Lululemon Athletica Case Study

advertisement

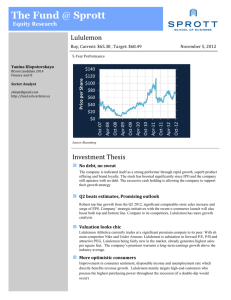

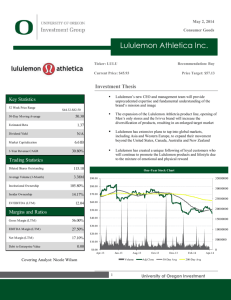

Lululemon Athletica, Inc. Ralph Forgeon Caroline Carlson Robert Livingston Hanz Masood Courtney Fields Bus 475: Seminar in Strategy and Policy Dr. Ybarra May 1, 2014 1 Introduction Lululemon Athletica Inc. designs and retails athletic clothing. The Company produces fitness pants, shorts, tops and jackets for yoga, dance, running, and general fitness. Lululemon serves customers globally through its online and 254 retail stores. Mission and Goals Mission Statement: Creating components for people to live longer, healthier, fun lives. Lululemon has developed a distinctive community-based strategy that we believe enhances the brand and reinforces guest loyalty. The key elements of the company’s strategy is to: - Design and develop innovative athletic apparel that combines performance with style and incorporates real-time guest feedback - Locate stores in street locations, lifestyle centers and malls that position each Lululemon Athletica store as an integral part of its community - Create an inviting and educational store environment that encourages product trial and repeat visits; and - Market on a grassroots level in each community, including through social media and influential fitness practitioners who embrace and create excitement around our brand. 2 Growth Strategy Key elements of Lululemon’s growth strategy are to: ● Grow the Store Base in North America. As of February 2, 2014, the company’s products were sold through 225 corporate-owned stores in North America, including 171 in the United States and 54 in Canada. Lulu expects that most ofthe near-term store growth will occur in the United States. The company opened 36 net stores in the United States, including three ivivva branded stores, and three net stores in Canada in fiscal 2013, including one ivivva branded store, and they plan to open up to 39 new stores, including ten ivivva athletica branded stores in North America in fiscal 2014. ● Expand Beyond North America. As of February 2, 2014, Lululemon operated 25 corporate-owned stores in Australia, four corporate-owned stores New Zealand, and 17 showrooms outside of North America. The company plans to open two new Lululemon stores in fiscal 2014 in Australia and two other new stores internationally in fiscal 2014. Over the next two years the company intend to open additional showrooms as preseeding activities in the Asian and European markets. ● Develop Direct to Consumer Sales Channel. The company launched their retail website in the first quarter of fiscal 2009. The addition of e-commerce to their direct to consumer sales channel expanded their customer base and supplemented their growing store base over the past four years. The company operates country and region specific websites in Australia, Europe and Asia, and brand specific websites in North America. Lululemon 3 plans to continue developing e-commerce website to provide a distinctive online shopping experience and extend their reach. ● Increase our Brand Awareness. The company plans to continue focusing on increasing brand awareness and customer loyalty through amplification of their brand stories and their grassroots marketing efforts, social media activities and planned store expansion. The company believes that increased brand awareness will result in increased comparable store sales and store productivity over time. ● Introduce New Product Technologies. The company remains focused on developing and offering products that incorporate technically advanced fabrics and innovative functional features that differentiate Lululemon in the market. Collaborating with leading fabric manufacturers, the company has jointly developed and trademarked names for innovative fabrics such as Luon and Silverescent. Among their ongoing efforts, the company is developing fabrics to provide advanced performance features such as UV protection and inherent reflectivity. In addition, the company plans to continue to develop differentiated manufacturing techniques that provide greater support, protection, and comfort. ● Broaden the Appeal of Products. The company will selectively seek opportunities to expand the appeal of the brand to improve store productivity and expand their market. To enhance product appeal, the company intends to: 4 ● Expand Product Categories. The company continues to expand product offerings in complementary existing and new categories such as swim, tennis and golf; ● Increase the Range of Athletic Activities Products Target. The company believes their guests purchase products mainly for activities such as yoga, running and general fitness. The company will continue to expand product categories and educate guests on the versatility of products; ● Grow the Men's Business. The company believes the premium quality and technical rigor of our products will continue to appeal to men and that there is an opportunity to expand the men's business as a proportion of our total sales; and ● Develop our Youth Brand. The company launched our youth focused brand, ivivva athletica, in fiscal 2009. We believe the premium quality and technical rigor of our dance-inspired products designed for female youth serve an open market and provide us with an opportunity for future growth. Customer Base Lululemon’s target demographic is predominantly the well-educated, upper middle class woman that values her appearance. Overall, Lulu directs their products to those who take part in an active, healthy lifestyle, typically with a larger disposable income. Their premium price reflects their top of the line, high quality fabrics and trend setting style. To many consumers, buying a Lulu item is a step towards buying your ticket of acceptance into the culture of elite and luxurious fitness. 5 Company History After 20 years in the surf, skate and snowboard business, founder Chip Wilson took the first commercial yoga class offered in Vancouver and found the result exhilarating. To Wilson, the post-yoga feeling was so close to surfing and snowboarding that it seemed obvious that yoga was an ideology whose time had come (again). Figure: Company Vehicle Cotton clothing was being used for sweaty, stretchy power yoga and seemed completely inappropriate to Chip, whose passion lay in technical athletic fabrics. From this, a design studio was born that became a yoga studio at night to pay the rent. Clothing was offered for sale and an underground yoga clothing movement was born. The success of the clothing was dependent on the feedback from yoga instructors who were asked to wear the products and provide their insights. Founded in 1998, lululemon's first real store opened in the beach area of Vancouver BC called Kitsilano, in November of 2000. The idea was to have the store be a community hub where people could learn and discuss the physical aspects of healthy living from yoga and diet to running and cycling as well as the 6 mental aspects of living a powerful life of possibilities. Unfortunately for this concept, the store became so busy that it was impossible to help the customer in this way in addition to selling the product. 