The FSA's “Scary” Approach to Market Abuse

advertisement

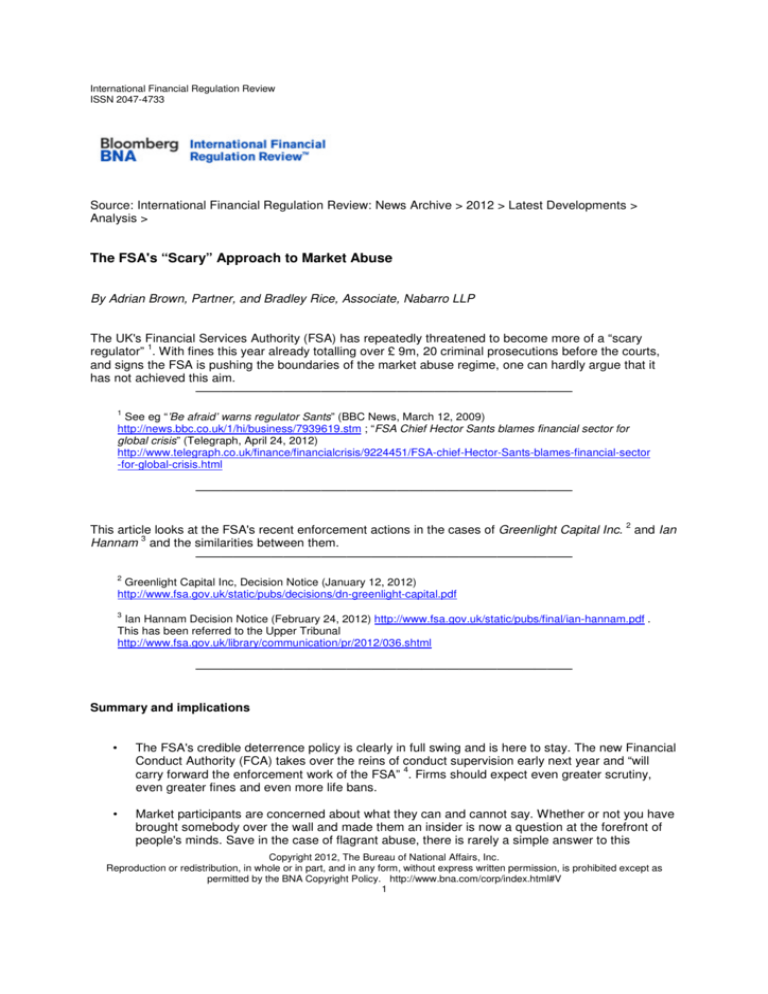

International Financial Regulation Review ISSN 2047-4733 Source: International Financial Regulation Review: News Archive > 2012 > Latest Developments > Analysis > The FSA's “Scary” Approach to Market Abuse By Adrian Brown, Partner, and Bradley Rice, Associate, Nabarro LLP The UK's Financial Services Authority (FSA) has repeatedly threatened to become more of a “scary 1 regulator” . With fines this year already totalling over £ 9m, 20 criminal prosecutions before the courts, and signs the FSA is pushing the boundaries of the market abuse regime, one can hardly argue that it has not achieved this aim. —————————————————————————————— 1 See eg “’Be afraid’ warns regulator Sants” (BBC News, March 12, 2009) http://news.bbc.co.uk/1/hi/business/7939619.stm ; “FSA Chief Hector Sants blames financial sector for global crisis” (Telegraph, April 24, 2012) http://www.telegraph.co.uk/finance/financialcrisis/9224451/FSA-chief-Hector-Sants-blames-financial-sector -for-global-crisis.html —————————————————————————————— 2 This article looks at the FSA's recent enforcement actions in the cases of Greenlight Capital Inc. and Ian 3 Hannam and the similarities between them. —————————————————————————————— 2 Greenlight Capital Inc, Decision Notice (January 12, 2012) http://www.fsa.gov.uk/static/pubs/decisions/dn-greenlight-capital.pdf 3 Ian Hannam Decision Notice (February 24, 2012) http://www.fsa.gov.uk/static/pubs/final/ian-hannam.pdf . This has been referred to the Upper Tribunal http://www.fsa.gov.uk/library/communication/pr/2012/036.shtml —————————————————————————————— Summary and implications • The FSA's credible deterrence policy is clearly in full swing and is here to stay. The new Financial Conduct Authority (FCA) takes over the reins of conduct supervision early next year and “will 4 carry forward the enforcement work of the FSA” . Firms should expect even greater scrutiny, even greater fines and even more life bans. • Market participants are concerned about what they can and cannot say. Whether or not you have brought somebody over the wall and made them an insider is now a question at the forefront of people's minds. Save in the case of flagrant abuse, there is rarely a simple answer to this Copyright 2012, The Bureau of National Affairs, Inc. Reproduction or redistribution, in whole or in part, and in any form, without express written permission, is prohibited except as permitted by the BNA Copyright Policy. http://www.bna.com/corp/index.html#V 1 International Financial Regulation Review ISSN 2047-4733 question. It is ultimately dependant on the facts of each case. Ian Hannam's decision to refer the FSA's decision to the Upper Tribunal could offer some clarity in this area, but the Tribunal's judgement could be some time off. • Firms should be reviewing their internal policies, systems and controls in light of the FSA's increased scrutiny to ensure compliance. Senior management must be aware of these procedures and be provided with regular updates. At the far end of the spectrum, firms should consider and prepare for dawn raids and the subsequent reputational effect these will have. Staff training on these issues is something that has been widely received in recent months and has provoked lively debates. —————————————————————————————— 4 An update on the FSA's investigations and enforcement regime (FSA, Feb 23, 2012) http://www.fsa.gov.uk/library/communication/speeches/2012/0223-tm.shtml —————————————————————————————— The FSA's recent approach The reform of the regulatory regime in the UK is seen as a chance to change the culture of the industry. This is a prominent and recurring message coming from the FSA, which hopes its credible deterrence policy will improve behaviour and restore the integrity of the market. In a recent speech, Tracey McDermott, acting director of the Enforcement and Financial Crime Division (EFCD), warned that “the industry is not learning its lessons” and that “where we do not see improvements... we will be willing to 5 take tougher action” . —————————————————————————————— 5 Ibid. —————————————————————————————— 6 The FSA broke a number of records in 2011: the highest fine on an individual (£ 6m) : the highest fine for 7 retail failings (£ 10.5m) ; and the highest fine for failing to maintain financial crime systems and controls 8 (£ 7m) . There were probably others and 2012 does not show signs of letting up. There are currently 20 people awaiting criminal trial for insider dealing or misleading the market. We are increasingly seeing the FSA work alongside the police or the Serious Organised Crime Agency (SOCA) to investigate organised insider dealing rings. The FSA has successfully secured 11 criminal convictions to date, with the longest 9 sentence standing at