California Pizza Kitchen - University of Oregon Investment Group

U

NIVERSITY OF

O

REGON

I

NVESTMENT

G

ROUP

February 26 th , 2010

Consumer Goods

California Pizza Kitchen

BUY

Stock Data

Price (52 weeks) 9.41 – 17.44

Symbol/Exchange CPKI / NYSE

Beta 1.25

Shares Outstanding 24,183,000

Average daily volume

(3 month average)

400,876

Current market cap 365,975,000

Current Price

Dividend

Dividend Yield

$15.07

$0.00

0%

Valuation (per share)

DCF Analysis $15.18

Comparables Analysis

Target Price

Current Price

Summary Financials

$17.73

$16.46

$15.07

Revenue

Operating Cash Flow

662M 2009A

44.6M 2009A

Net Income 4.6M 2009A

B USINESS O VERVIEW

California Pizza Kitchen was founded in 1985 by Rick Rosenfield and Larry Flax in Beverly Hills,

California. Twenty years later, California Pizza kitchen operates over 250 restaurants around the world and is still run by its initial founders. The largest portion of CPK’s restaurants are still located throughout

California, however they are now located in dozens of states as well as internationally in Asia, North America and the Middle East. Almost all of California Pizza Kitchens revenues come from company owned full

Covering Analyst: Ari Siegel

Email: Asiegel@uoregon.edu

The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational.

Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be.

Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s portfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio.

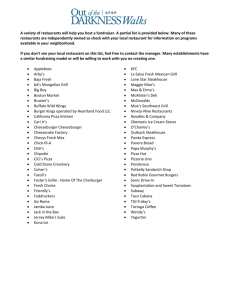

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p service restaurants, however about fifty stores have been franchised bearing the CPK name. Restaurant revenues tend to have very low margins because of the high cost of goods sold. Fortunately, CPK also generates higher margin revenue through a fairly recent franchising agreement with Kraft foods to produce and distribute a line of premium frozen pizzas. The compounded annual growth rate of Kraft franchise revenues has been extremely high over the past five years. For now however, Kraft franchise revenues are only 1% of CPK’s annual revenues. Other franchise revenue comprises about .72% of revenue, while restaurant sales comprise about 98.31%.

h t t p : / / u o i g . u o r e g o n . e d u

B USINESS AND G ROWTH S TRATEGIES

In the future, top line growth should be driven almost completely organically. While over this last year CPK did not open any new stores due to poor economic conditions, there are currently 8 full service store openings, 8 international franchised locations and 5 domestically franchised locations planned for 2010.

These newly opening stores should start CPKI’s recovery from the recession. Part of top line growth strategy going forward is to penetrate new target markets. Past stores have rarely been opened on college campuses, and starting in the fiscal 4 th quarter of 2009 stores have begun to be opened more frequently in those areas. New fast-casual dining restaurants are being opened in travel locations such as airports, which offer smaller menus to people on the go, who still want a meal that is higher quality than fast food.

Management plans to emphasize geographic diversification in the future as a result of past difficulty with California’s particularly poor economic environment dampening profitability. Currently, none of the newly planned stores will be located in the California area. Throughout the recession, CPK avoided broad menu price discounting in order to protect brand equity, while at the same time preventing price increases. Going forward menu price inflation is expected to be as little as a percentage point a year.

Even with management projecting fairly stable menu prices in the future, average check per customer has recently begun to increase. This is largely due to wine now being offered at all restaurants, and partially from new and expanded menu offerings.

The segment with the largest revenue growth going forward will be its Kraft franchise royalty line. As previously mentioned , the compounded annual growth rate of the Kraft royalty segment has been over 30% annually over the past five years, and this growth should continue, albeit at a lesser rate than previous years.

In their most recent conference call, CEO Larry Flax strongly emphasized that going forward CPK will contribute a larger amount of its attention and money to growing its higher margin revenue streams.

