As 'big boys' enter the arena, energy

advertisement

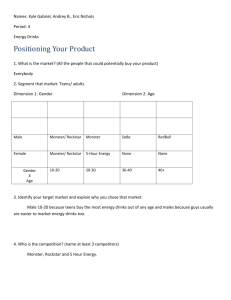

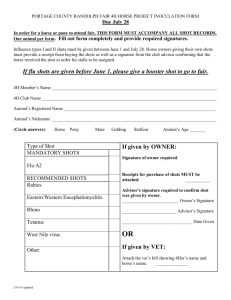

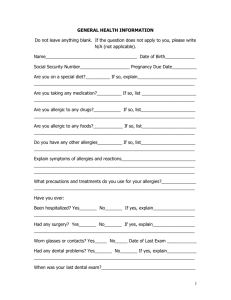

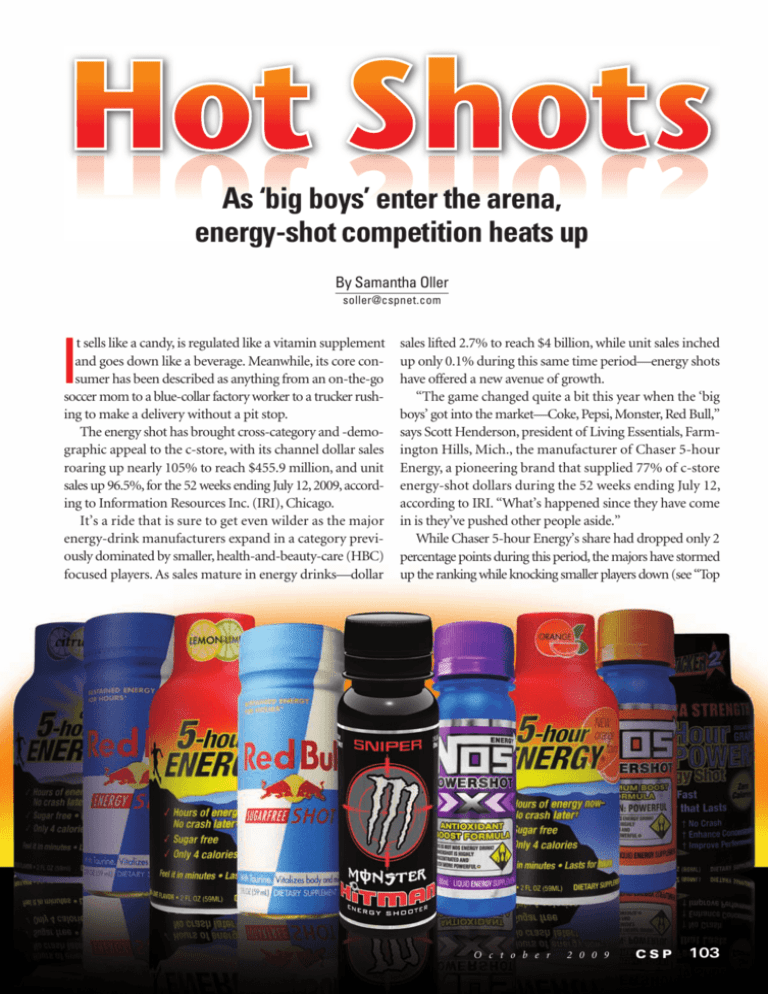

As ‘big boys’ enter the arena, energy-shot competition heats up By Samantha Oller soller@cspnet.com t sells like a candy, is regulated like a vitamin supplement and goes down like a beverage. Meanwhile, its core consumer has been described as anything from an on-the-go soccer mom to a blue-collar factory worker to a trucker rushing to make a delivery without a pit stop. The energy shot has brought cross-category and -demographic appeal to the c-store, with its channel dollar sales roaring up nearly 105% to reach $455.9 million, and unit sales up 96.5%, for the 52 weeks ending July 12, 2009, according to Information Resources Inc. (IRI), Chicago. It’s a ride that is sure to get even wilder as the major energy-drink manufacturers expand in a category previously dominated by smaller, health-and-beauty-care (HBC) focused players. As sales mature in energy drinks—dollar I sales lifted 2.7% to reach $4 billion, while unit sales inched up only 0.1% during this same time period—energy shots have offered a new avenue of growth. “The game changed quite a bit this year when the ‘big boys’ got into the market—Coke, Pepsi, Monster, Red Bull,” says Scott Henderson, president of Living Essentials, Farmington Hills, Mich., the manufacturer of Chaser 5-hour Energy, a pioneering brand that supplied 77% of c-store energy-shot dollars during the 52 weeks ending July 12, according to IRI. “What’s happened since they have come in is they’ve pushed other people aside.” While Chaser 5-hour Energy’s share had dropped only 2 percentage points during this period, the majors have stormed up the ranking while knocking smaller players down (see “Top O c t o b e r 2 0 0 9 CSP 103 Top 10 Energy-Shot Brands Living Essentials’ Chaser 5-hour Energy brand commanded more than 77% of c-store dollar sales in the 52 weeks ending July 12, with share slipping 1.5%. Brands backed by the major energy-drink players pushed their way up the ranking, with NOS from Coca-Cola’s Fuze subsidiary grabbing third place, followed by Monster’s Hitman and Pepsi-Cola-distributed Rockstar at No. 5. C-store sales ($ millions) PCYA* Brand Chaser 5-hour Energy Unit sales (millions) PCYA* $351.3 101.2% 111.9 100.5% Stacker 2 6 Hour Power $29.7 152.6% 10.3 154.6% NOS $15.3 263.1% 5.1 262.7% Monster Hitman $13.0 N/A 4.4 N/A Rockstar $6.5 N/A 2.3 N/A Amp $5.5 N/A 2.0 N/A Upshot $3.9 –55.5% 2.1 –55.3% Nitro2Go $3.2 13.9% 1.1 12.2% Vital 4U Screamin Energy $2.9 –10.0% 2.5 –10.2% test, although he confirmed it is taking place in two regions. 䊳 Also in June, Red Bull GmbH introduced a regular and sugar-free energy-shot extension off its popular Red Bull energy-drink brand. The shots contain Red Bull’s taurine, glucuronolactone and caffeine cocktail but are 2 ounces and 25 calories or less. Meanwhile, the shock waves of the subcategory’s explosive growth are still being measured within other categories, as retailers consider cannibalization dangers and bundling opportunities. Fine Young Cannibals The subcategory is so new and explosive that NACS assigned a designation for the Total (including brands not shown) $455.9 104.9% 151.7 96.5% products within the HBC category only Source: Information Resources Inc. * Percent change from a year ago late last year. But for energy-shot man52 weeks ending July 12, 2009 ufacturers, the outlines of its core consumer are already well established. 