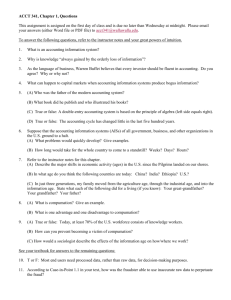

Non-Financial Goals and “Irrational” Decision

advertisement

Non-Financial Goals and “Irrational” Decision-Making Behaviors: Enhancing the Calculation of Private, Family Firm Value Jeremy A. Woods, Doctoral Student Department of Management, College of Business, University of Cincinnati Overview Many scholars have questioned the practical relevance of the business valuation models of neoclassical economics and agency theory-based business strategy in a world where many private, family owned and managed organizations (Astrachan & Shanker, 2003; Birch, 1979) fall beyond the limited boundaries of these models’ assumptions. Over the past three decades, family business scholars (Astrachan & Jaskiewicz, 2008), organizational psychologists (Staw, 1976, 1981; Staw & Ross, 1978, 1987), and behavioral economists (Kahneman & Tversky, 1979) have developed a number of empirically rigorous methods for measuring human decision-making behavior in private, entrepreneurial organizations. This paper proposes a hybrid equation for the calculation of firm financial value using constructs intended to capture the value of non-financial goals and “irrational” decision-making behaviors (i.e., behaviors which do not follow classic, prospective utility maximization functions). Emotional Value The equation presented here is inspired by a construct developed by Astrachan and Jaskiewicz (2008), emotional value (EV). Emotional value consists of emotional returns (ER = positive emotional benefits which come from owning and running a private business, such as sense of pride and accomplishment, flexible work hours and responsibilities, or the pleasure of working together with family members) and emotional costs (EC = negative emotional liabilities which come from owning and running a private business, such as stress from the entrepreneurial assumption of risk, reduced total leisure time, and professional-personal relationship conflicts with family members). Astrachan and Jaskiewicz integrate the abovementioned definitions with the more familiar economic constructs of discounted cash flows (DCF = the net present value of expected future cash flows, or the expected equity value of the firm) and discounted financial private benefits (DFPB = the net present value of expected non-equity benefits such as salary and perks not captured in the equity value of the firm) to come up with the following formula for total firm value (TV): TV = DCF + DFPB + (ER – EC) [1] This paper adds two additional elements to the equation above. Self-Justification The first additional element is based on Staw and Ross’ (1978) concept of escalation of commitment, in which individuals sometimes make decisions based on retrospective, rather than prospective, maximization of the non-financial goal of selfjustification. This concept is consistent with the basic idea of the Astrachan and Jaskiewicz model, which is that both financial and non-financial value must be considered when calculating the total value of privately held, entrepreneurial businesses. The escalation of commitment phenomenon can be seen as one particular way in which non-financial goals can become built into the value of the firm over time. The non-financial value of self-justification (SJ = the purely emotional value of justifying prior personal decisions by continuing to follow a certain course of action, which this paper will define as the difference between the prospective future utility of the most profitable course of action for the business minus the prospective future utility of the course of action being followed by the business, with DCF, DFPB, ER, and EC otherwise being held equal) could be added to equation [1] above as follows: TV = DCF + DFPB + (ER + SJ – EC) Equation [3] above should represent an expansion of existing constructs to allow for more accurate valuation of private, entrepreneurial businesses. This increased accuracy is reflected in the following propositions: [2] Risk Comfort The second additional element to be integrated into the equation above is based on Kahneman and Tversky’s (1979) prospect theory, in which human beings tend to misestimate prospective future financial utility depending on the risk context within which they perceive their decision options. Similarly to escalation of commitment, prospect theory is also a useful concept for the calculation of the non-financial value of a private, entrepreneurial firm. Kahneman and Tversky’s experiments tended to show that individuals favor a smaller benefit with certainty over the chance of a larger benefit and favor the possibility of the complete avoidance of large negative consequences over the certainty of experiencing mild negative consequences. This behavioral tendency can be seen as the pursuit of a non-financial goal which one might call “risk comfort”, which for the purposes of this paper shall be defined as a preference for certainty of benefits (however modest) and the avoidance of losses (whatever the risk). The non-financial value of risk comfort (RC = the preference of an individual decision maker for small positive benefits and avoidance of negative consequences, which this paper will define as the difference between the decision maker’s preference for a given decision option and the actual prospective future utility of that decision option, with DCF, DFPB, ER, SJ, and EC otherwise being held equal) could be added to equation [2] above as follows: TV = DCF + DFPB + (ER + SJ – RC – EC) Propositions [3] Proposition 1: Family business owners who derive emotional returns from their businesses will value their businesses higher than objective third parties. Proposition 2: Family business owners who derive emotional costs from their businesses will value their businesses lower than objective third parties. Proposition 3: Family business owners who place a financial value on self-justification will value their businesses higher than objective third parties. Proposition 4: Family business owners who frame the valuation of their businesses in terms of current revenue streams, rather than potential future revenue streams, will value their businesses lower than objective third parties. Next Steps To test the above-outlined propositions, this paper proposes to conduct survey research with a sample of family business owners from various countries around the world. The survey questions will measure emotional returns, emotional costs, self-justification, and risk comfort.. The survey will also capture information about these business owners’ valuations of their own businesses, which will be compared to objective third party assessments of the business’ values.