Q1 2013

www.businessmonitor.com

VietnaM

infrastructure Report

INCLUDES BMI'S FORECASTS

ISSN 1750-5593

Published by Business Monitor International Ltd.

VIETNAM INFRASTRUCTURE

REPORT Q1 2013

INCLUDES 10-YEAR FORECASTS TO 2021

Part of BMI's Industry Report & Forecasts Series

Published by: Business Monitor International

Copy deadline: October 2012

Business Monitor International

85 Queen Victoria Street

London

EC4V 4AB

UK

Tel: +44 (0) 20 7248 0468

Fax: +44 (0) 20 7248 0467

Email: subs@businessmonitor.com

Web: http://www.businessmonitor.com

© 2012 Business Monitor International.

All rights reserved.

All information contained in this publication is

copyrighted in the name of Business Monitor

International, and as such no part of this publication

may be reproduced, repackaged, redistributed, resold in

whole or in any part, or used in any form or by any

means graphic, electronic or mechanical, including

photocopying, recording, taping, or by information

storage or retrieval, or by any other means, without the

express written consent of the publisher.

DISCLAIMER

All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of

publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business Monitor

International accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the

publication. All information is provided without warranty, and Business Monitor International makes no representation of warranty of any kind as

to the accuracy or completeness of any information hereto contained.

Vietnam Infrastructure Report Q1 2013

© Business Monitor International Ltd

Page 2

Vietnam Infrastructure Report Q1 2013

CONTENTS

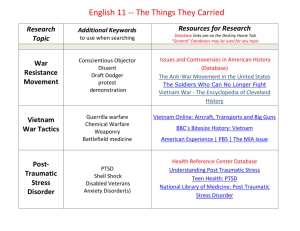

BMI Industry View ............................................................................................................................................ 5

SWOT Analysis ................................................................................................................................................. 6

Vietnam Infrastructure SWOT ............................................................................................................................................................................... 6

Market Overview ............................................................................................................................................... 7

Vietnam ....................................................................................................................................................................................................................... 7

Competitive Landscape ............................................................................................................................................................................................... 9

Table: Vietnam EQS Data ..................................................................................................................................................................................... 9

Building Materials .......................................................................................................................................... 10

Asia ........................................................................................................................................................................................................................... 10

Cement Forecasts ..................................................................................................................................................................................................... 16

Table: Vietnam Cement Production and Consumption Data, 2010 – 2016 .......................................................................................................... 16

Table: Vietnam Cement Production and Consumption Long Term Forecast, 2017 – 2021 ................................................................................. 16

Industry Forecast Scenario ........................................................................................................................... 17

Table: Vietnam Construction And Infrastructure Industry Data, 2010 – 2016 .................................................................................................... 17

Table: Vietnam Construction And Infrastructure Long Term Forecast, 2015 – 2021 .......................................................................................... 18

Construction And Infrastructure Forecast Scenario ................................................................................................................................................. 20

Transport Infrastructure ................................................................................................................................ 26

Table: Vietnam Transport Infrastructure Industry Data, 2010 – 2016 ................................................................................................................ 26

Table: Vietnam Transport Infrastructure Long Term Forecasts, 2015-2021 ....................................................................................................... 28

Transport Infrastructure Outlook and Overview ....................................................................................................................................................... 30

Title: Competitiveness Of Vietnam's Infrastructure ............................................................................................................................................. 30

Table: Vietnam Railway Corporation’s Main Targets ......................................................................................................................................... 34

Major Projects Table – Transport ............................................................................................................................................................................ 39

Table: Major Projects – Transport ...................................................................................................................................................................... 39

Energy And Utilities Infrastructure ............................................................................................................... 54

Table: Vietnam Energy and Utilities Infrastructure Industry Data, 2010 – 2016 ................................................................................................ 54

Table: Vietnam Energy and Utilities Infrastructure Industry Long Term Forecast, 2015-2021 .......................................................................... 56

Energy And Utilities Infrastructure Outlook and Overview ...................................................................................................................................... 58

Major Projects Table – Energy And Utilities ............................................................................................................................................................ 68

Table: Major Projects – Energy and Utilities ...................................................................................................................................................... 68

Residential/Non-Residential Construction and Social Infrastructure ...................................................... 80

Table: Vietnam Residential and Non-residential Building Industry Data, 2010 – 2016 ...................................................................................... 80

Table: Vietnam Residential and Non-residential Building Long Term Forecasts, 2015 – 2021........................................................................... 80

Residential/Non-Residential Building Outlook and Overview................................................................................................................................... 81

Major Projects Table – Residential/Non-Residential Construction And Social Infrastructure ................................................................................. 84

Table: Major Projects – Residential/Non-Residential Construction And Social Infrastructure ........................................................................... 84

Risk/Reward Ratings...................................................................................................................................... 86

Vietnam’s Risk/Reward Ratings ................................................................................................................................................................................ 86

Rewards ............................................................................................................................................................................................................... 86

Risks .................................................................................................................................................................................................................... 86

Regional Overview.................................................................................................................................................................................................... 87

Asia Pacific Infrastructure Risk/Reward Ratings................................................................................................................................................. 87

Table: Asia Infrastructure Risk/Reward Ratings.................................................................................................................................................. 93

© Business Monitor International Ltd

Page 3

Vietnam Infrastructure Report Q1 2013

Company Monitor ........................................................................................................................................... 94

Cavico Corporation ............................................................................................................................................................................................. 94

Electricity of Vietnam Group (EVN) .................................................................................................................................................................... 97

Global Overview ........................................................................................................................................... 100

Source: Bloomberg ......................................................................................................................................... 106

Methodology ................................................................................................................................................. 107

Industry Forecasts ...................................................................................................................................................................................................107

Construction Industry .........................................................................................................................................................................................108

Data Methodology ..............................................................................................................................................................................................108

New Infrastructure Data Sub-sectors..................................................................................................................................................................108

Construction .......................................................................................................................................................................................................110

Capital Investment ..............................................................................................................................................................................................111

Construction Sector Employment ........................................................................................................................................................................111

Infrastructure Risk/Reward Ratings .........................................................................................................................................................................112

Table: Infrastructure Business Environment Indicators .....................................................................................................................................113

© Business Monitor International Ltd

Page 4

Vietnam Infrastructure Report Q1 2013

BMI Industry View

BMI View: Construction activity in Vietnam continued to contract in the third quarter of 2012,

prompting us to pencil in a mild contraction for our 2012 construction forecasts. Real growth is now

expected to come in at a negative 0.2% in 2012, compared to our previous forecast of 0.1% real growth.

Despite this downward revision, we remain convinced that a near-term recovery is still on the cards for

Vietnam's construction industry – construction real growth is projected to reach 7.1% in 2013 – as

monetary conditions remain conducive for construction. This recovery will be led by the residential and

non-residential building construction sector as we expect the infrastructure sector to continue facing

difficulties in securing project financing.

The major developments in Vietnam’s infrastructure sector are:

In September 2012, Thailand-based Italian-Thai Development signed a memorandum of

understanding (MoU) to draw out the investment plan and technical design for phase 2 of the

Halong-Mong Cai expressway project in the Quang Ninh province. The 134km project, which is

part of the Noi Bai-Halong-Mong Cai expressway project, is expected to cost a total of

US$2.1bn. The expressway is expected to take three years to be completed. In September 2012,

A consortium led by South Korea's engineering and construction company Daelim Industrial

has entered into a contract with Cantho Thermal Power Company Limited for the

construction of a thermal power plant in the south of Vietnam. The contract has a value of

US$335mn, with construction work to be completed by October 2015. The power plant is to be

located in the O Mon district on the Mekong Delta. Daelim Industrial possesses a stake in the

project worth US$285mn, with the plant to have the capacity to generate 330MW of electricity.