1 Performance 1 Source: http://www.lululemon.com/about/history 7 8 9 10 11 12 13 14 15 Accounting performance peaked for LULU in 2011-2012. Sales growth was high for the 2011 fiscal year, at 57.1% compared to an average 54% from 2011-2014. Additionally, 2012 had the highest gross profit margin to date of 56.9%. Since 2011, sales growth has consistently decreased in 2012, 2013, and 2014 to 40.65%, 36.92%, and 16.11% respectively. However, the company continues to generate free cash flow, allowing for future investment, in addition to $698 million in cash, and zero debt. Economic performance has followed a similar trend. Economic value added has seen an increase since 2011 due to decreasing cost of capital and increasing operating profit, however, in 2014, Lululemon experienced a decrease in their economic value added from the previous year. Internal Environment Resources Tangible Human Resources Lulu employees are referred to as "educators," strategically positioned to ensure a to personal connection with each guest is developed. The educators go through extensive in-house training at the start of their employment and are well prepared to explain the technical and innovative design aspects of each product. The members of the sales team are given books to read about successful entrepreneurs, CD’s about success, reimbursed for any fitness classes and are taught to be living, breathing pristine examples of the fit, physically and mentally healthy Lululemon ideal. 16 Capital LULU continues to generate free cash flow, allowing for future investment, in addition to $698 million in cash, and zero debt, allowing for increased leverage. PPE Lululemon centrally distributes their finished products from distribution facilities in Vancouver, British Columbia, Sumner, Washington, and Melbourne, Victoria. The facilities are leased and are approximately 120,000 sqft., 167,000sqft., and 54,000 sqft, respectively. During 2013 Lulu purchased a distribution center in Columbus, Ohio that is expected to open in sometime in 2014. The expected store growth and expanded product offerings over the next several years should be satisfied by the current infrastructure. In addition to the distribution centers, Lulu has two executive and administrative offices in Vancouver and one in Melbourne. Intangible Brand The Lulu brand sells more than just workout clothes and gear. Their brand encourages loyalty through grassroots marketing, fostering dedication and involvement in the company culture beyond the initial purchase. Lululemon has intertwined their name’s image with the lifestyle of their targeted market segment. Lulu sells more than just an item of clothing, they sell an invitation to an idealised and highly desired healthy lifestyle by building networks of local yoga and fitness instructors, sponsoring and hosting events, posting In-store community boards, and providing In-store yoga, cross-fit, and running clubs. Culture- “a mission of creating components for people to live long, healthy and fun lives” Their culture promotes educating and encouraging the community to be healthy. 17 Capabilities Product Design & Pricing The unique design of Lululemon’s products are the key factor in their success. Yoga pants and jackets are intended to increases the “fitness” appearance of the customer. The jackets side panels tighten and narrow a woman’s waist. The yoga pants and leggings have a panel across the top to minimize and firm a woman’s lower stomach area, while the side stitching up the legs slims and smoothes thighs and lifts the glute area. This better fit is one of the factors that pushes a customer to pay the slightly higher price. Many competitors try to imitate Lululemon’s product’s structure and have come close but no company has been able to exactly replicate it exactly. Another key element to Lululemon’s high prices is that they boast innovation through their materials, such as their Full-On Luon fabric which provides for improved moisture wicking, four-way stretch and performance, soft touch feel, and increased support and coverage. Lululemon on average charges 20-50% more for their products than their competitor’s. Product Management & Lifecycle Lululemon does not often maintain intellectual property rights over the materials or fabrics that they use or over the actual manufacturing process they use in order to produce their products. Instead, they retain intellectual property over their designs and the looks of their products. Lululemon uses a very deliberate product lifecycle. They limit the availability of specific designs and in doing so they limit the number of people who own a particular color, pattern, or design 18 while creating a scarcity environment. What this means is that if the product isn’t bought now it is unlikely that it will be available in the future. This also reduces the need for mark downs or obsolete products. The typical time for a product’s design and inception to market is 8-10 months, with an average of nine months. This ability has been instrumental in reducing the need to chase trends and inventory needs. In certain circumstances where a response to changing market conditions Lululemon is able to bring certain styles and products to market in as little as two months. Research and Development Lululemon does not use big data in order to gather customer data, instead, it uses a developed system of customer responsiveness in order to see what types of trends are occurring among their customers. This system includes strategic positioning of folding tables for clothes which allows their employees to eavesdrop on the complaints of customers in the fitting rooms. Along with this tactic, stores are equipped with a board for customers to write down complaints and recommendations, which are then sent to the Lululemon headquarters. Christine Day, the previous CEO, would also walk around stores and see if there are any trends in complaints of a specific product or a product detail. Also, Lululemon has a program in which instructors of yoga, dance, pilates, or even personal trainers are eligible to become a part of the R&D team in order to test out their products and provide valuable feedback on the fit, function, fabric, design and quality. 