Research: Alpha Awards™ Top Service Providers

The

Trillion-Dollar

Payoff

By Nina Mehta

Accountants, administrators, lawyers and prime brokers are

scrambling to service the $1 trillion hedge fund industry. We tell

you who is winning the race in our first-ever Alpha Awards™.

I

f a hedge fund wants to expand from $500 million to $3 billion and from one investment strategy to four or more, what should it do?

Five years ago that question would have seemed

far-fetched. Now, says Richard Portogallo, global

head of prime brokerage at Morgan Stanley in New York, it’s

a question more and more hedge fund managers are asking.

As managers try to appeal to the growing pool of institutional investors allocating money to hedge funds, their

priorities are shifting. They need to be bigger so they can

absorb more capital, and they need stronger infrastructures

that can accommodate rapid growth and expansion into

new products and asset classes. To accomplish this, many

hedge fund managers are turning to service providers that

“understand the industry from a bottom-up perspective

and can help them grow their businesses,” says Portogallo.

Hedge funds have always looked to prime brokers, law

firms, accountants and administrators for the key services

they need to function. Now these service providers are

expanding their businesses to cater to the changing and

growing needs of hedge funds.

The hedge fund industry crossed the $1 trillion threshold earlier this year, doubling its assets under management

from just five years ago, according to Hedge Fund Research,

a Chicago-based data provider. The number of funds of

hedge funds and single-manager funds now exceeds 8,200,

compared with 3,900 at the end of 2000. Many industry

experts think hedge funds will reach $2 trillion in assets

within the next few years. Pension funds, endowments,

foundations and other institutional investors are driving

the growth, representing about 30 percent of net new flows

into hedge funds in mid-2004, compared with less than 5

percent in 2000, according to a study by Bank of New York

and Casey, Quirk & Associates, a Darien, Connecticut,

investment management consulting firm.

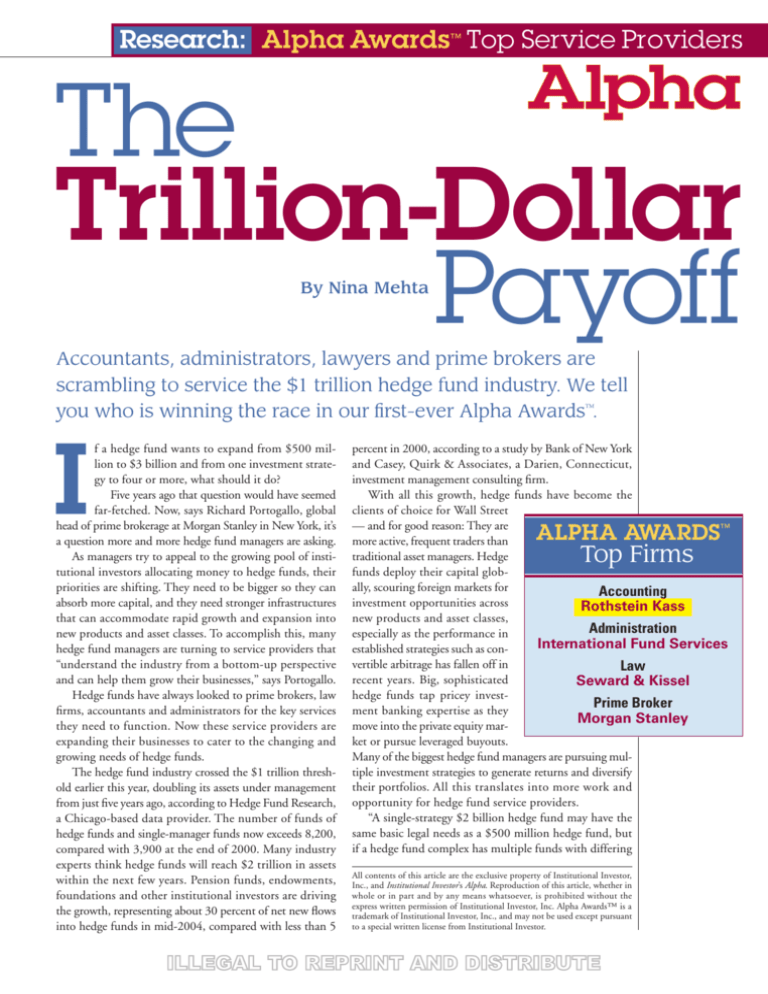

With all this growth, hedge funds have become the

clients of choice for Wall Street

— and for good reason: They are

™

more active, frequent traders than

traditional asset managers. Hedge

funds deploy their capital globally, scouring foreign markets for

Accounting

investment opportunities across

Rothstein Kass

new products and asset classes,

Administration

especially as the performance in

International

Fund Services

established strategies such as convertible arbitrage has fallen off in

Law

recent years. Big, sophisticated

Seward & Kissel

hedge funds tap pricey investPrime Broker

ment banking expertise as they

Morgan

Stanley

move into the private equity market or pursue leveraged buyouts.