M ANAGEMENT AND E MPLOYEE R ELATIONS

Rich Rosenfield and Larry Flax managed CPK from 1985 to 1992, and from 2003 to present day. In

1992 the two managers sold their company to PepsiCo for about 100 million dollars. In 1997, Bruckmann,

Rosser, Cherill and Company bought out PepsiCo’s stake and took CPK public. Following issues with management, Rich and Larry were then re-instated as managers. Even while not Corporate Officers Rick and

Larry were always involved with the company. The Board of Directors is made up of independent directors and the two CEO’s. Managers have a set salary, and also are awarded pay using equity incentive plans including options and restricted stock awards.

2

C a l i f o r n i a P i z z a K i t c h e n

P ORTFOLIO I NFORMATION u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

The Tall Firs, Svigals’ and DADCO portfolios are all currently underweight consumer goods and small cap

R ECENT N EWS

February 18

th

, 2010 – California Pizza kitchen announces financial results for the fourth quarter and fiscal year 2009

o California Pizza Kitchen reported revenue and net income for the fourth quarter and fiscal year 2009 ending January 3 rd , 2010. Overall, total revenue and net income slightly decreased from previous years largely reflecting a still recovering industry.

February 4

th

, 2010 - California Pizza Kitchen Creates Big Flavors in Small Cravings

o California Pizza Kitchen announced February 4 th the introduction of a new small cravings menu.

This menu includes the same quality of dish that customers are used to eating at CPKI in smaller portions. Up to the time of this report, this additional menu has seen success among customers.

This type of product introduction is an example of the ways restaurant sales growth will be strengthened going in future years.

January 25

th

, 2010 - California Pizza Kitchen Opens at Stony Brook University

o California Pizza Kitchen announced January 25th the opening of a new quick-serve store on the campus of Stony Brook University, located 60 miles east of New York City. It is a franchised location that will allow a student population of over 24,000 to order a premium selection of CPK’s pastas, salads, soups & pizzas. This store opening is an example of CPK’s move towards higher margin franchised revenue as well as new quick-serve locations.

I NDUSTRY

The full services restaurant industry is composed of businesses that provide food and other services to customers who order and are served by waiters while seated. Some of the subcategories in this industry include Asian, Traditional

American, Pizza, European,

Latin, Middle Eastern and

Casual Dining restaurants.

Overall, the industry can be broken down into full service restaurants, which comprise

34% of the industry, quick service restaurants, which comprise 31% of the industry, and an “other” category which comprises the remaining 35%.

Recently high growth in the

United States has been in the Asian category, followed by Middle Eastern. The highest growth has been in traditional North American food.

About 80% of industry revenue comes from household expenditure on restaurant meals. The US census has suggested that households with incomes of more than fifty thousand dollars account for more than two thirds of personal expenditure on food away from home – although this number does not stay exactly the same in the more specific restaurant industry. The remaining 20% of the industry’s revenue comes from businesses, and business travelers.

3

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

Over the past few years the restaurant industry has been dealing with declining revenues, in line with the overall global recession. This decline in revenues has led many companies’ to close underperforming stores as well as offer increased discounting to attract more customers. The restaurant industry’s success is particularly dependant on a few key factors which include the consumer sentiment index, expenditure by household income and per capita disposable income. All three of these factors have been negatively affected by the recession, however all three should begin to improve as unemployment and the overall global economy begins to recover.

More specifically, real GDP growth should increase to about 1% in 2010 and continue to slowly increase from that rate over the next few years. Unfortunately for the industry, unemployment tends to recover at a lag from GDP, and so unemployment is expected to remain fairly high in the short term. Unemployment is a key factor in determining the consumer sentiment index, house hold expenditure and disposable income per capita.

In general, the restaurant business will trend towards increased use of technology and more efficient operations in order to cut down on costs and improve profitability. While existing chains will continue to consolidate and attempt to maintain a competitive advantage in this saturated market, barriers to entry have been and will continue to be low. Continued new entrants into the market are guaranteed.

S.W.O.T.

