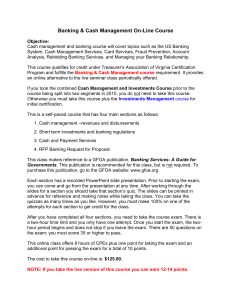

INTERNET BANKING QUALITY: MARKETING POSSIBILITIES AND

advertisement

ISSN 1822-6760. Management theory and studies for rural business and infrastructure development. 2011. Nr. 2 (26). Research papers. INTERNET BANKING QUALITY: MARKETING POSSIBILITIES AND CUSTOMERS’ LOYALTY Hermanis Rullis, Biruta Sloka University of Latvia Purpose of the research is to identify customers’ satisfaction with internet banking quality and customers’ loyalty. Internet banking is bank’s innovative product that has positive influence on environment, i.e., it provides possibility to save paper, energy and other resources and as result to decrease carbon footprint and to provide other business with possibility for sustainable development. Internet banking quality is important factor that influence adoption of internet banking and customers’ loyalty. Research results identified that internet banking users are satisfied with internet banking reliability, internet banking usability, internet banking quality. They have also positive attitude regarding internet banking and they are willing to recommend it. Internet banking quality cannot be considered as factor that hinders adoption of internet banking and use of internet banking as environment for marketing. Research methods used: literature review, survey methods, descriptive statistics, factor analysis. Keywords: internet banking, customer’s loyalty, marketing research, quality. JEL codes: M300; M310. Introduction Sustainable development usually is associated with environmental, social and economical issues. “Brundtland report”, Our Common Future (Brundtland, 1987) provided definition of sustainable development as development that “implies meeting the needs of the present without compromising the ability of future generations to meet their own needs”. Since most of banking products are intangible and due to specific of banking operations there is not obvious influence of banking institutions on sustainable development for average person, but it is not so simple. There are at least two ways of sustainable development integration into the banking institutions: bank's environmental and social responsibility that manifests as environmental initiatives and socially responsible initiatives; and integration of sustainability into a bank's core businesses (integration of environmental and social considerations in products’ strategy, design, etc.). Integration of sustainability into a bank's core businesses can facilitate bank’s support to environmentally and socially responsible, innovative and sustainable companies. Leading banks around the world (such as SEB, UniCredit Bank, Nordea, DnB Nor, etc.) have adopted “Equator Principles” on project financing that suppose assessing and handling environmental and social impacts when bank engage in project financing transactions (The Equator Principles, 2011). It is obvious evidence of banks’ engagement in issues related to sustainable development. Internet banking is bank’s innovative product that can provide input in both already mentioned ways: internet banking has positive influence on environment, i.e., it provides possibility to save paper, energy and other resources and as result to decrea193 se carbon footprint; and “provide the means for sustainable development of other businesses” (Sakalauskas, 2009). Importance of internet banking for bank’s operations supports also its possibility to provide environment for marketing. Bank can get benefit of internet baking only if it is adopted by customers. Adoption of internet banking is influenced by internet banking quality that also facilitates customers’ loyalty. B. Enguist, B. Edvardsson and S. P. Sebhatu (2007) argued that a service should correspond to customers’ expectations and satisfy their needs and requirements. Purpose of the research is to identify customers’ satisfaction with internet banking quality and customers’ loyalty. Research results extend knowledge in the field of science and give practical contribution that can be used by professionals to improve bank marketing practice. Research methods used: literature review, survey methods, descriptive statistics (mean, mode, median, indicators of variability) and