Daelim Industrial will be responsible for the plant's design and construction, while its Japanese

partner Sojitz Corporation will supply steam turbines.

In October 2012, the deputy director of the railway administration, Nguyen Van Doanh, said that

a total of 20 railway projects were earlier recommended by the Vietnam National Railway

Administration to be developed under the forms of BOT, build-transfer and build-transferoperate, and this list of projects was submitted to the Ministry of Transport in early 2010;

although a lack of investors prevented from starting them. Among the 20 railway projects calling

for investment in 2010-2020, they include the 381km Lao Cai-Hanoi-Hai Phong railway line, the

114km Bien Hoa-Vung Tau route and the 49km railway connecting Trang Bom in Dong Nai

with Hoa Hung in HCM City.

© Business Monitor International Ltd

Page 5

Vietnam Infrastructure Report Q1 2013

SWOT Analysis

Vietnam Infrastructure SWOT

Strengths

Weaknesses

Opportunities

Threats

The country’s strong project pipeline will sustain growth in the sector and add

capabilities for further development, particularly as transport structure improves.

Rapid growth has attracted investment from many of the world’s largest

infrastructure companies.

The poor state of infrastructure in the country provides easy wins for foreign

investors and construction companies.

A hike in electricity prices should stimulate investment in the energy sector.

State-owned companies dominate the infrastructure market. This is especially the

case in the utilities sector, where Electricity of Vietnam (EVN)’s dominant position

has deterred investors.

Vietnam relies heavily on foreign imports and it is estimated that the country

requires 2mn tonnes of steel billets to be imported a year.

The country presents a relatively risky environment for major infrastructure projects,

especially in relation to project finance operations.

Power outages are occurring daily in Vietnam, highlighting the country’s severe

electricity problems.

Demand for urban infrastructure projects in transport and sanitation over our 10year forecast period to 2021 will rise in tandem with urbanisation.

Severe drought is driving demand in electricity generation sources besides

hydropower; i.e. gas-fired and wind-powered plants.

If the government’s attempts to cool the overheating economy are successful,

Vietnam will see a more stable growth trajectory over the long term.

The Vietnamese government's shift in focus – from driving economic growth

towards fighting inflation and addressing macroeconomic imbalances – is expected

to have a cooling effect.

Public spending cuts, tighter credit conditions and aggressive monetary tightening

are likely to keep economic activity depressed.

Lack of energy infrastructure holds downside risk to nearly all projects and presents

a significant bottleneck to development.

Should any significant events occur to highlight Vietnam’s structural difficulties,

uncertainty and downside risks in the business environment could have a negative

impact.

The EU predicts Vietnam will not become a true market economy until 2018.

© Business Monitor International Ltd

Page 6

Vietnam Infrastructure Report Q1 2013

Market Overview

Vietnam

Vietnam's emergence as one of the most promising economies in Asia, if not the world, stems largely

from the Communist Party of Vietnam's (CPV) adoption of the Doi Moi market reform policies in 1986.

The gradual but steady shift from a largely agrarian country with a high degree of state ownership and

government intervention to a market economy has stimulated a flow of foreign investment and domestic

entrepreneurship, which are now the prime drivers of growth. For instance, Vietnam attracted foreign

direct investment (FDI) of almost US$14.7bn in 2011, according to Vietnam’s Ministry of Planning and

Investment, although this was a 21% drop from 2010’s recorded figure.

However, Vietnam’s poor infrastructure has long been an impediment to the country’s growth, as its

developing industry is highly dependent on sound infrastructure (especially power and road) to operate.

This infrastructure deficit is expect to worsen further as the combination of rising urbanisation and steady

population and GDP growth is expected to exert considerable pressure on Vietnam's urban transportation

systems. According to a draft national urban development programme approved by the government in

June 2012, Vietnam will strive to achieve an urbanisation rate of 38% with 870 urban areas by 2015 and

45% with 940 urban areas by 2020. It is estimated that the country has an urbanisation rate of 30%.

This urbanisation trend is felt acutely in Hoh Chi Minh City (HCM City) and Hanoi – the country's

largest cities and chief commercial hubs. The capital demand for transport infrastructure development in

HCM CITY is estimated to be US$3-4bn per annum between now and 2020, but the city's budget can

only provide US$500mn per annum, according to a statement from the HCM City government in July

2012. For Hanoi, the city authorities released the city's infrastructure development in July 2012. Under

this plan, the city would need about VND584trn (US$28bn) by 2020, VND324trn (US$15.6bn) of which

would be capital from the central budget and the city budget, with the remainder to be raised from social

resources.

Vietnam does not have the fiscal means to meet its infrastructure deficit. According to the Vietnamese

Ministry of Planning and Investment, there remains a huge deficit between the annual requirement for

infrastructure investment capital, which is estimated at about US$15bn, and the annual mobilised fund of

US$7-8bn.

Vietnam has been making noteworthy efforts to address this shortfall in investment, and the government

has made infrastructure a priority investment area. This has been demonstrated through various demandside policies aimed at boosting macroeconomic growth and a variety of infrastructure spending initiatives.

The use of official development assistance (ODA) to finance infrastructure projects has also achieved

success, with Europe, Japan and the Asian Development Bank becoming frequent co-financers in several

infrastructure projects.

© Business Monitor International Ltd

Page 7

Vietnam Infrastructure Report Q1 2013

Improved contract agreements between the Export-Import Bank of the United States (US Exim Bank)

and the Vietnam Development Bank (VDB) are also helping to provide financing for infrastructure

development. In February 2012, the US Exim Bank concluded a business-development mission into

Vietnam and is looking to invest up to US$1.5bn in infrastructure projects such as satellite, thermal power

and renewable energy projects.

Vietnam has also been pushing for the faster implementation and development of public-private

partnerships (PPPs) for upcoming infrastructure projects. While PPPs have the potential to address the

country’s infrastructure needs, this method is wholly predicated upon the creation of a regulatory PPP

framework to govern the sector. This has not been achieved due to an inability by sub-sovereign

governments and state agencies to carry out the necessary project assessments. In November 2010, the

prime minister had launched a mechanism piloting PPP investment model via Decision 71/QD-TTg,

which came into force from January 15 2011. Under this legislation, concerned agencies were tasked to

craft regulations that allow projects to be developed under a PPP model and to evaluate and award

projects for investment under a PPP model. However, progress on these tasks are proceeding very slowly,

and are still uncompleted as of July 2012.

This inability to complete its PPP plans and the poor credit conditions globally were causing project

delays. According to the Ministry of Planning and Investment, 4436 projects were delayed in 2011. These

projects accounted for 11.55% of the total amount of projects being implemented in Vietnam, with most

of them belonging to projects with more than 30% of state-owned investment capital. A total of 3568

projects had to adjust their investment capital; this does not include projects that, according to investment

management laws, are not allowed to adjust their total investment capital, due to price fluctuations and

policy changes.

These difficulties were also pushing the Vietnamese government to seek funds from non-banking sources,

such as project bonds and sovereign wealth funds. This trend is starting to take place, with the

Vietnamese government having granted approval for HCM City to issue bonds for infrastructure projects

in Q212. Meanwhile, the Association of South East Asian Nations (ASEAN), of which Vietnam is a

member, signed a shareholder agreement in April 2012 for the ASEAN Infrastructure Fund, a special

purpose vehicle aimed at providing member countries up to US$4bn for infrastructure development.