10 Energy-Shot Brands,” above). These “big boys” include: “Because of the convenience factor and cost, energy shots 䊳 The Coca-Cola Co. via its Fuze Beverage LLC subbridge a big gap of a demographic,” says Karen Finocchio, sidiary, which launched NOS Energy Shooter in May 2008, director of marketing for NVE Pharmaceuticals, Andover, and NOS Powershot X, an antioxidant-rich, grape-flavored N.J., manufacturer of Stacker 2 6 Hour Power energy shots, formula, off its NOS energy-drink line in November 2008. the No. 2 brand with 6.2% dollar share, according to IRI figNOS is now the No. 3 c-store energy-shot brand with a 263% ures. This past summer, the company launched an extraleap in dollar sales, according to IRI. strength grape flavor that retails at two for $3.99. “It can be 䊳 Hansen Natural Corp., manufacturer of Monster energy anyone from an 18- to a 54-year-old. It can be the extremedrinks, introduced an energy-shot extension, Monster Hit- sports person to the factory worker to the mom who works man, in October 2008. In April, it added the cherry-flavored all day to make dinner and to take care of the kids.” Monster Hitman Sniper to the lineup, which also includes NOS brand manager Tutul Rahman agrees: “It speaks to the low-calorie Hitman LoBo. Coca-Cola shares distribution people who are blue-collar workers, people getting up in the rights with Anheuser-Busch InBev for the products. morning, who are slightly older, looking for a pick-me-up.” 䊳 PepsiCo in February signed on as master distributor He cites energy shots’ low-fluid-volume, high-impact, nofor energy-drink and shot manufacturer Rockstar Inc. (Rep- crash profile for their unique appeal. resentatives with Rockstar were not available for comment.) “If I’m looking for energy with no liquid and all the The energy-shot brand, available in wild berry and tropical functionality, I go to energy shots,” he says. “If I’m lookpunch flavors, ranked fifth by c-store dollar sales in the 52 ing for energy but with a taste profile flavor, I’m going with weeks ending July 12, according to IRI. (PepsiCo retired the an energy drink. At the end of the day, we believe those are Amp energy-shot brand earlier this year.) two different consumers.” 䊳 In June, Dr Pepper Snapple Group began testing Venom The line between the two demographics, however, isn’t Bite, an energy-shot extension of its Venom energy-drink line. clear-cut. Spokesman Chris Barnes could not share parameters for the Kevin Platt, beverage category manager for Cumberland VPX Redline Power Rush 104 CSP $2.7 O c t o b e r 1.6 2 0 0 9 0.8 1,595.3% GRAPE NEWS: In September, Living Essentials launched a new grape flavor for its 5-hour Energy brand in response to consumer demand. And NVE Pharmaceuticals has added an extra-strength grape flavor to its 6-Hour Power line. Farms Inc., Framingham, Mass., says energy-shot sales are up 72% over the year prior, off an already strong base in 2008. “Energy drinks are showing a slight decline,” he says in an e-mail interview. “Although we have seen some cannibalization from our energy