20 May 2008

1Q08 Results

NEW HOONG FATT HOLDINGS BERHAD

Price:

(NHF)

7060

Key Stock Statistics

RM138.3m

Board:

Main

Sector:

Consumer Products

Recommendation:

BUY

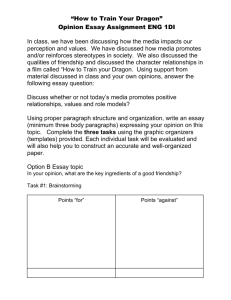

Share Price Chart

EPS (est.)

2007

30.6

2008F

35.4

P/E (est.)

6.0

5.2

2,000

2.10

2.00

Dividend/Share (sen)

14.9

NTA/Share (RM)

2.42

Book Value/Share (RM)

2.84

1.80

Issued Capital (mil shares)

75.2

1.70

RM2.18(H) – RM1.58 (L)

1.60

%

1.50

Per Share Data

2005

2006

2007

2008F

Book Value (RM)

2.22

2.56

2.76

3.01

Cash Flow (sen)

47.1

52.1

50.8

53.9

Earnings (sen)

27.7

35.8

30.6

32.6

Dividend (sen)

15.1

15.2

14.9

14.9

Payout Ratio (%)

18-Apr-08

1Q08 Results Highlight

(RM mil)

1Q08

4Q07

chg

Revenue

42.7

41.9

2%

1Q08

42.7

1Q07

36.6

chg

17%

27%

Op Profit

11.2

12.3

-9%

11.2

8.8

Depreciation

(4.3)

(4.3)

0%

(4.3)

(3.6)

22%

Int expense

(0.5)

(0.6)

-10%

(0.5)

(0.5)

13%

Pretax profit

6.3

7.3

-14%

6.3

4.8

31%

Net profit

5.7

5.9

-3%

5.7

5.3

8%

7.9

-3%

7.6

7.1

8%

39.8

39.1

35.9

31.1

PER (x)

6.6

5.1

6.0

5.2

P/Cash Flow (x)

3.9

3.5

3.6

3.4

EPS (sen)

7.6

P/Book Value (x)

0.83

0.72

0.67

0.61

Op margin

26%

29%

26%

24%

Pretax margin

15%

17%

15%

13%

Net margin

13%

14%

13%

14%

8.2

8.3

8.1

8.1

ROE (%)

12.5

14.0

11.1

10.8

Net Gearing (%)

22.1

14.6

11.4

10.5

Dividend Yield (%)

16-May-08

21-Mar-08

22-Feb-08

25-Jan-08

28-Dec-07

30-Nov-07

05-Oct-07

6.4

02-Nov-07

6.7

Kam Foong Keng & Chin Jit Sin

0

07-Sep-07

43.4

Prudential Unit Trust

500

13-Jul-07

Kam Lang Fatt & Wong Ah Moy

1,000

10-Aug-07

Major Shareholders:

1,500

1.90

00-Jan-00

52-weeks Share Price Range

Vol ('000)

Price (RM)

15-Jun-07

Stock Code:

Market Capitalisation:

RM1.84

1Q08 EPS was within expectations

P&L Analysis (RM m)

Year-end: Dec

2005

2006

2007

2008F

Revenue

154.2

156.9

156.8

180.0

41.3

45.3

42.0

44.6

(14.6)

(12.3)

(15.2)

(16.0)

Interest Expenses

(1.5)

(2.3)

(1.9)

(2.0)

Pre-tax Profit

25.1

30.7

24.9

26.6

Effective Tax Rate (%)

17.3

12.3

7.6

8.0

Net Profit

20.8

26.9

23.0

24.5

Operating Margin (%)

26.8

28.8

26.8

24.8

Pre-tax Margin (%)

16.3

19.6

15.9

14.8

Net-Margin (%)

13.5

17.1

14.7

13.6

Operating Profit

Depreciation

PP 1505(12242)/08/2008(010136)

New Hoong Fatt’s (NHF)’s 1Q08 EPS of 7.6 sen was

within expectations, coming in at 23.4% of our FY08

forecast of 32.6 sen. Operating profit rose 27% Y/Y to

RM11.2m on a 17% increase in revenue to RM42.7m.