factor analysis. Theoretical background Internet banking could become a widely adopted method for disseminating information and exchanges in the near future (Gan, 2006). Internet bank provides environment for marketing (public relations, advertising, promotion, direct marketing, etc.). Z. Liaoa and M. T. Cheung (2002) argued that a major force behind these developments is technology. C. B. Ho and W. Lin (2010) argued that information technology is a tool to achieve competitive advantage and has been developing rapidly in recent years. Marketing possibilities within internet bank have become available due to rapid development of information and communication technologies and have not been researched enough. There is possibility to use internet bank for marketing purposes if customers have adopted it. In order to facilitate adoption of internet banking there should be identified and eliminated factors that hinder it. Internet banking adoption has been topical subject of research at least for last ten years (Malhotra, 2010; Branca, 2008; Centeno, 2004; Jayawardhena, 2000). Researchers have paid a lot of attention also to issues related to internet banking quality (Bauer, 2005; Broderick, 2002; Jun, 2001). There were identified significant relationships among online customer service quality, online information system quality, banking service product quality, overall internet banking service quality and customer satisfaction (Rod, 2009). The service quality is the dominant variables that influence consumers’ choice of electronic banking (Gan, 2006). Customers’ loyalty and willingness to recommend it depends on customers’ satisfaction with internet banking. Customers’ satisfaction with internet banking is influenced by its quality. M. S. Sohail and N. M. Shaikh (2008) identified that the users of internet banking services have been satisfied with such variables as protection of banking information, personal information and feeling a sense of security. V. S. Chau and L. W. L. C. Ngai (2009) identified that there is a positive impact of internet banking service quality on satisfaction and loyalty. Y. K. A. Migdadi (2008) argued that internet banking service quality may differ as a result 194 of different country context. There is not done enough scientific research regarding internet banking quality and customers’ loyalty in Latvia. Authors adopted a multiple item scale for measuring internet banking service quality developed by C. B. Ho and W. Lin (Ho, 2010). There are five dimensions in the measurement scale for measuring the service quality of internet banking: customer service, web design, assurance, preferential treatment, and information provision. Questions for internet banking user have been united in following dimensions that are created by using also already mentioned measuring scale: internet banking reliability, internet banking usability, internet banking service quality, internet banking quality. Research authors have identified customers’ satisfaction with internet banking quality and customers’ loyalty. Research results Research authors conducted internet bank users’ survey in Latvia in 2010. Survey was sent to 1,273 private persons and there were received valid 873 responses. For survey there was chosen only current internet banking users because none users could not answer to these questions. Following questions were asked: Please evaluate internet banking reliability 1. Internet banking transactions are precise (Precise transactions) 2. Internet banking is safe (Safe) 3. I am familiar with possibilities provided by internet banking (Familiar) 4. I feel comfortable with internet banking (Convenient) 5. I have positive experience with internet banking (Positive experience). Please evaluate internet banking usability 6. Internet banking navigation is simple (Navigation is simple) 7. Internet bank has nice appearance (Attractive design) 8. Internet banking design is appropriate for such site (Appropriate design) 9. Internet banking leaves impression of competence (Sense of competence) 10. Internet banking creates sense of individualizations (Customization) 11. Links within internet bank are valid (Links are valid) 12. Internet banking pages open fast (Works