signed, and 61 vessels are

under construction.

Petrobras on 10 February raised US$8.5 billion in the

capital market, against demand of US$23 billion, in the

Overall, Petrobras has 504 vessels under contract,

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Energy & Environment

Politics, Law, Society

of which 265 are Brazilian built, 213 are foreign,

and 26 were provided under a special regime. The

local content varies from 50 percent (for anchor

handling and tug supply, or AHTS) to 60 percent

(for platform supply vessels, or PSV) and oil spill

response vessels (OSRV).

Fuel price adjustment

11

16

Graça Foster on 27 March advised analysts that

there will be another fuel price adjustment this year,

despite the impending election. The last adjustment

took place four months ago. Fuel imports this year

will generate a deficit of US$11.5 billion, according to

the National Petroleum, Natural Gas, and Biofuels

Agency (ANP).

Changing the guard

Minority shareholders for the first time succeeded

in electing two independent representatives to the

Petrobras board, defeating state pension fund representatives and other minority shareholders linked

to the government. Thus, the board will have three

independent representatives and the government

has had its influence reduced to seven seats.

Entrepreneur Jorge Gerdau was replaced by José

Guimarães Monforte, a former Citibank executive in

New York.

A group of foreign investors led by British firm

Aberdeen Assets that collectively own 0.5 percent of

Petrobras equity is advocating for a new independent

seat on the board in order to improve the company’s

governance.

CHS Inc., a US agricultural cooperative business with

global revenues of US$44 billion, has been operating in

Brazil for 11 years. On 18 March the company signed a

contract for the exclusive purchase of ethanol produced

by Brazilian firm Usibiorefinarias, from Rio Grande do

Sul. The ethanol is made from a strain of rice known as

“giant rice,” developed by Embrapa and not fit for human

consumption.

photograph: flickr/nasa

Ethanol barter

International Affairs

The idea is for the companies to evolve together by

means of ethanol barter operations, exchanging fertilizer

for biofuel.

Sugar, sugar

The world’s largest trading company for sugar was born

on 27 March as a result of a joint venture between Cargill

and Copersucar. Together they represent 25 percent of

global exports of sugar.

Electricity sector

Drought and rationing

The Committee for Monitoring the Electric Sector has

raised the risk of electricity rationing in Brazil from “very

low” to “low,” according to Minister for Mines and Energy

Edison Lobão. The continuing severe drought has depleted

reservoirs, requiring the operation of thermoelectric plants

as a complement to hydropower generation.

According to consultancy PSR the risk of a cut of 4

percent or higher in energy consumption rose from 24

to 46 percent. A reduction of this proportion could mean

energy disconnection for 12 million homes.

The executive secretary of the Ministry, Marcio

Brazil’s Sao Simao Reservoir

Zimmerman, testifying on 18 March at a public hearing in

the Chamber of Deputies, acknowledged for the first time

that Brazil faces an energy crisis. Thermoelectric plants

generate 20,000 MW, but they operate at a much higher

cost than hydropower plants, and that cost increased to

R$10 billion in the first quarter of 2014.

According to analysts at Citi Research and BTG Pactual,

it is highly unlikely that the goals established by official

agencies to avoid electricity rationing will be adopted.

Rescue package for distributors

In order to avoid further increases in electricity bills, the

government announced a rescue package of R$12 billion

to power distributors on 13 March. R$4 billion will come

from the Treasury and R$8 billion in the form of financing

through the Chamber for Marketing Electric Energy

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

(CCEE). In order to reduce the burden on the Treasury,

the government intends to raise the PIS/Cofins tax on

imported products.

According to Brazilian Electricity Regulatory Agency

(ANEEL), the package of aid will be paid in 2015 and will

cost consumers up to 9 percent on their electricity bills.

Private Brazilian banks on 20 March presented a proposal

to the Ministry of Finance that the Chamber of Electric

Power Markets (CDCEE) raise the needed R$8 billion on

the capital market.

