2012 Annual Report - Investor Relations Solutions

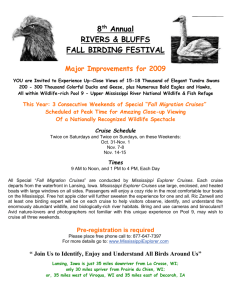

advertisement