The improved performance was due to an increase in

local and export sales, resulting in an enhancement in

operating margins from 24% to 26%. However, net

profit rose by a lesser 8% Y/Y to RM5.7m as it

incurred a tax charge of 8.9% versus a tax credit of

10.1% in 1Q07. Meanwhile, 1Q08 pretax profit fell

14% Q/Q to RM6.3m despite a 2% increase in

revenue, mainly due to an increase in administration

and operation costs such as annual insurance

premium and upkeep of plant and machinery.

www.kimengresearch.com.sg

New Hoong Fatt Holdings Berhad

20 May 2008

Maintaining FY08 forecasts

Table 2: Balance Sheet

NHF increased its installed capacity by ~50% by April2008, including expanding its metal components

factory, installing new plant and machinery (new press

line, a laser cutting machine and CNC milling

machine), new moulds and tools & dies and setting up

a trading branch in Kota Kinabalu. The opening of the

new branch in Kota Kinabalu, which commenced

operations in August 2007, will enable NHF to

diversify its network and tap into a whole new market

in Sabah and Sarawak. It spent some RM23m on

capital expenditure (capex) in FY07 and has allocated

another RM27m of capex in FY08 to expand capacity

at its metal and plastic parts manufacturing plants in

Klang whilst the balance will be spent on tools and

dies for new product development. The plants are

currently running at a combined average utilisation

rate of 60%. The expansion would also support the

group’s rising export sales, targeted to grow by at

least 10% this year. Export sales amounted to RM40m

or about 25% of total revenue in FY07. Its main export

markets are the ASEAN region, the Middle-east and

Central and South America. India and China are the

two new markets that NHF plans to exploit.

Y/E Dec 31 (RMm)

2005

2006

2007

Total Assets

257.8

260.9

278.9

296.2

Fixed Assets

151.3

156.0

161.1

183.3

75.2

73.6

86.5

90.9

31.3

Profit growth to lag revenue growth due to

margin pressures

Capacity expansion will drive revenue growth of ~15%

in FY08. However, net profit is expected to grow at a

more modest 6.5% to RM24.5m as operating margins

are expected to remain subdued at about 25% due to

higher steel and plastic resin prices. Higher steel

prices are expected to persist into 1H08 due to the

recovery in international demand, especially from

China and India. We have projected steel prices to

average US$960/mt in FY08 from about RM660/mt in

FY07. Meanwhile, plastic resin prices (which usually

move in tandem with crude oil prices) are also on an

uptrend.

Table 1: Average steel price

(US$/mt)

Steel Price

3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08

670

700

630

650

655

700

1085

Tax-exempt dividend due to availability of

tax credits

We expect NHF to maintain its dividend of 11 sen taxexempt in FY08, similar to FY07. Its dividends are

expected to be tax-exempt for the next few years as it

has some RM40m of tax credits available. This

translates to a gross dividend of 14.9 sen, with a gross

yield of 8.1%. The balance sheet remains healthy with

net debt of RM21.7m as at 31 March 2008, translating

to a net gearing of 10.2%.

2

Current Assets

2008F

Long Term Assets

31.3

31.3

31.3

Current Liabilities

68.9

50.7

46.6

53.3

Long Term Liabilities

22.1

17.8

24.6

26.2

Share Capital

Shareholders Funds

75.2

75.2

75.2

75.2

166.8

192.3

207.7

226.0

Recommendation

BUY. We continue to favour NHF for its attractive

dividend yield of 8.1% and its undemanding 5.2x PER

valuation.