19 Promotion & Service LULU utilizes a grassroots approach to marketing that inspires strong brand identity and customer loyalty. By refraining from using traditional advertising methods Lululemon instead focuses on word of mouth advertising along with their system of branching into communities and making an impact there. The way in which they accomplish this method of marketing is by building networks of community agents such as local yoga or fitness trainers. Lululemon also sponsors and hosts various events and programs, such as offering clubs for activities such as running, yoga, pilates, or crossfit. This coupled with store employees who are trained, educated, and encouraged to develop personal relationships results in the brand being connected with the lifestyle of their core customers and clientele. Distribution & Retail When Lululemon decides to open a new store it uses a set methodology. It first opens a showroom version of the store. This showroom model is a slimmed-down version of an established store which is open for fewer days and maintains limited inventory. By using this approach they are able to build up customer awareness in the selected area while testing the market. This allows them to exercise a cautious approach and rein in costs. Lululemon generally targets areas that can become intertwined with their usual modes of operation and which will help them to reinforce community marketing and branding efforts. Human Resource Management Lululemon stresses a deep rooted culture that is centered on training and personal growth. This distinctive corporate culture allows Lululemon to attract passionate and motivated employees. Helping their employees to reach their full potential in their health, personal, and professional 20 lives and realize their long-term objectives is of utmost importance. This is accomplished through providing a supportive and goal oriented environment with various personal development programs and goal coaching workshops. Lululemon firmly believe that their relationship with their employees is exceptional and one of the key contributors to their success.2 2 Sources: http://www.roadlessinvested.com/uploads/8/7/6/1/8761673/_____lululemon_athletica_inc._11-16-2012_-_beta_test.pdf http://online.wsj.com/news/articles/SB10001424052702303812904577295882632723066 http://www.lululemon.com/community/rd_team http://uk.reuters.com/article/2013/10/09/us-lululemon-outlook-analysis-idUKBRE9980LV20131009 21 Corporate Structure Officers Laurent Potdevin Chief Executive Officer John E. Currie Chief Financial Officer Tara Poseley Chief Product Officer Delaney Schweitzer Executive Vice President, Retail Operations North America Directors Dennis J Wilson Chairman of the Board of Directors Robert Bensoussan Director Michael Casey Director RoAnn Costin Director William Glenn Director Martha A.M. Morfitt Director Rhoda M. Pitcher Director Thomas G. Stemberg Director Emily White Director Mr. Potdevin brings more than 25 years in the retail industry to this role and a deep understanding of premium brands, athletic apparel, technical products, innovation and best-in-class customer experience. Mr. Potdevin comes to lululemon having most recently served as President of TOMS Shoes. Prior to joining lululemon in January 2007, he was Chief Financial Officer of Intrawest Corporation (NYSE: IDR; ITW), a world leader in destination resorts and leisure travel. Prior to joining Intrawest he held senior financial positions within the BCE group, and was a specialist in international taxation with a major accounting firm. A seasoned and accomplished retail executive, Ms. Poseley brings 25 years of experience in strategic product development, merchandising and brand management for both large-scale and entrepreneurial businesses. Prior to joining lululemon in October 2013, she was President of Kmart Apparel, a multi-channel, multi-category business. Delaney Schweitzer began her career at lululemon in 2002. As one of the Company’s pioneers, Ms. Schweitzer helped grow the company from one store in Canada to more than 164 stores in North America, and 45 Showrooms in the US. Since her days as a lululemon educator, then as a store manager, Ms. Schweitzer has served in various capacities within lululemon, including Director of Training and Culture, and Director of Original Intent. Dennis J. Wilson founded the company in 1998 and has served as the Chairman of our Board of Directors since 1998. From March 2010 until January 2012, he served as our Chief Innovation and Branding Officer, and from December 2005 until March 2010, he served as our Chief Product Designer. Mr. Wilson was our Chief Executive Officer from 1998 until December 2005. Robert Bensoussan has been a member of Lululemon’s Board since January 2013. Since 2008, Mr. Bensoussan has been a Director and the majority owner of Sirius Equity LLP, a UK company that invests in retail and brands based in the UK and Europe. From 2008 to 2012, Mr. Bensoussan served as Executive Chairman and CEO of LK Bennett, a UK fashion retailer, and has acted as non-Executive Chairman since 2012. Michael Casey has been a member of Lululemon’s Board since October 2007. He retired from Starbucks Corporation in October, 2007, where he had served as Senior Vice President and CFO from August 1995 to September 1997, Executive Vice President, CFO and Chief Administrative Officer from September 1997 to October 2007. RoAnn Costin has been a member of Lululemon’s Board since March 2007. She has served as the President of Wilderness Point Investments, a financial investment firm, since 2005. In 2011, she co-founded Paola Quadretti Worldwide, a women's made-to-measure clothing company and is Chairman of the Board. From 1992 until 2005, she served as the President of Reservoir Capital Management, Inc., an investment advisory firm. Mr. Glenn is the President of Global Commercial Services and an Executive Officer of American Express Company. Mr. Glenn joined American Express in 2002 where he served as President of the Merchant Services division. Martha A.M. (Marti) Morfitt has been a member of Lululemon’s Board since December 2008. She has served as a principal of River Rock Partners, Inc., a business and cultural transformation consulting firm since 2008. Ms. Morfitt served as the CEO of Airborne, Inc. from October 2009 to March 2012. She served as the President and CEO of CNS, Inc. a manufacturer and marketer of consumer healthcare products, from 2001 through March 2007. From 1998 to 2001, she was Chief Operating Officer of CNS, Inc. Rhoda M. Pitcher has been a member of Lululemon’s Board since December 2005. Since 1996 she has served as Managing Partner of Rhoda M Pitcher Inc., a management consulting firm providing services in organizational strategy and the building of executive capability to Fortune 500 corporations, institutions, start-ups and non-profits. From 1978 to 1997, Ms. Pitcher co-founded, built and sold two international consulting firms. Thomas G. Stemberg has been a member of Lululemon’s Board since December 2005. Since March 2007, he has been the managing partner of Highland Consumer Fund, a venture capital firm. From February 2005 until March 2007, he was a venture partner with Highland Capital Partners. Mr. Stemberg co-founded Staples, Inc., an office supplies retailer, serving as its Chairman from 1988 to 2005, and as its CEO from 1986 until 2002. Emily has been the Director of Business Operations, Instagram at Facebook since March 2012 where she is responsible for monetization, partnerships, user operations and all business-related functions. From September 2010 to March 2012 she was Sr. Director of Local and then Mobile Partnerships at Facebook Inc. Prior to joining Facebook, Emily was at Google Inc. running the North America Online Sales and Operations channel from 2001 to 2007 and the Asia Pacific & Latin America businesses from 2007 to 2009. 