Monster Beverage Corporation - Henry B. Tippie College of Business

advertisement

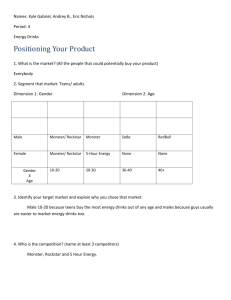

Krause Fund Research| Fall 2014 Consumer Staples Monster Beverage Corporation NASDAQ: MNST November 18th, 2014 Recommendation: BUY Analysts Caprice Claytor caprice-claytor@uiowa.edu Current Price: $110.07 Target Price: $128.24 Mengwei Fan mengwei-fan@uiowa.edu Company Overview MNST: Unleash the Beast! Monster Beverage Corporation is the nation’s largest publicly traded energy drink company by annual revenue. The company develops, markets, sells and distributes energy drinks and alternative beverages. Monster Beverage Corporation is segmented into two beverage businesses: Direct Store Delivery (DSD) and Warehouse, including energy drinks, juiced based drinks, and soda beverages. Within these segments, DSD accounts the majority of Monster’s revenue and is expected to grow 9% in the next year. Monster Beverage Corporation has a number of consolidated subsidiaries which conducts manufacturing, production, and distribution of its products. With anticipated economic growth and company development, Monster Beverage Corporation is expected to outperform the overall market. Stock Performance Highlights 52 Week High 52 Week Low Beta Value Average Daily Volume 109.58 56.66 1.04 1.72M Monster Beverage Corporation has identified growth opportunities in revenue and the energy drink industry. Monster Beverage’s revenue is expected to grow 8% in the next year and is position in an industry that has increased 10.8% by annual sales. The company’s innovative strategies to segue into alternative beverages will boost expansion within its product segments. Monster Beverage has a relatively high price to earnings ratio of 38.90. A high price to earnings ratio is indicates higher growth in expected earnings. When compared to its industry leader, Coca Cola Company, Monster Beverage surpass its competition by 8 points. In the long term, we expect Monster Beverage to generate higher earnings and profitability. The company focuses its endeavors on cultivating brand awareness and product promotion, also known as the push-pull strategy. Monster Corporation utilizes this strategy by directly bringing the products to their customers through public and sporting events, motivating customer demand. This technique accelerates the demand for Monster’s products, allowing high growth. Monster Beverage Corporation has returned 93.0% over the past year, which has significantly outperformed the S&P 500 by nearly 80% (13.97%). As the company maintains strategic innovations and increasing demand, we anticipate that Monster will continue of outperform the overall market. Below is a graph of MNST one year performance compared to the S&P 500.4 Share Highlights Market Capitalization Shares Outstanding Book Value per Share EPS (2014) P/E Ratio Dividend Yield Dividend Payout Ratio 18.11B 167.64M 8.27 2.50 38.90 N/A N/A Company Performance Highlights ROA ROE 23.84% 34.13% One Year Stock Performance vs. S&P 500 Liquidity Ratios Current Ratio Cash Ratio 2.60 0.67 Data Retrieved from Yahoo Finance! 1 In the long term, we anticipate that the S&P 500’s value will grow at a rate of 10%. Although the last 2 years’ average growth was 23%, 33% and 13% in November 2013 and 2014, respectively, the dramatic drop in the market last October has altered our prediction. Taking into consideration that the S&P 500 dropped nearly 200 points in mid-October, we anticipate high volatility in the years to come. Therefore, lowering our estimate to 10%. We believe this growth will be a result of accurate company valuations, consumer confidence and market efficiency. We also anticipate that the economic growth will be a catalyst for the S&P 500’s success. For the consumer staples sector, we anticipate the companies will follow the same track as the S&P 500 and have a relatively high growth value.4 Executive Summary We recommend Monster Beverage Corporation (NASDAQ: MNST) as a BUY. Although the U.S. economy has significantly recovered since the 2008 recession, we anticipate high volatility and frequent drops in the market, similar to October 2014. Monster Beverage Corporation moves non-cyclically with the market and therefore, will outperform and produce real returns during stable or low periods, as it has historically. In the past year, Monster has outperformed the S&P 500 by nearly 80% and has a return of 93%, as of November 17, 2014. Given Monster’s high P/E ratio and its identified growth, we anticipate that Monster will continue to significantly outperform the overall market. In the long term, given the dramatic growth trends and undeniable returns produced by Monster Beverage Corporation, its company’s stock is an ideal investment for the Krause Fund. Consumer Price Index The Consumer Price Index (CPI) is a monthly index released by the U.S. Department of Labor that measures the changes of prices paid for goods and services by consumers. The Consumer Price Index essentially evaluates the changes in consumers’ cost of living and measure the inflation rate relative to purchasing goods and services. Since the Consumer Price Index is highly correlated with the overall economy, variation in the index indicate the health of the economy. Throughout the last ten years, beginning in January, the inflation rate has ranged from -2.1% to 5.6% with 2008 being its highest. The peak in the Consumer Price Index is the result of the recession and the cost-pull theory. The cost pull inflation theory is the idea that companies will increase prices of goods and services to ensure that they will meet profit margins. However, the index had rebounded and the rate has stabilized at 1-2%. Following is a chart of the Consumer Price Index as annualized percentages over the last 10 years.6,7 Economic Outlook Standard & Poor’s 500 The S&P 500 (Standard & Poor’s 500) is a market valuedweighted index of 500 stocks designed to measure the broad performance of the economy and the overall return of the US equity market. The S&P 500 measures the changes of stock prices in the US equity market and gauges the consumer confidence level for businesses, consumers and investors. During the recession, the S&P 500 dropped 729 points from 1,526 to 797, in 2007 and 2009. However, quickly after the recession, the S&P 500 made a remarkable turn around and has had a steady increase moving forward. Due to the upward turn of the market and consumers’ confidence, the S&P500 is now at its highest level of roughly 2000. The chart below shows the price changes in the S&P 500 over the last 5 years.1,2,4 We also forecast that within the next 2-3 years the Consumer Price Index will be 2%. Our prediction is based on the confidence that consumers have in the economy and stability of our unemployment. Within the consumer staples sector, purchasers are willing to pay a small increase for products because of the demand and need for them. However, prices will stay relatively consistent with the Consumer Price Index’s movements, therefore steadying with the economy. On a yearly basis, we anticipate that prices will either climb by 2% to meet profit margins or companies will drive prices up for high profit yield. 7,8,9 In the short term, we predict that the S&P 500 will stabilize at a 2.5% growth rate. After a quick recovery from October’s sharp drop of roughly 8%, the S&P 500 has grown at nearly 10% in one month. Now that market has recovered, we believe that investors will stabilize the market with efficiency and revaluation. Within the consumer staples industries, we expect these companies to lead the market. Consumer staples companies are inelastic to stagnant and stable markets. Therefore, investing in a consumer staples company has a promising outlook compared to the overall market. 2 expenditures suggests a wealthy society and increased inflows into the economy. With the increase in disposable personal income and the demand for products and services, the consumer staples companies are anticipated to expand.16- Disposable Personal Income Disposable Personal Income is a monthly estimated statistic announced by the Bureau of Economic Analysis that accesses the amount of income available for spending and saving for a person after taxes have been paid. The most recent value of Disposable Personal Income in the United States is $15.7 billion, in September, the highest since 1959. The Disposables Personal Income has been an upward trend in the United States, and based on historical values, it is expected to continue to increase in the future. Many factors influence the DPI including overall economic conditions, employment rate, wages, consumer confidence, interest rates and taxation.13,14,15 21 With the growth in preceding quarters, we expected the real GDP to stabilize at 3.0% for the short term. Historically, the Federal Reserve lowers their estimates each quarter until the final data is in. Analyzing the past two months, the Federal Reserve has lowered their estimate 1.1%. We anticipated the final value will be 0.5% less than the third quarter. Even though there is a decrease quarter to quarter, we believe that 3.0% is a positive signal for consumer staples companies. In the short term, we estimated that the Disposable Personal Income will increase on average 2 billion dollars every month for the next six months. This increase will have a favorable impact on Consumer Staples. Consumer will become more confident in the economy’s direction given the recent rebound and, therefore, significantly increasing the Disposable Personal Income. In the long run, we are optimistic and anticipated a growth of 4% in the next 2-3 years. The increase in exports will signal a strong economy for the United States which is beneficial for the consumer staples sector. The expansion for goods and services internationally indicates profitability and growth for high demand companies. We also believe that higher prices, a result of demand, will lower the interest rates establishing significant expansion for the real GDP. Below is a graph of the Real Gross Domestic Product as annualized percentage of change over the last ten years.20 In the long run, we are less optimistic and expect the Disposable Personal Income will continue to grow, but at a slower pace than the last couple of years, as shown in the chart below. 