Business education: junior certificate syllabus

r c

MINISTRY OF EDUCATION AND TRAINING

Business Education

MOHLOLING

OA

THUTO

2004

Acknowledgement

This programme was developed by Commercial Subjects Panel of the National Curriculum Development Centre. The National Curriculum

Development Centre would like to thank the following persons for the contribution in the development of this programme:

Panel Members

Mr. Malefetsane

E.

Nketekete (Chair person

-

Mrs. ‘Mankoneng Jessie (Secretary- Central Inspectorate)

Mrs. ‘Maletele Motebang (NUL)

Mr. Raphooka Matooane (LCE)

‘Mathabang Moroj ele (Makoanyane High School)

Mr. Teba Ramahapu (ECOL)

Mrs. Ntholelo Nonyane (St. James Anglican High School)

Mr. Maloko Tau (Lesotho High School)

Mr. Joseph Lebusa ( IEMS)

Mr. Makara Rampeta (Sacred Heart High School)

Mr. Joseph Molise (Dahon High School)

Ms. Belina Moeletsi (Likuena High School)

Co-opted Members

Mrs. ‘Matiisetso Ramothamo (Lesotho High School)

Mr. Motlalemang Sefefo (Cana High School)

Mr. Martin Makoa (St. John’s High School

Mr. John Hlongwane (Hlotse High School)

~~ ~

@National Curricu pment Centre

2

SCOPE AND SEQUENCE

.

..........................................................................................................................................

Identifying different types of human needs

Show understanding of how business satisfy

.

Identify/mention the rights of consumers.

H Describe mechanisms that can be employed in human needs

Distinguish between barter system and money m

.

Identify different types of money.

Describe four functions of money.

. economy

______ ..........................................................................................................................................

Describe/explain four factors of production Explain the concept of scarcity as it relates to

Distinguish between stages of production

Describe/explain methods of production

Describe/explain division of labour

Identify the following: manufacturing, wholesaling, retailing, service and franchising.

. factors of production.

Explain different modes of production.

Explain the advantages and disadvantages of

.

. division of labour.

Distinguish between consumer and capital goods

Identify characteristics of the entrepreneur.

Explain the importance of entrepreneurship.

.

Describe the b c t i o n s of wholesalers, retailers and manufacturers.

. addressing the rights of consumers when violated.

Identify rational ways in which buying decisions can be reached.

__----

9

...................... ..................................................................................................................

Identify the following: sole trader,

.

Identify advantages and disadvantages of sole trader, partnership, limited liability companies partnership, companies and cooperatives in

.

Identify different types of wholesalers and retailers.

..

11

Explain market research (its purpose, factws to consider)

Identify the elements and explain the importance of a business plan.

................................................

Generate business idea from different sources such as common needs, problems, everyday activities, skills, magazines and newspapers, hobbies and trade shows.

Conduct market research using observation and survey methods.

Distinguish between consumer, industrial,

I

I resale, governments, local and international markets

.

Draw up a simple business plan.

. .....................................

Identifjdexplain the following: location, capital and licence.

-_ business

Identify /describe procedures followed in acquiring a business licence in Lesotho.

Explain the importance of registering fixed Identifjdexplain the sources and importance of assets. capital

Show how the assets are acquired and their relationship with capital

___---

I

...............................

Identify different types of banks and their

I

I functions in relation to business

Identify/explain the importance and types of transport

Explain the importance of insurance to

..............................................

Identify types of cheques and their treatment.

Explain reasons for dishonouring a cheque.

Identify factors that influence the choice of mode of transport.

Explain the principles of insurance. business

Explain the importance of advertising

~-

~ m d -

=

Explaidmention the advantages and disadvantages of advertising. when choosine advertising medium.

.............................................

Identifjdmention the functions of the commercial bank

IdentifyAist the advantages and disadvantages of various modes of transport

Explain different types of insurances and risks.

-- types of telecommunication electronic and other recent svstems.

