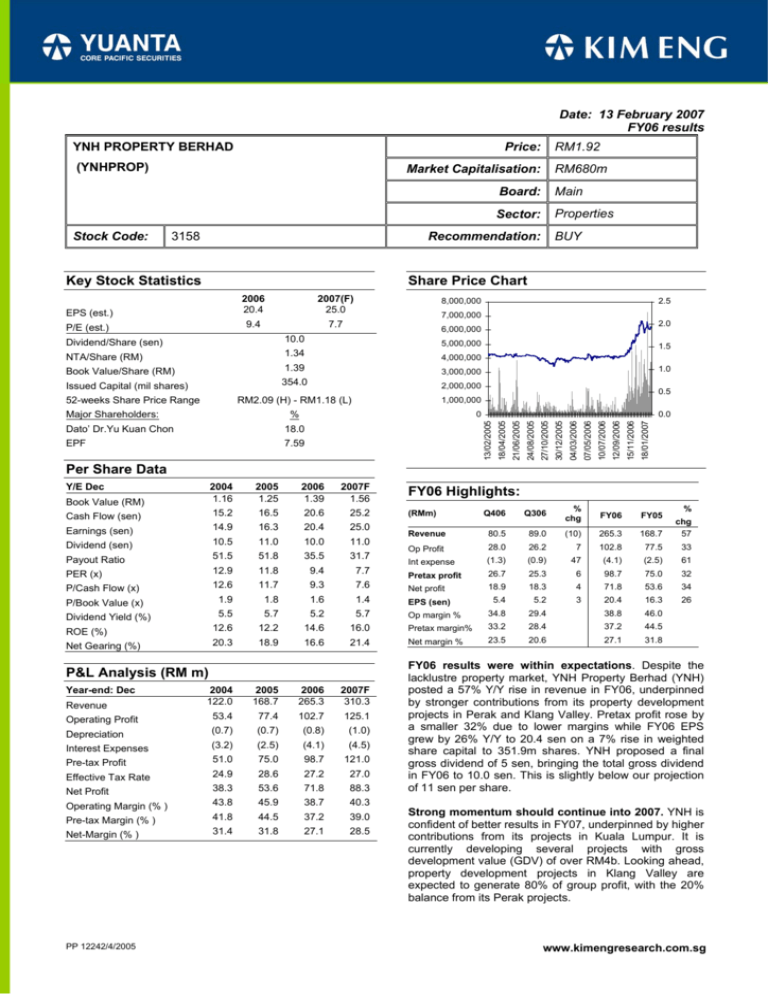

Date: 13 February 2007

FY06 results

YNH PROPERTY BERHAD

(YNHPROP)

RM680m

Market Capitalisation:

3158

Board:

Main

Sector:

Properties

BUY

Recommendation:

Key Stock Statistics

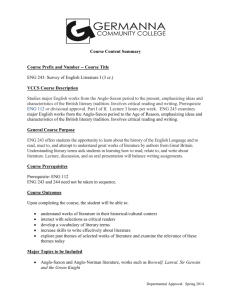

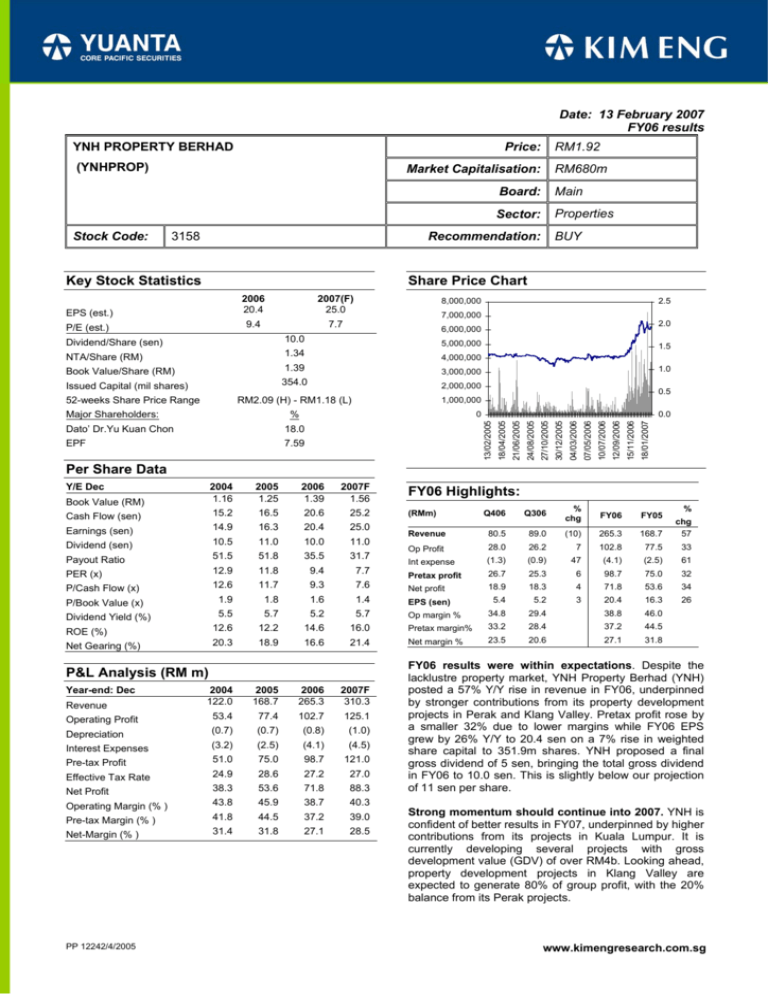

Share Price Chart

7.7

Dividend/Share (sen)

5,000,000

NTA/Share (RM)

1.34

4,000,000

Book Value/Share (RM)

1.39

3,000,000

Issued Capital (mil shares)

354.0

2,000,000

RM2.09 (H) - RM1.18 (L)

1,000,000

%

1.5

1.0

0.5

18/01/2007

15/11/2006

12/09/2006

7.59

10/07/2006

EPF

0.0

07/05/2006

18.0

04/03/2006

0

Dato’ Dr.Yu Kuan Chon

13/02/2005

Major Shareholders:

2.0

6,000,000

10.0

52-weeks Share Price Range

2.5

7,000,000

30/12/2005

9.4

8,000,000

27/10/2005

P/E (est.)

2007(F)

25.0

24/08/2005

2006

20.4

21/06/2005

EPS (est.)

18/04/2005

Stock Code:

RM1.92

Price:

Per Share Data

Y/E Dec

Book Value (RM)

2004

1.16

2005

1.25

2006

1.39

2007F

1.56

Cash Flow (sen)

15.2

16.5

20.6

25.2

Earnings (sen)

14.9

16.3

20.4

25.0

Dividend (sen)

10.5

11.0

10.0

11.0

Payout Ratio

51.5

51.8

35.5

31.7

PER (x)

12.9

11.8

9.4

7.7

P/Cash Flow (x)

12.6

11.7

9.3

7.6

P/Book Value (x)

1.9

1.8

1.6

1.4

EPS (sen)

Dividend Yield (%)

5.5

5.7

5.2

5.7

ROE (%)

12.6

12.2

14.6

16.0

Net Gearing (%)

20.3

18.9

16.6

21.4

P&L Analysis (RM m)

Year-end: Dec

Revenue

2004

122.0

2005

168.7

2006

265.3

2007F

310.3

Operating Profit

53.4

77.4

102.7

125.1

Depreciation

(0.7)

(0.7)

(0.8)

(1.0)

Interest Expenses

(3.2)

(2.5)

(4.1)

(4.5)

Pre-tax Profit

51.0

75.0

98.7

121.0

Effective Tax Rate

24.9

28.6

27.2

27.0

Net Profit

38.3

53.6

71.8

88.3

Operating Margin (% )

43.8

45.9

38.7

40.3

Pre-tax Margin (% )

41.8

44.5

37.2

39.0

Net-Margin (% )

31.4

31.8

27.1

28.5

PP 12242/4/2005

FY06 Highlights:

(RMm)

Q406

Q306

%

chg

FY06

FY05

168.7

%

chg

57

Revenue

80.5

89.0

(10)

265.3

Op Profit

28.0

26.2

7

102.8

77.5

33

Int expense

(1.3)

(0.9)

47

(4.1)

(2.5)

61

Pretax profit

26.7

25.3

6

98.7

75.0

32

Net profit

18.9

18.3

4

71.8

53.6

34

5.4

5.2

3

20.4

16.3

26

Op margin %

34.8

29.4

38.8

46.0

Pretax margin%

33.2

28.4

37.2

44.5

Net margin %

23.5

20.6

27.1

31.8

FY06 results were within expectations. Despite the

lacklustre property market, YNH Property Berhad (YNH)

posted a 57% Y/Y rise in revenue in FY06, underpinned

by stronger contributions from its property development

projects in Perak and Klang Valley. Pretax profit rose by

a smaller 32% due to lower margins while FY06 EPS

grew by 26% Y/Y to 20.4 sen on a 7% rise in weighted

share capital to 351.9m shares. YNH proposed a final

gross dividend of 5 sen, bringing the total gross dividend

in FY06 to 10.0 sen. This is slightly below our projection

of 11 sen per share.

Strong momentum should continue into 2007. YNH is

confident of better results in FY07, underpinned by higher

contributions from its projects in Kuala Lumpur. It is

currently developing several projects with gross

development value (GDV) of over RM4b. Looking ahead,

property development projects in Klang Valley are

expected to generate 80% of group profit, with the 20%

balance from its Perak projects.

www.kimengresearch.com.sg

YNH Property Berhad

13 February 2007

of GDV – are expected to have a combined GDV of

RM1b and will start to contribute in 2009.

Table 1: YNH’s property projects

GDV

(RMm)

Area

(acre)

Projects in Kuala Lumpur

2440

Lot 163 Suites, Jalan Perak

280

1.0

Ceriaan Kiara, Mont’ Kiara

160

3.1

Wisma YNH, besides Shangri-La

Kuala Lumpur

1000

3.0

Land behind Renaissance KL along

Jalan Sultan Ismail

200

2.0

Projects 1-5 Duta (near Duta

Nusantara & Duta Solaris)

800

18.0

Projects in Perak

2300

Manjung Point

2300

•

•

•

•

YNH will continue to scout for prime land in the Klang

Valley. This includes a 6-acre land near Plaza Mont

Kiara, which could be developed jointly with several

foreign parties into an integrated commercial

development with a GDV of at least RM0.5b.

Finance & dividends

Balance sheet is healthy, with net gearing of about 17%

as of Dec 2006. Dividends-wise, YNH’s policy is to

allocate at least 30% of its net profit as dividends. With

better profits, we expect YNH to raise its gross dividend

to 11 sen per share in FY07, translating to a net payout

of 32%.

782

Balance Sheet

Lot 163 Suites – The project is located in Jalan

Perak (next to Wisma Hong Leong), and comprises

service apartments, a retail arcade and an office

tower. Its GDV has risen to RM280m from RM218m,

due to an increase in lettable office space to around

100,000 sq ft. Take-up rate for the service

apartments is around 90%, while the office block is

up for en-bloc sale.

Y/E 31 Dec (RMm)

Ceriaan Mont Kiara – The project, which is

expected to be launched soon, is in the affluent Mont

Kiara area and will have 238 units of high-end

condominiums. The GDV is now higher at RM160m

from RM140m previously, thanks to an increase of

its selling price to RM360 psf.

2004

2005

2006

2007F

Total Assets

461.1

623.1

668.8

771.0

Fixed Assets

114.5

166.1

147.8

151.8

Current Assets

166.9

330.7

369.9

418.2

L T Assets

179.7

126.3

151.0

201.0

Current Liabilities

121.7

111.4

125.8

129.7

L T Liabilities

46.1

57.8

46.1

96.1

Share Capital

261.3

350.6

354.0

354.0

Shareholders Funds

303.6

439.4

493.0

553.3

Major shareholders

The Yu family now controls about 20% of YNH while the

Employees Provident Fund holds another 7.6%. The Yu

family also owns 20.7% of Rapid Synergy Berhad (RSB),

a company listed on the Second Board of Bursa

Malaysia. RSB is involved in property development,

property investments and the precision tools business.