drinks, we are showing positive results when both categories are added together. “I do believe that this is the same consumer and they are using this package as an alternative to having to drink a 16- or 20-ounce energy drink,” he continues. “These shots give you the same boost as the drinks without having to drink all of the fluid ounces. I think the consumers will continue to look for the low-calorie and sugar-free shots as they continue to look for that lift without all of the sugar that some of the drinks contain.” Gary Hemphill, an analyst with Beverage Marketing Corp., says intuitively he believes energy shots are siphoning away some sales from energy drinks. At the same time, “energy shots are broadening the market, more likely bringing more consumers into the market,” he says. 䊳 Bottled water While Rahman of NOS acknowl䊳 Candy edges “minor cannibalization” between 䊳 Meat snacks energy drinks and energy shots in general, he says it’s not something Fuze has experienced between its NOS energy drink and shot lines; rather, sales have been “purely incremental.” A representative for Red Bull concurs with the incremental nature of energy shots and their ability to draw in new consumers and increase usage occasions. A quick look at IRI figures shows that of the top 10 energy-drink brands in c-stores, six experienced a drop in dollar and unit sales during the 52 weeks ending July 12. Four of these—Red Bull, Monster, Rockstar and Amp—have or had an energy-shot extension. (One—the NOS brand of energy drink—posted a double-digit rise in dollar and unit sales.) It’s uncertain, however, whether these sales deficits are due to a trade-off to energy shots or another factor, such as the soft economy. Retail Side Within the c-store, retailers are feeling energy shots’ boost not only by strong dollar sales but also in their significant margin opportunity, ranging 45% to 50%—similar to energy drinks—at a $3 price point. But don’t get caught up in percentages. Pay mind to penny profits, says Henderson of Living Essentials. “Everyone seems hung up on gross-margin percentage,” he says. “You can’t spend a percent—you can only spend a dollar.” Other tricks of the trade with energy shots include: Placement. “It’s an impulse purchase—a brand new category—and the majority of consumers still have to get comfortable with the idea of energy shots,” says Rahman of NOS. “They’re not going into a c-store and looking for one.” Placement near the front counter is key. “We don’t sell like a beverage, we sell like candy,” agrees Henderson of Living Essentials. “Especially in a c-store, it’s impulse-driven, so there are definitely opportunities there.” While secondary placements—by the cooler, for example—are possible, theft can also be an issue in some stores because of the highly portable nature and higher price point of energy shots. “We’ve been given feedback from retailers that this is also a high-theft item, so they want to keep it close to the register and not have placements throughout the store,” says Geoff Bremmer, Monster brand manager for Hansen Beverage, Corona, Calif. The supplier does offer merchandising fixtures for the cooler door, but he says the checkout is primary. Promotions. In 2008, Living Essentials participated in a bundling promotion with Link Snacks Inc.’s Jack Link’s meat snacks via