fast) 13. Internet banking provides easy access to bank transactions (Easy access). Please evaluate internet banking service quality 14. Bank responds quickly to questions sent via internet bank (Quick response) 15. Internet bank provides all necessary information to solve problems (Support information available) 16. Internet banking service is faster than at the branch (Fast service). Please evaluate your satisfaction with internet banking quality 17. I am satisfied with internet banking quality (Satisfied with quality). Please evaluate your attitude regarding internet banking 18. I have positive attitude regarding internet banking (Positive attitude) 19.I can recommend my internet bank to others (Can recommend). Respondents were asked to evaluate mentioned above factors in the scale 1 – 10 where 1 is no importance and 10 is very important. 195 Survey results regarding internet banking reliability are presented in the Table 1. Table 1. Internet banking reliability Precise Positive Safe Familiar Convenient transaction experience N Valid 872 871 873 873 872 Missing 1 2 0 0 1 Mean 8.81 8.00 7.64 8.65 8.84 Std. Error of Mean 0.048 0.063 0.061 0.051 0.049 Median 9.00 8.00 8.00 9.00 9.00 Mode 10 9 8 10 10 Std. Deviation 1.418 1.864 1.812 1.506 1.453 Variance 2.011 3.476 3.285 2.268 2.110 Range 9 9 9 9 9 Minimum 1 1 1 1 1 Maximum 10 10 10 10 10 Source: Research authors’ conducted survey among internet banking users in Latvia in 2010 (n=873) Survey results in the Table 1 indicate that almost all respondents recognize following: internet banking transactions as precise (Mode 10, Median 9.00, Mean 8.81), internet banking is safe (Mode 9, Median 8.00, Mean 8.00), respondents are familiar with possibilities provided by internet banking (Mode 8, Median 8.00, Mean 7.64), respondents feel comfortable with internet banking (Mode 10, Median 9.00, Mean 8.65), respondents have positive experience with internet banking (Mode 10, Median 9.00, Mean 8.84). Survey results regarding internet banking usability are presented in the Table 2. Table 2. Internet banking usability N Navigation is simple 873 0 8.04 Attractive design 871 2 7.99 Appropriate design 870 3 8.23 Sense of competence 866 7 8.16 Valid Missing Mean Std. Error of Me0.054 0.055 0.054 0.055 an Median 8.00 8.00 8.00 8.00 Mode 8 8 8 8 Std. Deviation 1.590 1.620 1.597 1.622 Variance 2.529 2.625 2.550 2.630 Range 9 9 9 9 Minimum 1 1 1 1 Maximum 10 10 10 10 Source: Research authors’ conducted survey among internet banking users in Latvia in 2010 (n=873) Survey results in the Table 2 indicate that almost all respondents have alike opinions – they recognize following: internet banking navigation is simple (Mode 8, Median 8.00, Mean 8.04), internet bank has nice appearance (Mode 8, Median 8.00, 196 Mean 7.99), internet banking design is appropriate for such site (Mode 8, Median 8.00, Mean 8.23), internet banking leaves sense of competence (Mode 8, Median 8.00, Mean 8.16). Table 2 (Continue). Internet banking usability Links are Works fast Easy access valid N Valid 868 868 862 870 Missing 5 5 11 3 Mean 7.43 8.49 8.23 9.01 Std. Error of Mean 0.074 0.052 0.058 0.044 Median 8.00 9.00 9.00 9.00 Mode 8 10 9 10 Std. Deviation 2.181 1.539 1.716 1.302 Variance 4.755 2.368 2.946 1.696 Range 9 9 9 9 Minimum 1 1 1 1 Maximum 10 10 10 10 Source: Research authors’ conducted survey among internet banking users in Latvia in 2010 (n=873) Customization Survey results in the continue of Table 2 indicate that almost all respondents recognize following: internet banking creates sense of individualizations (Mode 8, Median 8.00, Mean 7.43), links within internet bank are valid (Mode 10, Median 9.00, Mean 8.49), internet banking pages open fast (Mode 9, Median 9.00, Mean 8.23), internet banking provide easy access to bank transactions (Mode 10, Median 9.00, Mean 9.01). Survey results regarding internet banking service quality, satisfaction and loyalty are presented in the Table 3. Table 3: Internet banking service quality, satisfaction and loyalty 855 18 6.13 Support information available 872 1 6,52 0.114 0.103 0.047 0.049 0.042 0.058 7.00 8 3.331 11.094 10 0 10 7.00 8 3.035 9.209 10 0 10 10.00 10 1.386 1.922 9 1 10 9.00 10 1.441 2.076 9 1 10 10.00 10 1.245 1.550 9 