Many of the biggest hedge fund managers are pursuing multiple investment strategies to generate returns and diversify

their portfolios. All this translates into more work and

opportunity for hedge fund service providers.

“A single-strategy $2 billion hedge fund may have the

same basic legal needs as a $500 million hedge fund, but

if a hedge fund complex has multiple funds with differing

ALPHA AWARDS

Top Firms

All contents of this article are the exclusive property of Institutional Investor,

Inc., and Institutional Investor’s Alpha. Reproduction of this article, whether in

whole or in part and by any means whatsoever, is prohibited without the

express written permission of Institutional Investor, Inc. Alpha Awards™ is a

trademark of Institutional Investor, Inc., and may not be used except pursuant

to a special written license from Institutional Investor.

“Institutional investors demand more due diligence, ask more questions and want more details.” Richard Portogallo,

global head of prime brokerage, Morgan Stanley. On West 48th Street, New York, September 14, 2005.

Photo by Juliana Thomas for Alpha

Alpha Awards Top Service Providers

ALPHA AWARDS™

Top Prime Brokers

Rank Firm

1

Morgan Stanley

2

Credit Suisse First Boston

3

Goldman, Sachs & Co.

4

Bear, Stearns & Co.

5 (tie) Banc of America Securities

UBS

Morgan Stanley

Richard Portogallo, 45,

Global Head of Prime Brokerage

If you’re starting a hedge fund, securing Morgan Stanley

as your prime broker could give you more time to focus on

investments instead of operations. The firm is “head and

shoulders above the competition,” says one hedge fund

manager. Another praises its “first-class client service

and superior technology.” Although Morgan Stanley has

taken its lumps in recent months, with the departure of

ex–chief executive officer Philip Purcell and the return of

John Mack, its prime brokerage unit remains the

industry’s gold standard. Led by 19-year Morgan Stanley

veteran Richard Portogallo in New York, the group has

about 500 people, almost half in client service, and

provides prime brokerage for more than $300 billion in net

client assets for more than 700 hedge fund firms.— N.M.

strategies, the amount of work quickly multiplies,” says

John Tavss, head of the alternative investment practice at

Seward & Kissel, a New York–based law firm that has been

advising hedge funds for more than half a century. Seward

& Kissel helped onetime journalist Alfred Winslow Jones

set up the first hedge fund in 1949 and still represents

A.W. Jones & Co., which now primarily manages funds

of hedge funds.

The hedge fund service provider industry is undergoing

its own transformation. “Service providers are becoming

bigger and stronger because hedge funds are getting bigger

and stronger,” says Jean-Louis Juchault, founder and chief

executive officer of Systeia Capital Management, a $1 billion, Paris-based hedge fund that’s active in convertibles,

mergers and acquisitions and event-driven strategies.

Service providers are expanding their relationships

with hedge funds so they can increase their market share

or cross-sell more services. Lawyers are providing expertise

on swaps contracts and other customized transactions.

Full-service fund administrators, which provide net-assetvalue calculations and portfolio accounting, are offering

more-extensive and independent portfolio pricing services

to their clients. Auditors are spending more time verifying

the accuracy of fund accounting and assessing the tax

implications of potential transactions as hedge funds

move into more-illiquid products and asset classes. Many

hedge fund service providers are also extending their services across traditional lines of business, with some fund

administrators offering tax preparation services and global

banks moving into fund administration.

The changing regulatory landscape is also creating

opportunity and demand. Last year the U.S. Securities

and Exchange Commission ruled that advisers to onshore

hedge funds with at least $30 million in assets, 15 or more

clients and whose funds have investor lockup periods of

less than two years must register as investment advisers by

February 2006. As a result, the majority of currently unregistered U.S.-based hedge fund advisers will soon be compelled to register and fulfill a range of legally mandated

compliance obligations.