A regulatory and legal framework to nurture the development of concessions is also largely absent,

although there are regulatory frameworks under construction. Law firm Duane Morris has identified four

main obstacles that are limiting the participation of the private sector in Vietnamese infrastructure. These

are:

The weak governance structures of the state-owned companies that dominate the construction

and utilities sectors;

Difficulty in accessing domestic capital;

© Business Monitor International Ltd

Page 8

Vietnam Infrastructure Report Q1 2013

Costly delays for projects, due to the weak regulatory environment;

The often uncertain support of the government.

Competitive Landscape

Table: Vietnam EQS Data

Latest FY

Earnings

Market

Cap

(US$mn)

Revenue

Growth

(% y-o-y)

Operating

Profit

Growth

(% y-o-y)

Total

Debt/

Ebitda

Interest

Coverage

Ratio

PE Ratio

Vietnam Construction &

IMPO

12/2011

232.9

-4.0

39.8

6.5

1.4

7.1

Songda Urban &

Industrial Zo

12/2011

154.3

-86.3

NA

-45.8

-30.1

NA

HCM City Infrastructure

INV

12/2011

100.4

0.4

-8.4

21.7

0.3

15.8

Becamex Infrastructure

Devel

12/2011

139.3

276.8

117.5

1.5

15.5

8.7

Petrovietnam

Construction Co

12/2011

182.1

26.9

-29.4

10.5

1.0

14.3

Development Invest

Construct

12/2011

104.8

-35.5

-80.9

8.7

2.3

20.4

Kinh Bac City

Development SH

12/2011

152.8

-30.7

-47.4

21.2

0.7

392.9

Cotec Construction JSC

12/2011

70.9

36.5

11.6

0.0

NA

5.1

Name

*exchange rates accurate as of 13/07/2012. Source: Bloomberg

Construction companies in Vietnam are fairly small and are confined to urban and roads infrastructure

projects. The inland waterway transport sub-sector is managed by two state corporations affiliated with

the Ministry of Transport, a state-owned enterprise (SOE) affiliated with the Vietnam Inland Waterway

Authority and some enterprises managed by other ministries, which are operating in support of the power

generation, cement and paper industries.

© Business Monitor International Ltd

Page 9

Vietnam Infrastructure Report Q1 2013

Building Materials

Asia

BMI View: Asia will continue to outperform in the production and consumption of building materials,

expanding its share of the global market as regional construction sectors exhibit strong levels of growth

across the board. Although we note that macroeconomic fundamentals and demographic trends will

support long-term growth, the risks weighing on our forecast are increasing in line with the increasingly

muted picture for the world-leading Chinese building materials sector.

Key Views:

Sound fundamentals - rising per capita incomes, demographic growth, industrialisation and

robust urbanisation - will be the key drivers of Asia's building materials consumption story.

Bearing in mind the continued weakness that we see in Europe (see our online service,

September 28 2012, 'Eurozone Weakness Still Depressing Market'), we forecast that Asia will

continue to expand its share of global total cement and steel production.

Growth in regional competition will intensify as small firms compete for market share. Over the

long term, this trend will switch to one of increasing consolidation.

Reflecting these trends, global building materials manufacturers will increasingly look to

enhance their operations to diversify against a slump in developed markets. In the cement

market, this will trigger the emergence of a number of Asian majors - China's Anhui Conch,

Thailand's Siam Cement and Indonesian firms Indocement and Semen Gresik continue to

improve sales volumes vis-a-vis established players such as Holcim and Lafarge.

Demand for building materials continues to weaken in China as the country faces a systemic reevaluation of fixed capital spending plans. Despite this, we believe growth rates will remain

relatively robust and will benefit in the immediate term from a new round of infrastructure

spending announced by local governments and supported by Beijing.

However, we note that chronic overcapacity and local government indebtedness pose significant

long term risks to our China forecast, and that these factors may work to drag down demand for

materials through 2013. A heavy landing in China - a scenario which is supported by our country

risk team - would cause a significant downward revision to our Asia building materials forecast.

Demand in India will support robust growth in the building material consumption over the

medium term, yet challenges such as rising input costs and significant overcapacity will mean

that the outlook for firms in the sector will remain challenging.

© Business Monitor International Ltd

Page 10

Vietnam Infrastructure Report Q1 2013

India's cement market will continue to face issues of surplus capacity as smaller firms begin to

undercut the profits of national majors. Over Q212, major firms were fined by the Competition

Commission of India (CCI) for engaging in cartelism and price fixing. Since then the price of

cement has slumped as new firms have entered the market.

Asia Forging Ahead

India/China - BMI's Steel Forecast - Production/Consumption ('000 tons)

Source: BMI, WSA

China - Slowing Yet Consumption Still Strong

We expect a slump in demand for cement and steel to continue to weigh on the country's building

materials sector for the foreseeable future. Both official and private sector data point to a deceleration in

construction spending over 2011, and we expect that, due to deterioration in macroeconomic

fundamentals, this trend will largely continue over 2012, despite the renewed efforts of the government to

bolster infrastructure spending.

Although we believe that the stimulus may support levels of growth experienced over H112 into 2013 as

the government looks to construct a further 7mn housing units, new rail projects get under way and local

governments such as Changsha and Nanjing announce ambitious spending plans, we do not believe that

investments will facilitate a rise in demand sufficient to return the ailing building materials sector back to

peak levels.

We believe that Chinese equities will continue to feel the brunt of a softening in demand, despite market

cement warming towards cement majors on announcement of market warming measures. Although

manufacturers may experience a slight rebound off the back of a renewed round of infrastructure

spending, the longer-term picture remains bleak.

Despite our forecast for a slowing steel production due to a fall in investment in real estate and fixed

capital, figures from the China Iron & Steel Association suggest that output grew by 1.2% month-on-

© Business Monitor International Ltd

Page 11

Vietnam Infrastructure Report Q1 2013

month (m-o-m) in August 2012. This is despite the fact that, according to Citigroup, China's steel

stockpiles stand at almost 100m tons. We believe that, if proven true, this trajectory is unsustainable and

reflects structural inefficiencies within China's steel market. If the pattern continues over the long term,

we believe that an increasing surplus of inventories may facilitate a shock leading to a production slump

and a period of painful readjustment for the industry. Previous rounds of stimulus, such as that

implemented in 2008, have only worked to exacerbate the issue of stock-piling, as producers have

historically upped output in excess of actual demand. As we believe that the most recent round of

stimulus spending will have a far smaller impetus on the construction sector, this issue poses a significant

threat to the medium-term performance of firms. According to China Daily, 83% of the nation's steel

producers ran loses over H112. With this in mind, and reflecting a trend that we believe will continue

over the long term, Boashan Iron & Steel Co, China's biggest listed steelmaker, has idled a three million

tonnes per annum (mtpa) plan in Shanghai.

Indian And Chinese Equities Diverging

Anhui Conch Cement & Asia Cement (HK) vs Ultratech Cement & Madras Cements

(India) - 2-Year Share Price Performance (% Change, Rebased October 2010)

Source: Bloomberg

India - Much Demand To Be Met

Overall, it is our view that India will emerge as a regional outperformer over 2012. According to World

Steel Association (WSA) estimates, steel production in the country grew by 5.7% year-on-year (y-o-y) in

2011. In line with robust economic growth, steel production in India has grown by an average of nearly

8% y-o-y since 2007, and in November 2011, India's steel ministry estimated that demand for the metal

could increase by around 9% y-o-y over the following five years.

