Etisalat 2009

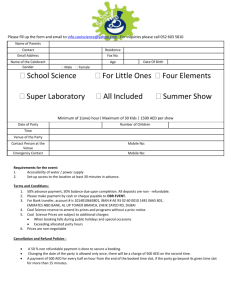

advertisement