22 Executive History CEO: Yellow- Christine M. Day (2008 - 2014) Purple- Laurent Patdevin (2014 - Present)3 3 Source: Bloomberg 23 External Environment Industry Industry Overview: Lululemon Athletica Inc. is classed under the Apparel & Accessories industry. The Apparel & Accessories industry consists of companies engaged in the manufacturing of clothing, such as men, women and children's clothing, uniforms, jackets, hats, socks, gloves, robes, hosiery and swim suits. The industry also includes accessories, such as handbags, attach cases, umbrellas, cosmetic bags, jewelry, watches, luggage, dog collars and leashes. The Apparel & Accessories industry excludes shoes, sneakers and slippers, classified in Footwear. The industry has a strongly bi-modal size distribution with a handful of very large firms, and a relative large number of much smaller firms. The rivalry among individuals and firms in the athletic and outdoor industry is legendary. And while it continues in earnest on some levels— competing for market share, signing endorsement contracts, hiring employees and developing new products. Competitive advantage in the industry derives primarily from brand, beauty and performance. Brands embody key messages and beliefs about the culture of a company and its products. Innovation in the industry is derived from better performing, more ―beautiful products and from building brand. Also, a hallmark of this industry is brand recognition and marketing. Research and Development is of the utmost importance. Athletic Apparel products are mostly nondurable goods, with a lifetime measured in months or a few years. Many athletic and outdoor products have a substantial fashion component, and consumers regularly replace footwear and apparel, and to a lesser extent gear. Athletic Apparel has strong seasonal sales cycles, and regular style changes. 24 Consequently, firms in the athletic and outdoor industry are regularly developing new products and designs to anticipate market and fashion trends. While much innovation is around style, and fashion trends, there is also continual effort to improve the performance characteristics of products Consequently, products in this industry are highly differentiated and customized, and different firms produce different products targeted to a wide range of market niches and end-users. Indeed, the process of growth in this industry is driven by segmentation: firms develop products and brands that are targeted to increasingly more finely disaggregated groups of consumers. The categories that define the industry change over time as firms define and develop new markets. Athletic Apparel is a globalized industry. A vast majority of apparel products are produced in Asia. Manufacturing locally is the exception, not the rule. Large incumbent companies like Nike and Adidas compete on a global scale, and get a majority of their revenue from outside the United States. Most small firms also sell internationally, although in general they get a majority of their revenue from sales in the United States, especially in the first few years of operation.4 Suppliers ● Delta Galil - Delta Galil is an Israeli textile firm with 10,000 employees worldwide, with revenue that is expected to grow to over $1B (USD) in 2014. The company sells their products to many leading retailers, including competitors such as Nike and Gap. About 1.2% of their revenue comes Lululemon. 4 Source: Joseph Cortright, Impresa, 2010. The Athletic and Outdoor Industry Cluster A White Paper. http://pdxeconomicdevelopment.com/docs/activewear/Athletic-Outdoor-Cluster-Analysis.pdf 25 ● Eclat Textile CO - Eclat Textile is a Taiwanese firm in the business of weaving, dying, and selling of multiple types of textile materials. Their forecasted revenue for 2014 is roughly $725M (USD). Similar to Delta Galil, Eclat sells their products to many major retailers, including competitors of Lululemon. Only 0.48% of Eclat’s revenue comes from Lululemon. ● Workday INC - Workday INC is a cloud-based software provider, who specializes in on-demand financial and human capital management. They have 2,600 employees, and are forecasted to see their revenue rise by over 50% from 2014 to 2015, to more than $700M. AS of now, 0.05% of their revenue comes from Lululemon, and they currently provide software to nearly 150 companies. Customers Lululemon does not have any true customers, as they sell almost entirely out of their own apparel stores. Outside of their own apparel stores, they have a partnerships with gyms and studios who teach yoga or pilates, such as CorePower. The number of Lululemon stores around the world increased from 211 in 2013, to 254 in 2014. Almost 84% of this store growth came solely from the United States, which saw 36 new stores added from last year. Entry Barriers Production and Distribution Within the industry, each company must be able to produce enough of their products to meet the demand of all the stores they distribute to, meaning they produce enough to be highly visible. New companies would not be able to match the total amount of products put out there without sacrificing an extreme amount of quality, which none of the larger companies must do. Whether it be to other retailers or to their own stores, each company must be prepared to distribute large amounts of their product to multiple 26 locations. It would a large amount of both time and money to set up a distribution system and relationship that could match that of the companies already in the market. Design patents When it comes to a product like yoga pants, specific types of designs can be patented by another company. Even if that company does not do it as well as others may be able to, they control that idea. This is important because it makes the development of a product more difficult with restrictions placed on what a company can use or do. Patent infractions can lead to costly lawsuits, which would be difficult for a new company to afford. Brand For brand, the specific importance depends on the specific area in which you try to get into the industry. In the high-end segment of the market, customers are not only buying quality, but a brand name that they recognize and trust. Brand can still be a major factor in other segments of the market, as customers can still be loyal to a brand regardless. Substitutes Lululemon