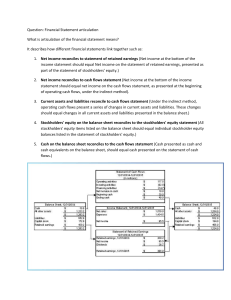

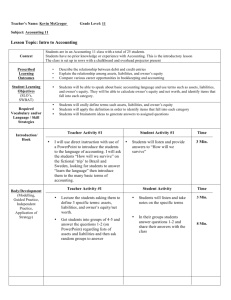

Introducing Financial Statements and Transaction Analysis

advertisement