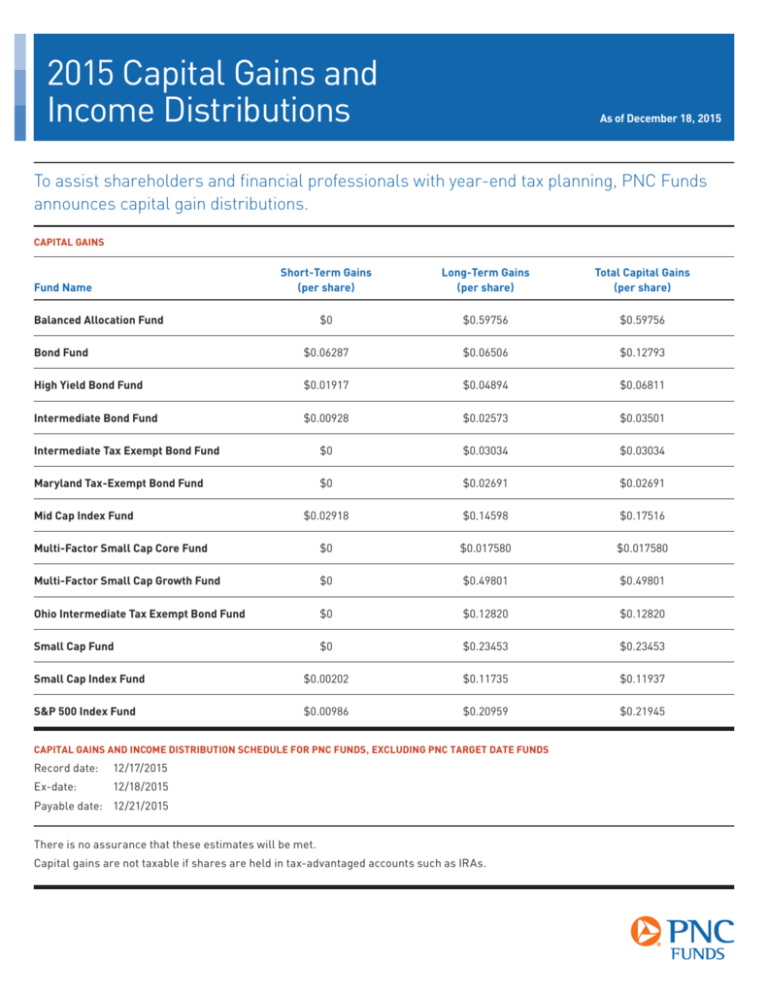

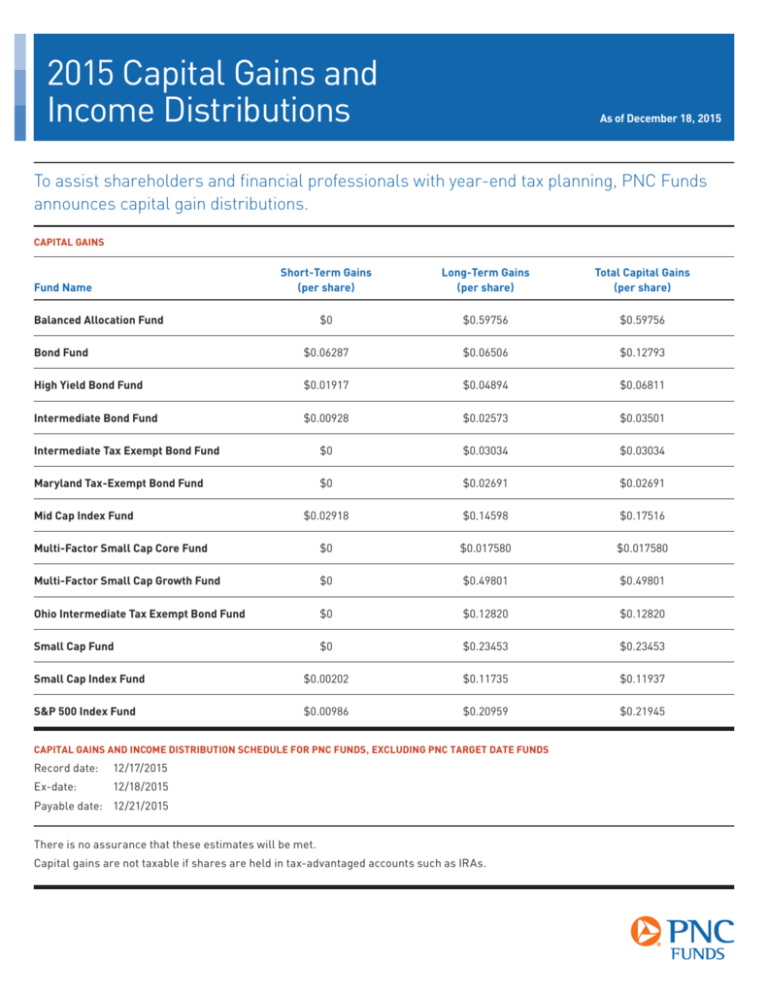

2015 Capital Gains and

Income Distributions

As of December 18, 2015

To assist shareholders and financial professionals with year-end tax planning, PNC Funds

announces capital gain distributions.

CAPITAL GAINS

Short-Term Gains

(per share)

Long-Term Gains

(per share)

Total Capital Gains

(per share)

$0

$0.59756

$0.59756

Bond Fund

$0.06287

$0.06506

$0.12793

High Yield Bond Fund

$0.01917

$0.04894

$0.06811

Intermediate Bond Fund

$0.00928

$0.02573

$0.03501

Intermediate Tax Exempt Bond Fund

$0

$0.03034

$0.03034

Maryland Tax-Exempt Bond Fund

$0

$0.02691

$0.02691

$0.02918

$0.14598

$0.17516

Multi-Factor Small Cap Core Fund

$0

$0.017580

$0.017580

Multi-Factor Small Cap Growth Fund

$0

$0.49801

$0.49801

Ohio Intermediate Tax Exempt Bond Fund

$0

$0.12820

$0.12820

Small Cap Fund

$0

$0.23453

$0.23453

Small Cap Index Fund

$0.00202

$0.11735

$0.11937

S&P 500 Index Fund

$0.00986

$0.20959

$0.21945

Fund Name

Balanced Allocation Fund

Mid Cap Index Fund

CAPITAL GAINS AND INCOME DISTRIBUTION SCHEDULE FOR PNC FUNDS, EXCLUDING PNC TARGET DATE FUNDS

Record date:

12/17/2015

Ex-date:12/18/2015

Payable date: 12/21/2015

There is no assurance that these estimates will be met.

Capital gains are not taxable if shares are held in tax-advantaged accounts such as IRAs.

INCOME DISTRIBUTION

Fund Name

Share Classes

Total Income Distributed per Share

Balanced Allocation Fund1

I shares

A shares

C shares

T Shares

$0.04414

$0.03600

$0.01581

$0.03846

International Equity Fund

I shares

A shares