A NALYSIS

Strengths

Recognizable Brand Name

Strong Balance sheet, consistent reduction in long term debt

Variety of different products and ways in which the CPK brand is being marketed

Price competitive without having had to discount menu prices through the recession

Weaknesses

Lack of geographic diversification, currently 40% of company operated stores are located within California

4

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

Opportunities

Franchised Restaurants and frozen pizzas have the possibility of improving overall margins in the long run

Management has hinted there is a chance of marketing products other than just frozen pizzas through Kraft

Company will be introducing quick serve restaurants, and catering services in addition to their traditional restaurants

New target markets such as college campuses can be accessed

Threats

Restaurant sales are sensitive to timing of weather, holidays and other special events

Depending on Nestle’s opinion of CPK’s frozen pizza’s, continued marketing of the product may be threatened

P ORTER ’ S 5 F ORCES A NALYSIS

Supplier Power

There is a low amount of supplier power. The industry has a wide variety of places to obtain the different ingredients used in making food.

Barriers to Entry

There are very low barriers to entry within the industry. A large number of people can afford to lease buildings and equipment, so initial capital start up costs are very low

Buyer Power

There is a high amount of buyer power within the industry. While to a certain extent people are willing to pay higher prices for good meals at a restaurant they trust, it is not too long before sales are hurt by a high price elasticity of demand

Threat of Substitutes

There is a high threat of substitutes within the restaurant industry. Over the recession people have substituted towards more home cooked meals as disposable income per capita decreased

Degree of Rivalry

There is a high degree of rivalry within the industry. Tens of thousands of restaurants within the industry all compete for the same customers

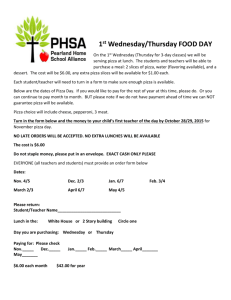

C OMPARABLES A NALYSIS

There were a few criteria used for selecting comparable companies. First, they had to operate in the restaurant industry for the purpose of ease of comparison. After this, they were chosen if growth, cash flow and risk characteristics were similar to California Pizza Kitchens outlook. This process should give a relatively clear picture of what the market is currently pricing a company with a similar profile to California Pizza Kitchen.

5

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

The three multiples used to calculate the implied price were EV/Revenue, EV/EBITDA and EV/OCF.

EV/Revenue is a measure of how well a company produces revenue relative to its enterprise value, and is fundamentally affected by how good a company’s margins, growth and risk are. EV/EBIDTA is a good proxy for how well cash flow is produced relative to enterprise value and is also fundamentally affected by expected growth and risk. EV/OCF is also an estimate of how well a company produces cash flows relative to enterprise value, and will be affected by factors similar to the previous two multiples. Given that the three multiples used are affected by the fundamentals in similar ways, they were all weighted equally in the comparables analysis.

The Cheesecake Factory Inc. (CAKE) – 20%

The Cheesecake Factory is an upscale casual dining restaurant chain located throughout the United States. The company’s full service restaurants offer over 200 items on their menu’s, with offerings ranging from pizza, seafood and salads to omelets, baked goods and steak. There are currently more than 150 stores bearing the cheesecake factory name, none of which are y franchised locations.

While the Cheesecake Factory is a slightly more risky company than California Pizza

Kitchen, it has similar growth and cash flows and thus makes a more than reasonable comparable. The higher beta is likely due to the company being a slightly more upscale dining experience than CPK. For example, in 2008 it’s average check size per guest was $18.50 in 2008 as compared to about $14 at

CPK. Like most casual dining restaurants within the United States, the Cheese Cake Factory operates in a highly competitive environment, and faces a large amount of competition.

PF Chang’s China Bistro Inc. (PFCB) – 20%

PF Chang’s owns and operates two chains of casual dining restaurants – the PF

Chang chain and the Pei Wei Asian Diner (which is more of a quick service chain).

The company currently operates 189 full service PF Chang restaurants and 159 Pei

Wei restaurants. While the majority of these restaurants are located within the United

States, the company has development and license agreements to develop restaurants in Mexico and the Middle East.

PF Chang’s has slightly lower risk , most likely due to having better geographic diversification as compared to CPK.

An average check size of $8 at its Pei Wei Restaurants also likely contributes to the lower risk. Its’ margins and growth potential are also very similar to California Pizza Kitchen.

Red Robin Gourmet Burgers Inc. (RRGB) – 30%

Red Robin develops, operates and franchises casual dining restaurants within the

United States and Canada. In 2008, approximately 423 restaurants were operated, 294 of which were company owned and 129 of which were operated under a franchise agreement. Its average check size is about $11.50, which is similar to California Pizza

Kitchens.