13,14 Data Retrieved from FRED We anticipate the DPI will only grow to $17 billion in the next 2-3years. With the decrease in growth of Disposable Personal Income, we expect consumer staples companies to establish new strategies to maintain profit margins. Although we forecast growth to decrease, we expect demand to be consistent and benefit the consumer staples companies moving forward.15 Capital Markets Outlook The consumer staples sector mostly consist of non-cyclical industries, therefore, as the United States equity market experiences dramatic drops as it did last October, investors are going to want to seek stable companies that produce high demand products. The consumer staples sector is resistant to stagnation and a down turning market, consequently, making our industry’s prospects a positive investment no matter what direction the market is going. Given the expected growth in Disposable Personal Income and real GDP, we are confident that the increase in demand and the expansion of the economy will be beneficial for the consumer staples sector. Over the past year, the Consumer Staples Select SPDR ETF has performed relatively close to the S&P 500 with only a 3 point difference. Given that the S&P 500 is expected to grow 10+% in the next 2-3 years, an investor can expected the same return from a consumers staples company. Shown following in the chart is price changes of the consumer staples sector and the S&P 500 in the past year.4 Real Gross Domestic Product The Real Gross Domestic Product (Real GDP) is a comprehensive statistic of all goods and services produced in the United States. The Real GDP is quarterly released by the Bureau of Economic Analysis indicating the economic health and measuring profitability growth and expected returns on the capital market. In the third quarter of 2014, the Real GDP increased at an annual rate of 3.5%. In the second quarter, the Real GDP increased 4.6%. The 2014 increase is primarily a result from governmental spending, fixed investments, exports and positive contributions from personal consumption expenditures. The improvement in Real GDP is a positive indicator for the growth of the consumer staples sector. The positive flows from personal consumptions 3 The consumer staples industry group moves consistently with the market and in the last six months has barely underperformed the S&P 500. Compared to the competing industry groups, the consumer staples has ranked the fifth highest with a return of 7.57%. Below is a chart showing how the consumer staples industry group’s returns compare to the S&P 500 and other sectors.32 Data Retrieved from Yahoo Finance! Notice that during the latest drop, the Consumer Staples Select SPDR ETF dropped fewer points than the S&P 500, which was most likely carried by high demand companies such as: the beverage, food, and tobacco industries. As the economy recovers, we believe that the market will experience frequent drops allowing in the consumer staples sector to slightly outperform the market in the long run. Industry Analysis Industry Overview The consumer staples sector is segmented into the following industry groups: Food & Staples Retailing o Drug Retail, Food Distributors, Food Retail, Hypermarkets & Super Centers Food, Beverages & Tobacco o Brewers, Distillers & Vintners, Soft Drinks, Agricultural Products, Packaged Foods & Meats, Tobacco Household & Personal Products32 Sector industries’ return over six months. Data retrieved from Select Sector SPDR Sub-Industry The beverage industry is segmented into three sub-industries that is comprised of alcoholic and non-alcoholic beverages: Brewers, Distillers and Vintner, and Soft Drinks. These subindustries consist of wines, beers, spirits, energy drinks, sodas, and non-carbonated beverages. In the beverage industry, the soft drink sub-industry is leading with approximately 62% of the industry’s revenue in 2014. Specifically, energy drinks make up $6.8 Billion of its revenue and leads in growth with 10.8%. In the United States, Monster Beverage Corporation accounts for one-third of the energy drink revenue itself, making it the nation’s leading energy drink producer.22,25,31 Below is a pie chart of the estimate weight of each industry group in the S&P 500. The consumer staples is ranked the sixth highest with 10% of the S&P 500 index.32 Consumer Discretionary Consumer Staples Energy 3% 12% 22% 3% 10% 9% 11% 14% 16% Profitability Financials $1,500,000,000 Healthcare $1,000,000,000 $500,000,000 Industrials $0 Materials Technology In Dollars Utilities Profitability by sub-industry categories. Data retrieved from IBISWorld Sector industries’ estimated weight in the S&P 500. Data retrieved from Select Sector SPDR As demonstrated in the chart above, the soft drink subindustry hold the majority of the beverage industry’s 4 profitability with energy drinks in the top three controlling $787.2M. Given its high growth and profitability, we expect energy drink producing companies to propel and actively expand in market capitalization.22-32 Company Segmentation for the Soda Sub-Industry Coca Cola Co Recent Development and Industry Trends The most recent trends and developments, encourage a positive outlook for the consumer staples industry group. Although there is heavy momentum toward healthier beverages, the increase for demand signals growth of this industry. The expansion in grocery and discount retail store products signal an increase in average price per volume, therefore, allowing visible improvements in profitability. The strengthening dollar has increased competition between foreign manufacturers such as Red Bull and has advocated growth and demand in emerging markets. The developing concerns for healthier and more environmental safe products has drove producers to use more ecological bottles and cans, along with reducing the artificial flavors and additives in products. We anticipate that the product innovations and increased demand, will expand the consumer staples group by 4% in the next 5 years.31 Pepsi Co 29% 41% Dr Pepper Snapple Group 10% Other 20% Data Retrieved For IBISWorld In the chart below shows the leading firms within the beverage industry compared to Monster Beverage Corporation by financial ratios and comparative values.23 Market and Competition The soft drink sub-industry is highly concentrated with about 50 of its top companies contributing to 95% of its revenue. The demand is driven by young demographics, its taste, and the post consumption benefits. This contributes to new players to entering the industry. As new players enter the market, competitive innovation will promote fast growing niche products. However, customer loyalty will protect the leading companies’ revenues and eliminate new entrees. Despite the declining revenue and growth of soda products, the acceleration in energy drink revenues has kept these companies in the green. To maintain profit margins, soda companies will need to adopted new strategies to innovate energy drink products into their product lines.23 Company Coca-Cola Pepsi Co Dr. Pepper Snapple Monster Beverage Market Cap (M USD) 181,840.4 0 136,921.9 4 12,074.39 EPS P/E Ratio Cash Div. 2.0539 20.1857 4.4148 20.5830 3.4447 17.9636 15,027.48 2.4119 37.2698 0.305 0 0.655 0 0.410 0 - Data Retrieved from Bloomberg Industry Leaders The industry’s three major players are Coca Cola Company, PepsiCo Inc. and Dr. Pepper Snapple Group Inc. Their market caps are 187.99B, 147.30B and 13.75B respectively. Coca Cola Company, PepsiCo Inc. and Dr. Pepper Snapple Group Inc. are the major players of soda, and juice and bottle water productions. Coca Cola Company makes up 28.8%, 32.8% and 5.6% of the soda, juice and water bottle industries, respectively. PepsiCo Inc. holds 20.3%, 36.6% and 9.9% of the soda, juice and water bottle industries. Dr. Pepper Snapple Group controls 10.0% and 8.8% of the soda and juice industries, respectively. Below is a chart showing that the major soda companies make up 59% of the soda sub-industry, the largest sub industry.23 5 Market Capitalization: Coca Cola and