As hedge funds grow in size and sophistication, client

service has become the industry mantra. That means a

“commitment to help us on any level — technology, integration with the rest of the firm or consulting services —

at any time,” says the chief operating officer of a U.S. East

Coast hedge fund with more than $2 billion in assets. Of

course, not all service providers are created equal. “Many

overpromise what they can deliver,” says a manager of a

multibillion-dollar hedge fund, based on the West Coast,

that invests in multiple asset classes. “This is an industry

ripe with overpromise.”

To determine which firms have or haven’t delivered on

their promises, Alpha went directly to the hedge fund managers that use their services. This summer we surveyed more

than 600 hedge funds, representing more than $675 billion in single-manager hedge fund assets. We surveyed

more than half of the 100 biggest single-manager hedge

fund firms, as well as almost 100 funds of hedge funds. We

asked them to rate their accounting firms, fund administrators, law firms and prime brokers on dozens of specific

service issues — everything from competitiveness of rates

for securities lending to accessibility of senior management.

Our inaugural Alpha Awards rank the top prime brokers, law firms, fund administrators and accounting firms

as rated by their hedge fund client. In addition to ranking

the top firms based on overall quality of service, we rank

the leading service providers in 23 more specialized categories, such as securities lending for prime brokers and

regulatory compliance for accounting firms. For more

information on the methodology, see “Compiling the

Ranking” on page 36.

In most categories the biggest and most established

service providers scored best. This suggests the importance

hedge funds place on working with firms that know their

businesses and have proven track records. But knowledge

and reputation can’t make up for mediocre service. Hedge

fund managers know that a winning investment strategy

can capsize because of shoddy accounting or financing that

dries up just when it’s needed most.

In prime brokerage Morgan Stanley takes top honors

by a wide margin over Credit Suisse First Boston and Gold-

man, Sachs & Co., which place second and third, respectively. The hedge funds we polled say they prize client service above all else, followed by operations, reporting and

technology and securities lending. Morgan Stanley finishes

at or near the top in all of those categories.

When it comes to law firms, hedge funds care most

about the depth and breadth of experience related to their

business. Although Sidley Austin Brown & Wood scores

highest in that area and in quality of service, hedge fund

heavyweight Seward & Kissel edges out Sidley Austin for

the No. 1 spot by doing better in fees and brand image.

Both firms have a sizable margin over third-ranked law

firm Akin Gump Strauss Hauer & Feld.

Rothstein Kass is the leader among accounting firms.

Goldstein Golub Kessler places second in that category,

followed by Deloitte Touche Tohmatsu. The managers we

surveyed rate International Fund Services, which is owned

by financial services giant State Street Corp., as the top

fund administrator, followed by Goldman Sachs and Citco Fund Services. IFS administers about $120 billion in

hedge fund assets, less than half the level of assets serviced

by New York–based Citco, the world’s biggest hedge fund

administrator.

As the hedge fund industry grows, managers are adapting their organizations and their investments to appeal to

the pension funds and other institutional investors driving

ALPHA AWARDS™

Top Administrators

Rank Firm

1

International Fund Services

2

Goldman, Sachs & Co.

3

Citco Fund Services

4

Bisys Alternative Investment Services

5

HSBC Alternative Fund Services

International Fund Services

Gary Enos, 48, Head of Alternative Investment

Services, State Street Corp.

In 2002, International Fund Services was a premier and

feisty administration firm providing fund valuations and

other services on $35 billion of hedge fund assets. Then in

July of that year, financial services giant State Street Corp.

announced it was buying the New York–based firm as part

of a push into this burgeoning area. IFS has since almost

doubled its employees, from 500 to 950. Gary Enos, the 20year State Street veteran who helped engineer the deal,

says IFS’s assets have more than tripled, to $120 billion, as

the firm caters to the needs of clients of all sizes and levels

of sophistication, including funds of hedge funds. “IFS

impresses us with their ability to answer any and all

questions in a timely manner,” says one manager. — N.M.

Photo by Tracy Powell for Alpha

the market. “Institutional money is stickier,” says Morgan

Stanley’s Portogallo. “That tends to be better for the manager over the long term, but institutional investors demand

more due diligence, ask more questions and want more

details about the allocation of their capital.”

Managers who want to attract institutional money

need to be willing to provide greater transparency, reporting, portfolio risk analytics and operational controls.