Eletrobras losses

12

16

The renewal of electric concessions in 2012 has affected

cash flow for Eletrobras so deeply that it has been obliged

to fire over 4,400 employees, thereby reducing its expenditures by 16 percent. It has even moved its headquarters

from a building in downtown Rio de Janeiro to cheaper

one in Botafogo.

Eletrobras lost R$19 billion in 2013 and requires a financial

injection of R$10 billion in 2014.

Selling in the free market

Brazilian enterprise Alupar is accelerating construction

of the Ferreira Gomes hydropower plant, located on the

Araguari River in the state of Amapá, with the hope of

selling energy on the spot market in the second half of

this year. The plant has an installed capacity of 252 MW,

70 percent of which is to be sold to the regulated market,

leaving Alupar free to sell 30 percent to corporate clients

on the free market.

Veirano Advogados

Electric Energy …

Energy & Environment

Politics, Law, Society

International Affairs

Politics, Law, Society

Rousseff

Pressure in the Chamber

Rousseff, who built a reputation as an efficient and

effective manager while in the previous administration,

has had her aura eroded by the glaring deficiencies of the

Program to Accelerate Growth (PAC), for which she had

direct responsibility.

On 13 March, yielding to intense pressure from the Brazilian Democratic Movement Party (PMDB) and allied

parties, President Dilma Rousseff nominated several new

cabinet ministers (see Table 1).

PMDB is the largest party in the Chamber of Deputies,

with 75 representatives, and it is hopelessly split between

a faction that endorses the government, led by Vice-President Michel Temer, and one that is hostile to it, led by the

party leader in the Chamber, Deputy Eduardo Cunha.

Indeed, Cunha has managed to form a mini-coalition of

eight parties (including PMDB), called Blocão (Big Block),

to fight the government on some important bills. The

differences between the two factions seem at present

irreconcilable.

As a consequence, Rousseff recently suffered another

defeat in the Chamber, as after much debate various

commissions demanded the presence of no fewer than

10 cabinet ministers to testify on various issues. The

request was led by Blocão.

The campaign heats up

A Datafolha poll released on 5 April showed a six-point

slide in voter intentions for President Dilma Rousseff,

though at 38 percent she still enough to ensure victory

in the first ballot. Aécio Neves and Eduardo Campos

maintained the level of support shown in a February poll,

with 16 percent and 10 percent respectively.

More recently, the string of scandals at Petrobras, whose

board she chaired, have further dented her reputation,

and the opposition is making hay of it.

Campos/Silva

Only six months before the election, and six months after

the announcement of a national alliance between the

Brazilian Socialist Party (PSB) of Eduardo Campos and

Marina Silva’s Sustainability Network (Rede), the two

parties still do not know if the alliance will be sustained

in the gubernatorial elections for at least half of the 27

states. Silva’s party objects to PSB’s “maintenance of the

old politics.”

Campos himself is still unknown by most electors, and

in order to gain national exposure will travel throughout

the country, followed by Silva. He left the governor’s seat

in Pernambuco on 4 April in order to devote himself full

time to the presidential campaign.

After months of generic accusations against the government, Campos of late has started direct attacks against

the president, saying on 10 March that “Brazil can’t stand

five more years of Rousseff.” He has, however, asserted

that his party will not engage in confrontation with former

president Lula da Silva, who is stumping for Rousseff.

The Campos/Silva team has endorsed an orthodox policy

of austerity, prioritizing control of inflation, and has surrounded itself with economic advisors inherited mostly

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Energy & Environment

Politics, Law, Society

NomineeMinistryCurrent position

Gilberto Occhi

Cities

Caixa Econômica Federal vice-president

Miguel Rossetto

Agrarian Development

Petrobras Bio-combustíveis president

Vinícius Nobre Lages

Tourism

SEBRAE international advisor

Neri Geller

Agriculture

Secretary for Agricultural Policy

Eduardo Lopes

Fisheries

Senator

Clélio Campolina Dias

Science and Technology

Federal University of Minas Gerais rector

Ricardo Berzoini

Institutional Development

–

Institutional Development

13

16

from the Real Plan, in particular André Lara Resende,

Pérsio Arrida, and Eduardo Giannetti da Fonseca.