C shares

$0.37070

$0.32514

$0.24427

Large Cap Growth Fund

I shares

A shares

$0.16608

$0.10516

Mid Cap Index Fund

I shares

R4 shares

$0.13238

$0.12474

Multi-Factor Small Cap Core Fund

I shares

$0.04370

Multi-Factor Small Cap Growth Fund

I shares

$0.02791

Multi-Factor Small Cap Value Fund

I shares

A shares

C shares

$0.38533

$0.32968

$0.24424

Small Cap Fund

I shares

$0.03080

Small Cap Index Fund

I shares

R4 shares

$0.10263

$0.09433

S&P 500 Index Fund1

I shares

A shares

C shares

R4 shares

R5 shares

$0.14023

$0.13149

$0.10486

$0.13479

$0.13825

1 Represent dividend payments for fourth quarter 2015 only.

Questions:

• Call Shareholder Services at 800-622-FUND (3863)

• Consult your tax advisor

• Visit the Performance section or the Investor Education section at pncfunds.com

Please consult with a tax advisor before making any tax-related investment decisions.

You should consider the investment objectives, risk, charges, and expenses of PNC Funds carefully before investing. A prospectus or

summary prospectus with this and other information may be obtained at 800-622-FUND (3863) or pncfunds.com. Please read the prospectus

carefully before investing.

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

PNC Capital Advisors, LLC , a subsidiary of The PNC Financial Services Group, Inc., serves as investment adviser and co-administrator to PNC Funds and

receives fees for its services. PNC Funds are distributed by Professional Funds Distributor LLC , which is not affiliated with PCA and is not a bank.

©The PNC Financial Services Group, Inc. All rights reserved.

1215