wholesaler McLane. The company, which launched a new grape flavor in September, is in talks with a confectioner on another joint marketing event. According to Rahman, some customers are also buying bottled water to chase their energy shot, another potential bundling opportunity. Cumberland Farms has not yet experimented with bundling, but it may do so as impulse sales heat up. Racks. Once delegated to supplier-specific counter racks, Bundle Me With 106 CSP O c t o b e r 2 0 0 9 ENERGY SHOTS VS. ENERGY DRINKS Do you believe energy shots cannibalize sales from energy drinks? SKUs. In the same area, the retailer has placed two 31.1% No shelves of energy 12.6% Don’t know and power bars, creating an impulsedriven energy center at Source: Kraft/CSP Daily News Poll. Based on 135 respondents. the front of the store. energy shots have since graduated to The company stocks 5-hour Energy, community racks to accommodate the Monster Hitman, NOS, Rockstar, Red growing selection of SKUs from major Bull, Wet Planet Beverages’ Jolt suppliers [CSP—Sept. ’09, p. 32]. Endurance and DMD Pharmaceuti“Now you’re starting to see a profit- cals’ Ephrine Plus shots, with the assortgenerating thing—you’re putting more ment determined by syndicated data, emphasis on a solid display that can flavor profiles and recommendations best turn product,” says Rahman. from its suppliers. Cumberland Farms, which has 576 “I believe the key is having the top sites across the Northeast, has placed flavors as well as trying some of the two-shelf energy-shot racks at all of its newer, innovative ones,” says Platt. “As checkouts, displaying about 12 assorted new entries into the category begin to 56.3% Yes 108 CSP O c t o b e r 2 0 0 9 gain traction in the market, the consumers begin to look for alternate shots, similar to the energy drinks.” With more than 100 energy-shot products on the market, brands are attempting to differentiate themselves through palatability—a weakness within the category in general—effectiveness, flavor variety, price point, or, if an extension, the cache of an energy-drink brand. Extreme sports marketing and sponsorships, a carry-over from the energy-drink business, also adds a sheen. Meanwhile, the HBC side of the category is focusing on functionality. In September, Convenience Valet, Melrose Park, Ill., began taking orders for an energy-shot line extension to Alacer Corp.’s vitamin C-infused, energy-boosting Emergen-C dissolvable powder line. The shots provide a boost of energy but do so in a formula enhanced with vitamins and antioxidants. The three 2.5-ounce shots include Emergen-C, an orange-flavored, vitamin C spiked shot; Emergen-C Alert!, a berry-flavored product formulated to enhance energy and mental focus; and Emergen-C Immune+, a citrus-flavored shot that aims to boost the immune system. Bremmer of Hansen anticipates a “shake-out,” similar to that which occurred in energy drinks, within the energy-shots category. Because of the newness of the category, he declined to cite a desired minimal number of SKUs. However, he says the 80/20 rule is a good model to follow—80% of SKUs should come from the sales leaders, while 20% should reflect innovation: “new ideas, new flavor profiles, things that differentiate,” he explains, “rather than being just another energy ■ shot with a label on it.”