Pepsi’s companies are relatively larger than Monster Beverage. However, all of the companies are considered a large stock company by qualified size. Coca Cola and Pepsi’s size can be explained by their long years of growth and development compared to Monster’s shorter life cycle. Monster Beverage’s size ranks third, above Dr. Pepper and Snapple Group, which is appropriate for its expected growth and profitability. EPS: Earnings per Share (EPS) generally serves as an indicator for company’s profitability. EPS is a major component in determining a company’s stock price. Relatively high EPS is a good indication of the company’s continuing values. Overall, all the four companies seem to be in a great position. P/E Ratio: A high Price to Earnings Ratio suggest higher expected earnings in the future. Compared to the industry leaders, Monster Beverage has the highest P/E ratio by over 7 points. We anticipate that Monster with generate higher earnings in the short to long term. Cash Dividend: Cash dividends are annually or quarterly dividends to stockholders. Monster Beverage does not pay dividends to its stockholders which makes its value 0. As an investor, we would consider Monster’s reinvestments as a positive outlook. The reinvestments enable Monster to maximize gains and increase its intrinsic value.23 N/A 2246 2061 1703 1304 Year Data retrieved from: Net Advantage (Standard and Poor’s) Corporate Strategy Monster Beverage Corporation mainly focuses on developing and marketing new products and expanding its international business. In recent years, the company has been particularly aiming at developing healthier drinks that have fewer calories to meet the demand from consumers who are concerned about health. For 2013, nine different innovative products were introduced. Selling its products in 114 countries, the company also plans to introduce its products in additional countries to increase sales outside of the United States. The graph below shows the amount of gross sales to customers outside of the United States and its percentage of total sales have been increasing. The chart below compared the stock prices of leading firms within the beverage industry compared to Monster Beverage Corporation. Currently, Monster Data retrieved from IBISWorld Beverage Corporation is providing a higher return than its leading competitors. We can expect this for the long term considering Monster’s reinvestment policy and high P/E ratio. 2013 2012 2011 Gross Sales to customers outside of United States (in Million $) 580.6 513.9 381.0 Percentage of total sales 23% 22% 20% Life Cycle Monster Beverage Corporation is currently in the growth stage. According to Jeffrey Hooke of Security Analysis and Business Valuation on Wall Street, the performance of a corporation in the growth stage should have a “steady growth in sales as product acceptance widens.” The Financial Summary shows that the revenue of Monster Beverage Corporation has been constantly growing. As a matter of fact, 2013 is Monster’s 21st consecutive record year of increasing gross revenue. As the company develops and markets more innovative products, the long term trend will remain and will reach a steady state.33,34 Key Investment Positives and Negatives Overall, the beverage industry is anticipated to be a growth industry. Since Americans are choosing a healthier lifestyle and with government campaigns promoting healthier habits, the demand and revenue for both regular and diet soft drinks will decline. This decline will be counteracted by the growth in energy drink products and new innovations and therefore, maintaining profit margins within the industry.22,23,24 Financial Summary Monster Financial Summary (Million $) 2013 2012 2011 2010 2009 2,246 2,061 1,703 1304 1143 Revenue 340 286 212 209 Net Earnings 339 1,420 1,043 1,362 1082 800 Total Asset 1.95 1.86 1.53 1.14 1.11 EPS Data retrieved from: Net Advantage (Standard and Poor’s) 35 Company Analysis Company Overview Beginning in 1930s, Monster Beverage Corporation was known as Hansen’s Juices, Inc. and changed its name to Monster Beverage Corporation on January 5, 2012. Headquartered in Corona, California, Monster is a holding company and conducts no operating business except through its consolidated subsidiaries. It is the nation’s largest publicly traded energy drink company by annual revenue and offers products including energy drinks and juice based and soda beverages. The company has two segments, DSD Segment and Warehouse Segment. The majority of its revenue is derived from product sales in its DSD Segment which is primarily energy drinks products.33 2014 2013 2012 2011 2010 536.1 484.2 454.6 356.4 238.1 1Q 687.2 630.9 592.6 462.1 365.7 2Q 636.0 590.4 541.9 474.7 381.5 3Q N/A 540.8 471.5 410.9 318.7 4Q Products and Segments Monster Beverage Corporation has two different segments, Direct Store Delivery Segment that includes energy drinks, and the Warehouse Segment, that includes juice-based and soda beverages. DSD Segment The energy drinks are developed, marketed, and sold under multiple brand names, including Monster Energy®, Monster Rehab®, and etc. The sales from Monster Energy® brand energy drinks accounted for 92.5%, 92.3% and 91.2% of the total sales for year 2013, 2012, and 2011, respectively. The DSD segment operates primarily through a special distributor network.33 6 Warehouse Segment The Warehouse Segment sells the products directly to retailers. The products include Huber’s® lemonade, a ready to drink lemonade product that contains no preservatives and artificial flavors. Along with others, the corporation produces Hansen’s® soda, a leading natural soda product on the West Coast of United States for the last 30 years.33 identification and competitors.33 The pie chart below shows the percentage of sales from the DSD Segment and the Warehouse Segment.33 96% Direct Store Dilevery their products from Manufacture and Distribution Instead of directly manufacturing its product, Monster Beverage Corporation outsources the manufacturing to a third party bottlers and co-packers throughout the United States and abroad. Monster is generally responsible for the purchases and deliveries to its third party bottlers and copackers. The company purchases ingredients, such as concentrates, sweeteners, juices, and cans, from US and foreign suppliers and delivers the ingredients to its third party partners. Generally, all raw materials are purchased from single manufacturers. Independent suppliers hold the largest portion of the expenses for product development, which allows Monster Corporation to develop new products and flavors. Monster Beverage Corporation packages its products both domestically and internationally, enabling them to produce its products closer to the selling markets and to reduce freight and transportation costs. Monster Energy® Drinks are sold in roughly 114 countries and territories and account for $580.5 million gross sales outside the United States for the year ending December 31, 2013.33 Other Products Monster Beverage Corporation also plans on introducing additional flavors and developing new product lines. 4% distinguish Warehouse Significant Customers Monster Beverage Corporation’s primary customers are beverage distributors, retail grocery chains, drug and specialty chains, wholesalers, mass merchandisers, convenience stores, health food distributors and the military. For 2013 and 2012, Coca-Cola Refreshment USA, Inc. (“CCR”) accounted for nearly 29% and 28% of Monster’s total sales. The chart below shows the percentages of sales from the company’s primary customers. As we can see that full service distributors were the major buyers from 2011 to 2013.33 2013 2012 2011 63% 63% 64% Full service distributors 9% 10% Club stores, drug chains & mass 9% merchandisers 23% 22% 20% Outside the U.S. 3% 4% 4% Retail grocery, specialty chains and wholesalers 2% 2% 2% Other Competition The beverage industry is highly competitive. Monster Energy Corporation’s major competitors in the energy drink industry are Red Bull, Rockstar Energy and NOS Energy Drink. The areas of competition include pricing, packaging, flavor, and development of new products as well as promotional and marketing strategies. Major competitors in the beverage industry include PepsiCo, Inc., The Dr. Pepper Snapple Group, Inc. Although some of the competitors are better positioned in the beverage industry, Monster’s low property plant and equipment capital structure provides Monster a competitive advantage. As shown in the chart below, compared to Coca-Cola Co, Pepsi Co, and Dr. Pepper Snapple, Monster has the highest Price to Earnings ratio which gives it a positive potential outlook.22,23,33 P/E Ratio 40 30 20 Marketing Strategy Monster Beverage Corporation’s marketing strategy focuses on their endeavors on cultivating brand awareness and product promotion. Monster Corporation utilizes a push-pull strategy which enhances demand for their products with promotions and advertising. Monster Corporation pushes its brands with competitions, endorsements from selected public and sporting figures, sampling, sponsorship, advertisements and coupons. It also pulls the consumers’ demand by directly bringing