Red Robins overall risk profile is very similar to California Pizza Kitchens with a beta of 1.36. While RRGB’s beta is likely lower when unleveraged, in past years it has

6

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u taken on a large amount of debt to finance quick expansion and this has also increased its levered beta. However more recently, its revenue growth has stabilized to levels comparable to CPK’s, and its margins are also similar.

Brinker International Inc. (EAT) – 30%

Brinker International owns, develops, operates and franchises various restaurant chains within the United States. The chains it owns include Chilli’s Grill & Bar and

On the Border Mexican Grill restaurants. It currently operates or has franchised

1689 restaurants, most of which are Chilli’s. Brinker’s is fairly geographically diversified, having locations throughout Europe, South America, Asia and the

Middle East.

Brinker’s has a risk profile that is fairly comparable to California Pizza Kitchens.

The slight premium on its beta is likely due to its relatively higher proportion of debt. Its margins are similar to

CPK’s, however its revenue has actually been decreasing in recent years. This top line growth is somewhat deceiving however, as its EBITDA growth has been comparable to the industrys’.

D ISCOUNTED C ASH F LOW A NALYSIS

Line Items were projected out to 2020 in the DCF analysis. After this point there was not a lot of value to be gained from further projections due to lack of information. However, from 2019 to 2020 nominal free cash flow is growing at a bit under 10% a year, and so an intermediate terminal growth rate of 5% a year was used until 2025. Line items were generally projected as a percent of revenues.

Revenues

In order to project total revenue for coming years, top line sales were broken down into three segments – Restaurant

Sales, Franchised Restaurant Sales and Kraft Sales.

Restaurant Sales have experienced negative growth in recent years as a result of the recession, however they will begin to see signs of growth as the overall economy improves. While 2010 nominal growth will be negative, this is largely because of a shift from a 53 week fiscal 2009 to a 52 week fiscal 2010. This change alone will cause about a negative

1.5% difference in sales. Not including this effect, sales in 2010 increase by over 1%. CPK is currently planning to open 8 full service restaurants in 2010, and so restaurant sales growth will trend towards historic levels starting in

2011. Revenues will then begin to trail off towards the terminal year as CPK puts more focus on franchise revenue and the market for CPK restaurants becomes more saturated.

Kraft Royalty growth should take a hit in the short term as a result of Nestle’s purchase of Kraft. While Nestle goes through the merger with Kraft, there will not be as much of a focus on marketing CPK frozen pizza’s. However, in the long term, Nestle has the intention of continuing to sell CPK’s products; so growth should increase back to a slight discount of historic rates. Management has even hinted at the possibility of an agreement to sell more than just pizza’s with Nestle.

Restaurant Franchise Growth should be higher than company owned restaurant sales going into the future, largely due to management focus on this segment. In 2010, there are plans to open 13 new franchised restaurants. 8 of these restaurants will be within the United States, while the other 5 will be opened internationally. As CPK currently only

7

C a l i f o r n i a P i z z a K i t c h e n u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u receives royalties from a little over 50 franchised restaurants, this growth should increase significantly within a few years and then trend downwards towards the terminal year.

Cost of Goods Sold

Costs of Goods Sold was projected by being broken down into its separate components. Each component was then projected as a percent of revenue.

Food, Beverage & Paper supplies should make a small spike upwards next year due to managements issues with buying cheese futures. After this point, this cost should trend towards historical levels before decreasing very slightly towards the terminal year as more revenues begin to come from royalties.

Labor as a percent of revenue should stay similar to 2009’s due to salary increases cancelling out with revenue per store increasing. After this point, labor costs should trend back to historical levels partially as a result of revenue per store increasing, and partially as a result of total revenue trends towards an increased amount of royalties.

Direct Operating & Occupancy Costs should also trend back towards historical levels as the economy recovers, as well as trend slightly downwards due to higher royalty revenues.

General & Administrative Expenses

General & Administrative Expenses have stayed relatively consistent over time, and thus their percent of revenue over the DCF was projected as an average of their historical percent of revenues.