...

111

=

Explain the importance of warehousing.

Explain the importance of communication.

Identifjdmention services offered by post office.

THEME: BUSINESS MANAGEMENT

.

_________

______-------------------------------------------------------------------------------------------------------------------------.

Determine a selling price of merchandise using a percentage mark-up and taking into

Determine a price of a manufactured commodity and service. consideration other factors namely cost, market price, market forces, quality and purchasing power of consumers.

------ ----- --- a

----_------

------------------------------------------------------------------------------------------------------------------.

Identify source documents in recording Distinguish between short-term and long-term Identify/explain advantages and disadvantages business transactions namely invoice, receipts, credit, as forms of buying and selling. of credit system cheque, order, quotation, credit/debit note and rice list

------- ..........................................................................................................................................

Record business transactions by means of a

Record transactions in the cash book, sales and

.

Prepare supplementary cash book and bank reconciliation. double entry in the ledger (cash, credit, and purchases books, petty cash book, general and bank transactions) a . returns allowances books using source documents.

Post information from subsidiary books to the ledger.

------- ..........................................................................................................................................

Construct a trial balance from a ledger and a Construct a trial balance from the ledger and given information. given information.

Identifjdmention errors which can be revealed by the trial balance and those which cannot be revealed by the trial balance. iv

stock) and other allowances. sole trader taking into account the adjustments: opening stocks and depreciation of fixed partnership business. expenditure and balance sheet of a non-trading concern.

V

BUSINESS EDUCATION

INTRODUCTION

The pulpose of Business Education syllabus is that students should gain the knowledge of how the business is established and operated. The syllabus covers four interrelated areas. The areas are business environment, business formation, business management and evaluating business performance.

MISSION STATEMENT

The organisation of the syllabus around these themes is intended to give students a holistic view of the nature of business. Business Education aims at equipping students with knowledge, attitudes and skills necessary for survival either as employed by others or self-employed.

It

aims at equipping students with entrepreneurial skills that are necessary for the development

of

enterprise culture.

SUBJECT

AIMS

After the completion of Business Education students are expected to have:

1.

2.

3.

4.

5 .

6.

7.

8.

9.

Acquired knowledge and understanding of the dynamic nature of business world.

Acquired knowledge, skills and attitudes that would enable them interpret the trends and developments in the business world for decision-making.

Have acquired an understanding of the role of business in socio-economic development.

Acquired knowledge, skills and understanding of processes involved in establishing a business.

Have developed understanding and appreciation of competitive nature of the business world.

Acquired knowledge, skills and attitudes in the management of business operations.

Acquired knowledge and skills of evaluating business information for decision- making.

Developed ability to apply entrepreneurial skills in non-business undertakings.

Developed ability to apply concepts, principles and skills acquired to new situations.

SPECIFIC OBJETIVES (End

of

Course Objectives)

After the completion of Business Education, students should be able to:

1 - Identify trends and factors within the environment that affect business.

2- Acquire knowledge, skills and attitudes important for establishing and managing a business.

3- Acquire knowledge and attitude of the interdependence of business for the well being of each other in promotion of economic growth.

4- Acquire the knowledge, attitudes and skills of general and specific management

5 -

6- functions of the business.

Acquire knowledge and skills of record keeping as a necessary management skill for the effective running

of

the business.

Evaluate the performance of business activities by using different statements and tools.

1

APPROACHES

Business Education should be practically oriented. Students should sei

1 the application of what they learn in school in real life situation. Attempts ( ere possible) should be made to show the relationship of Business Education with ther subjects such as Agriculture, Home Economics, Typing, Woodwork, asic

Handicrafts and others. To enhance the practicality of the subject projects shou be i central to its teaching. Thus students should be given hands on experience by king involved in different projects.

Group projects are strongly recommended. The projects should reflect the proc $s of

. and evaluating a business. The following should be demons ted:

Show how the business idea was arrived at (this will include market res

.