the products to their customers through public and sporting events. Monster Corporation believes the key to successful marketing is differentiation. It fulfills this strategy by frequently redesigning their packaging to maximize their 10 0 Coca-Cola Co Pepsi Co Dr. Pepper Snapple Monster Beverage P/E Ratio Governmental Regulations Monster Beverage Corporation and their products are subject to numerous U.S. federal, state and international regulations applicable to the production, transportation, sale, safety, advertising, labeling and ingredients of such products. Regulations and health officials impose a threat and adversely affect the company, finances and operations. These 7 factors such as regulation and litigation will cause a high volatility level of the stock price.33 issues caused by energy drinks. Although the Food and Drug Administration does not have any regulation subjects to energy drink industry, health experts are pushing the government to establish regulations that can limit the amount of caffeine in Energy Drinks. Also, the growing concerns about obesity problems may shift consumers’ preferences to healthier products such as bottle water, vitamin water, and natural juice.33 Partnership: Coca-Cola Company In August 2014, the Coca-Cola Company, one of major players in the beverage industry, acquired nearly 16.7 percent ownership in Monster and is willing to transfer its energy drink business to Monster. In return, Monster agreed to transfer its soda and juice based business to the Coca-Cola Company. We believe this agreement will help Monster expand business in both domestic and international markets, as it allows Monster to have access to networks that CocaCola has worldwide.36 Regulation There will be an increase in regulations in response to the concerns over health, obesity, and caffeine consumption. Enforced regulations and public concerns represent a risk to the success and stability of Monster Beverages Corporation. The food and drug regulations in countries outside of the United States can also limit the revenue of Monster’s products.39 Catalysts for Growth In 2013, gross sales outside of United States was $580.6 million. We anticipate that the number will grow in the next five years, because the demand in emerging market in countries such as China will help Monster spread their product to additional countries outside of United States. Consumer’s concerns about health and wellness will shift the demand of carbonated soda drinks, such as Coca Cola and Pepsi, to demand of healthier alternative beverages. As Monster developing more and more innovative products, it will attract more consumers.33 Valuation Discussion Valuation overview We used three different valuation techniques to evaluate the target stock price of Monster Beverage Corporation. The techniques include Discounted Cash Flow Model, Economic Profit Model, and Fundamental Price to Earning model. By using the DCF and EP models, we reached the intrinsic value of $128.24, which is 16.51% higher than its current stock price. The Fundamental Price to Earning model provides us an intrinsic value of $93.07. The discrepancy between these two results is due to the fact that Monster does not pay any dividend to its shareholders, which undermines the credibility of the intrinsic value provided by the DDM model. Thus, we believe the intrinsic value of 128.24 is more accurate. Key Investment Positives Efficient Capital Structure Monster’s strategy of outsourcing the manufacturing to third party bottlers and co-packers provides it with competitive advantages of lower labor, operating and overhead costs, enabling it to have more money to develop new products. Outsourcing also allows Monster to keep their property plant and equipment at a low level, which can help it reduce expenses such as depreciation and plant maintenance costs.37 Revenue Decomposition Based on economic indicators, industry information, and historical information, we forecast the potential growth rate of the revenue generated by four different product lines. We estimate Monster’s total net sales to grow at an average rate of 8.03% from 2014 to 2019. We expect the continuing value of the company to be 5.55%. Fast Expansion Monster Beverage Corporation believes that international growth is one of the key value drivers. We also believe that the rises of emerging markets will provide Monster great opportunities to expand spread its business and to generate value. The BRIC countries, Brazil, Russia, India, and China, account for more than 25 percent of global GDP. The increasing demand in these countries provides Monster a promising future.38 Energy Drinks Revenue generated by Monster’s Energy Drinks accounts for approximately 93% of its total revenue. We anticipate the pattern to remain in the next five years. We are very optimistic about the revenue generated by the energy drinks because we believe that the long term strategic partnership with Coca Cola is a good opportunity for Monster to boost its sales. We have forecasted the revenue to grow at 5.55% at a steady state in five years. Key Investment Negatives Public Concerns Studies found that energy drinks with a high level of caffeine can cause serious health problems in young children. There is also an increasing trend of people become aware of their health. Such study may create public concerns over health Non-Carbonated Drinks Monster has been investing in developing healthier “alternative” drinks that have no artificial flavors, caffeine, or preservatives to meet the increasing demand of its 8 customers. These healthy products will make up a large portion of the Non-Carbonated Drinks. We believe these new products will increasingly generate revenue for Monster in next five years because consumers are more aware of their health and obesity problems. Company, Pepsi Co, and Dr. Pepper Snapple Group as Monster’s major competitors. We averaged out the estimated Price to Earnings ratios of these company, which are calculated by using the stock price as of November 18, 2014 divided by the earnings of each company. Multiplying this industry average by the forecasted Earnings per Share of 2014 and 2015, we produced $52.35 and $53.90 respectively. The intrinsic value we produced by using the Relative P/E Valuation Model is lower than Monster’s current stock price, $110.07. We do not think this value accurately represents the intrinsic value of Monster. Carbonated Drinks Over the last four years, the revenue from Carbonated has been growing negatively because of the decreased sales by volume of Hansen’s ® soda. Also, transferring soda and juice business to Coca-Cola will affect the revenue from carbonated drinks in the long run. We have forecasted the revenue to grow at 3.0% in 2014. Weighted Average Cost of Capital For Weighted Average Cost of Capital, we reached an estimate of 7.88%. Other Products Monster has been focusing on introducing other innovative products such as energy shots. Although the revenue from other products only makes up a very small portion, it will help Monster grow because innovative products can easily attract consumer’s attention. Cost of equity We applied Capital Asset Pricing Model to calculate Monster’s Cost of equity. The Risk premium that we used is 4.64% which is the US historical geometric average premium. We used yield of 30 year US Treasury Bond as our risk free rate. The CAPM model gives us the cost of equity of 7.89%. The graph below shows the percentage of total revenue by product line Energy drinks Cost of Debt Monster does not have any publicly traded bond. We used its major competitor, the Coca-Cola Company’s 2.98% pretax cost of debt, as Monster’s pretax cost of debt. Non-Carbonated Cost of preferred Stock Monster does not have any preferred stock. Renenue 1% 1% 5% Capital Structure Monster does not have any short term or long debt. All of its $1.3 million debt at December 31, 2013 came from capital leases and collateralized by vehicles. The low debt capital structure gives Monster lower debt ratio and debt to equity ratio, compared to its competitors. Carbonated 93% Other Sensitivity Analysis We built a Sensitivity Analysis to evaluate how the intrinsic value changes as key assumptions change. Discounted Cash Flow and Economic Profit Model The Discounted Cash Flow model and the Economic Profit Model produced the same results of $128.24per share, 16.51% higher than the current stock price of $110.07 as of November 18th 2014. We reached a conclusion of buy based on these results. Risk-Free-Rate: The Risk-Free-Rate of 3.07% that we used in our models is the yield of 30 year US Treasury Bond. This risk free rate produced the intrinsic value of $128.24 per share. As the sensitivity table shows, the intrinsic value decreases dramatically as the Risk-Free-Rate increases. A risk free rate of 2.67% will produce a price of $153.58 per share, which is 39.53% higher than Monster’s current price. Dividend Discount Model By using the Dividend Discount Model, which is also known as the Fundamental Price to Earning model, we got an intrinsic target price of $93.07. This price is lower than the one provided by the DCF and EP model because Monster does not pay