Pre-Opening Costs

Pre-Opening Costs were abnormally low over the past few years as a result of reduced store openings. These costs should increase to slightly less than their historic levels as CPK begins to open larger amounts of restaurants again.

Store Closure Costs

Store Closure Costs were historically very low before the recession. These costs were projected at an average of percent of revenues of the years prior to 2007

Depreciation

Depreciation rose in 2009 due to an accounting change that accelerated the depreciation of several of CPK’s assets.

Depreciation was projected to increase slowly over time, as theoretically Depreciation and Capital Expenditures should converge in perpetuity.

Net Working Capital

Current Assets were first adjusted by removing cash and marketable securities. After this point, Adjusted Current

Assets and Liabilities were projected as averages of their historical years percent of revenues. It should be noted that

2007 was treated as an outlier for current liabilities.

8

C a l i f o r n i a P i z z a K i t c h e n

Capital Expenditures u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

While in the short term Capital Expenditures are projected to remain similar to recent levels, in the longer term they should theoretically somewhat converge with depreciation, and so Cap Ex is projected to decrease as a percent of revenues over time.

Cost of Capital and Beta

California Pizza Kitchen has undergone somewhat significant changes in its capital structure over the last 5 years. Up until 2008, it was relatively debt free at which point it took out about 75 million dollars worth of debt. By 2009 that debt had decreased to half of its original amount. At the time of this report, CPK’s debt level is currently at 22.3 million dollars. Management has stated that they plan to pay off the rest of this debt by the 3 rd quarter of 2010. As a result of this, a 5 year regression on CPK’s stock price and the S & P 500 was not appropriate. Instead the Hamada formula was applied to find CPK’s beta. Because CPK should have no debt by the time the first year of relevant cash flows is over, free cash flow was discounted at the cost of equity after 2011. This cost of equity was calculated using

CPK’s unlevered beta from the Hamada formula, as oppose to its levered beta. 2010’s WACC was calculated using

CPK’s levered beta, as well as the assumption that the debt was paid off at the end of 2010 (instead of in the third quarter).

R ECOMMENDATION

California Pizza Kitchen has relatively strong growth potential within the casual dining industry. Its valuable brand name and high quality food services are reflected in the DCF and Comparables analysis. Combined, the

DCF

Comps

Implied price of California Pizza Kitchen is $16.48, which suggests an undervaluation of 9.34%. Given this

Implied Price

Current Price undervaluation, and the fact that our three portfolios are underweight small cap and consumer goods, I’m

Undervalued recommending a BUY for the Tall Firs, Svigals’ & DADCO.

Our portfolios can benefit from an undervalued company with a higher beta as the overall economy begins to improve.

Price

$15.18

$17.73

$16.46

$15.07

9.20%

Weight

0.5

0.5

9

C a l i f o r n i a P i z z a K i t c h e n

A PPENDIX 1 – C OMPARABLES A NALYSIS

CPKI

CPKI

Weight

EBITDA(ttm)

OCF

Net Income(ttm)

Weight

Beta

EV/Rev

EV/EBITDA

EV/OCF

48.9

66.22

8.7

1.2

0.57

7.65

5.65

CAKE

CAKE

164.3

169.2

49.9

0.25

1.92

Multiples

0.93

9.05

8.79

PFCB

PFCB

u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

RRGB

RRGB

EAT

EAT

20.00% 20.00% 30.00% 30.00%

Mean

Price

Shares Outstanding

15.07

24

Market Cap

365.975

Long Term Debt (MRQ)

22.3

Cash(MRQ)

Enterprise Value

Revenue(ttm)

Gross Profit(ttm)