. and business plan).

Show aspects of management.

Show business records (ledger and other books).

Preparation of final accounts.

Remarks as to whether a project has achieved its aims.

I

I

I

I

I

4 arch

The subject should be presented in such a way that it reflects the business as a dhole.

The diagram below reflects the general orientation which can be follow$P in teaching/learning the subject:

I 1

Teaching methods used should encourage students to be acquainted with

1 affairs particularly those that affect business. Hence students should be encouri read newspapers and listen to radio and television. Teaching methods shou cater for different learning abilities of pupils. nent

:d to also

2

ASSESSMI3NT

ASSESSMENT OBJECTIVES

The assessment objectives in Business Education have been grouped as follows:

1. Knowledge - Application

2. Analysis and Synthesis

3. Evaluation and Decision-making

1. Knowledge - -

Students should be able

to:

(a) Demonstrate knowledge of terms, facts, methods and procedures, concepts, principles and techniques relevant to the syllabus.

(b) Demonstrate understanding of knowledge through numeracy, literacy, presentation and interpretation.

(c) Apply knowledge and information to various business situation and problems.

Illustrative verbs that will be used to test these objectives will include: define, name, explain, prepare, rewrite, calculate, record, draw-up, describe, identi&.

2. Analysis

(d) Select data relevant to different business situations and problems.

(e) Analyse, present and order information in written, numerical and in appropriate accounting form.

Illustrative verbs that will be used in the test items will include: prepare, draw-up, compare.

3. Evaluations and Decision-making

,$I Apply facts, data and information in new situations in making judgement and decisions.

(g) Demonstrate ability to interpret and evaluate business information in order to draw conclusions.

(h) Identi5 significant issues in business that can have a signifzcant impact on decisions.

Illustrative verbs that will be used in the test items will include: indicate, choose, decide, present, select, design, comment, and advise.

3

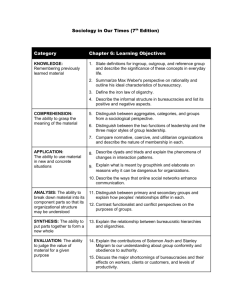

Specification Grid

The assessment objectives are weighted as follows:

Paper

1

2

Assessment Objectives

Analysis Knowledge, Comprehension and

Application (Knowledge with underst andign)

70%

60%

20%

Evaluatior

Decision - king

10%

10%

INTERNAL ASSESSMENT

Practical projects, assignments, exercises and classroom tests should form pi teaching. t

of

EXTERNAL EXAMINATIONS

Form C

1. Two papers shall be set.

Paper 1 (2% hours)

- fifty multiple choice questions covering the whole syl accounting for

50 marks ibus

Paper 2 (3 hours)

-

These sections are divided as follows:

Section A : Three compulsory questions based on: Business Environ

Starting and Business Management.

Section B: One compulsory question asked from either evaluation performance of a trading or nun-trading concern.

Section ent,

If a

(150 marl

I

4

FORM A SYLLABUS

END OF LEVEL OBJECTIVES

At the end

of Form

A students should be able to:

1. Identify types of human needs.

2. Distinguish between systems

of

exchange.

3. Explain how business satisfies human needs.

4. Explain factors of production.

5. Distinguish between stages of production.

6. Explain methods of production.

7. Exdain the division of labour.

8. Identify different types of business.

9. Identify different types of business ownership.

CONTENT

1. Human needs and business.

1.1 Types of human needs, material and service.

1.2 Purpose of business.

1.3 Barter system and money economv.

2. Production

2.1 Factors of production.

2.2 Stages of production.

2.3 Methods of production.

2.4 Division of labour.

3. Types of business

3.1 Manufacturing

3.2 Wholesaling

3.3 Retailing

3.4 Service

3.5 Franchising

4. Business ownership

4.1 Sole trader

4.2 Partnership

4.3 Companies

4.4 Cooperatives

NOTES

1.1 It is important to show the relationship between a business and satisfaction of human needs.

1.2

A

brief discussion of the evolution of need satisfaction.