© Business Monitor International Ltd

Page 12

Vietnam Infrastructure Report Q1 2013

The outlook for cement consumption is equally robust, and we expect growth to average nearly 10% y-oy between 2012 and 2016. The country currently has 137 large and 365 mini cement plants, according to

the Cement Manufacturers Association.

Our optimistic outlook is weighed to the upside and could be further buoyed if the government is

successful in gaining the US$1tn in infrastructure investments by 2017 - a sum required to fulfil the goals

outlined by its National Planning Committee. However, risks are abound, and we note that the operating

environment for firms will remain challenging over the medium term.

Over Q212, major firms, such as UltraTech Cement and Shree Cement were fined by the Competition

Commission of India (CCI) for engaging in cartelism and price fixing and, since then, the price of cement

has slumped as new firms have entered the market and undercut the majors.

According the Economic Times, the price of cement in Andhra Pradesh - India's second largest producer

of the material - fell 10% over the first few weeks of September, and is down 25% from the industry's

peak levels of Rs 300 per bag. Overcapacity in the state is now at 60%, and production continues to be

disrupted by poor access to inputs such as sand and the increasing activity of the Telangana independence

movement, which has caused deadlock over the state budget. Across the country, margins have been

further squeezed by a rise in the price of inputs such as gypsum and diesel. However, a fall in the price of

imported coal has gone some way to curb loses.

However, over the medium term, we expect firms to benefit from a renewed infrastructure drive and a

softening of interest rates. We forecast that India's building material consumption growth will overtake

that of all other regional competitors over 2012, and with this in mind believe that the medium term will

witness the expansion of a number of global majors into the country.

An example of this is the expansion of HeidelbergCement in central India. The company has announced

that the firm is to increase its grinding capacity from 3.1 mtpa to 6 mtpa and clinker output capacity from

1.2 mtpa to 3.1 mtpa. The expansion is scheduled to begin in November 2012 and represents the

attraction of central areas such as Uttar Pradesh and Madhya Pradesh, which consistently offer higher

realisation rates to firms.

In contrast to Andhra Pradesh, according to TET utilisation rates in the region stand at around 90-95%.

Fast-growing Indian manufacturer India Cement is also looking to diversify its operations away from

established regions of Andhra Pradesh, Tamil Nadu and Rajasthan and open new plants in Madhya

Pradesh.

Despite growing demand for steel, the land clearance obstacles facing foreign steel players such as

POSCO and ArcelorMittal continue to stall a vast pipeline of projects. Reports in January 2012 that

POSCO may build a smaller steel plant than the mega 12 mpta mill originally planned in India's eastern

state of Orissa are a direct result of the long-running land and environmental disputes that have paralysed

© Business Monitor International Ltd

Page 13

Vietnam Infrastructure Report Q1 2013

the project since 2008. While the introduction of a new land bill could, if approved, bring much-needed

speed and clarity to the acquisition process, there remains much opposition to the proposed bill.

Overcapacity And Increased Competition Driving Regional Shift

India - Cement Consumption, Production & Capacity By Region (mn tons)

Source: Cement Manufacturers' Association, BMI

Dynamic and Increasingly Competitive

Indonesia - the continent's third most populous country - the Philippines, Thailand and Vietnam will also

be key growth markets for the consumption of building materials in the region over the coming years.

Moreover, the high interest rates implemented by various Asian countries in 2011 are likely to fall in

2012 as disinflationary, rather than inflationary, pressures take precedence in the face of softening global

activity. This could make it increasingly tenable for cement and steel companies to finance their capital

expenditures through debt and take on new projects in 2012.

We expect cement consumption in the country to grow by an average of 6.2% y-o-y between 2012 and

2016, but note that the robust outlook for infrastructure investment over the coming years, combined with

ongoing improvements in the business environment creates upside risks. Through passing a much-delayed

land bill at the end of 2011 (see our online service, December 16 2011, 'Land Acquisition Bill A Big First

Step'), Indonesia took a major step towards removing a long-term obstacle to investment in the sector.

This growth potential is attracting the attention of foreign cement companies within the region. In July

2011, Siam Cement announced plans to spend US$219mn on developing its ceramic and construction

material businesses in Indonesia, whilst Anhui is reportedly planning to build plants in South Kalimantan,

East Kalimantan and Papua - investing in a new capacity of 10mtpa. In August 2012, Mexico's Cemex

© Business Monitor International Ltd

Page 14

Vietnam Infrastructure Report Q1 2013

announced that it was raising the cement production capacity of its APO plant in the Philippines by

1.5mtpa.

These investments will add welcome new capacity and stimulate increased competition in a market where

significant potential for consolidation exists. Vietnam is another market that looks set for increasing

consolidation. We expect over-capacity, together with high energy and transportation costs, to put

increasing pressure on many of the less competitive and inefficient cement companies.

Finally, we believe that Semen Gresik's announcement in March 2012 that it is in talks with Myanmar's

foreign investment body over plans to build a 1.5mn to 2.5mn tonnes/year cement plant in the country

could provide the firm with an important foothold in the resource-rich frontier market. Myanmar's

reliance on imported cement and the potential for growth driven by demand for mining-related

infrastructure projects could generate significant rewards for foreign players prepared to brave the

political and industry-specific risks (see our online service, March 20 2012, 'Semen Gresik's Seeks

Frontier Foothold').

South East Asia Picking Up Chinese Slack

Asia - BMI's Cement Consumption Forecast (% y-o-y Growth)

Source: USGS, BMI

© Business Monitor International Ltd

Page 15

Vietnam Infrastructure Report Q1 2013

Cement Forecasts

Table: Vietnam Cement Production and Consumption Data, 2010 – 2016

Cement production

(including imported clinker),

tonnes

Cement production

(including imported clinker),

tonnes, % y-o-y

2010

2011

2012e

2013f

2014f

2015f

2016f

50,816,923

45,837,500

47,694,500

50,348,760

53,206,724

56,336,812

59,607,235

6.1

-9.8

4.1

5.6

5.7

5.9

5.8

Cement consumption,

tonnes

49,633,422

45,223,301

47,012,275

49,574,510

52,340,442

55,374,453

58,544,698

Cement consumption,

tonnes, % y-o-y

11.3

-8.9

4.0

5.5

5.6

5.8

5.7

1,183,500

614,199

682,225

774,251

866,282

962,359

1,062,537

-64.1

-48.1

11.1

13.5

11.9

11.1

10.4

Cement net exports, tonnes

Cement net exports, tonnes,

% y-o-y

e/f = BMI estimate/forecast. Source: BMI Research, USGS, UN.

Table: Vietnam Cement Production and Consumption Long Term Forecast, 2017 – 2021

2015f

2016f

2017f

2018f

2019f

2020f

2021f

Cement production

(including imported clinker),

tonnes

56,336,812

59,607,235

63,076,952

66,637,578

70,344,120

73,995,195

73,995,195

Cement production

(including imported clinker),

tonnes, % y-o-y

5.9

5.8

5.8

5.6

5.6

5.2

0.0

Cement consumption,

tonnes

55,374,453

58,544,698

61,912,829

65,367,031

68,963,121

72,495,987

72,495,987

Cement consumption,

tonnes, % y-o-y

5.8

5.7

5.8

5.6

5.5

5.1

0.0

Cement net exports, tonnes

962,359

1,062,537

1,164,124

1,270,547

1,380,999

1,499,207

1,499,207

Cement net exports, tonnes,

% y-o-y

11.1

10.4

9.6

9.1

8.7

8.6

0.0

e/f = BMI estimate/forecast. Source: BMI Research, USGS, UN.