Neves

Senator Aécio Neves of the Brazilian Social Democracy

Party (PSDB) is now on the political offensive. He led

efforts for the creation of a commission of inquiry into

scandals at Petrobras and is intensifying his contacts with

the São Paulo business community.

Neves has selected Armínio Fraga, José Roberto

Mendonça de Barros, and Mansueto Almeida as his economic advisors.

On 31 March, he declared his support for a bill that

reduces the minimum age of criminal responsibility from

18 to 16 years for certain categories of crimes and argued

that the tax burden needs to be lightened.

Maranhão governor Roseana Sarney, Brazilian

Democratic Movement Party (PMDB)

n Mato Grosso do Sul governor André Puccinelli, PMDB

n Mato Grosso governor Silval da Cunha Barbosa, PMDB

n Ceará governor Cid Gomes, Republican Party of the Social Order (PROS)

n Bahia governor Jaques Wagner, Workers’ Party (PT)

n Alagoas governor Teotônio Vilela, PSDB.

n

Table 1: Cabinet minister nominees

Ideli SalvatiHuman Rights

International Affairs

Senators and governors

In this year’s election to Congress, there will be only

one eligible vacancy per state for the Senate. IBOPE

polls show that voters still support state governors such

as Omar Aziz in Amazonas and Antonio Anastasia in

Minas Gerais. Governor Siqueira Campos of Tocantins,

a Brazilian Social Democracy Party (PSDB) member,

resigned on 4 April and may run for the Senate.

Contrary to expectations, Chief Justice Joaquim Barbosa

of the Supreme Federal Court didn’t resign before 4 April,

which means that he will not run for office but will remain

on the Court at least until the end of this year, when his

turn in the presidency expires.

Six state governors have decided to complete their terms

and thus cannot be reelected in 2014:

Workers’ Party plans

The Workers’ Party (PT) plans to have run its own

gubernatorial candidates in 12 states, and to support

those of the Brazilian Democratic Movement Party

(PMDB) in another seven. The states where PT will put

up its own candidates include the three largest electoral

colleges in the country and are as follows: São Paulo, Rio

de Janeiro, Minas Gerais, Rio Grande do Sul, Piauí, Bahia,

the Federal District, Acre, Paraná, Mato Grosso do Sul,

Roraima, and Goiás.

In Amazonas, Pará, Sergipe, Alagoas, Paraíba, Mato

Grosso, and Tocantins, and possibly also in Maranhão

and Roraima, it will support PMDB candidates.

PT has also named the coordinators of the government’s

program in a possible second term by President Rousseff:

Mario Aurelio Garcia, special advisor to the president for

international affairs; and economist Alessandro Teixeira,

special advisor in the president’s personal cabinet. They

were also responsible for the campaign in 2010.

Veirano Advogados

Government & Regulatory …

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Politics in brief

Peace offerings?

President Rousseff on 10 March received a delegation of

deputies and senators from Brazilian Democratic Movement Party (PMDB). She offered them airports in the

states of Maranhão, Pará, Sergipe, Alagoas, Tocantins,

and Paraíba.

Real celebration

Politics, Law, Society

Defense issues

Army purchases

The Brazilian Army has purchased RB870 anti-aircraft

missiles, produced by Swedish aircraft manufacturer

SAAB and valued at R$29.5 million.

On 24 March, the Army also received 13 new armored

vehicles. The amphibious Guaraní, a successor to the

Urutu EE11, was delivered to the 15th Brigade of Mechanized Infantry at Cascavel, Paraná, on the border with

Paraguay.

Cardoso remarked that “there is indeed an opposition in

Brazil, and the country is adrift.”

The Guaraní weighs 18.3 tons and has a speed of 100

km/h. It requires two operators and carries eight combatants. As with the Urutu, which was exported to 18

countries and is still in use, Brazilian defense authorities

see a huge foreign market for the Guaraní.

Keeping the Amnesty Law

New trainers?