14.3

373.975

658.6

80.4

23.65

60

1419

150

82.3

1486.7

1,601.70

993.20

41.88

23

963.24

153.6

23.1

1093.74

1196.3

213.15

20.02

16

320.32

178.2

10

488.52

857.4

103.2

18.25

102

1861.5

727

123.9

2464.6

3246.7

2180.7

24.59

52.00

1130.99

332.28

61.25

1402.02

1790.83

926.44

138.8

139.8

39.2

0.25

0.9

0.91

7.88

7.82

92.6

91.16

21.8

0.25

1.36

0.57

5.28

5.36

378.1

201.83

336 189.95

79.2

0.25

1.69

0.76

6.52

7.34

48.12

1.48

0.77

6.92

7.13

Implied Price Weight

$20.48

$13.61

$19.11

33.33%

33.33%

33.33%

Weight 0.20

0.20

0.30

0.30

Implied Price

Undervalued

17.73

17.68%

10

C a l i f o r n i a P i z z a K i t c h e n

Line Items

Revenues

% Growth Rate

Cost of Products Sold

% of Revenue

Gross Profit

Gross Margin

Operating Items

General and Administrative Expense

% of revenue

Pre-Opening Costs

% of revenue

Store Closure Costs

% of revenue

Depreciation & Amortization

% of revenue

Operating Income

EBIT

Income tax provision

Tax Rate

Net Income

Net Margin

Add Back: Depreciation & Amortization

Cash from Operations

Cash and Marketable Securities

Current Assets

Total Adjusted Current Assets

% of Revenue

Current Liabilities

% of Revenue

Net Working Capital (NWC)