© Business Monitor International Ltd

Page 16

Vietnam Infrastructure Report Q1 2013

Industry Forecast Scenario

Table: Vietnam Construction And Infrastructure Industry Data, 2010 – 2016

2010

2011

2012e

2013f

2014f

2015f

2016f

Construction Industry

Value, VNDbn

139,162.0

162,620.0

176,907.1

200,669.0

226,016.2

252,303.6

281,090.3

Construction Industry

Value, US$bn

7.3

7.9

8.4

9.6

11.0

12.4

14.0

Construction Industry

Real Growth, % chg yo-y

10.1

-1.0

-0.2

7.1

6.4

6.4

6.4

Construction Industry,

% of GDP

7.0

6.4

6.1

6.1

6.0

5.9

5.9

Total Capital

Investment, VNDbn

704,401.0

745,494.0

847,631.6

954,642.1

1,075,165.7

1,201,771.8

1,338,833.9

Total Capital

Investment, US$bn

36.8

36.1

40.3

45.9

52.3

59.1

66.6

Total Capital

Investment, % of GDP

35.6

29.4

29.1

28.9

28.5

28.2

27.9

Capital Investment Per

Capita, US$

419.1

406.5

449.1

506.3

571.0

639.5

714.0

Real Capital Investment

Growth, % y-o-y

10.9

-10.4

4.3

5.9

6.0

6.2

6.1

Construction Industry

Employment, '000

2,707.8

2,687.2

2,682.5

2,831.2

2,974.8

3,127.4

3,290.6

Construction Industry

Employment, % y-o-y

7.7

-0.8

-0.2

5.5

5.1

5.1

5.2

Total Workforce, '000

61,842.0

62,824.3

63,694.6

64,449.1

65,116.8

65,719.2

66,294.0

4.4

4.3

4.2

4.4

4.6

4.8

5.0

Infrastructure Industry

Value As % of Total

Construction

46.1

47.0

46.9

46.4

45.9

45.3

44.6

Infrastructure Industry

Value, VNDbn

64,157.4

76,431.4

83,010.8

93,124.8

103,648.6

114,283.7

125,419.9

Infrastructure Industry

Value, US$bn

3.4

3.7

3.9

4.5

5.0

5.6

6.2

Infrastructure Industry

Value Real Growth, %

chg y-o-y

17.6

0.5

-0.4

5.8

5.1

5.0

4.7

Infrastructure Industry

Value as % of GDP

3.2

3.0

2.9

2.8

2.7

2.7

2.6

Construction Industry

Employees as % of total

labour force

© Business Monitor International Ltd

Page 17

Vietnam Infrastructure Report Q1 2013

Table: Vietnam Construction And Infrastructure Industry Data, 2010 – 2016

2010

2011

2012e

2013f

2014f

2015f

2016f

Residential and NonResidential Building

Industry Value As % of

Total Construction

53.9

53.0

53.1

53.6

54.1

54.7

55.4

Residential and NonResidential Building

Industry Value, VNDbn

75,004.6

86,188.6

93,896.4

107,544.2

122,367.6

138,019.9

155,670.4

Residential and NonResidential Building

Industry Value, US$bn

3.9

4.2

4.5

5.2

6.0

6.8

7.7

16.5

-3.8

-0.1

8.2

7.5

7.5

7.8

3.8

3.4

3.2

3.3

3.2

3.2

3.2

Residential and NonResidential Building

Industry Value Real

Growth, % chg y-o-y

Residential and NonResidential Building

Industry Value as % of

GDP

f = BMI forecasts. Sources: Census and Statistics Department/ILO

Table: Vietnam Construction And Infrastructure Long Term Forecast, 2015 – 2021

2015f

2016f

2017f

2018f

2019f

2020f

2021f

Construction Industry

Value, VNDbn

252,303.6

281,090.3

313,160.2

348,229.7

386,859.6

428,148.3

472,493.5

Construction Industry

Value, US$bn

12.4

14.0

15.7

17.4

19.3

21.4

23.6

Construction Industry

Real Growth, % chg yo-y

6.4

6.4

6.4

6.2

6.1

5.7

5.4

Construction Industry,

% of GDP

5.9

5.9

5.8

5.7

5.7

5.6

5.5

Total Capital

Investment, VNDbn

1,201,771.8

1,338,833.9

1,491,527.9

1,658,504.4

1,842,432.5

2,039,020.1

2,250,160.6

Total Capital

Investment, US$bn

59.1

66.6

74.6

82.9

92.1

102.0

112.5

Total Capital

Investment, % of GDP

28.2

27.9

27.6

27.3

27.0

26.6

26.1

Capital Investment Per

Capita, US$

639.5

714.0

792.4

873.9

963.2

1,058.1

1,159.6

6.2

6.1

6.1

5.9

5.8

5.4

5.1

Real Capital Investment

Growth, % chg y-o-y

© Business Monitor International Ltd

Page 18

Vietnam Infrastructure Report Q1 2013

Table: Vietnam Construction And Infrastructure Long Term Forecast, 2015 – 2021

2015f

2016f

2017f

2018f

2019f

2020f

2021f

Construction Industry

Employment, '000

3,127.4

3,290.6

3,464.2

3,642.9

3,829.4

4,013.6

4,197.5

Construction Industry

Employment, % y-o-y

5.1

5.2

5.3

5.2

5.1

4.8

4.6

Total Workforce, '000

65,719.2

66,294.0

66,773.8

67,197.2

67,607.8

68,026.5

68,431.5

4.8

5.0

5.2

5.4

5.7

5.9

6.1

Infrastructure Industry

Value As % of Total

Construction

45.3

44.6

43.9

43.2

42.5

41.8

40.9

Infrastructure Industry

Value, VNDbn

114,283.7

125,419.9

137,594.6

150,536.8

164,441.9

178,861.3

193,385.6

Infrastructure Industry

Value, US$bn

5.6

6.2

6.9

7.5

8.2

8.9

9.7

Infrastructure Industry

Value Real Growth, %

chg y-o-y

5.0

4.7

4.7

4.4

4.2

3.8

3.1

Infrastructure Industry

Value as % of GDP

2.7

2.6

2.5

2.5

2.4

2.3

2.2

Residential and NonResidential Building

Industry Value As % of

Total Construction

54.7

55.4

56.1

56.8

57.5

58.2

59.1

Residential and NonResidential Building

Industry Value, VNDbn

138,019.9

155,670.4

175,565.6

197,692.9

222,417.7

249,287.0

279,107.8

Residential and NonResidential Building

Industry Value, US$bn

6.8

7.7

8.8

9.9

11.1

12.5

14.0

Residential and NonResidential Building

Industry Value Real

Growth, % chg y-o-y

7.5

7.8

7.8

7.6

7.5

7.1

7.0

Residential and NonResidential Building

Industry Value as % of

GDP

3.2

3.2

3.3

3.3

3.3

3.3

3.2

Construction Industry

Employees as % of total

labour force

f = BMI forecasts. Sources: Census and Statistics Department/ILO

© Business Monitor International Ltd

Page 19

Vietnam Infrastructure Report Q1 2013

Construction And Infrastructure Forecast Scenario

In Decline

Construction Industry Value And Infrastructure Share

e/f = BMI estimate/forecast. Source: BMI, Vietnam General Statistics Office

BMI View: Construction activity in Vietnam continued to contract in the third quarter of 2012,

prompting us to pencil in a mild contraction for our 2012 construction forecasts; Real growth is now

expected to come in at -0.2% in 2012, compared to our previous forecast of 0.1% real growth. Despite

this downward revision, we remain convinced that a near-term recovery is still on the cards for Vietnam's

construction industry – construction real growth is projected to reach 7.1% in 2013 – as monetary

conditions remain conducive for construction. This recovery will be led by the residential and nonresidential building construction sector as we expect the infrastructure sector to continue facing

difficulties in securing project financing.