“Institutional investors can afford to tolerate more modest returns than can high-net-worth investors,” says Reiko

Isaac, CEO and founder of Amber Partners, a Bermudabased firm providing operational risk due-diligence services to hedge fund managers and investors. “But one

thing they cannot afford is to invest in a hedge fund that

blows up for noninvestment reasons.”

No investor wants to get caught holding the next Bayou

Management. According to a complaint filed by the U.S.

Attorney for the Southern District of New York, the Stamford, Connecticut–based Bayou allegedly set up a phony

accounting firm to audit its financial statements as part of a

plan to hide investment losses and induce investors to put

“No one wants

to be the service

provider for the

next failed hedge

fund,” says Gary

Enos, head of

alternative

investment

services, State

Street.

Alpha Awards Top Service Providers

more than $300 million in Bayou’s funds.

Many managers are being proactive, asking their auditors to conduct reviews of their funds’ internal accounting

controls to satisfy institutional investors, says Howard Altman, a co–managing principal in charge of the hedge fund

practice at Rothstein Kass in Roseland, New Jersey. “In

some cases hedge funds may also want to be prepared to sell

their business to an institution,” he adds. “They want to

have everything in their house in order for that eventuality.”

The biggest hedge fund firms have become institutions

in their own right, with sprawling infrastructures. Five years

ago only 32 hedge funds had $1 billion or more in assets,

according to Hedge Fund Research. Today more than 200

do. Even more startling is the percentage of total hedge

fund assets those funds control — more than 51 percent at

the end of 2004, up from 12 percent in 2000.

AS HEDGE FUNDS INCREASE IN SIZE, they are

catering to the demands of their larger investors. “Institutional investors often require a detailed breakdown of the

causes of performance,” says Ron Suber, manager of global clearing sales at Bear, Stearns & Co. in New York. “And

because they want it, prime brokers need to deliver it.”

Bear Stearns ranks No. 4 among prime brokers in overall

quality of service.

Hedge funds are strengthening their daily operations.

“We see leading clients looking increasingly institutional

— more like businesses that happen to be hedge funds than

a group of traders,” says Philip Vasan, New York–based

global head of prime services at CSFB.

David Swain, chief financial officer at CQS, a $5 billion London-based hedge fund manager specializing in

convertible and capital-structure arbitrage strategies, says

that many large hedge funds like his have decided to bring

more operations in-house to support their activities as

they grow. But he also points out that different strategies

have different service requirements. “A long-short equity

fund can rely on one or two prime brokers and its administrator to handle billions of dollars under management,”

says Swain. “If a hedge fund has a more fixed-income or

structured bias, it needs more.”

As hedge funds head into new markets and strategies, the

firms that service them have more ways to differentiate themselves. With more hedge funds venturing into private equity,

for example, brokers “must be able to finance assets that

range from straight equities to receivables on a securitized

note for a nonpublic security,” says Jon Hitchon, Deutsche

Bank’s London-based head of global prime services. Voters

rate Deutsche Bank the top prime broker for financing.

Prime brokers are the service providers with the most

intimate relationships with their hedge fund clients. Financing and securities lending remain the most lucrative

areas of their business, but competition has reduced margins and made growth in volume more important, forcing prime brokers to spend more money on automation

and technology. They are also integrating their services

across geographies and across equities and fixed income

to respond more effectively to clients whose strategies are

not straitjacketed by traditional asset-class boundaries.

What’s at stake is critical. Last year investment banks

reeled in $25 billion from hedge funds, more than one

eighth of total banking revenues, according to CSFB bank

analyst Marc Rubinstein in London. About $19 billion of

that came from sales and trading and $6 billion from

prime brokerage. The importance of hedge fund business

across bank divisions means that investment banks are

pulling out all the stops to service these clients. “We look

at our overall firm footprint with the hedge fund in prioritizing our highest-touch clients,” says CSFB’s Vasan.

The broad-gauge changes in the industry have made

hedge fund size increasingly important, even for start-ups.

As a result, it doesn’t pay for new fund managers to pinch

pennies when picking service providers. What’s critical is

getting a fund launched successfully, attracting appropriate

investors and performing well. “The manager is making a

huge entrepreneurial leap, and it’s a moment of intense personal and professional vulnerability,” says Alex Ehrlich,

global head of prime brokerage at fifth-ranked UBS in New

York. “He is trying to do what will give him the greatest

sense of comfort that they will be successful.”

