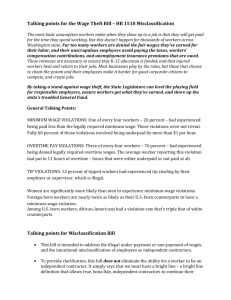

Who's the Boss - National Employment Law Project

advertisement