Construction activity in Vietnam is still in negative territory for the third quarter of 2012. The latest data

from the Vietnam General Statistics Office showed that real growth for the construction sector contracted

by 0.9% year-on-year (y-o-y) in Q312, compared with a growth of 5.0% y-o-y in Q311. However, the rate

of decline slowed down significantly in Q312, suggesting that construction activity was picking up for the

quarter. Construction activity in Vietnam had contracted earlier in the year by 3.8% y-o-y in Q212 and

8.3%y-o-y in Q112.

Therefore, even though the lack of growth in Q312 has prompted us to pencil in a mild contraction for our

2012 construction forecasts – construction real growth is forecast to reach a negative 0.2%, compared to

our previous forecast of 0.1% growth – we remain convinced that a robust recovery in Vietnam's

© Business Monitor International Ltd

Page 20

Vietnam Infrastructure Report Q1 2013

construction sector is just around the corner, with construction real growth expected to reach double-digit

levels in Q412.

On The Path To Recovery

Vietnam – Construction Real Industry Value Data (At 1994

Constant Prices), By Quarters, VNDbn And % chg y-o-y

f = BMI forecast. Source: General Statistics Office, State Bank of Vietnam

Our optimistic outlook for Vietnam's construction sector remains primarily driven by the country's

conducive monetary conditions. The benchmark interest rate in Vietnam has stayed at around 10.00%

since July 2012 and this should be favourable for construction activity. Indeed, we believe two indicators

are already suggesting that construction activity is picking-up in Vietnam.

Firstly, inflation for construction materials bottomed out in July and remains on the rise at the end of

September. This, in our opinion, indicates a growing demand for materials to carry out construction work.

Secondly, industrial production expanded by 9.7% y-o-y in September, a significant increase from 4.4%

y-o-y in August and the fastest rate of expansion since February. Industrial production is a measure of

output of the industrial sector (ie, manufacturing, mining, and utilities) and this increase in production

could boost the demand for non-residential buildings such as mining-related facilities and industrial

buildings (ie, factories, warehouses).

© Business Monitor International Ltd

Page 21

Vietnam Infrastructure Report Q1 2013

Monetary Conditions Conducive

Vietnam – Policy Rate, % & Headline CPI – Housing &

Construction Materials, % y-o-y

Source: General Statistics Office, State Bank of Vietnam

2013: Infrastructure Underperformance

We believe that the recovery in Vietnam's construction sector will last well into 2013, with real growth

for the sector forecast to come in at 7.1% for 2013. This recovery will be led by the residential and nonresidential buildings construction sector. Real growth for the building industry is forecast to reach 8.2% in

2013, compared to 5.8% for the infrastructure sector in the same year.

© Business Monitor International Ltd

Page 22

Vietnam Infrastructure Report Q1 2013

Residential And Non-Residential Leads

Vietnam – Construction (And Sum-Components) Industry Value

Real Growth Forecasts

e/f= BMI estimate/forecast. Source: General Statistics Office, State Bank of Vietnam, BMI

This underperformance of the infrastructure sector is primarily due to difficulties in securing financing.

We continue to see evidence of infrastructure projects being delayed by financing shortages. The latest

statistics from the transport ministry's department of planning and investment showed that in mid-2012,

there were around 107 road upgrading projects in need of funds, while only six of the 14 expressways

projects to be developed in Vietnam had reached financial closure by mid-2012. These financing

shortages are not confined to the transport sector. Vietnam's state utility EVN reported in late-June that

they faced a funding gap of around VND185trn (US$8.9bn) for power plant projects between 2011 and

2015.

In our opinion, these financing issues will not be resolved anytime soon due to three factors.

Firstly, the Vietnamese government is heavily burdened by the debts of its state-owned enterprises

(SOEs), and the need to repay this debt is limiting the government's ability to finance infrastructure

projects. Vietnam's budget for capital investment, which is primarily channelled towards infrastructure

development, contracted in September, the first time in seven months. Although the Vietnamese

government plans to raise funds by privatising several SOEs and raising electricity prices, these measures

would require several years of implementation before they could have an impact on project financing.

© Business Monitor International Ltd

Page 23

Vietnam Infrastructure Report Q1 2013

Limited By Debt

Vietnam – Capital Investment By State Budget, VNDbn And %

chg y-o-y

Source: Bloomberg, BMI, General Statistics Office of Vietnam

Secondly, we believe that poor global economic conditions will dampen the demand for riskier assets

such as infrastructure projects in Vietnam. The sector remains fraught with business environment issues

such as slow land clearances, poor planning, corruption, significant red tape, and lack of regulatory

clarity. These issues are a deterrent to foreign investment as they have led to severe delays and cost

overruns for many infrastructure projects in recent years. In September 2012, the transport ministry stated

that in the past three to six years, the implementation cost for transport projects jumped by an average of

180% against their approval cost.

The demand for infrastructure projects in Vietnam is also dampened by a lack of financial viability. Over

the course of 2012, we have noticed several transport infrastructure projects struggle to be financially

viable. A number of airports in Vietnam, particularly in the central provinces, are currently operating way

below capacity despite the rapid rise in the number of visitors in Vietnam, while certain toll roads in

HCM City are forced to reduce their toll fees to attract sufficient commuters to stay viable. While cost

overruns have contributed to this lack of viability, we believe that the transport infrastructure sector could

be oversaturated, as economic activity within Vietnam has not reached levels that are financially viable

for such infrastructure.

© Business Monitor International Ltd

Page 24

Vietnam Infrastructure Report Q1 2013

In Decline

Vietnam – Foreign Claims From European Banks, US$mn And %

chg y-o-y

Source: Bank For International Settlements (October 2012), BMI

Lastly, Vietnam relies significantly on European banks to finance its infrastructure and residential

development. With European banks set to face difficult economic conditions and stricter capital controls

over the coming years, funds from these European sources could decline as European banks look to

strengthen their capital ratios by calling back higher-risk loans and imposing curbs on issuing new loans.

For instance, lending growth from European banks to Vietnam continues to be in decline, falling from

10.5% y-o-y in Q411 to 9.4% y-o-y in Q112, according to data from the Bank Of International

Settlements. Although the Vietnamese government is trying to seek funds from non-banking sources such

as project bonds and sovereign wealth funds, it remains to be seen if they will be sufficient to cover the

decline in credit from European banks.