The skew toward larger hedge funds across the industry

means that smaller hedge funds have a steeper hill to climb.

“There is a growing division between the haves and have-

ALPHA AWARDS™

Top Accounting Firms

Rank Firm

1

Rothstein Kass

2

Goldstein Golub Kessler

3

Deloitte Touche Tohmatsu

4

KPMG

5

PricewaterhouseCoopers

Rothstein Kass

Howard Altman, 54, Co–Managing Principal,

Hedge Fund Practice

When it comes to serving hedge funds, the Big Four

accounting firms could take a page from the playbook of

their much smaller rival Rothstein Kass, in Roseland, New

Jersey. The firm outpaces its competitors in hedge funds’

opinion of its expertise, responsiveness, auditing,

compliance and tax work. “They keep us on the right side

of the issues,” one hedge fund manager says of the firm,

which was founded in 1959. The hedge fund practice is

run by co–managing principal Howard Altman, who has

been with the firm 27 years. His group works with 1,500

hedge funds. As hedge funds come under greater investor

and regulatory scrutiny, Altman expects demand for his

— N.M.

firm’s services only to increase.

nots,” says Deutsche Bank’s Hitchon.

Funds of hedge funds are actively fueling this

trend. Five or six years ago, a fund of funds with

$500 million was considered large. Now many

fund-of-funds firms have several times that and

prefer to allocate money in chunks of $25 million or more. A hedge fund with $100 million

in assets can’t command as much attention as it

once could. “That’s changed the game in terms

of what is viewed as attractive to big investors,”

says Seward & Kissel attorney Tavss.

This shift in orientation benefits hedge fund

service providers. Institutional investors, for

example, want to see hedge funds put in place

basic controls like independent net-asset-value

calculations and independent valuations of securities. “They’re used to the infrastructure and

oversight responsibilities of a pension plan,” says

Gary Enos, head of State Street’s alternative

investment servicing group, which includes IFS.

Full-service fund administrators are consequently gaining new clients as onshore hedge

funds, which traditionally have performed their

own fund accounting and portfolio valuation,

outsource those jobs. Fund administrators are

also able to charge higher fees for the valuation of

illiquid and hard-to-price securities, as the cost of

servicing specialized funds is rising.

And even the bigger hedge fund complexes

are making greater demands in the investor relations area. “We expect more from our administrator in how they manage the information they

give us and how they service the shareholders of

the fund,” says Martin Pabari, head of product

control at CQS. Pabari is responsible for ensuring the accurate reporting of his firm’s trading

profit and loss statements.

Institutional investors aren’t the only ones

concerned with the risks associated with a hedge fund going

belly up. “Five years ago, when a hedge fund was often just

a manager and ten sophisticated, high-net-worth investors,

the headline risk wasn’t as important,” says State Street’s

Enos. “When you have boards and shareholders to protect,

the diligence you do changes. No one wants to be the service provider for the next failed hedge fund.”

The fund administration business has consolidated in

recent years as the need for scale has become more important.

Administrators have also found that servicing their hedge fund

clients’ basic needs can be a conduit to new business.

“It’s a relationship-driven business,” says Robert Schultz,

head of alternative fund services for North America at

HSBC Holdings, the second-biggest hedge fund adminis-

trator. “You’re able to cross-sell more banking products to

those clients, so it’s a good way to increase the share of revenue from a client.” Schultz is the former president and

CEO of Bank of Bermuda in New York, which HSBC

bought last year.

As service providers vie for clients, they are not being held

back by their traditional boundaries. Fortis, a Brussels-based

bank that bought Dutch private bank and trust and administrative services firm MeesPierson in 1997, has been providing

credit to funds of funds for seven years. “Everyone wants to

keep clients under the same roof — it creates access to hedge

funds and consolidates relationships,” notes Lisa Welden,

director of business development at Fortis Prime Fund Solutions (USA) in New York. “If we get financing business from

Please visit www.institutionalinvestor.com/AlphaAwards for a more detailed look at the Alpha Awards for hedge

fund service providers. There you will find a more extensive ranking of the top firms in all of the

categories as well as a ranking of how members of the Hedge Fund 100 view their prime brokers, the

importance our respondents attach to each attribute of service and a detailed statement of our methodology.