We have been assured that YNH will remain the property

development arm of the Yu family; and the family’s longterm plan is to make RSB its property investment arm.

Wisma YNH – The flagship project is located next to

Shangri-La Hotel Kuala Lumpur, and will be

developed in a joint venture (60:40) with Singapore’s

CapitaLand Limited. The iconic project, with 1.2m sq

ft of Grade A office and retail space, has an

estimated GDV of RM1b. Construction is expected to

start in mid-2007, with completion slated for 2011.

The MOU was signed on 20 Dec 2006; a definitive

agreement will be signed once the relevant

approvals have been obtained.

Attractive valuations; BUY retained

YNH remains attractively valued, at 7.7x FY07 PER and

a projected dividend yield of more than 5%. A re-rating to

a PER of 9x will translate to a target price of RM2.25.

Manjung Point – Manjung Point, YNH’s flagship

project in Perak with a GDV of RM2.3b, will be

developed over 20 years. More than 60% of buyers

are civil servants – mainly navy personnel at the

nearby Lumut Naval Base. This project clearly

benefits from having a near-by captive market. YNH

is the largest property developer in the Manjung

district, with an estimated market share of 65-70%.

Annual output is about 500 residential and

commercial units, with respective average selling

prices of RM100,000 and RM350,000 per unit.

YNH also secured several parcels of prime land in Kuala

Lumpur (behind Renaissance Kuala Lumpur) and Mont

Kiara (Project 1-5 Duta/Solaris), measuring 20 acres.