© Business Monitor International Ltd

Page 25

Vietnam Infrastructure Report Q1 2013

Transport Infrastructure

Table: Vietnam Transport Infrastructure Industry Data, 2010 – 2016

2010

2011

2012e

2013f

2014f

2015f

2016f

Transport Infrastructure Industry

Value As % Of Total

Infrastructure

71.2

68.6

67.8

67.6

67.6

67.5

67.3

Transport Infrastructure Industry

Value, VNDbn

45,677.4

52,406.5

56,306.6

62,908.2

70,077.4

77,147.0

84,380.8

Transport Infrastructure Industry

Value, US$bn

2.4

2.5

2.7

3.0

3.4

3.8

4.2

Transport Infrastructure Industry

Value Real Growth, % chg y-o-y

21.2

-3.9

-1.6

5.4

5.1

4.8

4.4

Transport Infrastructure Industry

Value As Percent Of Total

Construction (%)

32.8

32.2

31.8

31.3

31.0

30.6

30.0

Roads and Bridges Infrastructure

Industry Value As % of Transport

Infrastructure

34.2

48.5

48.3

49.2

49.9

50.4

50.8

Roads and Bridges Infrastructure

Industry Value, VNDbn

15,621.7

25,394.5

27,223.8

30,946.4

34,943.5

38,856.7

42,852.4

Roads and Bridges Infrastructure

Industry Value, US$bn

0.8

1.2

1.3

1.5

1.7

1.9

2.1

Roads and Bridges Infrastructure

Industry Value Real Growth, %

chg y-o-y

34.3

43.9

-1.8

7.3

6.7

5.9

5.3

Roads and Bridges Infrastructure

Industry As % of Total

Infrastructure

24.3

33.2

32.8

33.2

33.7

34.0

34.2

Roads and Bridges Infrastructure

Industry As % of Total

Construction

11.2

15.6

15.4

15.4

15.5

15.4

15.2

Railways Infrastructure Industry

Value As % of Transport

Infrastructure

31.1

20.7

20.4

20.0

19.5

19.2

19.0

Railways Infrastructure Industry

Value, VNDbn

14,205.7

10,843.3

11,493.3

12,594.1

13,699.1

14,824.7

16,015.9

Railways Infrastructure Industry

Value, US$bn

0.7

0.5

0.5

0.6

0.7

0.7

0.8

Railways Infrastructure Industry

Value Real Growth, % chg y-o-y

25.2

-42.3

-3.0

3.2

2.5

3.0

3.0

© Business Monitor International Ltd

Page 26

Vietnam Infrastructure Report Q1 2013

Table: Vietnam Transport Infrastructure Industry Data, 2010 – 2016

2010

2011

2012e

2013f

2014f

2015f

2016f

Railways Infrastructure Industry

As % of Total Infrastructure

22.1

14.2

13.8

13.5

13.2

13.0

12.8

Railways Infrastructure Industry

As % of Total Construction

10.2

6.7

6.5

6.3

6.1

5.9

5.7

Airports Infrastructure Industry

Value As % of Transport

Infrastructure

17.9

11.7

11.9

11.4

11.1

10.7

10.5

Airports Infrastructure Industry

Value, VNDbn

8,176.3

6,113.6

6,687.2

7,190.5

7,758.5

8,284.5

8,854.0

Airports Infrastructure Industry

Value, US$bn

0.4

0.3

0.3

0.3

0.4

0.4

0.4

-19.3

-43.9

0.4

1.2

1.6

1.5

1.9

Airports Infrastructure Industry As

% of Total Infrastructure

12.7

8.0

8.1

7.7

7.5

7.2

7.1

Airports Infrastructure Industry As

% of Total Construction

5.9

3.8

3.8

3.6

3.4

3.3

3.1

Ports Harbours and Waterways

Infrastructure Industry Value As

% of Transport Infrastructure

16.8

19.2

19.4

19.4

19.5

19.7

19.7

Ports Harbours and Waterways

Infrastructure Industry Value,

VNDbn

7,673.8

10,055.1

10,902.3

12,177.2

13,676.4

15,181.1

16,658.5

Ports Harbours and Waterways

Infrastructure Industry Value,

US$bn

0.4

0.5

0.5

0.6

0.7

0.7

0.8

Ports Harbours and Waterways

Infrastructure Industry Value Real

Growth, % chg y-o-y

62.1

12.4

-0.6

5.3

6.1

5.8

4.7

Ports Harbours and Waterways

Infrastructure Industry As % of

Total Infrastructure

12.0

13.2

13.1

13.1

13.2

13.3

13.3

Ports Harbours and Waterways

Infrastructure Industry As % of

Total Construction

5.5

6.2

6.2

6.1

6.1

6.0

5.9

Airports Infrastructure Industry

Value Real Growth, % chg y-o-y

e/f = BMI estimate/forecast. Source: BMI Research

© Business Monitor International Ltd

Page 27

Vietnam Infrastructure Report Q1 2013

Table: Vietnam Transport Infrastructure Long Term Forecasts, 2015-2021

2015f

2016f

2017f

2018f

2019f

2020f

2021f

Transport Infrastructure Industry

Value As % Of Total

Infrastructure

67.5

67.3

67.0

66.6

66.2

65.7

65.4

Transport Infrastructure Industry

Value, VNDbn

77,147.0

84,380.8

92,186.3

100,318.4

108,892.0

117,562.2

126,407.3

Transport Infrastructure Industry

Value, US$bn

3.8

4.2

4.6

5.0

5.4

5.9

6.3

Transport Infrastructure Industry

Value Real Growth, % chg y-o-y

4.8

4.4

4.3

3.8

3.5

3.0

2.5

Transport Infrastructure Industry

Value As Percent Of Total

Construction (%)