1 10 9.00 10 1.718 2.952 9 1 10 Quick response N Valid Missing Mean Std. Error of Mean Median Mode Std. Deviation Variance Range Minimum Maximum Fast service Satisfied with quality Positive attitude Can recommend 862 11 9.18 869 4 8.53 872 1 9.24 867 6 8.57 197 Survey results in the Table 3 indicate that almost all respondents recognize following: bank responds quickly to questions sent via internet bank (Mode 8, Median 7.00, Mean 6.13, there is rather big variability of respondent’s views), internet bank provides all necessary information to solve problems (Mode 8, Median 7.00, Mean 6.52), internet banking service is faster than at branch (Mode 10, Median 10.00, Mean 9.18), respondents are satisfied with internet banking quality (Mode 10, Median 9.00, Mean 8.53), respondents have positive attitude regarding internet banking (Mode 10, Median 10.00, Mean 9.24 variability of respondent’s views is low), respondents can recommend their internet bank to others (Mode 10, Median 9.00, Mean 8.57, variability of responses is low). Research authors performed factor analysis by using orthogonal rotation. Table 4 shows the rotated factor matrix which is a matrix of the factor loading for each variable onto each complex factor. Table 4. Rotated Component Matrixa Component 1 2 3 Internet banking provide easy access to bank transactions 0.248 0.028 0.811 Internet banking service is faster than at the branch 0.094 -0.057 0.781 I feel comfortable with internet banking 0.388 0.066 0.777 I have positive experience with internet banking 0.363 0.038 0.777 I have positive attitude regarding internet banking 0.294 0.004 0.731 Internet banking transactions are precise 0.282 0.033 0.718 Internet banking is safe 0.352 0.032 0.604 I am familiar with possibilities provided by internet banking 0.310 0.139 0.559 I can recommend my internet bank others 0.053 0.553 0.569 Internet bank has nice appearance 0.262 0.035 0.850 Internet banking design is appropriate for such site 0.254 -0.015 0.837 Internet banking leaves sense of competence 0.313 0.021 0.819 Internet banking navigation is simple 0.380 0.052 0.726 Internet banking creates sense of individualizations 0.142 0.098 0.725 Links within internet bank are valid 0.475 0.038 0.652 Internet banking pages open fast 0.375 0.041 0.636 I am satisfied with internet banking quality 0.563 0.046 0.601 Bank respond quickly to questions sent via internet bank 0.046 0.026 0.898 Internet bank provides all necessary information to solve problems 0.028 0.081 0.896 Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalization. a. Rotation converged in 5 iterations. Source: Research authors’ conducted survey among internet banking users in Latvia in 2010 (n=873) Research authors identifies following complex factors (components): 1. component – reliability; 2. component – quality; 3. component – support. The discovered research results could be useful for bank marketing managers. 198 Conclusions Internet banking is bank’s innovative product that has positive influence on environment, i.e., it provides possibility to save paper, energy and other resources and as result to decrease carbon footprint and to provide other business with possibility for sustainable development. Importance of internet banking for bank’s operations supports also its possibility to provide environment for marketing. Bank can get benefit of internet baking only if it is adopted by customers. Internet banking quality is important factor that influence adoption of internet banking and customers’ loyalty. Research results identify that: • internet banking users are satisfied with internet banking reliability, internet banking usability, internet banking quality; • they have also positive attitude regarding internet banking and they are willing to recommend it. It proofs customers’ loyalty. Internet banking quality cannot be considered as factor that hinders adoption of internet banking and use of internet banking as environment for marketing. In order to improve service quality in banking sector there should be done additional research that would identify current state of internet banking products adoption. Research results would allow to increase internet banking service quality and as result facilitate a switch of customers from branches to internet banking. References 1. Bauer, H. H., Hammerschmidt, M., Falk, T. (2005). Measuring the quality of e-banking portals // International Journal of Bank Marketing. – Vol. 23. No. 2. 