QCLN Fund Report

advertisement

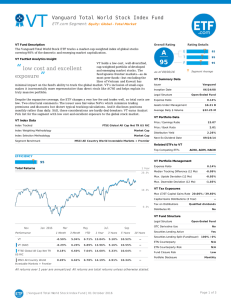

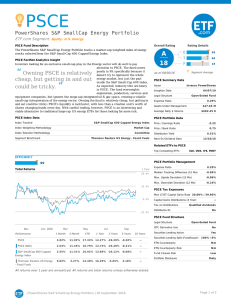

QCLN First Trust NASDAQ Clean Edge Green Energy Index Fund ETF.com Segment: Equity: Global Renewable Energy QCLN Fund Description Overall Rating The First Trust NASDAQ Clean Edge Green Energy Index Fund tracks a market-cap-weighted index of US-listed firms involved in clean energy. QCLN FactSet Analytics Insight QCLN holds a broad portfolio of US-listed firms in the clean energy industry. Eligible companies must be manufacturers, developers, distributors, or installers of one of the following four sub-sectors: advanced materials (that enable clean-energy or reduce the need for petroleum products), energy intelligence (smart grid), energy storage and conversion (hybrid batteries), or renewable electricity generation (solar, wind, geothermal, etc). Because there is subjectivity in classifying companies as “clean energy”, potential investors would be well-served by reviewing the fund’s portfolio to make sure your definition of “clean energy” matches QCLN’s. This ETF is among the least expensive and most liquid funds in its segment, making it a strong contender for investors considering the space. “ QCLN holds a broad portfolio of US-listed firms in the clean energy industry ” QCLN Index Data Rating Details B 90 21 21 66 Segment Average as of 09/30/16 QCLN Summary Data Issuer First Trust Inception Date 02/08/07 Legal Structure Open-Ended Fund Expense Ratio 0.60% Assets Under Management $52.73 M Average Daily $ Volume $125.44 K QCLN Portfolio Data Index Tracked NASDAQ Clean Edge Green Energy Index Price / Earnings Ratio Index Weighting Methodology Market Cap Price / Book Ratio Index Selection Methodology Market Cap Distribution Yield Segment Benchmark Thomson Reuters Global Renewable Energy 208.82 2.01 1.43% Next Ex-Dividend Date 12/21/16 Related ETFs to QCLN Top Competing ETFs GEX, ICLN, KWT, YLCO EFFICIENCY QCLN Portfolio Management 90 Total Returns 1 Year 40.0% Expense Ratio 0.60% Median Tracking Difference (12 Mo) 0.06% Max. Upside Deviation (12 Mo) 0.64% Max. Downside Deviation (12 Mo) 20.0% -0.12% QCLN Tax Exposures Max LT/ST Capital Gains Rate 20.00% / 39.60% Capital Gains Distributions (3 Year) 0.0% Tax on Distributions -- Qualified dividends Distributes K1 No QCLN Fund Structure Legal Structure Nov Jan 2016 Performance Mar 1 Month May 3 Month YTD Jul 1 Year 3 Years Sep 5 Years Open-Ended Fund OTC Derivative Use 10 Years QCLN -0.22% 7.13% -5.72% 11.12% -1.81% 8.74% -- QCLN (NAV) -0.38% 6.77% -5.65% 10.93% -1.76% 8.54% -- NASDAQ Clean Edge Green Energy Index -0.41% 6.42% -6.19% 10.29% -1.95% 8.22% -- Thomson Reuters Global Renewable Energy 0.20% 10.66% -9.66% 17.81% 15.56% 8.39% -- Securities Lending Active Securities Lending Split (Fund/Issuer) ETN Counterparty No Yes 100% / 0% N/A ETN Counterparty Risk N/A Fund Closure Risk Low Portfolio Disclosure Daily All returns over 1 year are annualiz ed. All returns are total returns unless otherwise stated. | First Trust NAS DAQ Clean Edge Green Energy Index Fund | 30 S eptember 2016 Page 1 of 3 TRADABILITY 66 QCLN FactSet Analytics Block Liquidity AVERAGE SPREAD 5 0.5% 4 0.4% 3 0.3% 2 0.2% 1 0.1% 0% PREMIUM/DISCOUNT 1.0% This measurement shows how easy it is to trade 25,000 shares of QC LN. QC LN is rated a 5 out of 5. QCLN Tradability Avg. Daily Share Volume 8,370 Average Daily $ Volume $125.44 K Median Daily Share Volume 0.0% 6,665 Median Daily Volume ($) $102.75 K Average Spread (%) 0.22% Average Spread ($) -1.0% $0.03 Median Premium / Discount (12 Mo) Max. Premium / Discount (12 Mo) VOLUME 400K 300K OCT `16 APR JUL -0.05% 0.68% / -0.84% Impediment to Creations None 200K Market Hours Overlap 100.00% 100K Creation Unit Size (Shares) 50,000 Creation Unit/Day (45 Day Average) `16 0.13 Creation Unit Cost (%) 0.07% Underlying Volume / Unit 0% Open Interest on ETF Options -- Net Asset Value (Yesterday) $14.95 ETF.com Implied Liquidity 5 FIT QCLN Benchmark Comparison 21 QCLN Sector/Industry Breakdown QCLN Top 10 Holdings QCLN 38 Holdings Shared Holdings 9 (Count) S ec tor QCLN Benc hmark Linear Technology Corporation 9.89% Semiconductors 31.51% -- Tesla Motors, Inc. 8.08% Renewable Energy 20.63% 95.52% Acuity Brands, Inc. 7.93% First Solar, Inc. 7.01% Hexcel Corporation 5.88% Large Cree, Inc. 4.55% (>12.9B) Microsemi Corporation 4.51% Universal Display Corporation 4.31% ON Semiconductor Corporation 4.03% Mic ro SolarCity Corp. 3.84% (<600M) Equipment & Services Electrical Components & 9.06% -- Equipment Electric Utilities 8.81% -- Auto & Truck Manufacturers 8.08% -- Construction Supplies & 7.93% -- Fixtures Aerospace & Defense 5.88% -- Independent Power 2.81% -- Total Top 10 Weighting 60.03% Producers QCLN Geographic Exposure2.00% Renewable Fuels Commercial REITs Countries United States 4.48% 1.40% QCLN Benc hmark-- Regions 97.44% 22.59% 2.56% 6.91% Asia-Pacific United Kingdom -- 1.23% Europe India -- 3.56% Developed / Canada -- 0.75% Emerging Split Norway -- 0.88% Denmark -- 38.67% China Taiwan, Province of China North America QCLN Benc hmark Benchmark 34 Constituents 19.79% (Weight) QCLN Weighted Average Market Cap Benchmark 6.99 B 7.69 B 17.97% 38.67% Mid (>2.7B) 38.22% 22.01% S mall 38.08% 26.04% 5.73% 13.28% 208.82 24.34 Size Split (>600M) Price / Earnings Ratio Price / Book Ratio 2.01 2.10 Dividend Yield 1.21% 0.99% Number Of Holdings Concentration 38 34 High High 97.44% 23.34% 2.56% 22.90% QCLN Performance Statistics -- 53.76% Goodness of Fit (R 2) 0.48 Beta 0.69 Up Beta 0.58 89.53% / 97.44% / 10.47% 2.56% 2.83% | First Trust NAS DAQ Clean Edge Green Energy Index Fund | 30 S eptember 2016 Down Beta Downside Standard Deviation 0.68 1.30% Segment Benchmark Page 2 of 3 -Hong Kong -- 16.31% Other Thomson Reuters Global Renewable Energy 6.26% -0.00% © 2016, ETF.com The data and information contained herein is not intended to be investment or tax advice. A reference to a particular investment or security, a credit rating, or any observation concerning a security or investment provided in the ETF.com Service is not a recommendation to buy, sell, or hold such investment or security or to make any other investment decisions. You should not use such information for purposes of any actual transaction without consulting an investment or tax professional. ETF.com DOES NOT TAKE RESPONSIBILITY FOR YOUR INVESTMENT OR OTHER ACTIONS NOR SHALL ETF.com HAVE ANY LIABILITY, CONTINGENT OR OTHERWISE, FOR THE ACCURACY, COMPLETENESS, TIMELINESS, OR CORRECT SEQUENCING OF ANY INFORMATION PROVIDED BY ETF.com OR FOR ANY DECISION MADE OR ACTION TAKEN BY YOU IN RELIANCE UPON SUCH INFORMATION OR ETF.com. [ETF.com DOES NOT PROVIDE ANY RESEARCH OPINIONS.] ETF.com MAKES NO REPRESENTATIONS ABOUT THE SUITABILITY OF THE INFORMATION, PRODUCTS OR SERVICES CONTAINED HEREIN. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Data provider: FactSet Research Systems, Inc. | First Trust NAS DAQ Clean Edge Green Energy Index Fund | 30 S eptember 2016 Page 3 of 3