Equity Valuation for New Generation Cooperatives

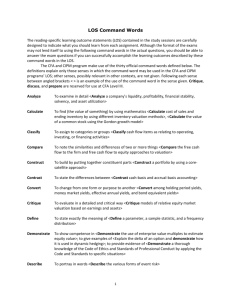

advertisement