substitutes include apparel outside of athletics. Cultural trends have shown an increase in acceptance of yoga pants and other athletic attire worn as everyday attire or even work attire. Ms. Herz can often be found at work or out to dinner wearing any one of her more than 10 pairs of elastic-waist pants. “If your entire outfit looks very chic, there’s no reason not to,” she said. Her collection ranges from high-end — David Lerner leggings and GoldSign jeggings (each about $150) to mass-market Hard Tail yoga pants ($65 to $95) to what she calls “toss away” jeggings from Forever 21 ($8 to $25), “just as good, by the way,” she said. 27 Competitors GAP Inc. Description: The firm, which operates about 3,400 stores worldwide, built its iconic casual brand on basics for men, women, and children, but over the years has expanded through the urban chic chain Banana Republic, family budgeteer Old Navy, online-only retailer Piperlime, and Athleta, a purveyor of activewear. Resources: Physical store locations, Reputation Capabilities: Sales and distribution, Manufacturing Under Armour Inc. Description: Specializing in sport-specific garments, it dresses its consumers from head (COLDGEAR) to toe. Products are made from its moisture-wicking and heat-dispersing fabrics, able to keep athletes dry during workouts. Under Armour sells its wares online, by catalog, through its own factory house stores, and in more than 25,000 retail stores worldwide. Resources: Tech knowledge, Reputation Capabilities: Product development, Marketing Nike Inc. 28 Description: NIKE designs, develops, and sells a variety of products and services to help in playing basketball and soccer (football), as well as in running, men's and women's training, and other action sports. Under its namesake brand, NIKE also markets sports-inspired products for children and various competitive and recreational activities, such as golf, tennis, and walking, and sportswear by Converse and Hurley. NIKE sells through more than 800-owned retail stores worldwide, an e-commerce site, and to thousands of retail accounts, independent distributors, and licensees. Resources: Tech knowledge, Reputation Capabilities: Corporate Management, R&D, Product design, Marketing, Sales and distribution Nordstrom Inc. Description: One of the nation's largest upscale apparel and shoe retailers, Nordstrom sells clothes, shoes, and accessories through more than 115 Nordstrom department stores about 125 off-price outlet stores (Nordstrom Rack) in more than 30 states and online. It also operates a pair of Jeffrey luxury boutiques, a "Last Chance" clearance store, and newly-acquired online private sale site HauteLook. With its easyreturn policy and touches such as thank-you notes from employees, Nordstrom has earned a reputation for top-notch customer service. Resources:Physical stores, Reputation Capabilities: Marketing, Sales and distribution, Customer responsiveness Adidas Description: The company sells sports shoes, apparel, and equipment sporting its iconic three-stripe logo in 170 countries. The #2 sporting goods manufacturer (behind NIKE) focuses on football, soccer, basketball, running, and training gear and apparel as well as lifestyle goods including SLVR and Y-3 fashion brands. adidas' wholesale division gets adidas and Reebok products to retailers while the retail 29 group runs its own 2,445 Reebok and adidas shops. Other businesses include TaylorMade-adidas Golf, Rockport, and Reebok-CCM Hockey. Resources: Reputation Capabilities: Marketing, Sales and distribution Lily Lotus Lily Lotus is a clothing line inspired by a passion for living colorfully, creatively and comfortably. Originally conceived as a line of stylish yoga lifestyle clothing, the brand has blossomed into a collection of everyday glamour for the modern active woman. The company’s universally uplifting designs, stylish fit and ultra comfortable fabrics inspire a lifestyle of laid back luxury and positivity. Easy-to-wear and form-flattering silhouettes flow seamlessly from studio to street. The company is committed to contributing beauty and comfort to the world while maintaining the integrity of our business practices. All of their products are proudly sewn, dyed and embellished entirely in the USA. The company thrives as a both a company and as individuals in sustainable harmony with the world we live in. Strategies: Boutique 30 31 32 33 34 35 External Environment Cont’d Macroenvironment Trends/Issues General Economic Outlook Overall, the macroeconomic environment has been improving steadily since the 2009 recession. Macroeconomic trends are extremely crucial for Lululemon as a discretionary good, because they can affect the sales of the product in a variety of ways. In this economic section, there will be an overview of GDP growth, inflation, unemployment, disposable income, and other factors. The focus will primarily be on the United States and Canada, due to the concentration of sales as well as production and employment. After posting negative GDP growth in both 2008 and 2009, the United States has seen mostly positive numbers since, mostly in the range of 2-3%. As of now, the median of 87 different forecasts pooled together by Bloomberg has US GDP to grow at a rate of 2.7% in 2014, and 3% in both 2015 and 2016. US unemployment had also ballooned to nearly 10% for 2009 and 2010, those numbers have consistently dropped since then, settling under 8% in 2013. Forecasts show a continuing trend of unemployment decreasing, with 2014, 2015, and 2016 numbers at 6.2%, 5.75%, and 5.4% respectively. CPI is forecasted to slightly increase year-over-year from it’s 2013 rate of 1.48%, to around 2.15% in the year 2016. Currently, disposable income has been rising at a near-linear rate for the past few years. In Canada, GDP growth is forecasted to be much stronger that it was in 2012 and 2013, with a 2016 median projection of 2.75%. CPI is expected to rise as well, but not hit 2% until 2016. 2014 is also the first year in which unemployment is expected to fall below 7% since 2008, with it trending slightly downward after that. After a drop in early 2012, Canadian disposable income has been on the rise, while average hourly wages as a whole have declined the past few quarters. 