Facts & Statistics on the Irish Stock Exchange, its listed companies and

advertisement

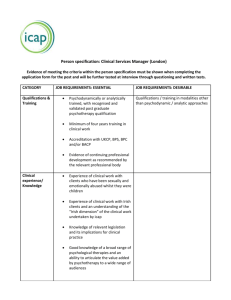

IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH FACTS & STATISTICS ON THE IRISH STOCK EXCHANGE, ITS LISTED COMPANIES AND THE ISE-RELATED SECURITIES INDUSTRY OCTOBER 2014 OUR VISION #1 EU EXCHANGE CHOICE FOR ISSUERS OF GLOBAL FIXED INCOME, FUNDS AND IRISH SECURITIES BENEFITS OF HAVING A LOCAL STOCK MARKET • Source of equity funding for enterprise • Lowers the cost of capital for domestic firms • Creates local knowledge and specialisation • Delivers macroeconomic benefits including greater R&D intensity and higher levels of foreign direct investment (FDI) Research compiled by Indecon IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 1 KEY STATISTICS 3 MARKETS 80 THE ISE AN INTERNATIONAL BUSINESS COUNTRIES WITH ISSUERS ON ISE MARKETS Main Securities Market Enterprise Securities Market Global Exchange Market SECURITIES LISTED 30 € 52 46 Irish Government Bonds MEMBER FIRMS Equities 2,196 Funds and sub-funds 24,169 Debt 37 INTERNATIONAL MEMBERS Source: ISE - September 2014 2 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 3 THE ECOSYSTEM SUPPORTING LISTING AND TRADING ON THE ISE STOCKBROKERS INVESTMENT FIRMS INTERNATIONAL BANKS Member firms supporting trading, corporate broking and research THE SECURITIES INDUSTRY EMPLOYING HIGHLY SKILLED PROFESSIONALS FUNDS IRISH GOVERNMENT BONDS Equity sponsors and ESM advisors Fund sponsors DEBT Debt listing agents EQUITIES Legal and accounting professionals supporting listing LAWYERS ACCOUNTANTS RESEARCH ANALYSTS 4 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 5 ECONOMIC IMPACT AND CONTRIBUTION IN IRELAND IRISH OPERATIONS OF ISE-RELATED ECOSYSTEM DIRECT ECONOMY WIDE €m €m Output/Sales Revenues from Irish operations €377m €704m Tax Contribution (incl. Stamp Duty) €230m - Irish Employment Incomes Supported €177m €314m Irish Non-Labour Business Expenditure €130m €242m GVA/GDP Contribution €207m €325m Irish Employment Supported - Full-Time Equivalents (FTEs) 2,101 2,977 € THE SECURITIES INDUSTRY SUPPORTING THE LOCAL ECONOMY € Source: Estimated impact based on Indecon analysis of 2012 figures 6 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 7 PROFILE OF COMPANIES ON ISE MARKETS ISE MARKET # COMPANIES Main Securities Market (MSM) 26 Enterprise Securities Market (ESM) 26 73% PRIMARY LISTED IN IRELAND 88% DUAL LISTED ISE LISTED COMPANIES MARKET PROFILE Total 52 SECTORAL PROFILE Exploration 29% Financial Services 19% Agri/Food/Beverages 17% Media and Leisure 7% Construction 8% Transport 6% ICT 4% Life Sciences, incl. Pharma and Medtech 4% Business Services 2% Retail/Wholesale 2% Other Manufacturing 2% Source: ISE - September 2014 8 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 9 FOOD/AGRICULTURE FINANCIAL SERVICES /REITS EXPLORATION ISE LISTED COMPANIES SECTORAL CLUSTERS Source: ISE - September 2014 10 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 11 WORLDWIDE EMPLOYEES EMPLOYEES 263,301 260,215 256,315 271,819 286,670 284,136 258,055 260,000 €83bn REVENUES 2012 2011 2010 2009 2008 2007 €8bn EARNINGS €7,273m €6,160m €6,783m €8,140m €7,976m 2009 2010 2011 2012 €82,867m 2012 2008 €78,653m 2011 €8,168m €73,491m 2010 2007 €78,193m 2009 €6,836m €80,980m 2008 2006 €90,679m 2007 WORLDWIDE EARNINGS €76,561m WORLDWIDE REVENUES 2006 ISE LISTED COMPANIES GLOBAL FOOTPRINT 2006 € Source: Indecon analysis based on Bloomberg 2012 data. Figures exclude Tesco and Diageo. 