President Rousseff, herself a victim of torture during the

military period (1964–85) indicated on the 50th anniversary of the military coup of 1964 that she does not agree

with the revision of the Amnesty Law of 1979 desired by

many left-wing groups and NGOs such as Amnesty International, which advocates changes in its text.

The Brazilian Air Force (FAB) is evaluating the possibility of replacing the Neiva T-25 Universal aircraft with

In a speech at Planalto Palace, Rousseff endorsed a 2010

decision of the Supreme Federal Court that regards the

Amnesty Law as constitutional.

Promising PAC

President Rousseff announced on 4 April, in São José

do Rio Preto, São Paulo, that she would launch the third

phase of the government’s Program to Accelerate Growth

(PAC 3) in August – only two months before the election.

International Affairs

photograph: Iveco

14

16

To celebrate the 20th anniversary of the Real Plan, which

put an end to galloping inflation in Brazil, a seminar took

place in São Paulo on 12 March. Former president Fernando Henrique Cardoso attended along with most of

his economic collaborators, a large segment of whom are

now providing economic advice to Aécio Neves.

Energy & Environment

The Guaraní weighs 18.3 tons and has a speed of 100 km/h

the 100 percent Brazilian-made T-Xc training aircraft,

developed by Novaer Craft. The T-25 has been in

use for 40 years in the primary training of Air Force

Academy cadets.

It will emphasize infrastructure and logistics projects.

Incriminating disclosures

Legal issues

Following incriminating disclosures of his connections with a foreign exchange dealer currently under

arrest, Deputy André Vargas of the Workers’ Party (PT)

obtained a 60-day leave of absence. He is the vicepresident of the Chamber of Deputies.

Another mensalão case?

Attorney-General Rodrigo Janot on 27 March requested

that former federal deputy Eduardo Azeredo (PSDBMG) be tried by the Supreme Federal Court for participating in the mensalão cash-for-votes scandal in the

state of Minas Gerais.

Veirano Advogados

Dispute Resolution …

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

Politics, Law, Society

Diplomatic briefs

Curbing campaign donations

Taking Venezuela in hand

A majority of the Supreme Federal Court voted against

political donations by corporate entities. Five more justices

still have until July to vote on this type of campaign finance

in order to implement the decision by the October election.

Foreign ministers of the South American regional group

Unasur met on 7 April in Caracas and talked with

Venezuelan President Nicolás Maduro for over an hour in

an attempt to end violence in that country over inflation

and food shortages. The Unasur commission had already

visited Venezuela in late March as part of its attempt to

foster a peaceful resolution.

A better future?

The UN Scientific Panel on Climate Change has moderated its forecast of 2007. At that time it predicted that

the Amazon forest would become a savanna. Seven years

later, in the light of currently available data, the scenario is

considerably less pessimistic.

High pay, high employment

In 2013, 87 percent of salary adjustments in Brazil

exceeded inflation. Employment will be the principal banner in President Dilma Rousseff’s re-election campaign,

as unemployment is now at an historic low of 4.8 percent.

Violence against the media

The mid-year session of the Inter-American Press Association in early April in Barbados heard a report from the

Brazilian Newspaper Association denouncing violence

against the media in Brazil. The report listed four deaths

and 66 cases of aggression against journalists from October 2013 to March 2014, encompassing cases of judicial

censorship, imprisonment, and intimidation. Minister

of Justice José Eduardo Cardozo has acknowledged the

gravity of the situation.

International Affairs

Brazilian Foreign Minister Luiz Alberto Figueiredo was

on a mediation committee along with diplomats from

Colombia, Ecuador, and other countries, participating

in a dialogue with all political forces in Venezuela. As a

result, on 14 April, Maduro met representatives of the

opposition Democratic Unity Roundtable (MUD) for the

first time since the disturbances began in mid-February.

US Secretary of State John Kerry on 13 March had

expressed the wish that the Unasur mission would

consult all parties concerned and hoped for third-party

participation in the mediation process, possibly by

Brazil. President Dilma Rousseff has decided to keep

Brazil distant from the crisis, however, and to exercise

diplomacy only within the framework of Unasur – clearly

with a view to the upcoming election.