30.6

30.0

29.4

28.8

28.1

27.5

26.8

Roads and Bridges Infrastructure

Industry Value As % of Transport

Infrastructure

50.4

50.8

51.1

51.4

51.6

51.7

51.8

Roads and Bridges Infrastructure

Industry Value, VNDbn

38,856.7

42,852.4

47,104.8

51,516.1

56,145.4

60,796.8

65,508.9

Roads and Bridges Infrastructure

Industry Value, US$bn

1.9

2.1

2.4

2.6

2.8

3.0

3.3

Roads and Bridges Infrastructure

Industry Value Real Growth, %

chg y-o-y

5.9

5.3

4.9

4.4

4.0

3.3

2.8

Roads and Bridges Infrastructure

Industry As % of Total

Infrastructure

34.0

34.2

34.2

34.2

34.1

34.0

33.9

Roads and Bridges Infrastructure

Industry As % of Total

Construction

15.4

15.2

15.0

14.8

14.5

14.2

13.9

Railways Infrastructure Industry

Value As % of Transport

Infrastructure

19.2

19.0

18.8

18.7

18.6

18.6

18.6

Railways Infrastructure Industry

Value, VNDbn

14,824.7

16,015.9

17,322.8

18,723.5

20,238.6

21,816.8

23,471.3

Railways Infrastructure Industry

Value, US$bn

0.7

0.8

0.9

0.9

1.0

1.1

1.2

Railways Infrastructure Industry

Value Real Growth, % chg y-o-y

3.0

3.0

3.2

3.1

3.1

2.8

2.6

Railways Infrastructure Industry

As % of Total Infrastructure

13.0

12.8

12.6

12.4

12.3

12.2

12.1

Railways Infrastructure Industry

As % of Total Construction

5.9

5.7

5.5

5.4

5.2

5.1

5.0

© Business Monitor International Ltd

Page 28

Vietnam Infrastructure Report Q1 2013

Table: Vietnam Transport Infrastructure Long Term Forecasts, 2015-2021

2015f

2016f

2017f

2018f

2019f

2020f

2021f

Airports Infrastructure Industry

Value As % of Transport

Infrastructure

10.7

10.5

10.4

10.3

10.3

10.4

10.5

Airports Infrastructure Industry

Value, VNDbn

8,284.5

8,854.0

9,577.0

10,373.0

11,255.3

12,207.7

13,240.2

Airports Infrastructure Industry

Value, US$bn

0.4

0.4

0.5

0.5

0.6

0.6

0.7

Airports Infrastructure Industry

Value Real Growth, % chg y-o-y

1.5

1.9

3.2

3.3

3.5

3.5

3.5

Airports Infrastructure Industry As

% of Total Infrastructure

7.2

7.1

7.0

6.9

6.8

6.8

6.8

Airports Infrastructure Industry As

% of Total Construction

3.3

3.1

3.1

3.0

2.9

2.9

2.8

Ports Harbours and Waterways

Infrastructure Industry Value As

% of Transport Infrastructure

19.7

19.7

19.7

19.6

19.5

19.3

19.1

Ports Harbours and Waterways

Infrastructure Industry Value,

HKDbn

15,181.1

16,658.5

18,181.7

19,705.7

21,252.7

22,740.9

24,186.8

Ports Harbours and Waterways

Infrastructure Industry Value,

US$bn

0.7

0.8

0.9

1.0

1.1

1.1

1.2

Ports Harbours and Waterways

Infrastructure Industry Value Real

Growth, % chg y-o-y

5.8

4.7

4.1

3.4

2.9

2.0

1.4

Ports Harbours and Waterways

Infrastructure Industry As % of

Total Infrastructure

13.3

13.3

13.2

13.1

12.9

12.7

12.5

Ports Harbours and Waterways

Infrastructure Industry As % of

Total Construction

6.0

5.9

5.8

5.7

5.5

5.3

5.1

e/f = BMI estimate/forecast, Source: BMI Research

© Business Monitor International Ltd

Page 29

Vietnam Infrastructure Report Q1 2013

Transport Infrastructure Outlook and Overview

Roads Dominant

Transport Infrastructure Value, By Industry, VNDbn

e/f = BMI estimate/forecast, Source: BMI, Local news sources, industry sources,

BMI Research (Major Projects Database)

BMI View: The transport sector forms the majority of infrastructure investment in Vietnam throughout

our 10-year forecast period, accounting for 65% in 2021. Vietnam still suffers from a significant deficit in

transportation infrastructure and we believe the Vietnamese government will continue to develop this

sector over the medium term. This is reflected in our forecast for transport infrastructure industry value,

which is expected to grow by an average of 4.8% year-on-year (y-o-y) between 2013 and 2017.

Title: Competitiveness Of Vietnam's Infrastructure

Rank/133 in

2009/10*

Rank/139 in

2010/11**

Rank/142 in

2011/12***

Rank/144 in

2012/13****

102

117

123

120

Quality of Railroad Infrastructure

58

59

71

68

Quality of Port Infrastructure

99

97

111

113

Quality of Air Transport Infrastructure

84

88

95

94

111

123

123

119

Quality of Roads

Quality of Overall Infrastructure

*Rank out of 133 countries in 2009/10. ** Rank out of 139 countries in 2010/11. *** Rank out of 142 countries in

2011/12. ****Rank out of 144 countries in 2012/13. Source: World Economic Forum, Global Competitiveness Report

2009/10, 2010/11, 2011/12 and 2012/13

© Business Monitor International Ltd

Page 30

Vietnam Infrastructure Report Q1 2013

Roads Dominate With....

Within the transport infrastructure sector, the roads and bridges sub-sector leads in terms of contributions

to the total transport infrastructure industry value, accounting for 49% of total value in 2013. Although

most of Vietnam’s national road network is paved (only 26%, or 45,603km out of 171.392km, is

unpaved, as of 2008), surveys indicated that approximately 40% of the network is in a poor or very poor

condition and will require substantial investment to reach a maintainable condition. Vietnam’s Ministry

of Transport and Communications has estimated that the country will require close to US$60bn in the

period up to 2020 to fund new road infrastructure projects. Reaching this investment target will be crucial

to Vietnam’s long-term economic well-being, as roads facilitate the transport of most freight within the

country, with a market share of around 60% of domestic cargo. Combined with increased traffic levels in

Vietnam’s urban areas and growing trade volumes to and from the country, there is a need for roads.

Over the past quarter, there have been several announcements regarding new road projects to be

developed in Vietnam:

In July 2012, the Ministry of Transport said that construction work on 24 new roads is expected

to start soon. They include: Ho Chi Minh roadway La Son-Tuy Loan section, Long Thanh-Dau

Giay highway, Da Nang-Quang Ngai highway, BOT and BT highway tunnel over Ca mountain

pass on National Road 1A, Tan Vu- Lach Huyen motorways.

In August 2012, Transport Engineering Design Incorporated (TEDI) presented detailed planning

report of the ring road 5 in Hanoi. The 385km project is expected designed in detail between

2012 and 2015, with the US$4.7bn project fully completed by 2030. Ring road 5 is expected to

be divided into four parts: Son Tay-Phu Ly, Phu Ly-Bac Giang; Bac Giang-Thai Nguyen and

Thai Nguyen-Son Tay.

In September 2012, Thailand-based Italian-Thai Development signed a MoU to draw out the

investment plan and technical design for phase 2 of the Halong – Mong Cai expressway project

in the Quang Ninh province. The 134km project, which is part of the Noi Bai – Halong – Mong

Cai expressway project, is expected to cost a total of US$2.1bn. The expressway is expected to

take three years to be completed.

However, there are concerns about the viability of toll roads in Vietnam over the near-term. In July 2012,

the Vietnamese government accepted a proposal from the Ministry of Finance to reduce toll fees for

trucks using the Ho Chi Minh City (HCMC)Trung Luong expressway by 25-30%. The approval was given on July 4 2012 and would allow the

finance ministry to finalise the details and determine a date for the toll cut. Once implemented, trucks

weighing over 18 tonnes and 40-feet container trucks would pay around VND448,000-480,000 (US$2223) per trip for using the 61.9km expressway, compared with the current fee of VND640,000 (US$31).

© Business Monitor International Ltd

Page 31

Vietnam Infrastructure Report Q1 2013

The decision to cut toll fees is because traffic volumes fall sharply in the HCMC-Trung Luong

expressway once it required commuters to pay a toll fee in February 2012.

We believe that this toll cut in one of the highways linking Vietnam's most economically developed cities

reflects our concerns about the viability of building toll roads in Vietnam. The approval of the toll cut not

only suggests that the sector could be oversaturated, but that economic development within Vietnam has

not reached levels that are financially viable for such tolls roads.

This lack of financial viability for toll roads in Vietnam is collaborated with anecdotal evidence regarding

the HCMC-Trung Luong Expressway. According to the association, heavy trucks – the main vehicle used

by transport companies – have to pay a toll fee of VND320,000-640,000 for a round trip on the

expressway. However, these companies only earn a profit of VND300,000-400,000 for each transport trip

within 100km.

Costly To Build

Investment Cost of Expressways In Vietnam, US$mn per km

Source: Vietnam The Business Times (May 3 2012).

We believe that this lack of viability and the need for unattractive toll fees are due to the high cost of

construction for expressways within Vietnam. According to anecdotal evidence from the Vietnamese

Business Times, the cost of constructing an expressway in Vietnam is about 1.5-2 times higher than

neighbouring countries such as China, Indonesia, Malaysia and Thailand. The HCMC-Trung Luong

expressway, for example, costs around US$9.9mn per km, higher than an average expressway in China

(US$6mn/km) and the US (US$8mn/km).

© Business Monitor International Ltd

Page 32

Vietnam Infrastructure Report Q1 2013

We believe there are several factors contributing to this high construction cost for toll roads:

High inflation and domestic interest rates.

The lack of project management expertise to complete road projects within budget, resulting in

site clearance delays and cost overruns.

Corruption, with anecdotal evidence suggesting that 30% of a project's value is pocketed by the

contractor in order to pay bribes to relevant parties.

Deficiency in regulations and government institutions that effectively balance the need to

safeguard the public interest with the need for expeditious provision of land for infrastructure

development. The current regulation – Decree 69/2009/ND-CP – only gives district-level

people's committees, not the central government, the right to hire companies to settle site

clearance and compensation issues.