These land parcels – which were acquired in joint

ventures with landowners, who will receive a percentage

2

ANALYSTS’ COVERAGE / RESEARCH OFFICES

SINGAPORE

Sebastian HENG Head of Research

+65 6432 1858 sebastianheng@kimeng.com

Strategy

Oil & gas

Marine

Stephanie WONG

Regional Head of Institutional Research

+65 6432 1451 swong@kimeng.com

Telcos

Media

Consumer

Gregory YAP

+65 6432 1450 gyap@kimeng.com

China Consumer

Regional Themes

Rohan SUPPIAH

+65 6432 1455 rohan@kimeng.com

Conglomerates

Transport

Pauline LEE

+65 6432 1453 paulinelee@kimeng.com

Bank & Finance

Consumer

Wilson Liew

+65 6432 1454 wilsonliew@kimeng.com

Properties

David LOOMIS

+65 6432 1417 dloomis@kimeng.com

Korea Special Situations

KELIVE Singapore

ONG Seng Yeow Head of Research

+65 6432 1832 ongsengyeow@kimeng.com

TAN Chin Poh

+65 6432 1859 chinpoh@kimeng.com

GOH Han Peng

+65 6432 1857 gohhanpeng@kimeng.com

Geraldine EU

+65 6432 1469 geraldineeu@kimeng.com

Daniel THAM

+65 6432 1412 danieltham@kimeng.com

HONG KONG / CHINA

Stephen BROWN Head of Research

+852 2268 0638 stephenbrown@kimeng.com.hk

Edward FUNG

+852 2268 0632 edwardfung@kimeng.com.hk

Utilities

Telcos

Ivan LI

+852 2268 0641 ivanli@kimeng.com.hk

Bank & Finance

Alvin WONG

+852 2268 0633 alvinwong@kimeng.com.hk

Property

Larry GRACE

+852 2268 0630 larrygrace@kimeng.com.hk

Oil & Gas

Dennis LAM

+852 2268 0635 dennislam@kimeng.com.hk

Consumer

Ivan CHEUNG

+852 2268 0634 ivancheung@kimeng.com.hk

Industrials

Elsa YANG

+852 2268 0631 elsayang@kimeng.com.hk

China consumer

MALAYSIA

YEW Chee Yoon Head of Research

+603 2141 1555 cheeyoon@kimengkl.com

Strategy

Banks

Telcos

Property

Shipping

Oil & gas

Gaming

Media

Power

Construction

Food & Beverage

Manufacturing

Plantations

Tobacco

Electronics

INDONESIA

Katarina SETIAWAN Head of Research

+6221 3983 1458 ksetiawan@kimeng.co.id

Strategy

Telcos

Cigarettes/Consumer

Shipping

Others

Andrey WIJAYA

+6221 3983 1457 andreywijaya@kimeng.co.id

Retail

Cement

Pharmaceutical

Mining

Ricardo SILAEN

+6281 3983 1455 rsilaen@kimeng.co.id

Heavy Equipment

Resources

Property

Yusuf Ade Winoto

+6281 3983 1455 yawinoto@kimeng.co.id

Banking

Multifinance

Yuniar RESTANTO

+6221 3983 1455 yrestanto@kimeng.co.id

Technical Analyst

Adi N. Wicaksono

+6221 3983 1455 anwicaksono@kimeng.co.id

Generalist

PHILIPPINES

Ed BANCOD Head of Research

+63 2 849 8848 ed_bancod@atr.com.ph

Strategy

Telcos

Banking

Luz LORENZO Economist

+63 2 849 8836 luz_lorenzo@atr.com.ph

Strategy

Economics

Laura DY-LIACCO

+63 2 849 8843 laura_dyliacco@atr.com.ph

Utilities

Media

Conglomerates

Leo VENEZUELA

+63 2 849 8839 leo_venezuela@atr.com.ph

Consumer

Property

Ports

3

TAIWAN

Darryl CHENG

+886 2 2718 1647 darryl.cheng@yuanta.com.tw

Downstream

Chialin LU

+886 2 2758 5097 chialin.lu@yuanta.com.tw

Communications

Networking

Camera

Eric LIN

+886 2 2546 0618 eric.lin@yuanta.com.tw

Optical

Passive components

TFT-LCD

Tess WANG

+886 2 2719 8105 tess.wang@yuanta.com.tw

Financials

THAILAND

David BELLER

+662 658 6300 x 4740 david.b@kimeng.co.th

Banks

Shipping

Construction

Montip NITIBHON

+662 658 6300 x 4750 montip@kimeng.co.th

Telecoms

Entertainment

Naphat CHANTARASEREKUL

+662 658 6300 x 4770 naphat.c@kimeng.co.th

Electronics

Automotive

Tourism

Commerce

Bussaba WATCHARAPASORN

+662 658 6300 x 4760 bussaba.w@kimeng.co.th

Property

Nash SHIVARUCHIWONG

+662 658 6300 x 4730 nathavut@kimeng.co.th

KELIVE Thailand

George HUEBSCH Head of Research

+662 658 6300 ext 1400 george.h@kimeng.co.th

SOUTH KOREA

Woo-Kyun CHANG Head of Research

+82 2 6730 1555 wkchang@kimeng.co.kr

Bank & Finance

Stockbrokers & Insurers

Peter AUO

+82 2 6730 1562 peterauo@kimeng.co.kr

Auto & Auto-parts manufacturers

Shipbuilding & Shipbuilding Parts

Construction & Construction material

Heather KANG

+82 2 6730 1551 hkang@kimeng.co.kr

Food & Beverage

Consumer & Retailers

Travel & Hotel

Youna HONG

+82 2 6730 1553 younahong@kimeng.co.kr

Pharmaceuticals

Casinos & Resorts

Media & Advertising

YNH Property Berhad

13 February 2007

DISCLAIMER

THIS RESEARCH REPORT IS FOR OUR CLIENTS ONLY TO WHOM IT IS SPECIFICALLY ADDRESSED TO OR IS

ALLOWED ACCESS TO. IF YOU ARE NOT A CLIENT AND/OR DO NOT AGREE TO BE BOUND BY THE TERMS AND

DISCLAIMERS SET OUT BELOW, YOU SHOULD DISREGARD THIS RESEARCH REPORT IN ITS ENTIRETY AND

INFORM US THAT YOU NO LONGER WISH TO RECEIVE SUCH RESEARCH REPORTS.