Ignoring an activist

The Brazilian Foreign Ministry has officially ignored the

presence in Brazil of former Venezuelan deputy Maria

Corina Machado, who was expelled from the Venezuela

Chamber of Deputies because of her opposition to

Nicolás Maduro.

International Affairs

photograph: flickr/Hugo Chávez

PT is pressuring Vargas to resign, since further disclosures in the case may compromise his role in the Petrobras commission of inquiry. The case will be adjudicated

by the Supreme Federal Court.

Social issues

15

16

Energy & Environment

Venezuelan President Nicolás Maduro

Machado came to Brazil to ask it to take a firmer position in regard to the mediation by Unasur. On 2 April,

she made a speech in the Brazilian Senate in which she

described human rights violations by the Maduro government and was very much applauded.

Abstaining over Crimea

With 100 governments voting in favor, 11 against, and

58 abstentions, the UN General Assembly on 27 March

condemned the annexation of Ukraine’s Crimea by Russia.

Brazil was among those abstaining.

Managing the Internet

The Committee for Management on the Internet (CGI.br)

on 5 April finalized the text to be presented to the NET

World Conference scheduled for 23–24 April in São Paulo.

The civil framework for the Internet was approved by

the Chamber of Deputies, and its advocates are already

talking about a global project.

…

april 2014 · Volume 03 · Number 04

Viewpoint

Economy & Business

In the meantime, the bill is pending approval by the

Senate. It is hoped that it will be approved by 22 April,

when Brazil will host an international conference on

governance of the Internet. The bill’s main point is the

neutrality of the network.

Patting oneself on the back

President Dilma Rousseff gave the inaugural speech at

the 64th annual meeting of the Inter-American Development Bank (IDB) board of governors on 4 April at the

Costa do Sauípe resort on the coast of Bahia. Her speech

downplayed a negative Standard & Poor’s report on

the Brazilian economy and heaped praise on her own

administration.

16

16

Finding friends in BRICS

The next BRICS summit will take place in Brazil next

July. It is expected that Russia will take a more positive

approach toward two BRICS initiatives that it had offered

only lukewarm support to earlier: the creation of a BRICS

development bank and also of a contingency reserve.

It seems Russia wants the support of large emerging

economies like Brazil when it comes to matters such as

UN sanctions over the annexation of Crimea.

Energy & Environment

Politics, Law, Society

International trade in brief

Nixing Mercosur?

International Affairs

percent to US$239.6 billion and exports dropped 1 percent

to US$242.2 billion.

Putative presidential candidate Aécio Neves, in a speech

delivered in Porto Alegre on 7 April, proposed the end

of Mercosur “as it does not represent the interests of

Brazilians.” Instead he proposes a free foreign trade

area, “in partnership with countries with which Brazil has

complementarities.”

The small trade surplus was pushed principally by a 14

percent rise in petroleum imports in relation to 2012, the

tax burden, deficient infrastructure and logistics, and

high labor costs. Among external factors are a weaker

economy in China, Brazil’s largest market, and weaker

commodity prices.

A boost for Argentinean imports

The Brazilian government expects that the World Soccer

Cup of 2014 will improve matters, generating US$11

billion and about the same amount in public investment.

The elections, the first round of which will take place on 5

October, may also influence trade results.

Brazil has established a credit line of R$2 billion to finance

Argentinean imports of Brazilian products. To that effect,

a Brazilian mission visited Buenos Aires on 14 March,

headed by the new minister for development, industry,

and foreign trade, Mauro Borges, for discussions with the

Argentina authorities.

The officials also discussed the formulation of a joint

proposal by Mercosur to the European Union, with a view

to effecting the free trade agreement that has been under

discussion for 13 years.

Trade surplus shrinking

Brazil’s trade surplus shrank in 2013 as imports rose 6.5

Taking it to the WTO

The government of Japan has joined the European Union

in questioning Brazilian fiscal incentives before the World

Trade Organization (WTO).

Veirano Advogados

VistaBrazil 04.14

april 2014 · Volume 03 · Number 04

Viewpoint