Photo by Juliana Thomas for Alpha

“Hedge funds

may want to be

prepared to sell

their business

to an institution,”

says Howard

Altman,

co–managing

principal,

Rothstein Kass.

Alpha Awards Top Service Providers

alternative investment practice at PricewaterhouseCoopers,

points out that investment advisers with long-short equity

funds and other strategies that are relatively easy to administer and audit could pay $70,000 to $100,000 to register

and set up a comprehensive compliance program. For the

largest hedge funds, the cost could range from $500,000 to

$1 million or more, depending on the fund’s structure and

the complexity of the products and strategies it uses.

Many hedge fund managers gearing up for registration are testing the waters with mock audits that simulate

the real exams carried out periodically by SEC inspectors.

Law and accounting firms and consultants conduct these

exams on-site at the hedge fund. A mock exam can last a

few days or a full month and cost $40,000 to $150,000

or more, depending on the size and complexity of the

hedge fund, says Zornada.

Hedge fund compliance needs will continue after the

registration deadline, as funds begin facing real SEC

audits. The SEC’s requirement that registered investment

advisers conduct annual reviews of their compliance programs also guarantees that hedge funds will continue to

turn to attorneys, accountants and other vendors to help

them with periodic evaluations.

Artabane of PricewaterhouseCoopers suggests that

another area likely to draw attention in coming years is

ALPHA AWARDS™

Top Law Firms

Rank Firm

1

Seward & Kissel

“If a hedge fund

complex has

multiple funds

with differing

strategies, the

amount of

work quickly

multiplies,” says

John Tavss,

partner, Seward

& Kissell.

a fund-of-funds client we administer, we’re more comfortable

making loans to them, and we may not need to charge them

high minimum fees for custody services.”

Hedge fund registration is a fresh summons for a range of

services from lawyers, accountants and administrators. U.S.based hedge funds are turning to their outside legal counsel

for help in registering and drafting written compliance procedures and codes of ethics. Documentation isn’t likely to be

the biggest registration-related expense, however.

“The cost is not just getting some papers drafted by

lawyers,” says George Zornada, a partner in the investment

management and securities law practice at law firm Kirkpatrick & Lockhart Nicholson Graham in Boston. “It’s instituting the whole compliance infrastructure. That’s expensive,

and that’s a new world for many hedge fund operators.”

The required infrastructure covers a lot of territory. A

registered investment adviser must have a chief compliance

officer, although that person doesn’t have to be an attorney

or accountant. Meeting other compliance obligations could

run the gamut from purchasing new recordkeeping systems

to establishing formal assessments of the quality of broker

executions and valuation procedures for illiquid securities.

Anthony Artabane in New York, who leads the global

2

Sidley Austin Brown & Wood

3

Akin Gump Strauss Hauer & Feld

4

Schulte Roth & Zabel

5

Maples and Calder

Seward & Kissel

John Tavss, 51, Head of

Alternative Investment Practice

New York–based Seward & Kissel has been serving hedge

funds since Harry Truman was president. The firm, which

helped Alfred Winslow Jones set up the first hedge fund

partnership in 1949, today represents more than 200

hedge fund firms. John Tavss, who started at Seward

& Kissel in 1979 doing tax work, heads up the alternative

investment practice, which has more than 30 attorneys,

including six partners. Hedge fund managers praise the

group’s ability to “deliver an opinion quickly” and say that

their “advice is always practical.” Seward & Kissel’s

lawyers get involved in many of the day-to-day issues that

arise for their clients, such as registration and compliance,

employment contracts, compensation and the legal

— N.M.

structure and terms for new funds.

Photo by Juliana Thomas for Alpha

Alpha Awards Top Service Providers

hedge fund corporate governance. With institutional investors and regulators demanding more transparency, hedge

funds currently organized as partnerships could come under pressure to have boards of directors and rethink their

compensation structures. “Hedge funds may have to hold

themselves to a higher standard,” says Artabane.

Accountants, lawyers and other service providers will

undoubtedly be standing in line, ready to help them do it.

ALPHA AWARDS™: The Top Firms by Aspect of Service

Here is a list of the accounting firms, administrators, law firms and prime brokers that scored highest on various aspects of service, as rated by the hedge fund managers that use them.

