Lessons Learned from Past Fundraising Mistakes

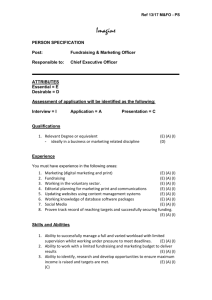

advertisement

Lessons Learned from Past Fundraising Mistakes: A Look at the Cases Canadian Council of Christian Charities Annual Conference, September 2012, Vancouver, BC Charles De Jager & Luke Johnson De Jager Volkenant & Company Barristers & Solicitors, Surrey, BC OUTLINE • • • • • • • • • • • • • • Brief overview of new CRA Fundraising Policy Are fundraising activities charitable?: Vancouver Society Refunding a gift, split-receipting requirements: Richert Risk of revocation for involvement in tax shelters: Millennium Unscrupulous fundraisers: Innovative Gifting Director obligations for fundraising: AIDS Society Court's limited power to re-direct specified gifts: YWCA Board permits fraud, complicit donors penalized: Coombs Risk of gift being disallowed in tax shelter: Norton Effect of private benefit on donations: Ballard Requirement to control and document fundraising: ICAN Access by CRA to charity’s records of donors: Redeemer Class action remedies: Cannon Common Errors NEW CRA FUNDRAISING POLICY • New CRA Policy Fundraising by Registered Charities CG-013 issued April 20, 2012 interprets cases, the Income Tax Act and policy to provide charities with a comprehensive guide for fundraising activities • CRA policy is that fundraising is not a charitable purpose in itself or a charitable activity that directly furthers a charitable purpose FUNDRAISING • Fundraising is “any activity that includes a solicitation of present or future donations of cash or gifts in kind, whether the solicitation is explicit or implied” SCOPE Fundraising can be carried out by the charity or by anyone acting on its behalf and includes: • face to face canvassing, telemarketing, major gift work with individuals, direct mail • internet or media campaigns (for example, electronic mail, online publications, Web sites, television or radio) • printed information, advertisements or publications (for example, newspapers, flyers, brochures, and magazines) • events (sports tournaments, runs, walks, auctions, dinners, galas, concerts, and travel or trekking adventures) • sales of goods or services • donor stewardship, and membership or corporate sponsorship programs • researching and developing fundraising strategies and plans or prospective donors • recruiting development officers, hiring fundraisers • operating donor recognition programs EXCLUDED Fundraising does not include: • seeking grants, gifts, contributions, or other funding from other charities or governments • recruiting volunteers to carry out general operations of the charity • related business activities PROHIBITIONS Fundraising must not: • Become a purpose of the charity (a collateral non-charitable purpose) • Deliver more than incidental private benefit (a benefit that is not necessary, reasonable, or proportionate in relation to the resulting public benefit) • Be illegal or contrary to public policy • Be deceptive • Be an unrelated business CRA ASSESSMENT • • • Disallow fundraising where the resources devoted to fundraising exceed the resources devoted to charitable activities Discourage fundraising without an identifiable use or need for the proceeds Disallow inappropriate purchasing or staffing practices: – purchases of fundraising merchandise or services for unnecessary fundraising or that do not increase fundraising revenue – paying more than fair market value for fundraising merchandise or services – sole source or not-at-arm's length contracts for fundraising merchandise or services without justification or independent verification that contract is for fair market value • Discourage activities where most of the gross revenues go to contracted non-charitable parties CRA ASSESSMENT, cont. • Discourage commission-based fundraiser remuneration or payment of fundraisers based on the amount or number of donations • Disallow misrepresentations in fundraising solicitations or in disclosure about fundraising costs, revenues or practices • Discourage fundraising initiatives or arrangements that are not well documented • Discourage high fundraising expense ratio • Consider the size of the charity • Consider causes with limited appeal • Accept donor development programs • Consider involvement in gaming activities FUNDRAISING RATIO • Costs / revenue under 35%: unlikely to generate concerns by the CRA • Costs / revenue of 35% to 70%: CRA will examine the average ratio over recent years to determine if there is a trend of high fundraising costs. The higher the ratio, the more likely CRA will be concerned the charity is engaged in fundraising that is not acceptable, requiring a more detailed assessment of expenditures • Costs / revenue above 70%: raises concerns