any dividend to its shareholders. Therefore, we did not consider this intrinsic value to reach an investment recommendation. Beta The Beta that we used to calculate the Weighted Average Cost of Capital is a weekly data retrieved from the Bloomberg. The intrinsic value is also very sensitive to the Beta. A 3 percent increase of Beta can cause 7 percent decrease of in price. Relative P/E Valuation Model In order to evaluate Monster’s performance relative to other companies within the beverage industry, we conducted a Relative P/E Valuation Model. We choose Coca Cola Equity Risk Premium 9 The Equity Risk Premium will also influence Monster’s stock price because equity makes up the majority of the capital structure. There is a positive correlation between the Risk Premium and the intrinsic value. If the Risk Premium increase to 4.68%, the price would decrease to $126.12 per share. The sensitivity table shows that, compared to Beta and risk free rate, stock price is less sensitive to Equity Risk Premium CV Growth Rate The intrinsic value increases as the CV growth rate increases. The CV growth rate that we are using is 5.55%, but when it increases to 5.95%, the intrinsic value will be driven to $150.47 per share. When it decreases to 5.15%, the stock price will decrease to $112.55 per share. Factors such as capital expenditures, depreciation costs, and research can affect the CV Growth Rate. Important Disclaimer This report was created by students enrolled in the Security Analysis (6F:112) class at the University of Iowa. The report 10 11 was originally created to offer an internal investment recommendation for the University of Iowa Krause Fund and its advisory board. The report also provides potential employers and other interested parties an example of the students’ skills, knowledge and abilities. Members of the Krause Fund are not registered investment advisors, brokers or officially licensed financial professionals. The investment advice contained in this report does not represent an offer or solicitation to buy or sell any of the securities mentioned. Unless otherwise noted, facts and figures included in this report are from publicly available sources. This report is not a complete compilation of data, and its accuracy is not guaranteed. From time to time, the University of Iowa, its faculty, staff, students, or the Krause Fund may hold a financial interest in the companies mentioned in this report. Yahoo Finance, Retrieved from: http://finance.yahoo.com/news/consumer-staples-stockoutlook-june-220001757.html 12 K-Swiss. (2009). Annual report 2009. Retrieved from: http://www.wikinvest.com/stock/KSwiss_(KSWS)/Filing/10-K/2009/F5210191 13 United States Disposable Personal Income. (1959-2014 Trading Economics. Retrieved from: http://www.tradingeconomics.com/united-states/disposablepersonal-income 14 Disposable Income. InvestWords. Retrieved from: http://www.investorwords.com/1491/disposable_income.ht ml#ixzz3CJfmWQE2 15 Bureau of Economic Analysis. (2014) Retrieved from: http://www.bea.gov/newsreleases/national/pi/pinewsrelease. htm References: 1 The Financial Journalist. (2014, September 4). An Overview of 10 Economic Reports and Indicators You Need to Know. Retrieved from: http://www.aimr.org/pressroom/fjnews.html 16 http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.Z G 17 Bloomberg Economic Statistics U.S. GDP 18 http://bea.gov/newsreleases/national/gdp/gdpnewsrelease. htm 19 http://www.forbes.com/sites/samanthasharf/2014/08/28/us-gdp-grew-4-2-in-the-second-quarter-2013-up-from-firstestimate/ 2 Bloomberg L.P. (2014, September 5). Description of Standard & Poor’s 500. Retrieved from Bloomberg database. 3 FactSet Research Systems Inc. (2014 September 4). Return on Standard and Poor’s 500 from 2004 to 2014. Retrieved from FactSet database. 20 Federal Reserve Bank of St Louis. (2014) Retrieved from: http://research.stlouisfed.org/fred2/series/GDPC1 4 Yahoo Finance! 2014 21 Bureau of Economic Analysis. (2014) Retrieved from: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrele ase.htm 5 Investopedia US. (2014, September 5). Inflation: What Is Inflation? Retrieved from: http://www.investopedia.com/university/inflation/inflation1. asp 22 First Research. (2014, September 14). Soft Drink Manufacturing Industry Profile. Retrieved from: http://www.firstresearch.com/Industry-Research/Soft-DrinkManufacturing.html 6 U.S. Bureau of Labor Statistics. (2014, September 4). Consumer Price Index - All Urban Consumers. Retrieved from: http://data.bls.gov/timeseries/CUSR0000SA0?output_view= pct_1mth. Valuation Academy. (2014, September 14). Porter’s Five Forces In Action: Sample Analysis of Coca-Cola. Retrieved from: http://valuationacademy.com/porters-five-forces-inaction-sample-analysis-of-coca-cola/ 23 7 Economics Online. (2014, September 5). Stable Prices. Retrieved from: http://www.economicsonline.co.uk/Managing_the_economy /Stable_prices.html 24 IBISWorld. (2014, September). Energy Drink Production in the US. Retrieved from: IBIS Industry Market Research database. 8 Bloomberg L.P. (2014, September 5). Description of Consumer Price Index. Retrieved from Bloomberg database. 25 IBISWorld. (2014, September). Soda Production in the US. Retrieved from: IBIS Industry Market Research database. 9 The Financial Journalist. (2014, September 4). An Overview of 10 Economic Reports and Indicators You Need to Know. Retrieved from: http://www.aimr.org/pressroom/fjnews.html 26 IBISWorld. (2014, September). Juice Production in the US. Retrieved from: IBIS Industry Market Research database. 10 Zacks Equity Research.(June 21, 2013). Consumer Staples Stock Outlook. 27 IBISWorld. (2014, September). Beer, Wine & Liquor Stores in the US. Retrieved from: IBIS Industry Market Research database. 11 28 IBISWorld. (2014, September). Bottled Water Production in the US. Retrieved from: IBIS Industry Market Research database. 29 IBISWorld. (2014, September). Tea Production in the US. Retrieved from: IBIS Industry Market Research database. 30 IBISWorld. (2014, September). Coffee Production in the US. Retrieved from: IBIS Industry Market Research database. 31 IBISWorld. (April, 2014). Global Soft Drink & Bottled Water Manufacturing. Retrieved from: http://clients1.ibisworld.com/reports/gl/industry/industryoutl ook.aspx?entid=42 32 Select Sector SDPR. (2014) Retrieved from: http://www.sectorspdr.com/sectorspdr/ 33 Monster Beverage Corporation. (2014, September 21). Monster Beverage Corporation 2013 Annual Report. Retrieved from: http://files.shareholder.com/downloads/HANS/3494687229 x0x746046/8bb1c204-a666-4a75-a933178abd4742d9/Monster_Beverage_2013_Annual_Report.pd f 34 Hooke J. C. (2010). Security Analysis and Business Valuation on Wall Street (2nd Edition). Wiley. 35 Data retrieved from: Net Advantage (Standard and Poor’s) 36 Study finds energy drinks can lead to serious health issues in young children. (2014) Retrieved from: http://www.kshb.com/decodedc/study-finds-energy-drinkscan-lead-to-serious-health-issues-in-young-children 37 Pros & Cons of Outsourcing Manufacturing Jobs. (2014) Retrieved from: http://smallbusiness.chron.com/pros-ampcons-outsourcing-manufacturing-jobs-40320.html BRIC Countries – Background, Latest News, Statistics and Original Articles. (2014) Retrieved from: http://www.globalsherpa.org/bric-countries-brics 39 Bowman. L. (Nov 17th 2014) Study finds energy drinks can lead to serious health issues in young children. Retrieved from: http://www.kshb.com/decodedc/study-finds-energy-drinkscan-lead-to-serious-health-issues-in-young-children 38 12 MONSTER BEVERAGE CORPORATION Revenue Decomposition (Million $) Fiscal Years Ending Dec. 31 Segments Direct Store Delivery Growth Warehouse Growth Total Net Sales Change in Total Net Sales Product Lines Energy drinks Growth Non-Carbonated Growth Carbonated Growth Other Growth Total Net Sales Change in Total Net Sales 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019CV 1608.33 32.63% 94.90 3.95% 1703.23 30.62% 1966.48 22.27% 94.22 -0.72% 2060.70 20.99% 2147.36 9.20% 99.07 5.15% 2246.43 9.01% 2399.03 11.72% 89.32 6.00% 2309.70 11.00% 2650.92 10.50% 70.11 5.00% 2721.03 17.81% 2908.06 9.70% 41.43 5.00% 2949.50 8.40% 3108.72 6.90% 59.34 5.00% 3168.05 7.41% 3264.15 5.00% 116.29 5.00% 3380.44 6.70% 3394.72 4.00% 173.21 5.00% 3567.93 5.55% 1563.33 32.70% 94.40 17.21% 32.47 -1.33% 13.03 4.88% 1703.23 30.62% 1906.24 21.93% 110.22 16.76% 31.04 -4.38% 13.21 1.31% 2060.70 20.99% 2082.24 9.23% 120.15 9.01% 29.25 -5.80% 14.80 12.08% 2246.43 9.01% 2311.28 11.00% 130.96 9.00% 30.12 3.00% 15.98 8.00% 2488.35 10.77% 2530.86 9.50% 141.43 8.00% 31.48 4.50% 17.26 8.00% 2721.03 9.35% 2745.98 8.50% 151.34 7.00% 33.37 6.00% 18.82 9.00% 2949.50 8.40% 2951.93 7.50% 160.42 6.00% 35.20 5.50% 20.51 9.00% 3168.05 7.41% 3152.66 6.80% 168.44 5.00% 36.79 4.50% 22.56 10.00% 3380.44 6.70% 3329.21 5.60% 176.02 4.50% 37.89 3.00% 24.82 10.00% 3567.93 5.55% 13 MONSTER BEVERAGE CORPORATION Income Statement (Million $) Fiscal Years Ending Dec. 31 Sales COGS excluding D&A Depreciation Amortization of Intangibles Gross Income SG&A Expense EBIT (Operating Income) Non-operating Income - Net Non-operating Interest Income Other Income (Expense) Interest Expense Unusual Expense - Net Pretax Income Income Taxes Consolidated Net Income Net Income EPS Total Shares Outstanding 2011 2012 2013 2014E 1,703.23 2,060.70 2,246.43 2,488.35 791.84 974.48 1,050.74 1,149.82 17.03 20.51 22.71 28.96 0.05 0.05 0.05 0.09 894.31 1,065.66 1,172.93 1,309.48 437.89 515.03 589.22 606.59 456.42 550.62 583.72 702.88 1.62 (0.37) (8.18) 3.11 1.67 1.40 1.00 1.20 (0.05) (1.77) (9.18) 1.92 0.05 --0.00 0.73 1.10 11.64 0.00 457.27 549.15 563.89 709.11 171.05 209.13 225.23 279.46 286.22 340.02 338.66 429.65 286.22 340.02 338.66 429.65 1.54 1.86 2.00 2.60 174.28 165.78 166.82 165.03 14 2015E 2,721.03 1,257.34 33.19 0.09 1,430.40 663.31 767.09 3.40 1.33 2.08 0.00 0.00 773.90 313.20 460.70 460.70 2.82 163.37 2016E 2,949.50 1,362.91 36.27 0.09 1,550.22 719.01 831.22 3.69 1.47 2.22 0.00 0.00 838.59 339.38 499.22 499.22 3.08 161.83 2017E 3,168.05 1,463.91 38.10 0.09 1,665.96 772.28 893.67 3.96 1.64 2.33 0.00 0.00 901.60 364.88 536.72 536.72 3.35 160.40 2018E 3,380.44 1,562.05 39.33 0.09 1,778.97 824.06 954.91 4.23 1.82 2.41 0.00 0.00 963.37 389.88 573.49 573.49 3.61 159.08 2019CV 3,567.93 1,648.68 40.16 0.09 1,879.00 869.76 1,009.23 4.46 2.01 2.45 0.00 0.00 1,018.16 412.05 606.11 606.11 3.84 157.85 MONSTER BEVERAGE CORPORATION Balance Sheet (Million $) Fiscal Years Ending Dec. 31 Assets Current Assets Cash Short Term Investments Accounts Receivables, Net Inventories Other Current Assets Total Current Assets Net Property, Plant & Equipment Property, Plant & Equipment - Gross 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019CV 359.33 411.28 218.74 155.61 37.71 1,182.68 45.15 82.11 222.51 97.04 236.71 203.11 75.70 835.07 69.14 116.35 211.35 402.25 296.18 221.45 51.82 1,183.04 88.14 152.47 524.29 410.80 298.60 254.28 52.70 1540.68 101.03 194.31 770.70 419.54 326.52 278.06 53.59 1848.42 110.40 236.87 1090.38 428.46 324.44 301.41 54.51 2199.20 115.98 278.72 1453.56 437.58 316.81 323.74 55.43 2587.12 119.73 320.57 1858.55 446.88 304.24 345.45 56.37 3011.50 122.24 362.42 2264.25 456.39 321.11 364.61 57.33 3463.69 123.93 404.27 Accumulated Depreciation Total Investments and Advances Intangible Assets Deferred Tax Assets Other Assets Total Assets 36.96 23.19 48.40 58.58 4.41 1,362.40 47.21 21.39 54.65 59.50 3.58 1,043.33 64.32 9.79 65.77 63.61 10.15 1,420.51 93.280 10.87 65.68 68.09 6.19 1,792.55 126.472 12.06 65.63 65.84 6.77 2,109.12 162.742 13.39 65.58 61.55 7.33 2,463.04 200.844 14.86 65.53 57.09 7.88 2,852.21 240.177 16.50 65.48 52.63 8.40 3,276.76 280.336 18.32 65.43 47.99 8.87 3,728.23 Liabilities & Equity ST Debt & Current Portion of LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities 0.00 113.45 11.00 141.65 266.09 0.00 127.33 5.47 155.75 288.55 0.00 119.38 9.36 187.28 316.01 0.00 146.25 6.74 200.82 353.81 0.00 159.93 7.55 219.60 387.08 0.00 173.36 8.19 238.03 419.58 0.00 186.20 8.80 255.67 450.68 0.00 198.68 9.40 272.81 480.90 0.00 209.70 9.94 287.94 507.59 Deferred Income Total Liabilities 117.15 383.24 110.38 398.93 112.22 428.23 214.28 568.09 234.32 621.40 253.99 673.57 272.81 723.49 291.10 772.00 307.24 814.83 230.29 1,168.64 288.97 1,508.66 369.10 1,847.33 369.10 2,276.97 369.14 2,737.68 369.15 3,236.89 369.16 3,773.61 369.16 4,347.11 369.17 4,953.22 (1.55) 0.00 (418.23) 979.16 1,362.40 0.55 1.53 (1,155.31) 644.40 1,043.33 (1.23) 0.00 (1,222.91) 992.28 1,420.51 (1.23) 0.00 (1,420.39) 1,224.46 1,792.55 (1.23) 0.00 (1,617.86) 1,487.73 2,109.12 (1.23) 0.00 (1,815.33) 1,789.47 2,463.04 (1.23) 0.00 (2,012.81) 2,128.73 2,852.22 (1.23) 0.00 (2,210.28) 2,504.76 3,276.76 (1.23) 0.00 (2,407.75) 2,913.40 3,728.23 Shareholders' Equity Common Stock and additional paid-in capital Retained Earnings Cumulative Translation Adjustment/Unrealized For. Exch. Gain Unrealized Gain/Loss Marketable Securities Treasury Stock Total Shareholders' Equity Total Liabilities & Shareholders' Equity 15 MONSTER BEVERAGE CORPORATION Cash Flow Statement (Million $) Fiscal Years Ending Dec. 31 Operating Activities Net income (loss) Amortization of trademark Depreciation & amortization Loss (gain) on disposal of property & equipment Stock-based compensation Loss (gain) on put option Loss (gain) on investments, net Deferred income taxes Tax benefit from exercise of stock options Provision for (reversal of) doubtful accounts Accounts receivable Distributor receivables Inventories Prepaid expenses & other current assets Prepaid income taxes Accounts payable Accrued liabilities Accrued promotional allowances Accrued distributor terminations Accrued compensation Income taxes payable Deferred revenue Net Operating Cash Flow Investing Activities Maturities of held-to-maturity investments Sales of available-for-sale investments Sales of trading investments Purchases of held-to-maturity investments Purchases of available-for-sale investments Purchases of property & equipment Proceeds from sale of property & equipment Additions to trademarks Decrease (increase) in other assets Net Investing Cash Flow Financing Activities Principal payments on debt Tax benefit from exercise of stock options Issuance of common stock Purchases of common stock held in treasury Net Financing Cash Flow Net increase (decrease) in cash & cash equivalents Cash & cash equivalents, beginning of year Cash & cash equivalents, end of year 16 2011 2012 2013 286.22 0.05 17.03 (0.02) 19.42 0.73 0.04 (0.69) (3.82) 0.05 (56.75) (0.26) (4.47) (6.21) 9.47 26.25 8.14 28.44 (0.33) 2.88 13.92 (6.28) 333.83 340.02 0.05 20.51 0.03 28.41 1.11 (1.90) (2.46) (19.66) (0.01) (17.77) 0.00 (47.57) (4.52) (33.21) 3.66 6.46 2.72 0.79 2.50 14.17 (5.66) 287.68 338.66 0.05 22.71 0.51 28.76 0.84 (3.55) (7.07) (30.35) 0.13 (43.03) (7.38) (21.55) (4.50) 24.01 (8.20) 2.27 8.93 1.55 1.97 34.31 2.98 342.03 407.92 30.55 34.72 (583.14) (33.31) (25.55) 0.52 (5.13) 0.41 (173.03) 841.58 68.45 17.05 (597.16) (9.50) (42.94) 0.29 (6.30) 0.38 271.85 256.84 5.79 2.25 (557.42) -(40.76) 9.02 (11.18) (4.36) (339.81) (1.94) 3.82 20.32 (176.39) (154.19) (2.08) 19.66 11.02 (727.67) (699.08) (1.89) 30.35 21.25 (67.60) (17.89) 4.49 354.84 359.33 (136.82) 359.33 222.51 (11.17) 222.51 211.35 MONSTER BEVERAGE CORPORATION Cash Flow Statement (Million $) Fiscal Years Ending Dec. 31 Operating Activities Net Income Add: Depreciation & amortization Changes in Working Capital Change in deferred taxes Accounts receivable Inventories Prepaid expenses & other current assets Change in accrued compensation and other liabilities Accounts payable Income taxes payable Deferred revenue Net Operating Cash Flow Investing Activities Change in short-term investments Change in long-term investments Capital Expenditure Capitalization of intangible assets Decrease (increase) in other assets Net Investing Cash Flow Financing Activities change in current portion of long term debt Change in accumulated other comprehensive income Issuance of common stock Repurchases of common stock Net Financing Cash Flow Cash & cash equivalents, beginning of year Net increase (decrease) in cash & cash equivalents Cash & cash equivalents, end of year 2014E 2015E 2016E 2017E 2018E 2019CV 429.65 29.05 460.70 33.28 499.22 36.36 536.72 38.19 573.49 39.42 606.11 40.25 (4.48) (2.42) (32.83) (0.88) 13.54 26.88 (2.62) 102.06 557.94 2.25 (27.92) (23.78) (0.90) 18.78 13.68 0.81 20.04 496.95 4.29 2.08 (23.35) (0.91) 18.44 13.43 0.63 19.67 569.86 4.46 7.64 (22.33) (0.93) 17.64 12.85 0.61 18.82 613.67 4.46 12.57 (21.70) (0.94) 17.14 12.48 0.60 18.29 655.81 4.64 (16.87) (19.16) (0.96) 15.13 11.02 0.53 16.15 656.84 (8.56) (1.08) (41.85) 0.00 3.96 (47.52) (8.74) (1.20) (42.56) (0.04) (0.58) (53.11) (8.92) (1.33) (41.85) (0.04) (0.57) (52.71) (9.11) (1.47) (41.85) (0.04) (0.54) (53.02) (9.31) (1.64) (41.85) (0.04) (0.53) (53.36) (9.51) (1.82) (41.85) (0.04) (0.47) (53.68) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.04 0.01 0.01 0.01 (197.47) (197.47) (197.47) (197.47) (197.47) (197.47) (197.43) (197.47) (197.47) (197.47) 211.35 524.29 770.70 1090.38 1453.56 312.94 246.40 319.68 363.18 404.99 524.29 770.70 1090.38 1453.56 1858.55 0.00 0.00 0.01 (197.47) (197.47) 1858.55 405.70 2264.25 17 MONSTER BEVERAGE CORPORATION Common Size Income Statement Fiscal Years Ending Dec. 31 Sales COGS excluding D&A Depreciation Amortization of Intangibles Gross Income SG&A Expense EBIT (Operating Income) Non-operating Income - Net Non-operating Interest Income Other Income (Expense) Interest Expense Unusual Expense - Net Pretax Income Income Taxes Consolidated Net Income Net Income 2011 100.00% 46.49% 1.00% 0.00% 52.51% 25.71% 26.80% 0.10% 0.10% 0.00% 0.00% 0.04% 26.85% 10.04% 16.80% 16.80% 2012 100.00% 47.29% 1.00% 0.00% 51.71% 24.99% 26.72% (0.02%) 0.07% (0.09%) -0.05% 26.65% 10.15% 16.50% 16.50% 2013 100.00% 46.77% 1.01% 0.00% 52.21% 26.23% 25.98% (0.36%) 0.04% (0.41%) -0.52% 25.10% 10.03% 15.08% 15.08% 18 2014E 100.00% 46.21% 1.16% 0.00% 52.62% 24.38% 28.25% 0.13% 0.05% 0.08% 0.00% 0.00% 28.50% 11.23% 17.27% 17.27% 2015E 100.00% 46.21% 1.22% 0.00% 52.57% 24.38% 28.19% 0.13% 0.05% 0.08% 0.00% 0.00% 28.44% 11.51% 16.93% 16.93% 2016E 100.00% 46.21% 1.23% 0.00% 52.56% 24.38% 28.18% 0.13% 0.05% 0.08% 0.00% 0.00% 28.43% 11.51% 16.93% 16.93% 2017E 100.00% 46.21% 1.20% 0.00% 52.59% 24.38% 28.21% 0.13% 0.05% 0.07% 0.00% 0.00% 28.46% 11.52% 16.94% 16.94% 2018E 