36 Outside of the United States and Canada, GDP trends tend to be positive. For the United Kingdom, GDP projects to surpass 2% for the first time since 2007. Australian GDP growth is forecasted to be in the 23% range for the next few years, higher than their 2013 rate. For New Zealand, GDP forecasts show an increase to 3.2% for 2014, but decreasing back towards their 2013 level of 2.5% after that. Interest rates on the 10-year note for all of the countries listed above are expected to rise with each upcoming forecasted quarter. Since 2011, the US dollar has strengthened against the Canadian dollar, with 1 USD now worth around 1.1 CAD. The Canadian dollar has also lost a fair amount of value against the GBP and AUD in the past year or so, while having a steady drop against the NZD in past five years. Labor Costs and Price Controls Increasing labor costs and other factors associated with the production of Lululemon’s products in overseas could increase the costs to produce these products. During fiscal 2012, approximately 34% of Lululemon’s products were produced in China and increases in the costs of labor and other costs of doing business in China could significantly increase Lululemon’s costs to produce their products and could have a negative impact on their operations, revenue and earnings. Also with factories in Cambodia and Bangladesh, Lululemon’s business is highly susceptible to changes in labor regulations in those countries, as well as shortage of labor; these would increase costs while labor strikes or other troubles due to poor working conditions can negatively affect the Lululemon brand. Since Lululemon’s products are more of a luxury apparel, there are no price controls influencing Lululemon. The products are priced based on costs and competition. However, Lululemon’s sales and profitability may be drastically affected due to changes in prices. Lululemon’s business is subject to significant pressure on pricing and costs caused by many factors, including intense competition, constrained sourcing capacity and related inflationary pressure, pressure from 37 consumers to reduce the prices, and changes in consumer demand. These factors may cause Lululemon to experience increased costs, reduction in sales prices, or reduced sales in response to increased prices, any of which could cause the operating margin to decline if Lululemon is unable to offset these factors with reductions in operating costs Political/Legal Intellectual Property Lululemon owns the material trademarks used in connection with the marketing, distribution and sale of all of their products in Canada, the United States and in the other countries in which their products are currently or intended to be either sold or manufactured. Their major trademarks include lululemon athletica & design, the logo design (WAVE design) and lululemon as a word mark. In addition to the registrations in Canada, the United States, and Australia, lululemon’s design and word mark are registered in over 68 other jurisdictions, which cover over 112 countries. Lululemon owns trademark registrations for names of several of their fabrics and products including Luon, Silverescent, VitaSea, Boolux, Luxtreme, Groove Pant, Light as Air, and Power Y. In addition to trademarks, Lululemon owns 22 industrial design registrations in Canada that protect their distinctive apparel and accessory designs, as well as a number of corresponding design patents in the United States and registered community designs in Europe. Lululemon’s fabrics and manufacturing technology are not patented and can be imitated by their competitors. The intellectual property rights in the technology, fabrics and processes used to manufacture their products are owned or controlled by their suppliers and are generally not unique to them. Their ability to obtain intellectual property protection for their products is therefore limited and they currently own no patents or exclusive intellectual property rights in the technology, fabrics or processes underlying their products. As a result, Lululemon’s current and future competitors are able to manufacture and sell 38 products with performance characteristics, fabrics and styling similar to their products. Because many of their competitors have significantly greater financial, distribution, marketing and other resources than Lululemon does, they may be able to manufacture and sell products based on Lululemon’s fabrics and manufacturing technology at lower prices than Lululemon can. If their competitors do sell similar products to Lululemon’s at lower prices, Lululemon’s net revenue and profitability could suffer. Lululemon’s failure or inability to protect their intellectual property rights could diminish the value of their brand and weaken their competitive position. Lululemon currently relies on a combination of copyright, trademark, trade dress and unfair competition laws, as well as confidentiality procedures and licensing arrangements, to establish and protect our intellectual property rights. There is no assurance that these steps to protect the intellectual property rights will be adequate to prevent infringement of such rights by others, including imitation of Lululemon’s products and misappropriation of their brand. In addition, intellectual property protection may be unavailable or limited in some foreign countries where laws or law enforcement practices may not protect Lululemon’s intellectual property rights as fully as in the United States or Canada, and it may be more difficult for Lululemon to successfully challenge the use of their intellectual property rights by other parties in these countries. There is no guarantee that Lululemon’s pending patents, trademarks and other proprietary rights will be approved since these trademarks and other proprietary rights could potentially conflict with the rights of others and may be prevent Lululemon from selling some of their products. Lululemon’s success depends in large part on their brand image. They believe that their trademarks and other proprietary rights have significant value and are important to identifying and differentiating their products from those of their competitors and creating and sustaining demand for their products. Lululemon has obtained and applied for some United States and foreign trademark registrations, and will continue to evaluate the registration of additional trademarks as appropriate. However, there is no guarantee that any of their pending trademark applications will be approved by the applicable governmental authorities. Moreover, even if 39 the applications are approved, third parties may seek to oppose or otherwise challenge these registrations. Third parties may also assert intellectual property claims against Lululemon, particularly as Lululemon expands their business and the number of products. Lululemon’s defense of any claim, regardless of its merit, could be expensive and time consuming and could divert management resources while successful infringement claims against Lululemon could result in significant monetary liability or prevent it from selling some of their products. In addition, resolution of claims may require Lululemon to redesign their products, license rights from third parties or cease using those rights altogether. Any of these events could harm our Lululemon and cause their results of operations, liquidity and financial condition to suffer. Lululemon Athletica Canada Inc. v. Calvin Klein Inc. Lawsuit In 2012, Lululemon settled a lawsuit accusing Calvin Klein Inc. of infringing patents for pant designs. Terms