This report is not a solicitation or an offer to buy or sell any securities or related financial products. The information and

commentaries are also not meant to be endorsements or offerings of any securities, options, stocks or other investment

vehicles. The report has been prepared without regard to the individual financial circumstances, needs or objectives of

persons who receive it. The securities discussed in this report may not be suitable for all investors. The appropriateness of

any particular investment or strategy whether opined on or referred to in this report or otherwise will depend on an investor’s

individual circumstances and objectives and should be independently evaluated and confirmed by such investor, and, if

appropriate, with his professional advisers independently before adoption or implementation (either as is or varied).

To the extent that the reader is an accredited or professional investor or a person who is not a citizen or resident of

Singapore or a dependent of either for the purposes of the Singapore Securities and Futures Act ("SFA") or Financial

Advisers Act ("FAA"), Kim Eng specifically relies on the exemption from all suitability compliance requirements provided

pursuant to regulations and guidelines to the SFA and/or the FAA.

Kim Eng, its affiliate companies and/or their respective associates, directors and employees may have investments in

securities or derivatives of securities of companies mentioned in this report, and may make investment decisions that are

inconsistent with the views expressed in this report. Derivatives with respect to the companies mentioned in this report may

be issued by Kim Eng, its related companies or associated/affiliated persons.

Kim Eng and its related and affiliated companies are involved in many businesses that may relate to companies mentioned

in this report, including market making and specialized trading, risk arbitrage and other proprietary trading, fund

management, investment services and corporate finance and we may perform or seek to perform broking, investment

banking and other services for such companies.

Except with respect the disclosures of interest made above, this report is based on current public information that we

consider reliable but we make no representation that it is accurate or complete, and it should not be relied as such.

Additional information on mentioned securities is available on request

This report is being disseminated to or allowed access by our clients in their respective jurisdictions by the Kim Eng affiliated

entity/entities operating and carrying on business as a securities dealer in that jurisdiction (collectively or individually, as the

context requires, "Kim Eng") which has, vis-à-vis such client, approved of, and is solely responsible in that jurisdiction for,

the contents of this publication in that jurisdiction. This report is not directed to, or intended for distribution to or use by, any

person or entity who is a citizen or resident of or located in any jurisdiction where such distribution or use would be contrary

to applicable law or regulation.

THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE

PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR

TRANSMITTED INTO THE REPUBLIC OF KOREA. FAILURE TO COMPLY WITH THIS RESTRICTION MAY

CONSTITUTE A VIOLATION OF SECURITIES LAWS IN THE REPUBLIC OF KOREA. BY ACCEPTING THIS REPORT,

YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS.

THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE

PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR

TRANSMITTED INTO MALAYSIA OR PROVIDED OR TRANSMITTED TO ANY MALAYSIAN PERSON. FAILURE TO

COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN MALAYSIA. BY

ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS.

Jurisdiction Specific Additional Disclaimers: Without prejudice to the foregoing, the reader is to note that additional

disclaimers, warnings or qualifications may apply if the reader is receiving or accessing this report in or from other than

Singapore.

© 2005 Kim Eng Research Sdn Bhd. All rights reserved. Except as specifically permitted, no part of this presentation may

be reproduced or distributed in any manner without the prior written permission of Kim Eng Research Sdn Bhd. Kim Eng

Research Sdn Bhd accepts no liability whatsoever for the actions of third parties in this respect.

Kim Eng Research Sdn Bhd is a participant in the CMDF-Bursa Research Scheme for this stock. We receive

RM15,000 in remuneration per company per year for the coverage of stocks participating in this scheme.

4

Singapore

London

New York

South Korea

Kim Eng Securities Pte Ltd

Kim Eng Research Pte Ltd

9 Temasek Boulevard

#39-00 Suntec Tower 2

Singapore 038989

Kim Eng Securities (London) Ltd

6/F, 20 St. Dunstan’s Hill

London EC3R 8HY, UK

Kim Eng Securities USA Inc

th

406, East 50 Street

New York, NY 10022, U.S.A.