2.1 Refer to local examples.

3.1 Refer to the relationship between these types of businesses.

4.1 Briefly discuss the nature of each

(membership, capital).

5

1. Generate business ideas based on identified needs.

2. Mention different ways of finding information about the market.

3. Explain the purpose of the market research.

4. Identify factors to consider for market

5 . research.

Explain the importance of a business plan.

6. Identify the elements of a business plan.

5. Business idea

5.1 Generating ideas.

5.2 Market research.

5.3 Business plan.

7. Identify factors that determine the lo-cation of the business.

8. Identify sources of capital.

9. Explain the-importance of capital.

10. Explain the importance of acquiring a business licence.

6. Factors considered when starting a business.

6.1 Location

6.2 Capital

6.3 Licence

6.4 Acquisition of assets

1 1. Identify different types of banks and functions of commercial banks.

12. Explain the-importance of transport.

13. Distinguish between different types sf transport.

14. Explain the importance of insurance to a business.

15. Explain the importance of advertising.

~ -

~~~ ~ ~~ ~~~~

T T i ~ y - W e m t y p e s o - .

~

7. Supportive services

7.1 Banking

7.2 Transport

7.3 Insurance

7.4 Advertising

5.1 Discuss different needs as sources of ideas.

5.2 IdentlJication of: market, competitors, finance, management and employees, location and type of business.

6. I Refer to density of population, purchasing power, premises, competition, sources of supply, labour, legal requirements.

6.2 Briefly show the role of capital in business and sources.

6.3 Show the relationship between assets, liabilities and capital.

7.1 Brief discussion referring to types, functions(saving and lending) and sewices such as current account, savings account and deposit account.

7.2 Brief discussion of importance and types.

7.3 Refer to the importance (risks, premium, agreement and compensation).

~

7.4 Refer to the importance of advertising

- - -~

ZDi&ZalfJerent media.

~ ~ ~~~

6

8. Pricing : merchandise

26. Identify factors to consider when pricing a commodity.

27. Identify different forms of buying and selling.

9. Forms of buying and selling.

9.1 Credit

9.2 Cash

8.1 Determine a selling price using a percentage mark-up. Discuss factors that influence pricing e.g. transport; tax etc.

9.1 Briefly refer to some advantages and disadvantages of credit sales and purchases.

9.2 Briefly refer to advantages and disadvantages of cash sales and wurchases.

10.1 Correlate with (9) and (1 1). Discuss the purpose and basic format of each document.

28. Identify source documents to record business transactions.

10. Business documents

10.1 Invoice

10.2 Receipts

10.3 Cheque

10.4 Order

10.5 Quotation

10.6 Credit note and debit note

10.7 Price list

11. Ledger

29. Record business transactions by means of a double-entry in the Ledger.

12. Trial balance

30. Construct a Trial balance fiom a ledger or given information.

3 1. Prepare a Trading and Profit and Loss

Accounts of a sole trader.

13. Final accounts

11.1 Correlate with (a) and (1 0).

13.1 Simple Trading and Proft and Loss account without returns and allowance.

7

END OF LEVEL OBJECTIVES

At the end of Farm B students should be able to:

1. Identify different types of money.

2. Describe four functions of money.

CONTENT

1. Monetary System

1.1 Types of money

1.2 Functions of money

3. Explain scarcity in relation to factors of production.

4. Explain different modes of production.

5. Explain the advantages and disadvantages of division of labour.

6 . Distinguish between consumer and capital goods.

7. Identify the characteristics of an entrepreneur.

8. Explain the importance of entrepreneurship.

2. Factors of production

2.1 Scarcity of factors of production.

2.2 Modes of production: labour and capital intensive.

2.3 Division of labour

2.5 Capital goods and consumer goods.

2.6 Entrepreneurship

(a) Importance of entrepreneurship

NOTES

9

1 . 1 Revise the evolution of need satisfaction.

9. Describe functions of different types of business units.