of the settlement are confidential, the companies. Lululemon withdrew the case in a filing today in federal court in Wilmington, Delaware. The company sued New York-based Calvin Klein in August of that year seeking unspecified damages, including lost profits and royalties, for infringement of three patents. The patents cover products sold in the U.S. under the Astro Pant name, Lululemon said. Calvin Klein’s alleged infringing products include knee-length running tights and overlapping waistband pants. Trade Regulations Lululemon is subject to strict trade and other regulations and failure to comply with these regulations could lead to investigations or actions by government regulators and negative publicity. The labeling, distribution, importation, marketing and sale of Lululemon’s products are subject to extensive regulation by various federal agencies, including the Federal Trade Commission, Consumer Product Safety Commission and state attorneys general in the United States, the Competition Bureau and Health Canada in Canada, as well as by various other federal, state, provincial, local and international regulatory authorities in the countries in which Lululemon’s products are distributed or sold. If they fail to comply with any of these regulations, we could become subject to enforcement actions or the imposition of 40 significant penalties or claims, which could harm their results of operations or their ability to conduct business. In addition, the adoption of new regulations or changes in the interpretation of existing regulations may result in significant compliance costs or discontinuation of product sales and could impair the marketing of Lululemon’s products, resulting in significant loss of net sales. Lululemon’s ability to source their merchandise profitably or at all could be hurt if new trade restrictions are imposed or existing trade restrictions become more burdensome. The United States and the countries in which their products are produced or sold internationally have imposed and may impose additional quotas, duties, tariffs, or other restrictions or regulations, or may adversely adjust prevailing quota, duty or tariff levels. For example, under the provisions of the World Trade Organization, or the WTO, Agreement on Textiles and Clothing, effective as of January 1, 2005, the United States and other WTO member countries eliminated quotas on textiles and apparel-related products from WTO member countries. In 2005, China’s exports into the United States surged as a result of the eliminated quotas. In response to the perceived disruption of the market, the United States imposed new quotas, which remained in place through the end of 2008, on certain categories of natural-fiber products that we import from China. These quotas were lifted on January 1, 2009, but Lululemon have expanded their relationships with suppliers outside of China, which among other things has resulted in increased costs and shipping times for some products. Countries impose, modify and remove tariffs and other trade restrictions in response to a diverse array of factors, including global and national economic and political conditions, which make it impossible for Lululemon to predict future developments regarding tariffs and other trade restrictions. Trade restrictions, including tariffs, quotas, embargoes, safeguards and customs restrictions, could increase the cost or reduce the supply of products available to Lululemon or may require them to modify their supply chain organization or other current business practices, any of which could harm the business, financial condition and results of operations. 41 Political Considerations Lululemon’s operations are also susceptible to the political climate in foreign countries since almost all of Lululemon’s suppliers are located outside of North America. During fiscal 2012, approximately 54% of Lululemon’s products were produced in South and South East Asia, approximately 34% in China, approximately 3% in North America and the remainder in the Peru, Israel, Egypt and other countries. As a result of Lululemon’s international suppliers, they subject to risks associated with doing business abroad, including: ● political unrest, terrorism, labor disputes and economic instability resulting in the disruption of trade from foreign countries in which Lululemon’s products are manufactured; ● the imposition of new laws and regulations, including those relating to labor conditions, quality and safety standards, imports, duties, taxes and other charges on imports, as well as trade restrictions and restrictions on currency exchange or the transfer of funds; ● reduced protection for intellectual property rights, including trademark protection, in some countries, particularly China; ● changes in local economic conditions in countries where Lululemon’s manufacturers, suppliers or guests are located. These and other factors beyond Lululemon’s control could interrupt their suppliers’ production in offshore facilities, influence the ability of their suppliers to export the products cost-effectively or at all and inhibit the suppliers’ ability to procure certain materials, any of which could harm Lululemon’s business, financial condition and results of operations.5 Controversies 5 Source: LULULEMON ATHLETICA INC. FORM 10-K 2013 42 In 2007, Lululemon had to remove all of the health benefit claims regarding seaweed contents in its VitaSea product, after testing showed there was no significant difference in terms of mineral content between a VitaSea shirt and a cotton T-shirt. Although they pulled the line, the company had commissioned their own exam, which claimed the VitaSea product did in fact contain seaweed.6 A massive recall of black yoga pants occurred in March of 2013, when it was discovered that a large amount of the pants were transparent. This also resulted in the leave of the companies CPO, Sheree Waterson. This recall caused revenue and brand issues for the company.7 Lululemon’s founder, Chip Wilson, has been the source of multiple controversial statements. He claimed that the name Lululemon came from the fact that the name is difficult for Japanese people to pronounce, that he thought this could be used as a marketing tool, and “It’s funny to watch them try and say it.” Wilson has also claimed that child labor should be acceptable, because it gives the children an opportunity to make money. In a blog post in 2009, he claimed that birth control pills and smoking lead to more divorce and breast cancer, and were key factors in the creation of Lululemon because of their connection to women’s education and power. Wilson also stated that making plus-size clothing was not profitable because the extra material created a greater cost. Wilson was forced to step down from his role as Chairman of the Board in 2013 after he claimed that "Frankly some women's bodies just don't actually work for it." and "They don't work for some women's bodies...it's really about the rubbing through the thighs, how much pressure is there over a period of time, how much they use it."8 6 http://lululemon.com/community/blog/how-lululemon-came-into-being-a-gross-generalization/ http://www.nytimes.com/2007/11/14/business/14seaweed.html http://web.archive.org/web/20071222015702/http://www.lululemon.com/about/media/news/74 7 http://money.cnn.com/2013/03/19/news/companies/lululemon-pants/index.html?iid=EL http://money.cnn.com/2013/04/04/news/companies/lululemon-pants-fiasco/index.html?hpt=hp_t2 8 http://thetyee.ca/News/2005/02/17/LuluCritics/ 43 Technological The current environment is seeing major technological improvements. This is a very competitive front among rivals. R&D budgets for leading sporting goods manufacturers such as Nike, Puma, Asics and other spend more than one percent of their annual global turnover on R&D. Additionally, technology in the athletic apparel industry has allowed entrance of technology companies. Leading manufacturers of tech devices such as Apple, Sony, and Samsung are entering or partnering in the market. Apple, for example, has partnered with Nike on the Nike + iPod sports kit that allows connection to an iPod from Nike+ censored shoes. Moreover, In January 2012, Apple obtained a patent for a “smart garment” on which advanced sensors are affixed that transfer data - such as location information, psychometric data of the wearer, garment performance and wear data. More recently, a startup company called Athos will be shipping tops, compression shorts, and leggings in Spring 2014 that accomplish just what Apple had its eye on. At Under Armour, the goals are similar. The company has been developing a shirt that tracks heart rate, breathing, and G-force. Outside of apparel, Under Armour’s Nike veterans are using biomimicry to enhance shoe performance with the spine shoe. Outside of products, retail has also seen changes in technology. Bloomberg analysts contend that multiple retailing channels (online, e-commerce, mobile shopping, outlets, and social media) raise customer awareness across a wide audience, translating into higher sales. Multiple selling channels also help http://lululemon.com/community/blog/how-lululemon-came-into-being-a-gross-generalization/ http://www.huffingtonpost.com/2013/07/31/lululemon-plus-size_n_3675605.html http://www.bloomberg.com/video/lululemon-pants-don-t-work-for-some-women-founder-ATKjgs7jQduIr_ou1z8XYg.html http://www.today.com/money/lululemon-co-founder-steps-down-wake-womens-bodies-remark-2D11721314 http://www.businessinsider.com/outrageous-remarks-by-lululemon-founder-chip-wilson-2013-12#ixzz2rtTHmZ7w 44 dissipate excess inventory. U.S. online shopping represents 7.1% of retail sales, up from less than 4% a decade ago, and is expected to continue to grow. Source: Bloomberg Technology has also allowed for the increase in loyalty programs. Bloomberg analysts argue that apparel retailer sales should get a boost in 2014 as stores ramp up loyalty programs. Children’s Place started its loyalty program in 2013 and has more than 7.2 million people enrolled, with loyalty customers accounting for 60% of total sales. Loyalty members spend 2.5 times more annually and have twice as many transactions, according to management. Gap launched a program allowing customers to order online and reserve for in-store pickup. Socio Cultural 45 The largest population trends in the United States right now are the rise of the Hispanic group, the aging of the population as a whole, and migration. The elderly population is expected to be roughly double by the year 2050, with the 65 and older group growing from 13% to 20% of the total population. The age group of 15-64 is expected to grow as well, at rate of around 40%, due to a still high fertility rate. The age group of 20-24 is also one of the largest groups that are broken down in the picture below. In fact, the male 20-24 group is the largest sub-group of males shown. The Hispanic population is projected to make up 30% of the population by the year 2050, compared to roughly half of that now. In the last census, population data showed large migration into states in the south and west, while the midwest and east saw their regions lose some of their population. This pattern of migration likely has to do with economic growth, since people were exploring better opportunities after the recession of 2009. The population growth rate also slowed to 0.77%, one of the lowest levels in history for the US. Canada has a very similar population growth rate to that of the United States, as well as a population cluster at ages 45-64. They do not have a comparable cluster among the young adults like the United States. The Canadian population has also been migrating westward for better economic opportunities, especially in the province of Alberta. The province of Western Australia also has been a place with heavy migration, due to a massive boom in mining. Australia as a whole also has a lower median age than Canada and the US, and a population growth of over 1%. The United Kingdom has a very low growth rate of 0.54% with a median age of 40, although their 25-29 age group is one of the largest in the country. New Zealand has an interesting population aspect, in that they have more men than women in their 54 and younger age group, and a younger median population in total.9 9 http://www.bloomberg.com/news/2010-12-22/u-s-population-shift-accelerates-to-south-west-states-2010-census-shows.html http://www.pewsocialtrends.org/2008/02/11/us-population-projections-2005-2050/ http://www.smithsonianmag.com/40th-anniversary/the-changing-demographics-of-america-538284/?no-ist http://www.reuters.com/article/2008/02/12/us-usa-population-immigration-idUSN1110177520080212 http://www.censusscope.org/us/chart_age.html 46 Spending on workout clothing increased 7% last year while spending on all other types of clothing increased only 1%. Fashion trends, especially for women, have shifted now leaving fitness wear as a common option for several occasions other than working out. “Fitness chic sends a message to others that you are living a healthy lifestyle,” says Noreen Naroo, senior creative director for Under Armour. Yoga pants have been called “the new jeans” as they are now being paired with boots and nice tops for nicer occasions than just casual loungewear. Generation Y, a huge section of Lulu’s customer base, is expected to make up 46% of the workforce by 2020.10 https://www.cia.gov/library/publications/the-world-factbook/geos/us.html http://www.theglobeandmail.com/report-on-business/economy/economy-lab/canadas-population-continues-to-flow-westward/article15587238/ http://www.abs.gov.au/ausstats/abs@.nsf/latestProducts/3101.0Media%20Release1Sep%202013 10 Source:http://www.kenan-flagler.unc.edu/executive-development/custom-programs/~/media/DF1C11C056874DDA8097271A1ED48662.ashx 47