Accounting Firms

Rank

1

2

3

Rank

1

2

3

Rank

1

2

3

Rank

1

2

3

Rank

1

2

3

Rank

1

2

3

Rank

Audit

Rothstein Kass

Deloitte Touche Tohmatsu

PricewaterhouseCoopers

Fees

Rothstein Kass

KPMG

Goldstein Golub Kessler

Hedge fund expertise

Rothstein Kass

Goldstein Golub Kessler

Ernst & Young

Regulatory compliance

Rank

1

2

3

Rank

1

2

3

Rank

1

2

Fund accounting

Prime Brokers

International Fund Services

Goldman, Sachs & Co.

Citco Fund Services

Rank

Middle-office services

International Fund Services

Citco Fund Services

Bisys Alternative Investment Services

Transfer agency

International Fund Services

Goldman, Sachs & Co.

Citco Fund Services

Treasury and credit products

Citco Fund Services

HSBC Alternative Fund Services

Rothstein Kass

KPMG

Deloitte Touche Tohmatsu

Law Firms

Responsiveness & quality of personnel

Rank

Rothstein Kass

Goldstein Golub Kessler

Deloitte Touche Tohmatsu

Tax

1

2

3

Rank

Rothstein Kass

Deloitte Touche Tohmatsu

KPMG

1

2

3

Rank

Administrators

Rank

1

2

3

Client services

1

2

International Fund Services

Goldman, Sachs & Co.

3

Citco Fund Services

1

2

3

Rank

1

2

3

Rank

1

2

3

1

2

3

Rank

Fees

Seward & Kissel

Sidley Austin Brown & Wood

Akin Gump Strauss Hauer & Feld

Hedge fund expertise

Sidley Austin Brown & Wood

Seward & Kissel

3

Schulte Roth & Zabel

1

2

3

Rank

Rank

Brand image

Schulte Roth & Zabel

Seward & Kissel

Sidley Austin Brown & Wood

1

2

Rank

1

2

3

Quality of service

Sidley Austin Brown & Wood

Seward & Kissel

Akin Gump Strauss Hauer & Feld

1

2

3

Rank

Business consulting

Morgan Stanley

Credit Suisse First Boston

Goldman, Sachs & Co.

Capital introduction

Morgan Stanley

Deutsche Bank

Credit Suisse First Boston

Client services

Morgan Stanley

Credit Suisse First Boston

UBS

Financing

Deutsche Bank

Bear, Stearns & Co.

Morgan Stanley

Operations

Banc of America Securities

Morgan Stanley

Credit Suisse First Boston

Reporting & technology

Morgan Stanley

Banc of America Securities

Goldman, Sachs & Co.

Securities lending

1

2

Morgan Stanley

Bear, Stearns & Co.

3

UBS

Rank

1

2

3

Trade execution

Credit Suisse First Boston

Morgan Stanley

Bear, Stearns & Co.

Compiling the Ranking

e compiled our inaugural Alpha Awards ranking of the top hedge fund service providers based on voting in the summer of 2005 by representatives

from more than 600 hedge fund management firms. Of these firms, 550 run singlemanager funds and almost 100 manage funds of hedge funds. More than half the

firms in the 2005 Hedge Fund 100, Alpha’s annual ranking of the largest singlemanager hedge funds, participated in the survey.

We asked hedge funds to rate the quality of service they received for the 12

months ended May 31, 2005, from the accounting firms, administrators, law firms

and prime brokers they used during that period. For each type of provider, service quality was broken down into broad attributes, each of which included a

series of specific points of service. Respondents also rated the importance of

each service attribute, the result of which was then used to calculate the overall winner in each of the four major categories, rewarding firms that do well in

W

the tasks hedge funds prize most.

In the accompanying tables we rank only those service providers for which

we received a minimum number of responses. Only responses from singlemanager hedge fund firms were considered in the prime broker ranking;

responses from both single-manager and fund-of-funds firms were included in

the accounting firm, administrator and law firm rankings. For a more detailed

description of our methodology as well as a more complete ranking of firms rated

in each of the four overall groups and 23 categories, please visit the Alpha Awards

Web site, www.institutionalinvestor.com/AlphaAwards.

Alpha’s hedge fund service provider survey was conducted under the direction of Director of Research Operations Sathya Rajavelu, Assistant Managing Editor for Technology and Development Lewis Knox and Senior Editor Jane B.

Kenney, with assistance from Associate Editor Michele Bickford.

Posted with permission from the September/October 2005 issue of Alpha. Copyright Institutional Investor 2005. All rights reserved.