10. Discuss advantages and disadvantages of different types of business ownership. 4.2 Partnership

4.3 Limited liability companies

8

I

1 1. Generate business ideas from different sources.

12. Conduct market research by using observations or survey research method.

13. Distinguish between various types of market.

14. Draw up a simple business plan.

5. Business idea

5.1 Market research

5.2 Business plan

5.3 Types of markets

5.1 Markets include: Consumer, government, export and local markets.

15. Explain procedures to be followed to acquire a licence in Lesotho.

16. Explain obligations observed after acquiring a licence.

17. Explain the importance of registering fixed assets and their value.

6. Factors considered when establishing business

6.1 Capital

6.2 Licence

6.3 Acquisition of assets

6.1 Revise sources of capital: loan, private, credit facilities, contributions.

18. Identify types of cheques and explain their treatment.

19. Explain reasons for dishonouring a cheque.

20. Identify factors that are considered when choosing a mode of transport.

2 1. Explain the principles of insurance.

22. Explain advantages and disadvantages of advertising.

23. Explain factors that are considered when choosing advertising medium..

24. Explain the importance of warehousing

25. Explain the importance of communication.

26. Discuss services offered by post office.

27. Determine a price of a commodity and a service.

7. Supportive services

7.1 Banlung

(a) Types of cheques and their treatment

(b) Reasons for dishonouring a cheque

7.2 Transport

(a) Choosing a mode of transport

7.3 Insurance

(a) Principles of insurance

7.4 Advertising

7.5 Warehousing

7.6 Communication

(a) Importance of communication

(b) Services offered by the Post Office.

(c)

8. Pricing

(a) Production of goods and services

7.1 Cheques: crossings, endorsements, reasons for dishonouring a cheque.

7.2 Discuss the following services provided by the Post Office: post office boxes, private bags facilities; fast-mail, registered mail, express mail, ordinary.

8.1 Simple costing to determine a selling price: Consider cost elements such as material, labour and overheads.

9

29. Distinguish between different forms of buying and selling on credit.

9.

9.1

Types of credit

Short term credit

9.2 Long-term credit

30. Record transactions in the subsidiary books using source documents.

3 1. Post information from subsidiary books to the

Ledger.

32. Construct a Trial Balance from the Ledger and given information.

33. Identify errors which cannot be revealed and those that can be revealed bv the Trial balance.

10. Business Documents and

Subsidiary Books

10.1 Cash Book

10.2 Sales journal

10.3 Purchase journal

10.4 Returns and allowances journal

10.5 Petty cash book

10.6 General iournal

11. Ledger

12. Trial Balance

13. Final Accounts and Balance

Sheet 34. Prepare final accounts and Balance Sheet of a sole trader tcaking into account given adjustments.

9.1 Reference shuuld be made to open credit account.

9.2 Brief study of hire purchase and deferred

Davments.

10.1 The use of all relevant documents should be emphasis:d.

10.2 Treatment of cash discount should also be emphasized.

1 1.1 Classification of Ledger accounts should be introduced.

12. Treatment of correction of errors is not required.

13.1 Treatment of final accounts should include both merchandise and service businesses.

13.2 The following end of period adjustments should be treated: accruals, prepayments, bad debts, closing stocks and depreciation of fixed assets.

10

i FORM C SYLLABUS

CONTENT END OF LEVEL OBJECTIVES

At the end of Form C students should be able to:

1. Identify different types of wholesalers and retailers.

2. Prepare the final accounts- and Balance sheet of a partnership business including adjustments.

3. Prepare current accounts both in the ledger as well as in the balance sheet.

1. Types of Businesses

1.1 Wholesaler

(a) General

(b) Specialist

1.2 Retailers

(a) Supermarket

(b) Street markets

(c) Hawkers

(d) Mobile shop

(e) Chain stores

(f) Mailorder

(g) General dealer

(h) Speciality shop

(i) Bazaars

(i) Hypermarket