100.00% 46.21% 1.16% 0.00% 52.63% 24.38% 28.25% 0.13% 0.05% 0.07% 0.00% 0.00% 28.50% 11.53% 16.97% 16.97% 2019CV 100.00% 46.21% 1.13% 0.00% 52.66% 24.38% 28.29% 0.13% 0.06% 0.07% 0.00% 0.00% 28.54% 11.55% 16.99% 16.99% MONSTER BEVERAGE CORPORATION Common Size Balance Sheet Fiscal Years Ending Dec. 31 Asset Current Assets Cash Short Term Investments Accounts Receivables, Net Inventories Other Current Assets Total Current Assets Net Property, Plant & Equipment Property, Plant & Equipment - Gross Accumulated Depreciation Total Investments and Advances Intangible Assets Deferred Tax Assets Other Assets Total Assets 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019CV 21.10% 24.15% 12.84% 9.14% 2.21% 69.44% 2.65% 4.82% 2.17% 1.36% 2.84% 3.44% 0.26% 79.99% 10.80% 4.71% 11.49% 9.86% 3.67% 40.52% 3.36% 5.65% 2.29% 1.04% 2.65% 2.89% 0.17% 50.63% 9.41% 17.91% 13.18% 9.86% 2.31% 52.66% 3.92% 6.79% 2.86% 0.44% 2.93% 2.83% 0.45% 63.23% 30.97% 16.51% 12.00% 10.22% 2.35% 72.05% 4.06% 7.81% 3.75% 0.00% 2.64% 2.74% 0.25% 81.73% 40.07% 15.42% 12.00% 10.22% 2.39% 80.10% 4.06% 8.71% 4.65% 0.00% 2.41% 2.42% 0.25% 89.23% 49.28% 14.53% 11.00% 10.22% 2.43% 87.45% 3.93% 9.45% 5.52% 0.00% 2.22% 2.09% 0.25% 95.95% 58.67% 13.81% 10.00% 10.22% 2.47% 95.16% 3.78% 10.12% 6.34% 0.00% 2.07% 1.80% 0.25% 103.06% 66.98% 13.22% 9.00% 10.22% 2.51% 101.93% 3.62% 10.72% 7.10% 0.00% 1.94% 1.56% 0.25% 109.29% 0.00% 12.79% 9.00% 10.22% 2.55% 34.56% 3.47% 11.33% 7.86% 0.00% 1.83% 1.34% 0.25% 41.47% Liabilities & Shareholders' Equity Current Liabilities ST Debt & Current Portion of LT Debt Accounts Payable Income Tax Payable Other Current Liabilities Total Current Liabilities 0.00% 6.66% 0.65% 8.32% 15.62% 0.00% 6.18% 0.27% 7.56% 14.00% 0.00% 5.31% 0.42% 8.34% 14.07% 0.00% 5.88% 0.27% 8.07% 14.22% 0.00% 5.88% 0.28% 8.07% 14.23% 0.00% 5.88% 0.28% 8.07% 14.23% 0.00% 5.88% 0.28% 8.07% 14.23% 0.00% 5.88% 0.28% 8.07% 14.23% 0.00% 5.88% 0.28% 8.07% 14.23% Deferred Income Total Liabilities 6.88% 22.50% 5.36% 19.36% 5.00% 19.06% 8.61% 22.83% 8.61% 22.84% 8.61% 22.84% 8.61% 22.84% 8.61% 22.84% 8.61% 22.84% 13.52% 68.61% 14.02% 73.21% 16.43% 82.23% 14.83% 91.51% 13.57% 100.61% 12.52% 109.74% 11.65% 119.11% 10.92% 128.60% 10.35% 138.83% (0.09%) 0.00% (24.56%) 57.49% 79.99% 0.03% 0.07% (56.06%) 31.27% 50.63% (0.05%) 0.00% (54.44%) 44.17% 63.23% (0.05%) 0.00% (57.08%) 49.21% 72.04% (0.05%) 0.00% (59.46%) 54.68% 77.51% (0.04%) 0.00% (61.55%) 60.67% 83.51% (0.04%) 0.00% (63.53%) 67.19% 90.03% (0.04%) 0.00% (65.38%) 74.10% 96.93% (0.03%) 0.00% (67.48%) 81.66% 104.49% Shareholders' Equity Common Stock Par/Carry Value Retained Earnings Cumulative Translation Adjustment/Unrealized For. Exch. Gain Unrealized Gain/Loss Marketable Securities Treasury Stock Total Shareholders' Equity Total Liabilities & Shareholders' Equity 19 MONSTER BEVERAGE CORPORATION Weighted Average Cost of Capital (WACC) Estimation (Million $) Risk Free Rate Risk Premium Beta Cost of Equity Pre-tax cost of debt Marginal Tax Rate After-tax cost of debt Cost of Preferred Stock 3.07% 4.64% 1.04 7.89% 2.98% 36.00% 1.91% 0 Market Value of Debt Pre-Tax Cost of Debt Marginal Tax Rate 16.15 2.98% 36.00% Market Value of Equity Cost of Equity Market Value of preferred Cost of Preferred Stock WACC 18246.96 7.89% 0 0 7.88% 20 MONSTER BEVERAGE CORPORATION Value Driver Estimation (Million $) Fiscal Years Ending Dec. 31 Revenue Less: Cost of Sales Less: Sell, General and Administrative Expense Less: Amortization of non-goodwill Intangibles Less: Depreciation Add: Implied Operating Lease Interest EBITA Income Tax Provision Add: Tax Shield on Lease Interest Add: Tax Shield on Interest Expense Less: Tax on Interest ( or Investment) Income Less: Tax Non-Operating income Total Adjusted Taxes Change in Deferred Taxes NOPLAT 2011 1703.23 791.84 437.89 0.05 17.03 0.49 456.92 171.05 0.18 0.02 0.60 0.58 170.06 (0.10) 286.75 2012 2060.70 974.48 515.03 0.05 20.51 0.43 551.05 209.13 0.15 0.00 0.50 (0.13) 208.92 (0.93) 341.21 2013 2246.43 1050.74 589.22 0.05 22.71 0.48 584.20 225.23 0.17 0.00 0.36 (2.95) 227.99 (4.11) 352.10 2014E 2488.35 1149.82 606.59 0.09 28.96 0.59 703.47 279.46 0.21 0.00 0.00 0.00 279.67 (4.48) 419.32 2015E 2721.03 1257.34 663.31 0.09 33.19 0.65 767.74 313.20 0.23 0.00 0.43 1.12 311.88 2.25 458.11 2016E 2949.50 1362.91 719.01 0.09 36.27 0.68 831.89 339.38 0.24 0.00 0.48 1.23 337.92 4.29 498.26 2017E 3168.05 1463.91 772.28 0.09 38.10 0.70 894.37 364.88 0.25 0.00 0.53 1.33 363.27 4.46 535.56 2018E 3380.44 1562.05 824.06 0.09 39.33 0.71 955.63 389.88 0.26 0.00 0.59 1.43 388.12 4.46 571.97 2019CV 3567.93 1648.68 869.76 0.09 40.16 0.72 1009.96 412.05 0.26 0.00 0.65 1.52 410.13 4.64 604.47 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019CV 17.97 218.74 155.61 37.71 430.03 11.13 236.71 203.11 75.70 526.64 10.57 296.18 221.45 51.82 580.01 26.21 298.60 254.28 52.70 631.80 38.53 326.52 278.06 53.59 696.71 54.52 324.44 301.41 54.51 734.88 72.68 316.81 323.74 55.43 768.66 92.93 304.24 345.45 56.37 798.99 113.21 321.11 364.61 57.33 856.26 113.45 117.15 11.00 241.59 188.44 45.15 48.40 16.49 27.60 326.08 127.33 110.38 5.47 243.18 283.45 69.14 54.65 14.43 24.97 446.63 119.38 112.22 9.36 240.95 339.06 88.14 65.77 16.15 19.94 529.06 146.25 214.28 6.74 367.27 264.53 101.03 65.68 19.79 17.06 468.09 159.93 234.32 7.55 401.80 294.92 110.40 65.63 21.63 18.83 511.41 173.36 253.99 8.19 435.53 299.35 115.98 65.58 22.72 20.73 524.36 186.20 272.81 8.80 467.81 300.85 119.73 65.53 23.46 22.74 532.30 198.68 291.10 9.40 499.19 299.80 122.24 65.48 23.95 24.91 536.38 209.70 307.24 9.94 526.89 329.38 123.93 65.43 24.28 27.19 570.21 ROIC Fiscal Years Ending Dec. 31 NOPLAT Beg. Invested Capital ROIC 2011 286.75 247.67 115.78% 2012 341.21 326.08 104.64% 2013 352.10 446.63 78.83% 2014E 419.32 529.06 79.26% 2015E 458.11 468.09 97.87% 2016E 498.26 511.41 97.43% 2017E 535.56 524.36 102.14% 2018E 571.97 532.30 107.45% 2019CV 604.47 536.38 112.69% FCF Fiscal Years Ending Dec. 31 NOPLAT Change in Invested Capital FCF 2011 286.75 78.41 208.35 2012 341.21 120.56 220.65 2013 352.10 82.43 269.67 2014E 419.32 (60.97) 480.29 2015E 458.11 43.32 414.80 2016E 498.26 12.95 485.32 2017E 535.56 7.95 527.61 2018E 571.97 4.08 567.89 2019CV 604.47 33.83 570.64 EP Fiscal Years Ending Dec. 31 Beg. Invested Capital ROIC WACC Economic Profit 2011 247.67 1.16 7.88% 267.23 2012 326.08 1.05 7.88% 315.51 2013 446.63 0.79 7.88% 316.90 2014E 529.06 0.79 7.88% 377.63 2015E 468.09 0.98 7.88% 421.22 2016E 511.41 0.97 7.88% 457.96 2017E 524.36 1.02 7.88% 494.24 2018E 532.30 1.07 7.88% 530.02 2019CV 536.38 1.13 7.88% 562.19 Invested Capital Fiscal Years Ending Dec. 31 Operating Current Assets Normal Cash Accounts Receivable Inventory Other Current Operating Assets Operating Current Assets Operating Current Liabilities Accounts Payable Deferred Income Income Taxes Payable Operating Current Liabilities Net Operating Working Capital Add: Net PPE Add: Intangibles Add: PV of operating lease Add: Other Operating Assets Invested Capital 21 MONSTER BEVERAGE CORPORATION Discounted Cash Flow (DCF) and Economic Profit (EP) Valuation Models (Million $) Key Inputs: CV Growth CV ROIC WACC Cost of Equity Fiscal Years Ending Dec. 31 DCF Model FCF FCF Continuing Value WACC Period Present Value of FCF Value of operating Assets Add: Excess Cash Add: Short term investment Add: Long term Investment Less: Present Value of operating lease Less: employee stock option Value of Equity Shares Outstanding Intrinsic Value Partial Year Adjustment Fiscal Years Ending 0.11 EP CV EP WACC Period Present Value of EP Beginning invested capital Value of operating Assets Add: Excess Cash Add: Short term investment Add: Long term Investment Less: Present Value of operating lease Less: employee stock option Value of the Firm Shares Outstanding Intrinsic Value Partial Year Adjustment 5.55% 112.69% 7.88% 7.89% 2014E 2015E 2016E 2017E 2018E 2019CV 480.29 414.80 485.32 527.61 567.89 570.64 24654.12 7.88% 1 445.20 2 356.41 3 386.53 4 389.53 5 388.64 5 16871.90 2014E 377.63 2015E 421.22 2016E 457.96 2017E 494.24 2018E 530.02 2019CV 562.19 24117.74 7.88% 1 350.04 529.06 2 361.93 3 364.75 4 364.88 5 362.72 5 16504.83 18838.20 498.08 410.80 10.87 16.15 1.27 19740.54 165.03 119.62 128.24 18838.20 498.08 410.80 10.87 16.15 1.27 19740.54 165.03 119.62 128.24 22 MONSTER BEVERAGE CORPORATION Dividend Discount Model (DDM) or Fundamental P/E Valuation Model Fiscal Years Ending Dec. 31 EPS Key Assumptions CV growth CV ROE Cost of Equity Future Cash Flows P/E Multiple 2014E $ 2.60 $ 2015E 2.82 $ 2016E 2017E 3.08 $ 3.35 $ 2018E 2019CV 3.61 $ 3.84 5.69% 20.80% 7.89% 33.05 EPS(next period) $ Future Stock Price $ 126.89 Dividends Per Share Period Discounted Cash Flows Intrinsic Value Partial Year Adjustment 3.84 -1 -2 -3 -4 -5 $ 126.89 5 -- -- -- -- -- $ 86.81 $ 86.81 93.07 23 MONSTER BEVERAGE CORPORATION Relative Valuation Models Price EPS 2014E EPS 2015E Coca Cola Company $ 41.88 $2.06 $2.11 20.3 19.8 $ 6.35 3.20 3.13 PEP Pepsico Inc $ 96.17 $4.60 $4.91 20.9 19.6 $ 3.69 5.67 5.31 DPS Dr Pepper Snapple Group Inc $ 69.25 $3.63 $3.87 19.1 17.9 $ 13.74 Ticker Company KO Average MNST MONSTER BEVERAGE CORPORATION $ 101.20 $ 2.60 $ Implied Value: Relative P/E (EPS14) $ 52.35 Relative P/E (EPS15) $ 53.90 PEG Ratio (EPS14) $ 26.62 PEG Ratio (EPS15) $ 27.37 24 P/E 14 Est. 5yr Gr. P/E 15 20.1 19.1 2.82 38.9 35.9 PEG 14 PEG 15 1.39 1.30 3.4 3.2 2.99 13.0 12.0 MONSTER BEVERAGE CORPORATION Key Management Ratios Fiscal Years Ending Dec. 31 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E Liquidity Ratios Current Ratio Current Asset/Current Liabilities 3.96 2.25 2.60 2.86 2.96 3.12 3.29 3.47 3.65 Quick Ratio (Cash+ST Investment+AR)/CL 3.72 1.93 2.88 3.49 3.92 4.39 4.90 5.43 5.99 Cash Ratio Cash/ CL 1.35 0.77 0.67 1.48 1.99 2.60 3.23 3.86 4.46 Activity or Asset-Management Ratios Receivable Turnover Ratio Net Sales/Accounts Receivables 7.79 8.71 7.58 0.00 7.62 8.39 9.31 10.41 10.53 Inventory Turnover Ratio COGS/Inventory 5.09 4.80 4.74 0.00 4.14 4.17 4.21 4.24 4.28 Total Asset Turnover Ratio Net Sales/Total Assets 1.25 1.98 1.58 0.00 1.18 1.10 1.03 0.97 0.91 Total Debt/Total Assets Total Liabilities/Stockholder's Equity 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.39 0.62 0.43 0.46 0.42 0.38 0.34 0.31 0.28 Financial Leverage Ratios Debt Ratio Debt to Equity Ratio Profitability Ratios Net Profit Margin Net Income/Net Sales 16.80% 16.50% 15.08% 17.27% 16.93% 16.93% 16.94% 16.97% 16.99% Return on Assets Net Income/Total Assets 21.01% 32.59% 23.84% 23.97% 21.84% 20.27% 18.82% 17.50% 16.26% Return on Equity Net Income/Stockholder's Equity 29.23% 52.77% 34.13% 35.09% 30.97% 27.90% 25.21% 22.90% 20.80% Payout Policy Ratios Payout Ratio Dividend per Share/EPS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Total Payout Ratio Dividend Repurchases/Net Income 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 25 MONSTER BEVERAGE CORPORATION Lease Present Value of Operating Lease Obligations 2013 Present Value of Operating Lease Obligations 2011 Operating Leases 5050 4958 4207 1089 493 1577 17374 Fiscal Years Ending Dec. 31 2014 2015 2016 2017 2018 Thereafter Total Minimum Payments Less: Interest 1228 PV of Minimum Payments 16146 Capitalization of Operating Leases Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment Year 1 2 3 4 5 6 & beyond PV of Minimum Payments 2.98% Lease Commitment 5050 4958 4207 1089 493 1577 1.0 PV Lease Payment 4903.7 4674.8 3851.8 968.2 425.6 1321.9 16146.0 2012 Fiscal Years Ending Dec. 31 2013 2014 2015 2016 2017 Thereafter Total Minimum Payments Less: Interest PV of Minimum Payments Capitalization of Operating Leases Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment Year 1 2 3 4 5 6 & beyond PV of Minimum Payments Operating Leases 3996 3385 3227 3241 2783 1411 18043 Fiscal Years Ending Dec. 31 2012 2013 2014 2015 2016 Thereafter Total Minimum Payments 1550 Less: Interest PV of Minimum Payments Capitalization of Operating Leases Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment Year 1 2 3 4 5 6 & beyond PV of Minimum Payments Present Value of Operating Lease Obligations 2009 Lease Commitment 3996 3385 3227 3241 2783 1411 2.98% 1.0 PV Lease Payment 4173 4052.1 3610 3403.8 3482 3188.0 2874 2555.1 790 682.0 649 544.0 14425.0 Total Minimum Payments 19338 Less: Interest 2106 16493 PV of Minimum Payments 17232 2.98% Capitalization of Operating Leases Pre-Tax Cost of Debt Number Years Implied by Year 6 Payment 2.98% 1.0 1.0 PV Lease Payment 3880.2 3191.7 2954.5 2881.4 2402.5 1182.8 16493.1 Year 1 2 3 4 5 PV of Minimum Payments Lease Commitment 3276 2513 2582 2453 8514 PV Lease Payment 3181.1 2369.5 2364.0 2180.8 7137.0 17232.4 2008 2010 Operating Leases 4173 3610 3482 2874 790 649 15578 1153 14425 Operating Leases 3276 2513 2582 2453 8514 Fiscal Years Ending Dec. 31 2010 2011 2012 2013 2014& Thereafter Operating Leases 3366 3221 3039 3027 6535 Fiscal Years Ending Dec. 31 2011 2012 2013 2014 2015 Fiscal Years Ending Dec. 31 2009 2010 2011 2012 2013 Operating Leases 3156 2845 2143 2255 9865 Total Minimum Payments 19188 Less: Interest 1931 PV of Minimum Payments 17257 Capitalization of Operating Leases Pre-Tax Cost of Debt 2.98% Number Years Implied by Year 6 Payment 1.0 Year PV Lease Payment 1 3366 3268.5 2 3221 3037.5 3 3039 2782.4 4 3027 2691.4 5 6535 5478.1 Total Minimum Payments 20264 Less: Interest 2281 PV of Minimum Payments 17983 Capitalization of Operating Leases Pre-Tax Cost of Debt 2.98% Number Years Implied by Year 6 Payment 1.0 Year PV Lease Payment 1 3156 3064.6 2 2845 2682.5 3 2143 1962.1 4 2255 2004.8 5 9865 8268.5 PV of Minimum Payments PV of Minimum Payments 17257.1 26 17983.4 Effects of ESOP Exercise and Share Repurchases on Common Stock Balance Sheet Account and Number of Shares Outstanding Number of Options Outstanding (shares): Average Time to Maturity (years): Expected Annual Number of Options Exercised: Current Average Strike Price: Cost of Equity: Current Stock Price: 12,973 3.74 3,467 $ $ 15.71 7.89% 110.07 2014E 43 2.09 90 Increase in Shares Outstanding: Average Strike Price: Increase in Common Stock Account: $ Change in Treasury Stock Expected Price of Repurchased Shares: Number of Shares Repurchased: 197,473,500 $ 110.07 1,794,072 Shares Outstanding (beginning of the year) Plus: Shares Issued Through ESOP Less: Shares Repurchased in Treasury Shares Outstanding (end of the year) 166,822,000 43 1,794,072 165,027,971 $ $ 2015E 6,868 5.95 40,842 197,473,500 118.75 1,662,928 165,027,971 6,868 1,662,928 163,371,911 27 $ $ 2016E 481 14.65 7,037 $ 2017E 481 14.65 7,037 $ 2018E 481 14.65 7,037 $ 2019E 481 14.65 7,037 197,473,500 128.12 1,541,371 197,473,500 $ 138.22 1,428,699 197,473,500 $ 149.12 1,324,263 197,473,500 $ 160.88 1,227,462 163,371,911 481 1,541,371 161,831,021 161,831,021 481 1,428,699 160,402,802 160,402,802 481 1,324,263 159,079,020 159,079,020 481 1,227,462 157,852,038 VALUATION OF OPTIONS GRANTED IN ESOP Ticker Symbol Current Stock Price MNST 110.07 Risk Free Rate 3.07% Current Dividend Yield 0.00% Annualized St. Dev. of Stock Returns Range of Outstanding Options Range 1 Range 2 Range 3 Range 4 Range 5 Range 6 Range 7 Range 8 Range 9 Range 10 Total 36.80% Number of Shares 43 4,400 23 2,445 145 1,777 1,381 1,796 956 7 12,973 Average Exercise Price 2.09 3.29 6.11 8.44 13.43 15.86 17.75 33.11 56.25 74.78 $ 15.71 28 Average Remaining Life (yrs.) 1.00 1.20 1.80 1.90 4.80 4.40 5.90 7.30 9.10 8.50 3.74 B-S Option Price $ 108.04 $ 106.90 $ 104.29 $ 102.11 $ 98.50 $ 96.25 $ 95.40 $ 85.28 $ 75.06 $ 65.73 $ 96.08 Value of Options Granted $ 4,646 $ 470,356 $ 2,399 $ 249,655 $ 14,283 $ 171,028 $ 131,753 $ 153,163 $ 71,758 $ 460 $ 1,269,500 Beta Equity Risk Premium $ 128.24 4.56% 4.58% 4.60% 4.62% 4.64% 4.68% 4.68% 4.70% 4.72% 1.00 143.33 142.02 140.74 139.48 138.24 135.83 135.83 134.66 133.51 1.01 140.38 139.12 137.87 136.65 135.45 133.12 133.12 131.99 130.87 1.02 137.56 136.33 135.12 133.94 132.78 130.52 130.52 129.42 128.34 1.03 134.84 133.66 132.49 131.34 130.22 128.03 128.03 126.96 125.92 1.04 132.76 131.60 130.46 129.34 128.24 126.11 126.11 125.06 124.04 1.05 129.75 128.63 127.53 126.45 125.39 123.33 123.33 122.32 121.34 1.06 127.34 126.26 125.19 124.15 123.12 121.11 121.11 120.14 119.18 1.07 125.03 123.98 122.94 121.93 120.93 118.98 118.98 118.03 117.09 1.08 122.81 121.79 120.78 119.79 118.82 116.92 116.92 116.00 115.09 3.07% 132.76 131.60 130.46 129.34 128.24 126.11 126.11 125.06 124.04 3.17% 127.36 126.30 125.25 124.23 123.22 121.25 121.25 120.29 119.35 3.27% 122.41 121.43 120.47 119.52 118.59 116.77 116.77 115.89 115.02 3.37% 117.84 116.94 116.05 115.17 114.31 112.63 112.63 111.81 111.00 3.47% 113.62 112.78 111.96 111.15 110.35 108.79 108.79 108.02 107.27 1.04 112.54 116.02 119.77 123.83 128.24 133.05 138.31 144.08 150.45 1.05 110.41 113.74 117.32 121.19 125.39 129.96 134.94 140.40 146.41 1.06 108.70 111.91 115.36 119.09 123.12 127.50 132.27 137.48 143.21 1.07 107.04 110.14 113.47 117.05 120.93 125.13 129.70 134.69 140.16 1.08 105.43 108.43 111.64 115.09 118.82 122.85 127.24 132.01 137.24 7.88% 112.54 116.02 119.77 123.83 128.24 133.05 138.31 144.08 150.45 8.08% 105.29 108.27 111.47 114.91 118.63 122.65 127.01 131.77 136.98 8.28% 98.93 101.51 104.26 107.21 110.37 113.78 117.45 121.43 125.75 8.48% 93.34 95.59 97.98 100.53 103.25 106.16 109.29 112.66 116.29 8.68% 88.38 90.35 92.45 94.67 97.03 99.55 102.25 105.13 108.22 Risk Free Rate Equity Risk Premium $ 128.24 4.56% 4.58% 4.60% 4.62% 4.64% 4.68% 4.68% 4.70% 4.72% 2.67% 160.17 158.45 156.78 155.14 153.54 150.44 150.44 148.94 147.46 2.77% 152.26 150.72 149.21 147.73 146.28 143.48 143.48 142.11 140.78 2.87% 145.12 143.73 142.36 141.02 139.71 137.15 137.15 135.91 134.70 2.97% 138.65 137.38 136.14 134.92 133.72 131.39 131.39 130.25 129.14 Beta CV Growth $ 128.24 5.15% 5.25% 5.35% 5.45% 5.55% 5.65% 5.75% 5.85% 5.95% 1.00 119.90 123.92 128.29 133.04 138.24 143.94 150.22 157.18 164.94 1.01 117.87 121.74 125.93 130.48 135.45 140.90 146.88 153.50 160.85 1.02 115.90 119.63 123.65 128.02 132.78 137.98 143.70 149.99 156.97 1.03 114.01 117.59 121.46 125.66 130.22 135.20 140.65 146.65 153.28 WACC CV Growth $ 128.24 5.15% 5.25% 5.35% 5.45% 5.55% 5.65% 5.75% 5.85% 5.95% 7.08% 156.84 164.24 172.50 181.77 192.25 204.20 217.95 233.93 252.73 7.28% 142.66 148.64 155.24 162.55 170.72 179.89 190.25 202.07 215.66 7.48% 130.91 135.83 141.21 147.12 153.65 160.89 168.96 178.02 188.27 7.68% 121.02 125.13 129.60 134.46 139.78 145.63 152.08 159.24 167.22 29 30