% of revenue

Change in Working Capital

Capital Expenditures

% of Revenue

Free Cash Flow

Present Value of FCF

A PPENDIX 2 – D u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

ISCOUNTED C

h t t p : / / u o i g . u o r e g o n . e d u

ASH F LOWS A NALYSIS

29489

50980

8200

1.48%

37900

29700

5.36%

66000

11.90%

-36300

6.55%

-12842

63712

11.49%

110

2006A

554601

15.64%

444150

80.08%

110451

19.92%

2007A

632884

14.12%

507094

2008A

677074

6.98%

553169

80.12%

125790

19.88%

81.70%

123905

18.30%

2009A 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E

664,686 662014.425 705725.18

756465.87 815395.105 875167.295 939777.433

1008609.915 1081515.011 1159685.096 1238121.953 1316174.98

-1.83% -0.40% 6.60% 7.19% 7.79% 7.33% 7.38% 7.32% 7.23% 7.23% 6.76% 6.30%

543504 542189.814 571637.39

607063.86 651704.538 696633.167

745008.56

798819.0527

855748.7523 916731.0686 974711.5073

1035171.62

81.77%

18.23%

81.90%

121182 119824.611 134087.78

18.10%

81.00%

19.00%

80.25%

149402.01 163690.567 178534.128 194768.873

19.75%

79.93%

20.08%

79.60%

20.40%

79.28%

20.73%

79.20%

209790.8623

20.80%

79.13%

225766.2585 242954.0277 263410.4455

20.88%

79.05%

20.95%

78.73%

21.28%

78.65%

281003.358

21.35%

43320

7.81%

6964

1.26%

707

0.13%

29489

5.32%

29,971

30,689

9689

31.57%

21,000

3.79%

50691

8.01%

7167

1.13%

9269

1.46%

37146

5.87%

21,517

21,444

6660

31.06%

14,784

2.34%

52378

7.74%

4478

0.66%

1033

0.15%

40299

5.95%

12,381

11,057

2395

21.66%

8,662

1.28%

52400 52134.0079 55576.254

59572.112 64212.8226 68919.9161 74008.0008

79428.59739

85169.91463 91325.85278 97502.79929

103649.519

7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88% 7.88%

1843 4634.10098 5292.9388

5673.494 6523.16084 7001.33836 7048.33075

7060.269406

7029.84757 6958.110578 7428.731717

7897.04987

0.28% 0.70% 0.75% 0.75% 0.80% 0.80% 0.75% 0.70% 0.65% 0.60% 0.60% 0.60%

539 526.87139 561.65907

602.0416 648.941074 696.511423 747.932105

802.7131853

860.7354997 922.9480136

985.37284

1047.49219

0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08% 0.08%

40181 40051.8727 43402.098

46522.651 50962.1941 55573.1232 60615.6444

65559.64448

70298.4757 75379.53126 80477.92693

85551.3736

6.05% 6.05% 6.15% 6.15% 6.25% 6.35% 6.45% 6.50% 6.50% 6.50% 6.50% 6.50%

26,219

2,490

22,478

22,478

29,255

29,255

37,032

37,032

41,343

41,343

46,343

46,343

52,349

52,349

56,940

56,940

62,407

62,407

68,368

68,368

77,016

77,016

82,858

82,858

-2091 7090.21687 9227.9271

11681.007 13041.0701 14618.1668 16512.5683

17960.61604

19685.29004 21565.36274 24293.23291

26136.0873

83.98%

4,581

0.69%

31.54%

15,388

2.32%

31.54%

20,027

2.84%

31.54%

25,351

3.35%

31.54%

28,302

3.47%

31.54%

31,725

3.63%

31.54%

35,836

3.81%

31.54%

38,979

3.86%

31.54%

42,722

3.95%

31.54%

46,802

4.04%

31.54%

52,722

4.26%

31.54%

56,722

4.31%

37146

51880

10800

1.71%

49400

38600

6.10%

101300

16.01%

-62700

9.91%

-26400

83433

13.18%

-5153

40299

61260

14400

2.13%

37500

40181 40051.8727 43402.098

44636

21,400

3.22%

55439 63429

46522.651 50962.1941 55573.1232 60615.6444

71873 79265 87298 96452

65559.64448

104539

70298.4757 75379.53126 80477.92693

113020 122182 133200

85551.3736

142273

23100 32755.95288 32624.2968 34778.378

37278.896

40182.949 43128.5429 46312.5526

49704.64076

53297.42876 57149.67724 61015.07229

64861.5521

3.41% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93% 4.93%

79500 73956.17487 73658.9225 78522.392

84168.047 90724.7978 97375.3404 104564.176

112222.8109

120334.5839 129032.1652 137759.4287

146443.985

11.74% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13% 11.13%

-56400 -41200.222 -41034.6258 -43744.014

-46889.15 -50541.849 -54246.7975 -58251.6239 -62518.17009 -67037.15519

-71882.488 -76744.3564 -81582.4334

8.33% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20% -6.20%

6300 15199.77801 165.596211 -2709.3886 -3145.1361 -3652.6984 -3704.94866 -4004.82639 -4266.546207 -4518.985097