ANALYSTS’ COVERAGE / RESEARCH OFFICES

SINGAPORE

Stephanie WONG Head of Research

Regional Head of Institutional Research

+65 6432 1451 swong@kimeng.com

Consumer

Industrial

Small/Mid Caps

Gregory YAP

+65 6432 1450 gyap@kimeng.com

Technology & Manufacturing

Telcos

Transport & Logistics

China Consumer

Rohan SUPPIAH

+65 6432 1455 rohan@kimeng.com

Oil & gas

Conglomerates

Pauline LEE

+65 6432 1453 paulinelee@kimeng.com

Bank & Finance

Retail

Consumer

Wilson LIEW

+65 6432 1454 wilsonliew@kimeng.com

Property & Construction

Hotel & Resort

Johnny TEO

+65 6432 1431 johnnyteo@kimeng.com

Industrial

Infrastructure

David LOOMIS

+65 6432 1417 dloomis@kimeng.com

Special Situations

KELIVE Singapore

ONG Seng Yeow Head of Research

+65 6432 1832 ongsengyeow@kimeng.com

TAN Chin Poh

+65 6432 1859 chinpoh@kimeng.com

GOH Han Peng

+65 6432 1857 gohhanpeng@kimeng.com

Geraldine EU

+65 6432 1469 geraldineeu@kimeng.com

Ken TAI

+65 6432 1412 kentai@kimeng.com

HONG KONG / CHINA

Edward FUNG

+852 2268 0632 edwardfung@kimeng.com.hk

Power

Construction

Ivan CHEUNG

+852 2268 0634 ivancheung@kimeng.com.hk

Property

Ivan LI

+852 2268 0641 ivanli@kimeng.com.hk

Bank & Finance

Larry GRACE

+852 2268 0630 larrygrace@kimeng.com.hk

Oil & Gas

Energy

Shadow LAU

+852 2268 0645 shadowlau@kimeng.com.hk

Small Caps

TAM Tsz Wang

+852 2268 0636 tamtszwang@kimeng.com.hk

Small Caps

Emily LEE

+852 2268 0631 emilylee@kimeng.com.hk

Small Caps

REGIONAL

Luz LORENZO Economist

+63 2 849 8836 luz_lorenzo@atr.com.ph

Economics

3

MALAYSIA

YEW Chee Yoon Head of Research

+603 2141 1555 cheeyoon@kimengkl.com

Strategy

Banks

Telcos

Property

Shipping

Oil & gas

Gaming

Media

Power

Construction

Food & Beverage

Manufacturing

Plantations

Tobacco

Electronics

INDONESIA

Katarina SETIAWAN Head of Research

+6221 3983 1458 ksetiawan@kimeng.co.id

Consumer

Infra

Shipping

Strategy

Telcos

Others

Ricardo SILAEN

+6281 3983 1455 rsilaen@kimeng.co.id

Auto

Energy

Heavy Equipment

Property

Resources

Teguh SUNYOTO

+6221 3983 1455 tsunyoto@kimeng.co.id

Cement

Construction

Pharmaceutical

Retail

Adi N. WICAKSONO

+6221 3983 1455 anwicaksono@kimeng.co.id

Generalist

Arwani PRANADJAYA

+6221 3983 1455 apranadjaya@kimeng.co.id

Technical analyst

PHILIPPINES

Ed BANCOD Head of Research

+63 2 849 8848 ed_bancod@atr.com.ph

Strategy

Banking

Laura DY-LIACCO

+63 2 849 8843 laura_dyliacco@atr.com.ph

Utilities

Conglomerates

Lovell SARREAL

+63 2 849 8871 lovell_sarreal@atr.com.ph

Consumer

Cement

Media

Robin SARMIENTO

+63 2 849 8831 robin_sarmiento@atr.com.ph

Ports

Mining

Ricardo PUIG

+63 2 849 8846 ricardo_puig@atr.com.ph

Property

Telcos

20 May 2008

TAIWAN

Kevin CHANG Head of Research

+8862 2547 1512 kevin.chang@yuanta.com.tw

Jack CHANG

8862 2546 4965

jack.chang@yuanta.com.tw

Non-Tech

Jill HUANG

8862 2546 4171

jill.huang@yuanta.com.tw

PC / Notebook

Eric LIN

8862 2546 0618

eric.lin@yuanta.com.tw

Optical

Chialin LU

8862 2714 9840

chialin.lu@yuanta.com.tw

Communications

Tess WANG

8862 2719 8105

tess.wang@yuanta.com.tw

Financial

THAILAND

David BELLER

+662 658 6300 x 4740 david.b@kimeng.co.th

Banks

Shipping

Naphat CHANTARASEREKUL

+662 658 6300 x 4770 naphat.c@kimeng.co.th

Electronics

Automotive

Tourism

Energy

Healthcare

Piya ORANRIKSUPHAK

+662 658 6300 x 4710 piya.O@kimeng.co.th

Property / Construction

Supattra KHONGRUNGPHAKORN

+662 6586300 ext 4800 supattra.k@kimeng.co.th

Nash SHIVARUCHIWONG

+662 658 6300 x 4730 nathavut@kimeng.co.th

KELIVE Thailand (for retail clients)

George HUEBSCH Head of Research

+662 658 6300 ext 1400 george.h@kimeng.co.th

VIETNAM

LE Huy Hoang

+84 8 838 6636 x 160 hoang.le@kimeng.com.vn

Recommendation definitions

Our recommendation is based on the

following expected price

performance within 12 months:

+15% and above: BUY

-15% to +15%: HOLD

-15% or worse: SELL

New Hoong Fatt Holdings Berhad

12 December 2007

DISCLAIMER

THIS RESEARCH REPORT IS FOR OUR CLIENTS ONLY TO WHOM IT IS SPECIFICALLY ADDRESSED TO OR IS

ALLOWED ACCESS TO. IF YOU ARE NOT A CLIENT AND/OR DO NOT AGREE TO BE BOUND BY THE TERMS AND

DISCLAIMERS SET OUT BELOW, YOU SHOULD DISREGARD THIS RESEARCH REPORT IN ITS ENTIRETY AND

INFORM US THAT YOU NO LONGER WISH TO RECEIVE SUCH RESEARCH REPORTS.

This report is not a solicitation or an offer to buy or sell any securities or related financial products. The information and

commentaries are also not meant to be endorsements or offerings of any securities, options, stocks or other investment

vehicles. The report has been prepared without regard to the individual financial circumstances, needs or objectives of

persons who receive it. The securities discussed in this report may not be suitable for all investors. The appropriateness of

any particular investment or strategy whether opined on or referred to in this report or otherwise will depend on an investor’s

individual circumstances and objectives and should be independently evaluated and confirmed by such investor, and, if

appropriate, with his professional advisers independently before adoption or implementation (either as is or varied).

To the extent that the reader is an accredited or professional investor or a person who is not a citizen or resident of

Singapore or a dependent of either for the purposes of the Singapore Securities and Futures Act ("SFA") or Financial

Advisers Act ("FAA"), Kim Eng specifically relies on the exemption from all suitability compliance requirements provided

pursuant to regulations and guidelines to the SFA and/or the FAA.

Kim Eng, its affiliate companies and/or their respective associates, directors and employees may have investments in

securities or derivatives of securities of companies mentioned in this report, and may make investment decisions that are

inconsistent with the views expressed in this report. Derivatives with respect to the companies mentioned in this report may

be issued by Kim Eng, its related companies or associated/affiliated persons.

Kim Eng and its related and affiliated companies are involved in many businesses that may relate to companies mentioned

in this report, including market making and specialized trading, risk arbitrage and other proprietary trading, fund

management, investment services and corporate finance and we may perform or seek to perform broking, investment

banking and other services for such companies.

Except with respect the disclosures of interest made above, this report is based on current public information that we

consider reliable but we make no representation that it is accurate or complete, and it should not be relied as such.

Additional information on mentioned securities is available on request

This report is being disseminated to or allowed access by our clients in their respective jurisdictions by the Kim Eng affiliated

entity/entities operating and carrying on business as a securities dealer in that jurisdiction (collectively or individually, as the

context requires, "Kim Eng") which has, vis-à-vis such client, approved of, and is solely responsible in that jurisdiction for,

the contents of this publication in that jurisdiction. This report is not directed to, or intended for distribution to or use by, any

person or entity who is a citizen or resident of or located in any jurisdiction where such distribution or use would be contrary

to applicable law or regulation.

THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE

PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR

TRANSMITTED INTO THE REPUBLIC OF KOREA. FAILURE TO COMPLY WITH THIS RESTRICTION MAY

CONSTITUTE A VIOLATION OF SECURITIES LAWS IN THE REPUBLIC OF KOREA. BY ACCEPTING THIS REPORT,

YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS.

THIS RESEARCH REPORT IS STRICTLY CONFIDENTIAL TO THE RECIPIENT, MAY NOT BE DISTRIBUTED TO THE

PRESS OR OTHER MEDIA, AND MAY NOT BE REPRODUCED IN ANY FORM AND MAY NOT BE TAKEN OR

TRANSMITTED INTO MALAYSIA OR PROVIDED OR TRANSMITTED TO ANY MALAYSIAN PERSON. FAILURE TO

COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF SECURITIES LAWS IN MALAYSIA. BY

ACCEPTING THIS REPORT, YOU AGREE TO BE BOUND BY THE FOREGOING LIMITATIONS.

Jurisdiction Specific Additional Disclaimers: Without prejudice to the foregoing, the reader is to note that additional

disclaimers, warnings or qualifications may apply if the reader is receiving or accessing this report in or from other than

Singapore.

© 2005 Kim Eng Research Sdn Bhd. All rights reserved. Except as specifically permitted, no part of this presentation may

be reproduced or distributed in any manner without the prior written permission of Kim Eng Research Sdn Bhd. Kim Eng

Research Sdn Bhd accepts no liability whatsoever for the actions of third parties in this respect.