(k) Department stores

2. Partnership Business ownership

2.1 Trading and Profit and

Loss

Accounts

2.1 Profit and Loss Appropriation

Account

2.2 Current accounts

NOTES

1.1. Review the importance and types of business.

1.2. Distinguish between general and specialist wholesaler. Cash and Carry is a mode of selling. Also relate the types wholesalers to the needs

of

1.3 customers.

Relate the establishment of these retailers to the type of needs, customers and availability of factors of production.

2.1 Students should be able to prepare appropriation account including interest on capitals, partners’ salaries and share of profit. Interest on drawings and bonuses should not be treated.

11

2.3 Balance sheet

4.

5 .

6.

7.

8.

9.

Discuss the functions of the commercial bank.

Discuss the advantages and disadvantages of various modes of transport.

Explain different types of insurances and risks.

Explain different types of advertising.

Explain different types of telecommunication systems such as telex/fax, telephone, telephone, telegram, electronic and other recent means.

Describe different types of warehouses.

3.Supportive Services

3.1 Banking

(a) Provision of e

Loans

Overdrafts

Letter of credits

Banker’s reference

ATM facilities

Stop order facilities

Credit transfer

Debit order

Direct debit

3.2 Transport

(a) Air

(b) Land

(c) Water

3.3 Insurance

(a) Types of insurant, e

Fire

0

& e

Burglary

+;mr+tmtPr-

Public liability

12

I

2.2 The importarge of partnership agreement as the basis of sharing profits and losses should be emphasised. ’

2.3 Adjustments may be treated within the final accounts.

3.1 These services should be treated within the context of their usefulness to the businesses. It is also important for students to learn about life insurance in relation to the other types of insurance.

0

0

Fidelity

Motor

3.4 Advertising

(a) Types of advertising

Informative

Persuasive

0

Generic

3.5 Warehousing

(a) Types of warehousing

Bonded

0

Ordinary

3.6. Communication

(a) Telecommunication

10. Discuss the rights of consumers.

1 1. Explain mechanisms which can be followed when consumer rights have been violated.

12. Identify rational ways in which buying decisions can be reached.

4. Consumer Education

12.1 Consumer rights

12.2Consumer rights enforcement mechanisms

0

Complaining to the seller

Taking the seller to a mediator

Court action

9.3 Buying Decisions

13.

Discuss advantages and disadvantages of credit system.

5. Credit system

5.1 Hire Purchase

5.2 Deferred payments

5.3 Open account

4.1 This should be dealt with within the context of business, that

is,

how consumer r i a t s affect or develop business.

4.2 Consideration of the following as the basis for rational buying decision:

Expiry date, cost per gram, contents of a product, economic pack and so on.

5.1. Review the work that has been covered in credit system.

13

14. Prepare supplementary cash book and bank reconciliation statement.

6. Cash and Cheques’ Management

6.1 Supplementary cash book

6.2 Bank reconciliation statement

6.1 It is important to establish the relationship between the business and the bank through their transactions.

7.1 The following items should be treated: credit transfer, stop order, dishonoured cheques, bank charges, debit order, late deposit, and unpresented cheques.

Bank overdraft should not be treated.

15. Prepare the books organisations. of non-trading

16. Prepare a simple individual and household budget based on one’s income and expenditure. z

7. Non-Trading Concerns

7.1 Books of non-trading organisations

(a) Receipts and payments

(b) Income and expenditure

(c) Balance sheet

7.2 Individual and household budget

7.1 Examples of such organisations are: clubs, schools, charity organizations.

Y

Use examples in the school or around

7.2

7.3

7.4

Show how adjustments are treated in the final accounts and the balance sheet.

Contrast such organisations with trading or business concerns e.g. purpose, formation and their accounts.

Separate preparation of trading account for fund raising activities is not reauired.

14