three years and four months . Suffice to say, credible deterrence is here to stay and the regulator is clearly getting much “scarier”. —————————————————————————————— 6 “FSA fines Dubai based investor US$ 9.6 million for market abuse” (FSA/PN/094/2011 November 9, 2011) http://www.fsa.gov.uk/library/communication/pr/2011/094.shtml 7 “FSA fines HSBC £ 10.5million for mis-selling products to elderly customers” (FSA/PN/105/2011 December 5, 2011) http://www.fsa.gov.uk/library/communication/pr/2011/105.shtml 8 “FSA fines Willis Limited £ 6.895 million for anti-bribery and corruption systems and controls failings” Copyright 2012, The Bureau of National Affairs, Inc. Reproduction or redistribution, in whole or in part, and in any form, without express written permission, is prohibited except as permitted by the BNA Copyright Policy. http://www.bna.com/corp/index.html#V 2 International Financial Regulation Review ISSN 2047-4733 (FSA/PN/066/2011 July 21, 2011) http://www.fsa.gov.uk/library/communication/pr/2011/066.shtml 9 “Investment banker, his wife and family friend sentenced for insider dealing” (FSA/PN/018/2011 February 2, 2011) http://www.fsa.gov.uk/library/communication/pr/2011/018.shtml —————————————————————————————— Greenlight Capital On 15 February 2012, the FSA issued final notices to Greenlight Capital, Inc., a US hedge fund, and its owner David Einhorn, fining them £ 7.2m for market abuse. Mr Einhorn allegedly received inside information relating to an equity raising by Punch Taverns Plc, before instructing Greenlight to sell some of its holding in Punch Taverns. Despite Mr Einhorn requesting not to be “wall-crossed”, the FSA still found that he had received inside information. The FSA stated that in isolation the separate aspects of the information disclosed to Mr Einhorn would not amount to inside information. However, taken together, they did constitute inside information particularly because they disclosed to Mr Einhorn the purpose and anticipated size and timing of the issuance. The senior broker acting for Punch was also fined £ 350,000 for disclosing the inside information. The FSA stated that he had considerable experience and understood that it is an offence to disclose inside information. The FSA was also critical of the broker's lack of action. He did not consult with his legal or compliance teams before organising the call with Greenlight; nor did he take any action, after he became aware that Greenlight had sold a significant stake in Punch Taverns, to address the risk that Greenlight was selling on the basis of the information gleaned from the telephone call. Greenlight's former trader and compliance officer was also fined £ 130,000 and banned from acting as a compliance officer for failing to question and make reasonable enquiries before selling the shares in Punch Taverns. According to the FSA, he had been told that Greenlight had around a week before the stock “plummets” and that Punch's management would have told them “secret bad things” if they signed a confidentiality agreement. The FSA say this should have alerted the trader to the risk that the order may have been based on inside information, and made him take steps to satisfy himself that this was not the case or make a suspicious transaction report to the FSA. Completing the FSA's action, a trading desk director at JP Morgan was also fined £ 65,000 for failing to identify and act on a suspicious order from Greenlight. The FSA were critical of the fact that he failed to identify and alert JP Morgan to the possibility that the trade was based on inside information and, therefore, no suspicious transaction report was submitted to the FSA. Suspicious transaction reporting has recently gained increased attention. Firms have an obligation to report suspicious transactions to the FSA. These reports assist the regulator to detect market abuse. The FSA has its own internal systems and controls to monitor suspicious transactions and, quite often, it will already know a lot more than the person making the report. The FSA is likely to take action against any “dog that doesn't bark”, or people who put their relationship with potential wrongdoers above their regulatory obligations and, consequently, let suspicions slip through the net. We are already aware of the FSA's increased scrutiny of firms' suspicious transaction reporting systems and controls. It is likely this is another area on the FSA's radar. Ian Hannam Copyright 2012, The Bureau of National Affairs, Inc. Reproduction or redistribution, in whole or in part, and in any form, without express written permission, is prohibited except as permitted by the BNA Copyright Policy. http://www.bna.com/corp/index.html#V 3 International Financial Regulation Review ISSN 2047-4733 Hot on the heels of the Greenlight saga, in February 2012 the FSA sought to fine Ian