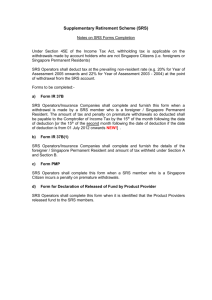

srs limited

advertisement