12 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 13 €23.5bn EQUITY FUNDS RAISED 2004 - 2013 FUNDS RAISED Irish Companies Other Companies ISE LISTED COMPANIES RAISING FUNDS INTERNATIONALLY €bn % OF TOTAL €20.1bn 85.4% €3.4bn 14.6% 41 NEW COMPANY LISTINGS ON ISE MARKETS 2004 - 2013 MINCON GAMEACCOUNT NETWORK CPL RESOURCES C&C GROUP HIBERNIA REIT ISEQ EXCHANGE TRADED FUND FASTNET OIL AND GAS PETROCELTIC INTL GREEN REIT TOTAL PRODUCE AER LINGUS GROUP ZAMANO FIRST DERIVATIVES SMURFIT KAPPA GROUP GREAT WESTERN MINING PETRONEFT RESOURCES ORIGIN ENTERPRISES FALCON OIL AND GAS MERRION PHARMACEUTICALS ARYZTA Source: ISE *Equity funds raised relate to all listings and include equity monies raised through introductory offers, share placings, open offers, rights issues, share allotments, and other means. 67% INTERNATIONAL INVESTORS IN IRISH LISTED COMPANIES Source: Federation of European Securities Exchanges (FESE) - market research 2007 14 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 15 ECONOMIC IMPACT AND CONTRIBUTION IN IRELAND IRISH OPERATIONS OF ISE LISTED COMPANIES DIRECT ECONOMY WIDE €m €m €12.1bn €24.0bn Irish Employment Incomes Supported €2.5bn €4.2bn Irish Non-Labour Business Expenditure €7.3bn €15.0bn €5.3bn €9.5bn Output/Sales Revenues from Irish Operations € ISE LISTED COMPANIES SUPPORTING THE IRISH ECONOMY € GVA/GDP Contribution Irish Employment Supported – Full Time Equivalents (FTEs) 49,148 97,435 Source: Estimated impact based on Indecon analysis of 2012 figures. Figures exclude Tesco and Diageo. 16 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 17 TOP 6 MOST SIGNIFICANT FACTORS IN COMPANIES DECISION TO LIST ON IRISH STOCK EXCHANGE WHY COMPANIES LIST ON THE ISE € Access to Irish investors 88.4% Access to international investors 80.8% Achieving the best valuation for the company 77% Ability to maintain or grow liquid market for shareholders 72% Profile of company raised with investors, customers, suppliers, other finance providers and employees Access to option of dual listing with certain international markets 69.2% 68% Source: Indecon analysis of Confidential Survey of ISE-listed Companies 18 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 19 INTERNATIONAL PARTNERS WORLD CLASS ACCESSIBLE SYSTEMS IRISH LISTED COMPANIES #1 TRADING VENUE 20 TRADING CLEARING SETTLEMENT XETRA EUREX CREST EQUITY TRADING MEMBERS SOURCING GLOBAL INVESTORS IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 21 FACTORS INFLUENCING DECISIONS BY DEBT ISSUERS TO LIST ON ISE - VIEWS OF ISE DEBT LISTING AGENTS WHY GLOBAL DEBT ISSUERS CHOOSE THE ISE Efficiency of listing process 100% Experience and reputation of the ISE and the Central Bank 100% Expertise and technical knowledge 100% Communication and willingness to engage 88.9% Competitive listing fees 88.9% Choice of markets 66.6% Source: Indecon Confidential Survey of Irish Stock Exchange Debt Listing Service Providers 22 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 23 DEBT LISTING GLOBAL FOOTPRINT AUTOPISTAS METROPOLITANAS DE PUERTO RICO BBVA 24 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 25 EUROPE 2013 ACROSS 48 EXCHANGES 1,000 5,000 4,562 4,562 2,000 10,000 20,000 Malta Stock Exchange SIX Swiss Exchange Borsa Istanbul CEESEG - Vienna Oslo Børs