Hannam, former Global Co-Head of UK Capital Markets at JP Morgan, £450,000 for market abuse. Mr Hannam has referred the decision to the Upper Tribunal. The FSA states that Mr Hannam sent two emails to clients in late 2008 which contained inside information concerning Heritage Oil plc, another client. No trades were carried out on the back of this information and Mr Hannam's honesty and integrity were not in question. Mr Hannam argued that the information was not sufficiently precise to be price-sensitive and, therefore, was not inside information. As such, and in addition, he was authorised to disclose the information as he was acting in his client's best interests, and according to their instructions, by trying to “facilitate a ‘substantial’ corporate transaction”. Hannam also argued that the information had already been disclosed by Heritage's CEO to Hannam's client. The FSA rejected this argument and said that, by repeating what the CEO had said, Hannam had still disclosed inside information, and that his repetition could have added credence and weight to the information. This in turn could have influenced his client's decision to trade. Similarities in the information disclosed Information Event Timing Amount Contextual Greenlight Equity issuance “within less than a... week” £ 350 million At an advanced stage and “mostly all the shareholders are supportive” Purpose of the equity issuance Hannam Potential takeover “Thursday of next week” “£ 3.50–£ 4.00 per share” “very excited about the recent drilling results of Heritage Oil” “just found oil and it is looking good” The table suggests that disclosing information concerning the event, the timing and the amount together is likely to be enough to cross the line. Add to this certain contextual information and it becomes harder to argue that you have not disclosed inside information. In Greenlight the FSA read all the information together. It is possible that they adopted the same thinking in Hannam's case. As such, you should think carefully about the information you can disclose and its effect when read together. Unhelpfully, each case will depend on its facts and the context will be crucial. Admittedly, this is an easier task for the FSA with the benefit of hindsight, rather than the broker who is under pressure to secure the best deal for his client. Nonetheless, the FSA have made their approach clear. Points to remember Recent enforcement actions have forced the industry to take note and review their procedures. It would be hard to argue now that the FSA is not a “scary” regulator, and it shows no signs of letting up. That said, there is very little guidance or clarity for firms. Save for the obvious cases of market abuse, brokers can rightly feel concerned about what information they can legitimately disclose in the proper course of their work. Unfortunately, this depends almost entirely on the context, although the Greenlight and Hannam cases do have similarities. Brokers who are considering disclosing the type of transaction, the price and timing should be extra vigilant. Any information which is precise enough to enable another to draw a conclusion on, broadly, whether to trade or not, will be inside information. The wall-crossing procedure is rather in a state of confusion at present. Hopefully the Upper Tribunal will Copyright 2012, The Bureau of National Affairs, Inc. Reproduction or redistribution, in whole or in part, and in any form, without express written permission, is prohibited except as permitted by the BNA Copyright Policy. http://www.bna.com/corp/index.html#V 4 International Financial Regulation Review ISSN 2047-4733 offer some guidance when it decides Mr Hannam's case. In the meantime, internal procedures should be reviewed with a view to minimising the number of people who are wall-crossed and, even then, ensuring that information is only disclosed when it is truly necessary. Adrian Brown is a partner and head of the financial services regulatory practice at Nabarro LLP. He advises investment banks, broker dealers, fund managers and corporate finance houses on all aspects of financial services regulation. Telephone: +44 (0) 20 7524 6400; Email: aj.brown@nabarro.com. Bradley Rice is an associate in the financial services regulatory practice at Nabarro LLP. He advises a broad range of clients on all aspects of financial services regulation, including FSA-authorisations and permissions, application of the FSA's rules, investigations and enforcement actions and anti-money laundering advice. Telephone +44 (0) 20 7524 6990; Email: b.rice@nabarro.com. Copyright 2012, The Bureau of National Affairs, Inc. Reproduction or redistribution, in whole or in part, and in any form, without express written permission, is prohibited except as permitted by the BNA Copyright Policy. http://www.bna.com/corp/index.html#V 5