Developing Effective Recovery and Resolution Plans

advertisement

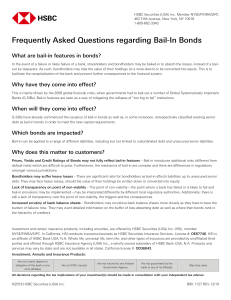

Developing Effective Recovery and Resolution Plans Presentation to the 14th Annual Conference of the International Association of Deposit Insurers Kuala Lumpur, Malaysia 28 October 2015 Christine M. Cumming Visiting Scholar, Rutgers University and Columbia University Preamble • Recovery and resolution planning for systemically important financial institutions involves a journey of learning and problem-solving. • The objective of recovery and resolution planning is not to preserve a failing financial institution “as is” but to • a) limit spillovers within the financial system and the economy • b) preserve critical functions within the financial system; and • c) impose costs on shareholders, creditors and the financial (banking) industry rather than the taxpayer. 2 Presentation Plan • Getting started—Crisis Management Groups, Cooperation Agreements, Recovery Planning • The Resolution Planning Cycle • The Components of Resolution Plans: Resolution Strategy, Recapitalization, Funding, Sale or Relaunch • Progress to Date • The Link Between Recovery and Resolution Planning and Next Steps 3 Recovery and Resolution Planning for G-SIFIs • The Financial Stability Board designates Globally Systemically Important Financial Institutions. • The Key Attributes sets out objectives and requirements for recovery and resolution planning for those financial firms designated as G-SIFIs. • Each G-SIFI has a Crisis Management Group (CMG) made up of the lead and major home authorities and major jurisdictions in which the G-SIFI is active. • The Cross-Border Crisis Management Group (CBCM) is the forum where the key jurisdictions can bring forward issues of mutual interest for study and for coordinating their approaches. • CBCM reports to the Resolution Steering Group • Recovery planning was completed for most G-SIFIs in 2011. • Resolution strategies were chosen for most G-SIFIs in 2012. • First complete operational plans for resolution developed 2013-5. • First Resolvability Assessment Process largely completed around mid2015. 4 Starting the Recovery and Resolution Planning Process • Forming a CMG: the principal supervisors/resolution authorities for a specific G-SIFI • Gathering Information with the clear intention to share it with CMG • Starting a dialogue with the financial company (bank) • This dialogue can be uncomfortable; the dialogue eventually needs to include all the CMG • Signing a Cooperative Agreement by parties within the CMG is necessary because it provides an understanding of obligations to safeguard information • Information needed to develop the bank’s “Heat Map” • Business Strategy • Organizational Structure • Financial and Risk Information 5 Bank Management Develops the Recovery Plan • The objective of recovery planning is to identify possible actions the bank can take first to stabilize the firm and then to restore its business health and profitability. • Historical experience suggests that the earlier the identification and proactive actions, the better. • Recovery planning relies on scenario-based stress tests. • Scenarios need to include both firm-specific and marketwide stresses and need to be stringent. • Banks also need to identify quantitative and qualitative triggers to begin considering options and to take action. 6 Choosing the Resolution Strategy: Single or Multiple Point of Entry • The CMG’s review and discussion with management of the recovery plan enhances the CMG’s understanding of the firm’s strategy, structure, finances and risk profile. • That understanding helps to inform the key decision about the resolution planning strategy. The two principal options are Single Point of Entry (SPE) and Multiple Points of Entry (MPE). • Both involve an internationally coordinated approach to resolution. • In the simplest form of SPE resolution, the resolution authority puts only the holding or parent company into resolution, and continues to operate the parent‘s subsidiaries as going concerns. 7 Why Single Point of Entry? • SPE has been adopted by most of the CMGs for GSIFIs. It becomes the preferred strategy for GSIFIs when the firm centralizes many or most key decision processes. • Prerequisites for SPE: • sufficient ability to move losses upstream and capital downstream in the organization; and • sufficient loss-absorbing capacity at the parent or a subsidiary that the parent can access. • Nonetheless, supervisory and resolution authorities have expressed a strong desire to have flexibility in choosing the resolution strategy at the time of failure. 8 Why Multiple Point of Entry? • Multiple points of entry (MPE) could be the preferred strategy in a range of possible cases: • A bank with strong regional autonomy • A bank with very clear business line boundaries • A bank with the potential for fairly clean good bank/bad bank separation. • Prerequisites for MPE: • a large degree of financial and operational separation across legal entities/jurisdictions, and • sufficient independent funding and loss-absorbing capacity at the potential points of entry 9 How will a Bank be Recapitalized in Resolution? Bail-in Powers • An important innovation of the Key Attributes is its requirement that resolution authorities have bail-in powers and its further clarifying how bail-in should work. • Bail-in is the power to convert liabilities to equity or write liabilities down in value; in either case, bailing in liabilities creates new capital. • Bail-in strengthens the entity in resolution to continue and retain business, improves its access to funding markets while in resolution, and improve its prospects for sale. • Bail-in is intended to reduce the permanent capital/funding need from the public sector to zero—that is, avoid bailout. • For bail-in to be effective, market expectations must change to incorporate the possibility that debt instruments could be converted to equity. Otherwise, bail-in actions can destabilize. 