2. Branca, S.A. (2008). Demographic influences on behaviour: An update to the adoption of bank delivery channels // International Journal of Bank Marketing. – Vol. 26. No. 4. 3. Broderick, J. A., Vachirapornpuk, S. (2002). Service quality in Internet banking: the importance of customer role // Marketing Intelligence & Planning. – Vol. 27. No. 1. 4. Brundtland, G.H. (1987). Our Common Future. The World Commission on Environment and Development // Oxford University Press, Oxford. 5. Centeno, C. (2004). Adoption of internet services in the acceding and candidate countries, lessons from the internet banking case // Telematics and Informatics. – Vol. 21. No. 4. 6. Chau, V.S. and Ngai, L.W.L.C. (2009). The youth market for internet banking services: perception, attitude and behavior // Journal of Service Marketing, Vol. 24. No. 1. 7. Enquist, B., Edvardsson, B., Sebhatu, S.P. (2007). Values-based service quality for sustainable business // Managing Service Quality. – Vol. 17. No. 4. 8. Gan, C., Clemes, M., Limsombunchai, V., Weng, A. (2006). A logit analysis of electronic banking in New Zealand // International Journal of Bank Marketing. – Vol. 24. No. 6. 9. Ho, C.B., Lin, W. (2010). Measuring the service quality of internet banking: scale devilment and validation // European Business Review. – Vol. 22. No. 1. 10. Jayawardhena, C., Foley, P. (2000). Changes in the banking sector-the case of Internet banking in the UK // Internet Research. – Vol. 10. No. 1. 11. Jun, M., Cai, S. (2001). The key determinants of Internet banking service quality: a content analysis // International Journal of Bank Marketing. – Vol. 19. No. 7. 12. Liaoa, Z., Cheung, M.T. (2002). Internet-based e-banking and consumer attitudes: an empirical study // Information & Management. – Vol. 39. 199 13. Malhotra, P., Singh, B. (2010). An analysis of Internet banking offerings and its determinants in India // Internet Research. – Vol. 20. No. 1. 14. Migdadi, Y.K.A. (2008). Quantitative Evaluation of the Internet Banking Service Encounter's Quality: Comparative Study between Jordan and the UK Retail Banks // Journal of Internet Banking & Commerce. – Vol. 13. No. 2. 15. Rod, M., Ashill, N.J., Shao, J., Carruthers, J. (2009). An examination of the relationship between service quality dimensions, overall internet banking service quality and customer satisfaction A New Zeland study // Marketing Intelligence & Planning. – Vol. 27. No. 1. 16. Sohail, M.S., Shaikh, N.M. (2008). Internet banking and quality of service Perspective from a developing nation in the Middle East // Online Information Review. – Vol. 32 No. 1. 17. Sakalauskas, V., Kriksciuniene, D., Kiss, F., Horvath, A. (2009). Factors for Sustainable Development of E-Banking in Lithuania and Hungary. // 5th International Vilnius Conference EURO Mini Conference “Knowledge-Based Technologies and OR Methodologies for Strategic Decisions of Sustainable Development”. 18. The Equator Principles A financial industry benchmark for determining, assessing and managing social & environmental risk in project financing, adopted on July 2006. – http://www.equator-principles.com/principles.shtml [2011 02 08]. INTERNETINĖS BANKININKYSTĖS KOKYBĖ: RINKODAROS GALIMYBĖS IR KLINTŲ LOJALUMAS Hermanis Rulis, Biruta Sloka Latvijos universitetas Tyrimo tikslas – išanalizuoti klientų, naudojančių internetinės bankininkystės paslaugas, pasitenkinimo ir lojalumo laipsnį. Tikslui pasiekti buvo naudoti mokslinės literatūros analizės, internetinės bankininkystės vartotojų apklausos, statistikos ir veiksnių analizės metodai. Tyrimo rezultatai rodo, kad internetinės bankininkystės vartotojai yra patenkinti šios paslaugos patikimumu, patogumu ir kokybe bei pasiruošę šią paslaugą rekomenduoti. Internetinė bankininkystė yra šiuolaikinė banko teikiama paslauga, kuri yra palanki supančiai aplinkai ir formuoja kitų įmonių darnaus vystymosi prielaidas. Raktiniai žodžiai: internetinė bankininkystė, klientų lojalumas, rinkodaros tyrimai, kokybė. JEL kodai: M300, M310. 200