Manitoba Advantage - Government of Manitoba

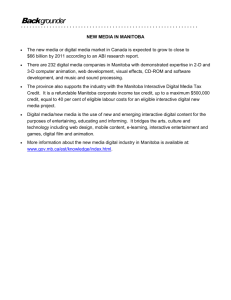

advertisement