IBRC Progress Update Report

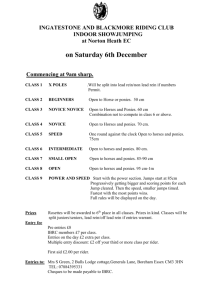

advertisement