COMM 498 Midterm Sample Exam International Business

advertisement

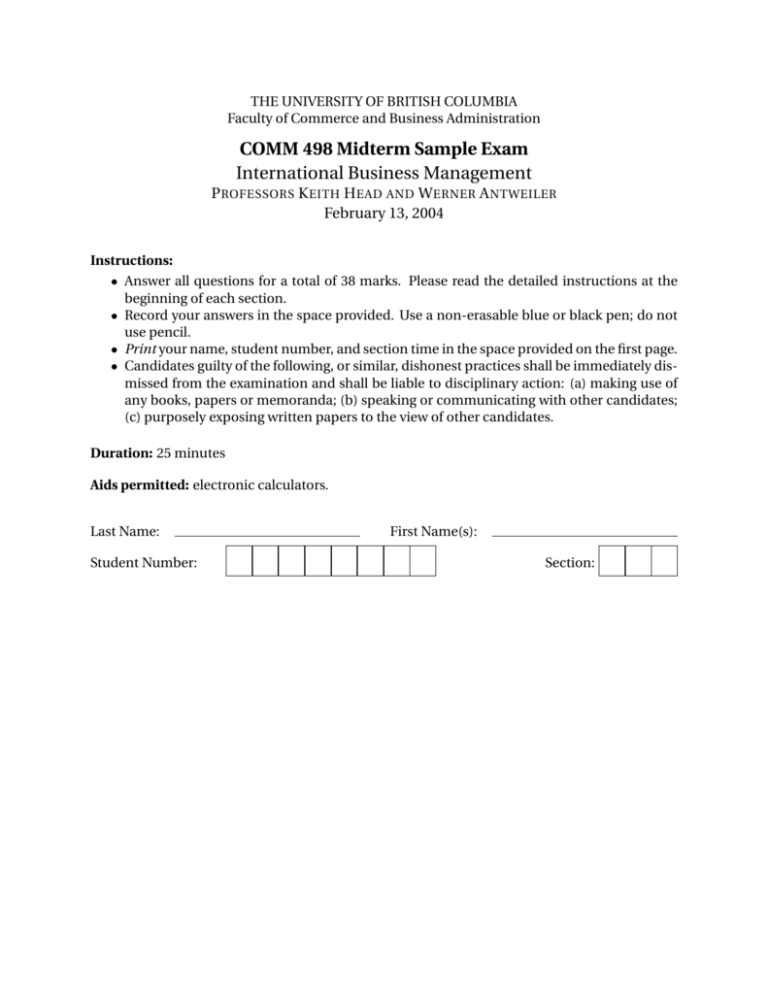

THE UNIVERSITY OF BRITISH COLUMBIA Faculty of Commerce and Business Administration COMM 498 Midterm Sample Exam International Business Management P ROFESSORS K EITH H EAD AND W ERNER A NTWEILER February 13, 2004 Instructions: • Answer all questions for a total of 38 marks. Please read the detailed instructions at the beginning of each section. • Record your answers in the space provided. Use a non-erasable blue or black pen; do not use pencil. • Print your name, student number, and section time in the space provided on the first page. • Candidates guilty of the following, or similar, dishonest practices shall be immediately dismissed from the examination and shall be liable to disciplinary action: (a) making use of any books, papers or memoranda; (b) speaking or communicating with other candidates; (c) purposely exposing written papers to the view of other candidates. Duration: 25 minutes Aids permitted: electronic calculators. Last Name: Student Number: First Name(s): Section: COMM 498 Midterm Sample Exam Page 2 of 3 Name: Part I: True/False Quiz (18 marks) Evaluate all responses separately and decide if each statement is either true or false. Each correct evaluation receives one point. 1. Consider two kingdoms (Gondor and Rohan) that trade with each other. Assume there are no other (civilized) countries in the world and labour is the only input. Productivities per hour in the three undifferentiated goods are shown in the first three data columns and wages per hour are in the last column. Trade costs are about 1% of the value of the goods. Rohan Gondor bridles 5 10 horseshoes 15 20 saddles 20 30 wages (Gold pieces) 6 9 Which situations below are consistent with each country’s competitive advantages? 1.1 Gondor and Rohan can both gain from trading with each other . . . . . . . . . . . . . . . . . . . . T F 1.1 1.2 Gondor will export bridles to Rohan and import horseshoes . . . . . . . . . . . . . . . . . . . . . . . T F 1.2 1.3 Gondor will export bridles and horseshoes and import saddles from Rohan . . . . . . . . T F 1.3 1.4 Gondor will export saddles and import horseshoes and bridles from Rohan . . . . . . . . T F 1.4 1.5 Rohan will import all three goods because it has comparatively lower productivity (high opportunity cost) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 1.5 1.6 There are no gains from trade in saddles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 1.6 2. According to empirical research on international and interprovincial trade flows based on the “Gravity Equation,” 2.1 the volume of trade between neighbouring British Columbia and Washington State should be about the same as between neighbouring Ontario and Michigan. . . . . . . . T F 2.1 2.2 doubling distance between countries decreases trade by about half. . . . . . . . . . . . . . . . T F 2.2 2.3 trade flows are proportional to the economic size of the importing country, but not the exporting country. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 2.3 2.4 there remains a significant border effect after adjusting for distance and size of the economies involved. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 2.4 2.5 the direction of trade can be predicted well, but not its volume. . . . . . . . . . . . . . . . . . . . . T F 2.5 2.6 Distance effects on trade in goods were important before the 1990s but have since been eliminated by the “communication revolution” (fax, internet, teleconferencing). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 2.6 (continued) Name: COMM 498 Midterm Sample Exam Page 3 of 3 3. Suppose that the 4-disc Fellowship of the Ring DVD set retails for £27 in the United Kingdom, where it is manufactured, and retails for 35 Euros in France. The current exchange rates are (approximately) .45 £/C$. and .7 Euros/C$. The difference in prices... 3.1 could be caused by short-run fluctuations in the exchange rate. . . . . . . . . . . . . . . . . . . . T F 3.1 3.2 cannot be calculated because we do not know the £/Euro exchange rate. . . . . . . . . . . T F 3.2 3.3 could be due to high French tariffs on UK goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . T F 3.3 3.4 is extremely unlikely because DVDs have low transport costs relative to their value. T F 3.4 3.5 could be caused by higher retailing costs and/or margins in France. . . . . . . . . . . . . . . . T F 3.5 3.6 could be caused by higher retailing costs and/or margins in the UK. . . . . . . . . . . . . . . . T F 3.6 Number of Statements: 18. True Statements: 7. Part II: Short Written Answers (20 marks) This section contains statements that can be true, false, or uncertain. Explain in detail why the statement is true, false, or uncertain. Make sure that you address all relevant issues, and identify their relative importance. Factual statements at the beginning of each question are put in italics to distinguish them from the statement that you must evaluate. 4. A Canadian company, CanCo, is facing anti-dumping duties on its export of widgets from Canada to the United States. The U.S. Department of Commerce has issued a preliminary finding that CanCo is selling widgets below normal value. The best strategy for CanCo is to exit the U.S. market. [10] 4. Exiting is one of four strategies. The other three options are (1) concede/settle by raising the price; (2) fight (in trade “courts”) the preliminary ruling through a NAFTA or WTO panel and/or fight to show that dumped imports were not a cause of injury to the U.S. widget industry; (3) circumvent by investing in the U.S. and producing there. Given the preeminence of the U.S. market, it is likely to be large enough that CanCo would not to simply exit. Conceding might be a good idea if CanCo is happy with higher prices. However, if it needs to charge low prices in the U.S. market for some reason, it make sense to contest the ruling. Circumvention by FDI is also possible but whether it is desirable depends on many other considerations besides the ADD. 5. When agreeing on the terms for an export to an unfamiliar foreign buyer, the exporter should insist that the deal is carried out on “open account,” and that the price should be quoted in home (export-country) currency. [10] 5. No. Unfamiliarity requires either a letter of credit, or payment in advance. L/C is better because it protects buyer as well (which means greater willingness to pay from the buyer). Quoting in home currency reduces exchange risk but may be unattractive to the buyer and force them to use forward contracts to hedge. If your access to such contracts is good it may give you a competitive advantage to quote in the buyer’s local currency, especially if that currency is highly liquid, like U.S. dollars or Euros.