with the CRA. The charity must be able to provide an explanation and rationale for this level of expenditure to show that it is not engaged in unacceptable fundraising FUNDRAISING COSTS ALL0CATION Fundraising ratio is derived from allocation on T3010 • 100% -- activities that are exclusively, or almost exclusively (90% or more of the activity is devoted to fundraising), undertaken to fundraise • 0% -- activity would have been undertaken without the fundraising component • Pro-rated -- less than 90% of the total content of the activity advances fundraising CRA RECOMMENDATIONS • • • • • • • Use a prudent planning process Evaluate fundraising performance in the context of CRA guidance, before and after Adopt appropriate procurement and staffing processes, scaled to the amount raised Be aware of risks associated with hiring third-party fundraisers Provide ongoing management and supervision of fundraising Keep complete and detailed records relating to fundraising activities Provide disclosure about fundraising costs, revenues, practices, and arrangements FUNDRAISING CASES • The following selected legal cases demonstrate what can happen when charities fail to comply with the law, Income Tax Act, and CRA policy in regards to fundraising activities • The emphasis is on the mistakes made, and lessons to be learned from these cases Vancouver Society of Immigrant and Visible Minority Women (SCC 1999) • Organization applied to register as a charity, and CRA refused. The organization appealed up to the Supreme Court of Canada • Result: Establishes a framework for analysis of what activities are charitable. The organization's proposed purposes and activities did not qualify • The Court confirmed the general principle that a charity’s purposes must be exclusively charitable and that all of its resources must be devoted to these purposes unless exempted under law and the Income Tax Act Result • CRA cites this case in support of its policy that fundraising is not a charitable purpose in itself or a charitable activity that directly furthers a charitable purpose • “…the character of an activity is at best ambiguous; for example writing a letter to solicit donations for a dance school might well be considered charitable, but the very same activity might lose its charitable character if the donations were to go to a group disseminating hate literature. In other words, it is really the purpose in furtherance of which an activity is carried out, and not the character of the activity itself, that determines whether or not it is of a charitable nature....” Result, cont. • The Court held that pursuing a purpose which is not itself charitable may not disqualify an organization from being considered charitable if the purpose is pursued only as a means to fulfill another, charitable purpose and not as an end in itself • CRA fits fundraising into this exemption Lessons Learned • CRA accepts fundraising within limits set by law and the Income Tax Act, but it is not in itself a true charitable purpose or activity • Fundraising is an exception to the general rule and is therefore likely to be enforced strictly Richert v. Stewards' Charitable Foundation (2005 BCSC) • A donor attended a luncheon event and made a donation of $1,000. The host charity deducted a portion of his donation to cover his meal and a complimentary book (following CRA’s split receipting rules). The offended donor demanded a refund (alleged a resulting trust) • Donor's claim dismissed and Appeal dismissed Lessons Learned • All advantages derived from attending an event, including complimentary items, must be deducted from the purchase price of the ticket to arrive at the eligible amount of the gift • Follow CRA split receipting rules • Clearly communicate policies in advance: gift acceptance policies, refunds, etc. • Be aware of donor expectations or risk “trivial misunderstandings” developing into court cases • A completed gift cannot be undone Millennium Charitable Foundation v. Canada (2008 FCA) • Charity being revoked for participation in tax shelters attempts to maintain its charitable status • Appeal denied and charity revoked Mistakes Made, Lessons Learned • The charity was purely a tax shelter vehicle: it had no proper charitable donations or activities to point to in attempting to maintain its status • Revocation is CRA's ultimate punishment for inappropriate fundraising • CRA holds all the cards Innovative Gifting Inc. v. House of the Good Shepherd (2010 OSCJ) • A promoter and team of financial advisors recruited charities into receiving cash donations from local donors. The cash donations were to be matched by an anonymous philanthropist by way of share donations. Promoter's fees were calculated on full value of cash