-4845.3328 -4861.86846 -4838.07693

56601

8.36%

-1641

53174.88

8.00%

-798

52961.154 56458.014

8.00%

2313

8.00%

9680

60517.27 57077.6573 61261.7107 65784.4203

8.00%

14501

7.00%

25840

7.00%

29741

7.00%

34672

70602.69406

7.00%

38203

70298.4757 75379.53126 80477.92693

6.50%

47241

6.50%

51648

6.50%

57584

85551.3736

6.50%

61560

2065.34472

7702.693

10285.83 16338.2439 16763.5432

17420.996

17110.59234

18861.51243 18381.96548 18269.65976

17410.4223

11

C a l i f o r n i a P i z z a K i t c h e n

A PPENDIX 3 – D ISCOUNTED C ASH F LOWS A NALYSIS A SSUMPTIONS u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

2011 & Forward WACC

Beta

Market Risk Premium

10 yr Bond

Return on Equity

Cost of Debt

Equity

Debt

Wacc

Terminal Growth

Shares Oustanding

Current Price

Weighted Implied

Sum of FCF

Terminal Value

PV of Terminal Value

Implied Value Per Share

1.2

7%

3.78%

12.18%

3.76%

365974.95

0.00%

12.18%

3%

24285

15.07

16.46

219799.77

839556.1299

149733.233

15.18

A PPENDIX 4 – B ETA S ENSITIVITY A NALYSIS

Standard Error

2

1.5

1

0.5

0

-0.5

-1

-1.5

-2

2010 WACC

Beta

Market Risk Premium

10 yr Bond

Cost of Equity

Cost of Debt

Equity

Debt

WACC

Beta

1.884

1.713

1.542

1.371

1.2

1.029

0.858

0.687

0.516

Implied Price

8.78

9.88

11.25

12.96

15.22

18.13

22.21

28.17

36.57

1.25

7.00%

3.78%

12.53%

4.18%

365974.95

22,300

11.97%

12

C a l i f o r n i a P i z z a K i t c h e n

A PPENDIX 5 – R EVENUE & COST OF GOODS S OLD PROJECTIONS

Company

CAKE

PFCB

RRGB

EAT u n i v e r s i t y o f o r e g o n i n v e s t m e n t g r o u p

h t t p : / / u o i g . u o r e g o n . e d u

Revenue Projections

Sales

% growth

Kraft Franchise Revenue

% growth

Other Franchise Revenue

% growth

Total Revenue

% growth

Cost of Goods Sold Projections

Costs of Sales

% of revenue

Food, Beverage & Paper Supplies

% of revenue

Labor

% of revenue

Direct Operating & Occupancy

% of revenue

2006A

444150

80.08%

135848

24.49%

199744

36.02%

108558

19.57%

2007A 2008A 2009A 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E

2006A

547968

15.43%

3691

82.00%

2942

3.85%

554601

15.64%

624324 665616 652,185 648924.075 691104.14 739481.43 794942.537 850588.514 910129.71 973838.7902 1042007.506 1114948.031 1187419.653 1258664.83

13.93% 6.61% -2.02% -0.50% 6.50% 7.00% 7.50% 7.00% 7.00% 7.00% 7.00% 7.00% 6.50% 6.00%

4710 6580 7739 8280.73 9522.8395 11427.407 14284.2593 17855.3241 22319.1551 26782.98609 30800.43401 35420.49911 40733.57398 46843.6101

27.61% 39.70%

3850 4878

30.86% 26.70%

17.61%

4762

-2.38%

7.00%

4809.62 5098.1972 5557.0349 6168.30879 6723.45658 7328.56768 7988.138767 8707.071256 9316.566244 9968.725881 10666.5367

1%

15.00%

6%

20.00%

9%

25.00%

11%

25.00%

9%

25.00%

9%

20.00%

9%

15.00%

9%

15.00%

7%

15.00%

7%

15.00%

7%

2007A

632884 677074 664686 662014.425 705725.18 756465.87 815395.105 875167.295 939777.433 1008609.915 1081515.011 1159685.096 1238121.953 1316174.98

14.12% 6.98% -1.83% -0.40% 6.60% 7.19% 7.79% 7.33% 7.38% 7.32% 7.23% 7.23% 6.76% 6.30%

2008A 2009A 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E

507094 553169 543504 542189.814 571637.39 607063.86 651704.538 696633.167 745008.56 798819.0527 855748.7523 916731.0686 974711.5073 1035171.62

80.12% 81.70% 81.77% 81.90% 81.00% 80.25% 79.93% 79.60% 79.28% 79.20% 79.13% 79.05% 78.73% 78.65%

153954 165526 154181 156897.419 169374.04 183442.97 195694.825 207852.233 220847.697

237023.33 254156.0275 272525.9976 287863.354 306010.683

24.33% 24.45% 23.20% 23.70% 24.00% 24.25% 24.00% 23.75% 23.50% 23.50% 23.50% 23.50% 23.25% 23.25%

228664 247276 247350 246269.366 261118.32 276110.04 297211.516 318560.895 341609.097 366125.3992 392049.1914 419806.0049 447581.0859 475139.167

36.13% 36.52% 37.21% 37.20% 37.00% 36.50% 36.45% 36.40% 36.35% 36.30% 36.25% 36.20% 36.15% 36.10%

124476 140367 141973 139023.029 141145.04 147510.85 158798.197 170220.039 182551.766 195670.3235 209543.5333 224399.0661 239267.0674 254021.771

19.67% 20.73% 21.36% 21.00% 20.00% 19.50% 19.48% 19.45% 19.43% 19.40% 19.38% 19.35% 19.33% 19.30%

A PPENDIX 6 – H AMADA B ETA

Beta D/E ratio S/E

1.92 0.09991341

0.9 0.15572723

1.36 0.53947687

1.69 0.36617306

0.301

0.293

0.392

0.342

Weight

20%

20%

30%

30%

Mean 1.479 0.32282311

0.339

Pure Business Beta

Sample D/E

Unlevered Business Beta

CPKI D/E

CPKI BETA

A PPENDIX 6 – S OURCES

IBIS World

Finace.Yahoo.com

FactSet

Etrade.com

CPK 10-k, 10-Q & Conference Calls

1.479

0.322823

1.203217

0.058642

1.253314

13