Tel: +44 20 7621 9298

Dealers’ Tel: +44 20 7626 2828

Fax: +44 20 7283 6674

Tel: +1 212 688 8886

Fax: +1 212 688 3500

Kim Eng Research Pte Ltd

Korea Branch Office

10th Floor, Seoul Finance Center,

84 Taepyung-ro 1-ka,

Chung-ku,

Seoul, Korea 100-768

Sunny YOON

syoon@kesusa.com

Tel: +82 2 6730 1550

Fax: +82 2 6730 1564

Jeffrey S. SEO

jseo@kesusa.com

Woo-Kyun CHANG (research)

wkchang@kimeng.co.kr

Tel: +65 6336 9090

Fax: +65 6339 6003

LAU Wai Kwok (sales)

lauwk@kimeng.com

Sebastian HENG (research)

sebastianheng@kimeng.com

David PIRKIS (sales)

dpirkis@kimeng.co.uk

Geoff HO (sales)

gho@kimeng.co.uk

James JOHNSTONE (sales)

jjohnstone@kimeng.co.uk

Lucy CHUAH

lchuah@kesusa.com

Lynda KOMMEL-BROWNE

lkommel@kesusa.com

Jonathan NASSER

jnasser@kesusa.com

Taiwan

Hong Kong

Thailand

Indonesia

Yuanta Core Pacific Securities

11/F, No 225, Nanking East Rd

Section 3

Taipei, Taiwan

Kim Eng Securities (HK) Ltd

Level 30,

Three Pacific Place,

1 Queen’s Road East,

Hong Kong

Kim Eng Securities (Thailand)

Public Company Limited

999/9 The Offices at Central World,

th

st

20 - 21 Floor,

Rama 1 Road, Pathumwan,

Bangkok 10330, Thailand

PT Kim Eng Securities

9/F, Deutsche Bank Bldg

JI. Imam Bonjol 80

Jakarta 10310, Indonesia

Tel: +886 2 2717 6391

Fax: +886 2 2545 6394

Gary CHIA (sales)

Gary.chia@yuanta.com.tw

Tel: +852 2268 0800

Fax: +852 2877 0104

Ray LUK (sales)

rluk@kimeng.com.hk

Stephen BROWN (research)

stephenbrown@kimeng.com.hk

Tel: +66 2 658 6300

Fax: +66 2 658 6384

Vikas KAWATRA (sales)

vkawatra@kimeng.co.th

Tel: +62 21 3983 1360

Fax: +62 21 3983 1361

Kurnia SALIM (sales)

ksalim@kimeng.co.id

Katarina SETIAWAN (research)

ksetiawan@kimeng.co.id

Ron GARCHA (sales)

ron@kimeng.co.th

David BELLER (research)

david.b@kimeng.co.th

Philippines

Malaysia

ATR-Kim Eng Securities Inc.

17/F, Tower One & Exchange Plaza

Ayala Triangle, Ayala Avenue

Makati City, Philippines 1200

Kim Eng Research Sdn Bhd

16/F, Kompleks Antarabangsa

Jalan Sultan Ismail

50250 Kuala Lumpur, Malaysia

Tel: +63 2 849 8888

Fax: +63 2 848 5738

Tel: +603 2141 1555

Fax: +603 2141 1045

Lorenzo ROXAS (sales)

lorenzo_roxas@atr.com.ph

YEW Chee Yoon (research)

cheeyoon@kimengkl.com

Ed BANCOD (research)

ed_bancod@atr.com.ph

South Asia Sales Trading

North Asia Sales Trading

North America Sales Trading

Connie TAN

connie@kimeng.com

Tel: +65 6333 5775

US Toll Free: +1 866 406 7447

Vivian LAU

vivianlau@kimeng.com.hk

Tel: +852 2268 0800

US Toll Free: +1 866 598 2267

Howard KEUM

hkeum@kesusa.com

Tel: +1 212 688 8886