and shares (which were actually worthless). The philanthropist did not in fact exist • Two charities refused to pay the promoter, and he sued to enforce a fundraising agreement Result • Court found in favour of the charities, and refused to uphold the promoter's fundraising agreement, for several reasons: – The fee portions of the agreements were nonsensical, and so unenforceable – The promoter gave the charities false information – The promoter failed to provide the donated shares – The agreements were void as contrary to public policy as the fees were not reasonable, justified or proportionate to the amount of money raised for charitable purposes (the promoter received 90% or more of the funds raised) Mistakes Made, Lessons Learned • Even sophisticated charities can be drawn into tax schemes • Promoters prefer using established, legitimate charities • Disentangling from a tax scheme is difficult and expensive, and puts the charity's registration at risk • Some opportunities are too good to be true • Be skeptical of professional fundraisers, and scrutinize their promises carefully • Courts are willing to get involved to assist charities Ontario v. AIDS Society for Children (2001 OSCJ) • A charity retained third party fundraisers. Donor complaints led to a provincial investigation, which revealed that all of the funds had been applied to the fundraising expenses, and the Society was in debt • The CRA revoked the charity’s registration and the Ontario Public Guardian applied to court to order an accounting of how funds were spent. Mistakes Made, Lessons Learned • Directors gave up too much control to the fundraisers, and failed to terminate the contracts when it became clear that 100% of the funds raised were going to expenses • Court found that the charity and the directors were responsible as fiduciaries to the public for all of the funds raised • Fundraisers are agents for a charity, and must account to the charity for every dollar raised Mistakes Made, Lessons Learned, cont. • The fundraising contracts were voidable as contrary to public policy, and because they misrepresented to donors how the funds would be used Re:YWCA Extension Campaign Fund (1934 SASK.K.B.) • In 1929, the Regina YWCA raised $17,000 to be used to build accommodations for young women. The amount was not enough to complete the project, and also attendance dropped and so the expanded accommodations were unnecessary • YWCA applied to court for consent to use the money for its operating deficit instead, under the cy-pres doctrine Result • The court refused the application Lessons Learned • A court has a general power to divert charity funds when a particular project proves impossible, but not when a charity simply decides not to proceed • A charity has a responsibility to notify donors in advance of how their donation may be used Coombs v. R (2008 TCC) • A charity’s accountant used his access to receipts to issue false donations receipts to his friends and family for several years, for well over $500,000. CRA investigated when the new accountant discovered the scheme, disallowed the donation claims and assessed penalties against the “donors”. The “donors” appealed to the Court Result • The appeals were denied and the penalties upheld. The Court found that the “donors” made no real gifts to the charity Mistakes Made, Lessons Learned • The charity’s executive director and board were far too trusting of the accountant, and allowed the scheme to proceed for years • Donors risk harsh penalties for false donations • The board and their new accountant managed to avoid revocation of their charity status, despite the scheme Norton v. the Queen (2008 TCC) • Donor gave $20,000 to her husband’s charity, received $15,000 back, claimed receipt for $20,000 Result • Court found the scheme was typical of the aggressive tax shelters that attempt to leverage tax deductions or credits. Court listed examples: gifting of art to charities, buying of false charitable tax receipts, tax shelters for research and development in Quebec, seismic data, marketing software • The technique is the same: donors write off more than the amount they have paid or are liable to pay • Donation receipt disallowed Mistakes Made, Lessons Learned • Donor relied on her husband • CRA challenges all aggressive tax schemes, and donors will be reassessed Ballard v. Canada (2011 FCA) • CRA challenged a donor scheme at Foundation that partnered with Trinity Western University • Students solicited donations from friends and family, then received bursaries for education expenses, equal to approximately 80% to 100% of the lesser of students’ eligible expenses and the funds that they had solicited. Donors appealed to have their donations recognized Result • Donations disallowed • Donors motivated to make gifts by knowledge that their relatives would receive scholarships. A gift is a gratuitous transfer of property owned by the donor in return for which no benefit flows to the donor. When a private benefit arises from a gift, a court will determine whether the strength of the link between any benefit to the donor and his or her “donation” is sufficiently strong to disqualify the “donation” from being a “gift” under the Income Tax Act • Appeal dismissed Mistakes Made, Lessons Learned • Private benefit taints fundraising programs • A true gift has minimal private benefit to the donor • Charities risk their reputation when they participate or endorse tax schemes International Charity Association Network v. Canada (2008 TCC) • Charity failed to provide CRA with documentation to explain, support or justify payments and expenditures of $26M in fundraising payments and $244M in charitable program expenditures (gifts in kind of medication) • Charity applied to postpone the CRA penalty (suspension of their receipting rights) Result • The Court denied ICAN’s application to postpone the suspension of receipting privileges • ICAN’s charity status revoked in 2008 Mistakes Made, Lessons Learned • Charities risk dissolution or having receipting privileges suspended for inappropriate fundraising arrangements • Charities must be able to prove direction and control of their own fundraising: this should be evident from documents, board, minutes, policies, etc. Redeemer Foundation (2006 FCA) • CRA challenged Redeemer Foundation scholarship program. This court decision did not assess the program, but dealt with a preliminary issue of the CRA’s right to access the donation records, and what procedures CRA needs to follow • Redeemer challenged CRA’s ability to access donor records Result • Redeemer Foundation lost: the SCC found that CRA was entitled to the donor information that Redeemer was obligated to collect. Result • A charity is required to maintain records to enable CRA to ascertain if there are grounds to revoke its registration as a charity, and to verify that the donations were eligible for deductions • CRA can access this information pursuant under its audit power in the Income Tax Act, which entitles CRA to examine all the books and records of a charity. CRA is not required to obtain a court order before obtaining this information Mistakes Made, Lessons Learned • CRA has broad power to access records • Onus is on charity to justify its fundraising schemes Cannon v. Funds for Canada Foundation (2012 ONSC) • Almost 10,000 donors gave millions to a tax scheme, which saw money flow through a complex structure to the promoters, and back to the donors • This decision was a certification motion for a class action by donors against a charity, its related trusts and entities, and their lawyers regarding a disallowed charity fundraising tax scheme • Result: the class action was certified and sent on to trial. Case is still in progress Mistakes Made, Lessons Learned • Class actions represent a new form of remedy for aggrieved donors against charities and tax scheme promoters, because they can now more easily band together to bring claims related to fundraising schemes • Court notes that the scheme required “legitimate charities ... that were in need of cash and were prepared to give back 99% of the money donated to them ...in return for the promise of a future income stream from the use of the Software Program...” COMMON FUNDRAISING ERRORS 1. Downplaying private benefits to donors 2. Issuing receipts improperly: receipting for services, not obtaining independent valuations for non-cash gifts 3. Allowing excessive or disproportionate fundraising costs, especially with thirdparty fundraisers 4. Being tempted into participating in suspicious tax schemes COMMON FUNDRAISING ERRORS 5. Assessing and reporting allocations incorrectly on the T3010 Annual Report. This leads charities to unnecessarily attract CRA attention by exaggerating fundraising costs, or risk censure for understating fundraising costs – Not following CRA requirements on what is considered fundraising – Incorrectly categorizing fundraising costs in line 5000 and following – Making errors in transferring amounts from the financial statements (addition errors, using the wrong line, using net amounts instead of gross, etc.) – Omitting fundraising costs altogether COMMON FUNDRAISING ERRORS 6. Improperly “lending” receipting status to a worthy individual or new organization 7. Not adequately overseeing or documenting fundraising practices DISCUSSION AND QUESTIONS #5 – 15243 – 91 Avenue Surrey, B.C., V3R 8P8 604-953-1500 www.dvclawyers.com cdejager@dvclawyers.com ljohnson@dvclawyers.com