Kim Eng Research Sdn Bhd is a participant in the CMDF-Bursa Research Scheme for this stock. We receive RM15,000 in

remuneration per company per year for the coverage of stocks participating in this scheme.

4

Singapore

London

New York

Taiwan

Kim Eng Securities Pte Ltd

Kim Eng Research Pte Ltd

9 Temasek Boulevard

#39-00 Suntec Tower 2

Singapore 038989

Kim Eng Securities (London) Ltd

6/F, 20 St. Dunstan’s Hill

London EC3R 8HY, UK

Kim Eng Securities USA Inc

th

406, East 50 Street

New York, NY 10022, U.S.A.

Yuanta Core Pacific Securities

11/F, No 225, Nanking East Rd

Section 3

Taipei, Taiwan

Tel: +44 20 7621 9298

Dealers’ Tel: +44 20 7626 2828

Fax: +44 20 7283 6674

Tel: +1 212 688 8886

Fax: +1 212 688 3500

Tel: +65 6336 9090

Fax: +65 6339 6003

LAU Wai Kwok (sales)

lauwk@kimeng.com

Stephanie WONG (research)

swong@kimeng.com

David PIRKIS (sales)

dpirkis@kimeng.co.uk

Geoff HO (sales)

gho@kimeng.co.uk

James JOHNSTONE (sales)

jjohnstone@kimeng.co.uk

Jeffrey S. SEO

jseo@kesusa.com

Lucy CHUAH

lchuah@kesusa.com

Tel: +886 2 2717 6391

Fax: +886 2 2545 6394

Arthur LO (sales)

Arthur.lo@yuanta.com.tw

Gary CHIA (research)

Gary.chia@yuanta.com.tw

Lynda KOMMEL-BROWNE

lkommel@kesusa.com

Peter HWANG

phwang@kesusa.com

Hong Kong

Thailand

Indonesia

Malaysia

Kim Eng Securities (HK) Ltd

Level 30,

Three Pacific Place,

1 Queen’s Road East,

Hong Kong

Kim Eng Securities (Thailand)

Public Company Limited

999/9 The Offices at Central World,

th

st

20 - 21 Floor,

Rama 1 Road, Pathumwan,

Bangkok 10330, Thailand

PT Kim Eng Securities

9/F, Deutsche Bank Bldg

JI. Imam Bonjol 80

Jakarta 10310, Indonesia

Kim Eng Research Sdn Bhd

16/F, Kompleks Antarabangsa

Jalan Sultan Ismail

50250 Kuala Lumpur, Malaysia

Tel: +62 21 3983 1360

Fax: +62 21 3983 1361

Tel: +603 2141 1555

Fax: +603 2141 1045

Kurnia SALIM (sales)

ksalim@kimeng.co.id

YEW Chee Yoon (research)

cheeyoon@kimengkl.com

Tel: +852 2268 0800

Fax: +852 2877 0104

Ray LUK (sales)

rluk@kimeng.com.hk

Tel: +66 2 658 6300

Fax: +66 2 658 6384

Vikas KAWATRA (sales)

vkawatra@kimeng.co.th

Philippines

Vietnam

ATR-Kim Eng Securities Inc.

17/F, Tower One & Exchange

Plaza

Ayala Triangle, Ayala Avenue

Makati City, Philippines 1200

Kim Eng Vietnam Securities Joint

Stock Company

1st Floor, 255 Tran Hung Dao St.

District 1

Ho Chi Minh City, Vietnam

Tel: +63 2 849 8888

Fax: +63 2 848 5738

Tel : (84) 8 8386636

Fax : (84) 8 8386639

Lorenzo ROXAS (sales)

lorenzo_roxas@atr.com.ph

DAO Minh Duc (sales)

Duc.dao@kimeng.com.vn

Ed BANCOD (research)

ed_bancod@atr.com.ph

LE Huy Hoang (research)

hoang.le@kimeng.com.vn

Katarina SETIAWAN (research)

ksetiawan@kimeng.co.id

South Asia Sales Trading North Asia Sales Trading

North America Sales Trading

Connie TAN

connie@kimeng.com

Tel: +65 6333 5775

US Toll Free: +1 866 406 7447

Warren KIM

wkim@kesusa.com

Tel: +1 212 688 8886

Eddie LAU

eddielau@kimeng.com.hk

Tel: +852 2268 0800

US Toll Free: +1 866 598 2267