10 What Kind of Liabilities Should Be Bailed-in? • The FSB has proposed a new TLAC (Total Loss-Absorbing Capacity) requirement to ensure recapitalization of failed firms. It requires banks to issue some specific bail-inable liabilities. Which? • Conceptually, bail-inable liabilities need to: • Predictably provide loss-absorbing capacity; • Avoid triggering runs; • Avoid de-stabilizing funding markets. • Subordinated and senior debt are most clearly bail-inable. In order to have enough to recapitalize a firm, G-SIFIs may need to issue larger amounts of senior debt. • By the above criteria, derivatives liabilities and short-term funding instruments seem ill-suited for bail-in. • Agreement that insured deposits should not be bailed in; also great reluctance to bail in uninsured deposits. • Possibility under some circumstances to use ex ante commitments by deposit insurance or resolution funds to recapitalize a bank or bear costs of resolution, if pre-funded and subject to limits. 11 Funding in Resolution • Resolution requires funding and liquidity • Funding is necessary to support the balance sheet and meet collateral requirements, but a failing firm’s funders pull back as the firm’s condition deteriorates and may be slow to return in a resolution. • Liquidity takes many forms, but a key form is access to trading markets, necessary in order to retain business and manage risk. Capital markets activities also depend on credit in the settlement process. • History Suggests Some Kind of Public Sector Funding May be Necessary • A review of historical cases of failure or near failure confirms that funding needs rise into and even after resolution. While funding eventually is restored, funding needs temporarily become very large. 12 Funding in Resolution on the FSB Agenda • How Much Private Sector Funding is Possible? Making sure there’s enough requires: • Improving the ability to estimate prior to resolution funding gaps that could occur in resolution. • Principles for managing liquidity such that as much private sector funding as possible can be obtained in resolution. The recent Basel III agreements on liquidity rules help. • If temporary public sector funding is necessary, it is important that: • Temporary funding be clearly distinguished from capital injections or other medium-term support (“bailout”) and designed to minimize moral hazard. • Principles are developed that recognize the potential need for temporary public funding. Because institutional arrangements differ across counties, the challenge is to develop guidance that is not too prescriptive and still ensures adequate preparation for a resolution. 13 Transforming the Firm in Resolution • The last key element involved in a resolution is triage by the resolution authority of the potential disposition of the failed financial firm. • The operational resolution plan will provide a crucial roadmap in making that triage. The resolution plan will set out: • • • The organizational structure of the firm Identification of the firm’s critical functions—a guide to what is most important to preserve A preferred resolution strategy. • On entry into resolution, the resolution authority will have additional insight into the sources and location(s) of recent and future losses. • • • Are the losses systemic or localized in business lines/subsidiaries? How much restructuring of the firm is necessary? Might differ with use of SPE or MPE strategy for resolution. • The resolution authority needs flexibility to adapt strategy as circumstances warrant and may need expert help. • Governance • Who runs the firm day-to-day in the interim? New management? • What governance and oversight does the resolution authority provide? 14 The Resolvability Assessment Process (RAP) • Prerequisites for successful resolution of a G-SIFI is shared understanding of the resolution plan, a willingness to act, and trust among the principals of the key resolution authorities and supervisors. • Hence the requirement in the Key Attributes that periodically the principals of the key agencies review and sign off the resolution plan in a letter to the Head of the Financial Stability Board. • That letter cites agreement on a resolution strategy and a list of major impediments; at this point, most of them are common to most G-SIFIs. 15 Preparing for the Resolvability Assessment Process • Staff develops the key documents for use in the RAP Meeting or Call • The CMG produces a technical resolvability assessment • Details both market-wide and firm-specific impediments to resolution. • The findings are a key element of supervisory feedback. • Signing of the Cooperation Agreement • In some cases, appending the latest version of the operational resolution plan to the CoAg • Drafting the RAP letter 16 Completing the Cycle: The Link Between Recovery and Resolution • The outcome of the RAP process is a list of impediments to resolution to be set aside. • Some might be industry-wide improvement, such as agreeing to reach a common global approach to a stay on derivatives exposures when resolution begins. • Others may be firm-specific, e.g., a need to simplify the corporate organization, to reduce complex risks, or to improve liquidity management. • Addressing these findings make resolution more feasible. • Many measures have the possibility of making a firm more “recoverable”. • A successfully executed recovery plan is always preferable to resolution. 17 Next Phase of Resolution Planning: Preparing to Execute Resolution • Most CMGs have developed to date: • A resolution strategy • An operational resolution plan with some detail, although additional work is needed • CoAgs to govern information-sharing • A resolvability assessment detailing impediments to resolution. • Next Steps • Follow up to addressing impediments to resolution • Preparing for the execution of the resolution plan—for example, to be able to effect a recapitalization • Valuing the failed organization—i.e., how much capital is needed • Exchanging debt into new equity; extinguishing old equity • Work on restructuring and governance in resolution 18