Warsaw Stock Exchange NASDAQ OMX Nordics & Baltics London Stock Exchange NYSE Euronext Deutsche Börse Irish Stock Exchange Luxembourg Stock Exchange Abu Dhabi SE Bermuda SE Mauritius SE Saudi Stock Exchange - Tadawul Muscat Securities Market Bursa Malaysia Athens Exchange Casablanca SE Ljubljana SE Cyprus SE New Zealand Exchange Taiwan SE Corp. Malta SE Egyptian Exchange Amman SE Budapest SE TMX Group Colombo SE BM&FBOVESPA Japan Exchange Group - Osaka Japan Exchange Group - Tokyo Borsa Istanbul Hong Kong Exchanges Shenzhen SE Lima SE The Stock Exchange of Thailand Colombia SE Tel Aviv SE Mexican Exchange Moscow Exchange GreTai Securities Market Shanghai SE Johannesburg SE Singapore Exchange Oslo SIX Swiss Exchange BSE India BSE India Wiener Borse Luxembourg SE NYSE Euronext (Europe) National Stock Exchange India NASDAQ OMX Nordic Exchange Korea Exchange London Stock Exchange Irish SE Deutsche Borse Luxembourg SE Source: Indecon analysis of FESE data (WFE data for London Stock Exchange) Source: Indecon analysis of World Federation of Exchanges (WFE), Federation of European Securities Exchanges (FESE) and London Stock Exchange data #2 NEW DEBT LISTINGS #3 WORLDWIDE 2013 27 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 26 5,000 21,719 25,000 IRISH STOCK EXCHANGE DEBT LISTINGS 30,000 6,000 4,000 15,000 3,000 0 FACTORS INFLUENCING DECISIONS TO LIST INVESTMENT FUNDS ON ISE – VIEWS OF ISE FUND SPONSORS WHY GLOBAL INVESTMENT MANAGERS CHOOSE THE ISE Efficiency of listing process 100% Experience and reputation of the ISE and Central Bank 87.5% Open communication and willingness to engage 75.0% ISE Competitive listing fees 75.0% Expertise and technical knowledge 62.5% Source: Indecon Confidential Survey of Irish Stock Exchange Funds Listing Service Providers 28 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 29 GLOBAL INVESTMENT MANAGERS IRISH STOCK EXCHANGE #4 FUND LISTING WITH ISE LISTED FUNDS WORLDWIDE 2013 7000 6000 5000 4000 2,352 3000 2000 1000 0 Japan Exchange Group - Tokyo TMX Group Budapest SE BM&FBOVESPA Santiago SE Euronext Shenzhen SE Moscow Exchange NASDAQ OMX Nordic Exchange NYSE Mexican Exchange National Stock Exchange India Irish SE Deutsche Börse BME Spanish Exchanges Luxembourg SE Source: Indecon Analysis of World Federation of Exchanges (WFE) and ISE fund and sub-funds data Global investment managers with ISE listed funds 30 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH 31 VIEWS ON THE ISE “A key advantage of the ISE is the flexibility of approach that it can offer to issuers via GEM…The openness of the ISE to converse with legal counsel/issuers directly has become a marked advantage over its competitors.” DEBT LISTING AGENT “The ISE is still seen as the exchange of choice for listing investment funds. Clients appreciate the smooth listing process. Costs are on a par with various exchanges around the world.” INVESTMENT FUND SPONSOR “The ISE was important to the development of the company as it enabled us to raise equity in order to grow the business and pay down debt.” ISE LISTED COMPANY Source: Indecon Research of market participants 2013 32 IRISH STOCK EXCHANGE LOCAL SUPPORT GLOBAL REACH Indecon statistics and analysis from research conducted on behalf of the Irish Stock Exchange published October 2014 Irish Stock Exchange 28 Anglesea Street Dublin 2, Ireland T +353 1 617 4200 F +353 1 677 6045 www.ise.ie